|

No-show Job

A no-show job or fictitious employment is a paid position that ostensibly requires the holder to perform duties, but for which no work, or even attendance, is actually expected. The awarding of no-show jobs is a form of political corruption, political or corporate corruption. A no-work job is a similar paid position for which no work is expected, but for which attendance at the job site is required. Upon auditing or inspection, personnel assigned to a no-work job may be falsely justified to the controllers as waiting for work tasks or not being needed "right now." For example: no-show or no-work jobs may be used during illegal activities for scamming a construction project to generate extra payout or to provide alibis. Organized crime and corruption ''The New York Times'' has written: "The no-show job has long played a central role in the annals of Crime in New York City, crime and corruption in New York, offering an efficient way for crooked politicians, Trade union, union offic ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

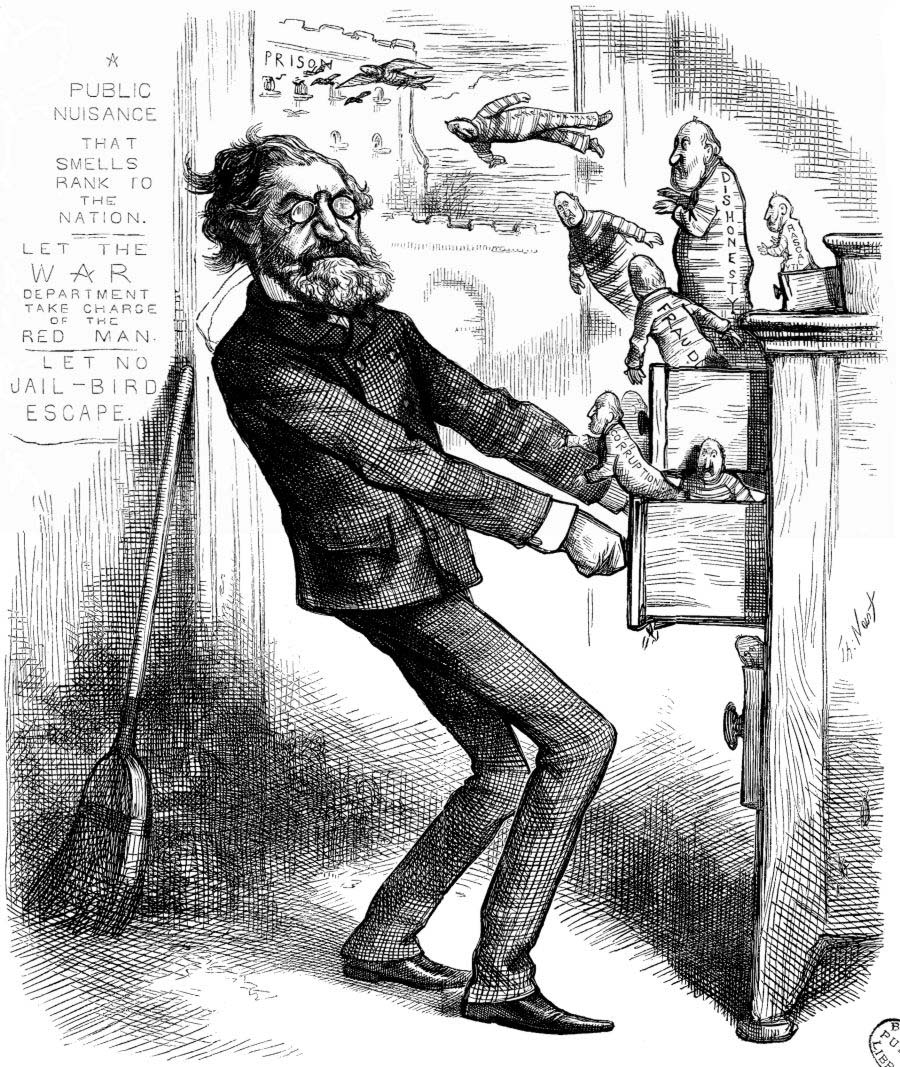

Political Corruption

Political corruption is the use of powers by government officials or their network contacts for illegitimate private gain. Forms of corruption vary but can include bribery, lobbying, extortion, cronyism, nepotism, parochialism, patronage, influence peddling, Graft (politics), graft, and embezzlement. Corruption may facilitate criminal enterprise, such as drug trafficking, money laundering, and human trafficking, although it is not restricted to these activities. Over time, corruption has been defined differently. For example, while performing work for a government or as a representative, it is unethical to accept a gift. Any free gift could be construed as a scheme to lure the recipient towards some biases. In most cases, the gift is seen as an intention to seek certain favors, such as work promotion, tipping in order to win a contract, job, or exemption from certain tasks in the case of junior worker handing in the gift to a senior employee who can be key in winning the favor. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Payroll

A payroll is a list of employment, employees of a company who are entitled to receive compensation as well as other work benefits, as well as the amounts that each should obtain. Along with the amounts that each employee should receive for time worked or tasks performed, payroll can also refer to a company's records of payments that were previously made to employees, including Salary, salaries and wages, Bonus payment, bonuses, and Withholding tax, withheld taxes, or the company's department that deals with Remuneration, compensation. A company may handle all aspects of the payroll process in-house or can outsource aspects to a payroll processing company. Payroll in the U.S. is subject to federal, state and local regulations including Fair Labor Standards Act of 1938, employee exemptions, Records management, record keeping, and Taxation in the United States, tax requirements. In recent years, there has been a significant shift towards cloud-based payroll solutions. These platfor ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corruption

Corruption is a form of dishonesty or a criminal offense that is undertaken by a person or an organization that is entrusted in a position of authority to acquire illicit benefits or abuse power for one's gain. Corruption may involve activities like bribery, influence peddling, and embezzlement, as well as practices that are legal in many countries, such as lobbying. Political corruption occurs when an office-holder or other governmental employee acts in an official capacity for personal gain. Historically, "corruption" had a broader meaning concerned with an activity's impact on morals and societal well-being: for example, the ancient Greek philosopher Socrates was condemned to death in part for "corrupting the young". Contemporary corruption is perceived as most common in kleptocracies, oligarchies, narco-states, Authoritarianism, authoritarian states, and mafia states, however, more recent research and policy statements acknowledge that it also exists in wealthy capitalist e ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

White Monkey

White monkey ( zh, c=白猴子, p=Bái hóuzi) is a term for the phenomenon of White people, white foreigners or immigrants in China and Japan being hired for modeling, advertising, English teaching, or promotional jobs on the basis of their race. The phenomenon is based on the perception that association with foreigners, specifically white foreigners, can signify prestige, legitimacy, and international status. The jobs themselves, called "white monkey jobs" or "white-face jobs", often require little actual work on the part of the model, who in some cases is not expected to be fluent in Chinese. The concept is considered a subset of a larger "rent a foreigner" industry in China and other parts of Asia. White monkey jobs are often related to marketing and advertising. The "white monkey" may be hired to act as an associate of an individual or pose as an authoritative figure to promote a brand or company, and businesses will occasionally hire these individuals to pose as a founder ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sinecure

A sinecure ( or ; from the Latin , 'without', and , 'care') is a position with a salary or otherwise generating income that requires or involves little or no responsibility, labour, or active service. The term originated in the medieval church, where it signified a post without any responsibility for the " cure areof souls", the regular liturgical and pastoral functions of a cleric, but came to be applied to any post, secular or ecclesiastical, that involved little or no actual work. Sