|

OASDI

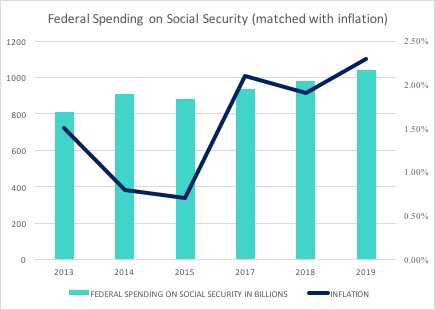

In the United States, Social Security is the commonly used term for the federal Old-Age, Survivors, and Disability Insurance (OASDI) program and is administered by the Social Security Administration (SSA). The Social Security Act was passed in 1935,Social Security Act of 1935 and the existing version of the Act, as amended, 2 USC 7 encompasses several social welfare and social insurance programs. The average monthly Social Security benefit for May 2025 was $1,903. This was raised from $1,783 in 2024. The total cost of the Social Security program for 2022 was $1.244 trillion or about 5.2 percent of U.S. gross domestic product (GDP). In 2025 there have been proposed budget cuts to social security. Social Security is funded primarily through payroll taxes called the Federal Insurance Contributions Act (FICA) or Self Employed Contributions Act (SECA). Wage and salary earnings from covered employment, up to an amount determined by law (see tax rate table), are subject to the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Social Security Trust Fund

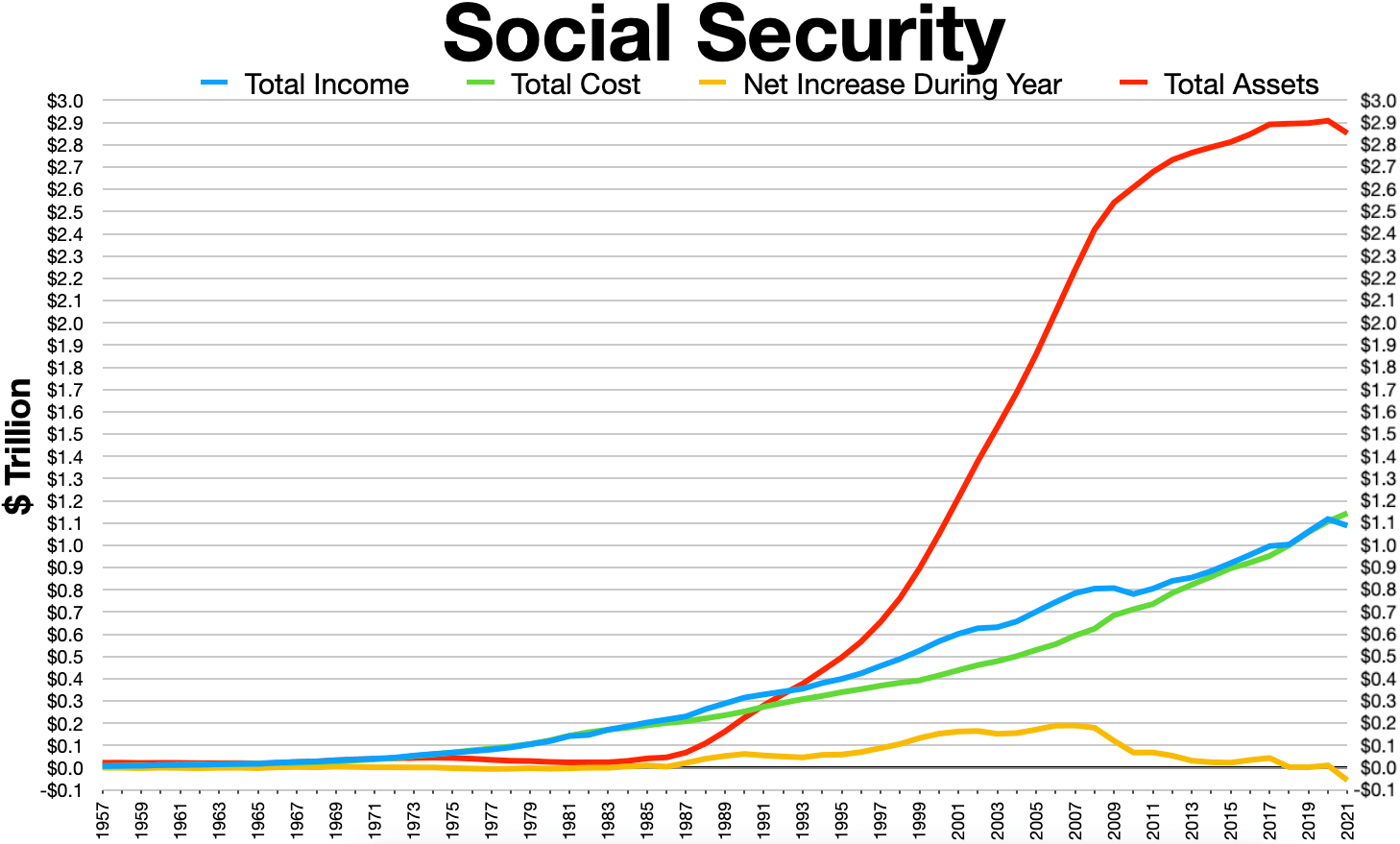

The Federal Old-Age and Survivors Insurance Trust Fund and Federal Disability Insurance Trust Fund (collectively, the Social Security Trust Fund or Trust Funds) are trust funds that provide for payment of Social Security (Old-Age, Survivors, and Disability Insurance; OASDI) benefits administered by the United States Social Security Administration. The Social Security Administration collects payroll taxes and uses the money collected to pay Old-Age, Survivors, and Disability Insurance benefits by way of trust funds. When the program runs a surplus, the excess funds increase the value of the Trust Fund. As of 2021, the Trust Fund contained (or alternatively, was owed) $2.908 trillion. The Trust Fund is required by law to be invested in non-marketable securities issued and guaranteed by the "full faith and credit" of the federal government. These securities earn a market rate of interest. Excess funds are used by the government for non-Social Security purposes, creating the obliga ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Social Security Disability Insurance

Social Security Disability Insurance (SSD or SSDI) is a payroll tax-funded federal insurance program of the United States government. It is managed by the Social Security Administration and designed to provide monthly benefits to people who have a medically determinable disability (physical or mental) that restricts their ability to be employed. SSDI does not provide partial or temporary benefits but rather pays only full benefits and only pays benefits in cases in which the disability is "expected to last at least one year or result in death". Relative to disability programs in other countries in the Organisation for Economic Co-operation and Development (OECD), the SSDI program in the United States has strict requirements regarding eligibility. SSDI is distinct from Supplemental Security Income (SSI). Unlike SSDI (as well as Social Security retirement benefits) where payment is based on contribution credits earned through previous work and therefore treated as an insurance b ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Social Security Payroll Tax

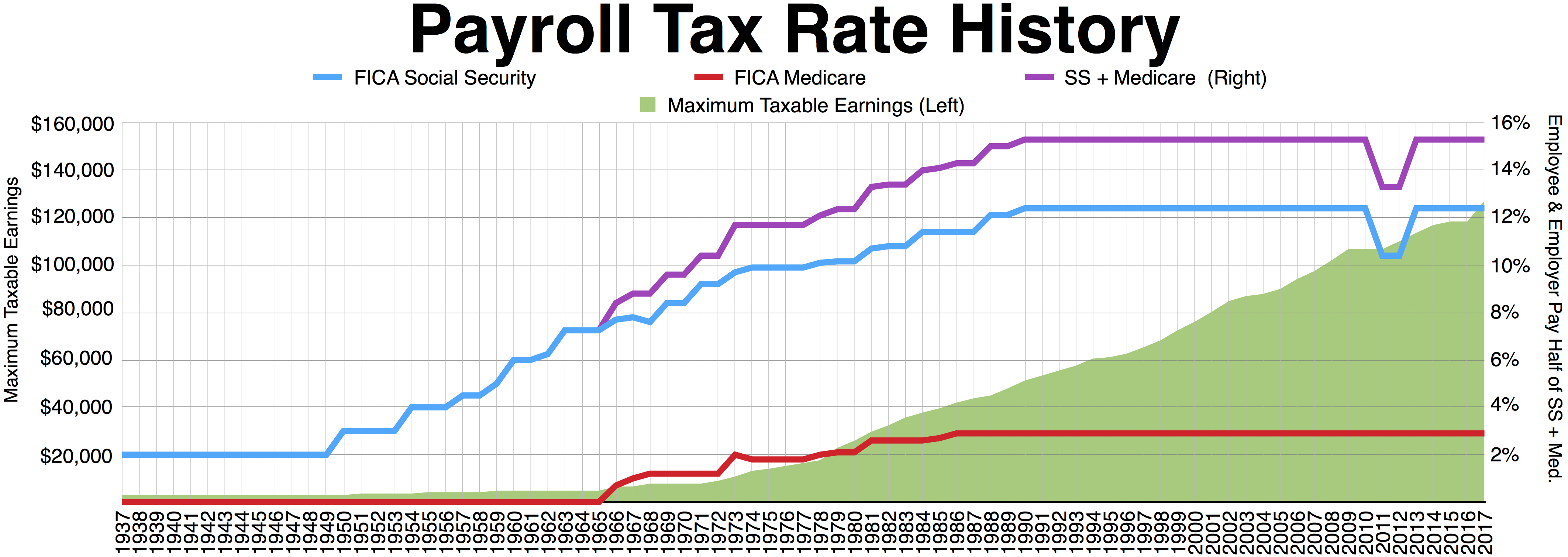

The Federal Insurance Contributions Act (FICA ) is a United States federal payroll (or employment) tax payable by both employees and employers to fund Social Security and Medicare—federal programs that provide benefits for retirees, people with disabilities, and children of deceased workers. Calculation Overview The Federal Insurance Contributions Act is a tax mechanism codified in Title 26, Subtitle C, Chapter 21 of the United States Code. Social security benefits include old-age, survivors, and disability insurance (OASDI); Medicare provides hospital insurance benefits for the elderly. The amount that one pays in payroll taxes throughout one's working career is associated indirectly with the social security benefits annuity that one receives as a retiree. Consequently, Kevin Hassett wrote that FICA is not a tax because its collection is directly tied to benefits that one is entitled to collect later in life. However, the United States Supreme Court ruled in '' Flemmi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Insurance Contributions Act Tax

The Federal Insurance Contributions Act (FICA ) is a United States federal payroll (or employment) tax payable by both employees and employers to fund Social Security and Medicare—federal programs that provide benefits for retirees, people with disabilities, and children of deceased workers. Calculation Overview The Federal Insurance Contributions Act is a tax mechanism codified in Title 26, Subtitle C, Chapter 21 of the United States Code. Social security benefits include old-age, survivors, and disability insurance (OASDI); Medicare provides hospital insurance benefits for the elderly. The amount that one pays in payroll taxes throughout one's working career is associated indirectly with the social security benefits annuity that one receives as a retiree. Consequently, Kevin Hassett wrote that FICA is not a tax because its collection is directly tied to benefits that one is entitled to collect later in life. However, the United States Supreme Court ruled in '' Fle ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Supplemental Security Income

Supplemental Security Income (SSI) is a means-tested program that provides cash payments to disabled children, disabled adults, and individuals aged 65 or older who are citizens or nationals of the United States. SSI was created by the Social Security Amendments of 1972 and is incorporated in Title 16 of the Social Security Act. The program is administered by the Social Security Administration (SSA) and began operations in 1974. Individuals or their helpers may start the application for SSI benefits by completing a short form on SSA's website. SSA staff will schedule an appointment for the individual or helper within one to two weeks and complete the process. SSI was created to replace federal-state adult assistance programs that served the same purpose, but were administered by the state agencies and received criticism for lacking consistent eligibility criteria. The restructuring of these programs was intended to standardize the eligibility requirements and level of benefits ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Social Insurance

Social insurance is a form of Social protection, social welfare that provides insurance against economic risks. The insurance may be provided publicly or through the subsidizing of private insurance. In contrast to other forms of Welfare spending, social assistance, individuals' claims are partly dependent on their contributions, which can be considered insurance premiums to create a common fund out of which the individuals are then paid benefits in the future. Types of social insurance include: * Universal health care, Public health insurance * Social Security (United States), Social Security * Unemployment Insurance, Public Unemployment Insurance * Public auto insurance * Parental leave, Universal parental leave Features * The contributions of individuals is nominal and never goes beyond what they can afford * the Social welfare, benefits, eligibility requirements and other aspects of the program are defined by statute; * explicit provision is made to account for the incom ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Temporary Assistance For Needy Families

Temporary Assistance for Needy Families (TANF ) is a federal assistance program of the United States. It began on July 1, 1997, and succeeded the Aid to Families with Dependent Children (AFDC) program, providing cash assistance to indigent American families through the United States Department of Health and Human Services. TANF is often regarded as just "welfare", but some argue this is a misnomer. Unlike AFDC, which provided a guaranteed cash benefit to eligible families, TANF is a block grant to states that creates no federal entitlement to welfare and is used by states to provide non-welfare services, including educational services, to employed people. The TANF program, emphasizing the welfare-to-work principle, is a grant given to each state to run its own welfare program and designed to be temporary in nature and has several limits and requirements. The TANF grant has a five-year lifetime limit and requires that all recipients of welfare aid must find work within three y ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Disability Beneficiaries

Disability is the experience of any condition that makes it more difficult for a person to do certain activities or have equitable access within a given society. Disabilities may be cognitive, developmental, intellectual, mental, physical, sensory, or a combination of multiple factors. Disabilities can be present from birth or can be acquired during a person's lifetime. Historically, disabilities have only been recognized based on a narrow set of criteria—however, disabilities are not binary and can be present in unique characteristics depending on the individual. A disability may be readily visible, or invisible in nature. The United Nations Convention on the Rights of Persons with Disabilities defines disability as including: Disabilities have been perceived differently throughout history, through a variety of different theoretical lenses. There are two main models that attempt to explain disability in our society: the medical model and the social model. The medi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Aid To Families With Dependent Children

Aid to Families with Dependent Children (AFDC) was a federal assistance program in the United States in effect from 1935 to 1997, created by the Social Security Act (SSA) and administered by the United States Department of Health and Human Services that provided financial assistance to children whose families had low or no income. The program grew from a minor part of the social security system to a significant system of welfare administered by the states with federal funding. However, it was criticized for offering incentives for women to have children, and for providing disincentives for women to join the workforce. In July 1997, AFDC was replaced by the more restrictive Temporary Assistance for Needy Families (TANF) program. History The program was created under the name Aid to Dependent Children (ADC) by the Social Security Act of 1935 as part of the New Deal. It was created as a means tested entitlement which subsidized the income of families where fathers were " ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Flemming V

Flemming is a surname and a male given name referring, like the more common '' Fleming'', to an inhabitant (or descendant thereof) of Flanders, Behind the Name. a region overlapping parts of modern Belgium, France, and the Netherlands. Notable people with the name include: Surname * Aida McAnn Flemming, Canadian teacher and writer * Arthur Flemming, American government official * Bill Flemming, American sportscaster * Brett Flemming, Canadian ice ho ...[...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

State Children's Health Insurance Program

The Children's Health Insurance Program (CHIP) – formerly known as the State Children's Health Insurance Program (SCHIP) – is a program administered by the United States Department of Health and Human Services that provides matching funds to states for health insurance to families with children. The program was designed to cover uninsured children in families with incomes that are modest but too high to qualify for Medicaid. The program was passed into law as part of the Balanced Budget Act of 1997, and the statutory authority for CHIP is under title XXI of the Social Security Act. CHIP was formulated in the aftermath of the failure of President Bill Clinton's comprehensive health care reform proposal. First Lady Hillary Clinton's brainchild in the aftermath of the failing of passage of her healthcare reform work, this Legislation to create CHIP was co-sponsored by Democratic Senator Ted Kennedy and Republican Senator Orrin Hatch. Despite opposition from some conservat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Franklin D

Franklin may refer to: People and characters * Franklin (given name), including list of people and characters with the name * Franklin (surname), including list of people and characters with the name * Franklin (class), a member of a historical English social class Places * Franklin (crater), a lunar impact crater * Franklin County (other), in a number of countries * Mount Franklin (other), including Franklin Mountain Australia * Franklin, Tasmania, a township * Division of Franklin, federal electoral division in Tasmania * Division of Franklin (state), state electoral division in Tasmania * Franklin, Australian Capital Territory, a suburb in the Canberra district of Gungahlin * Franklin River, river of Tasmania * Franklin Sound, waterway of Tasmania Canada * District of Franklin, a former district of the Northwest Territories * Franklin, Quebec, a municipality in the Montérégie region * Rural Municipality of Franklin, Manitoba * Franklin, Manitoba, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |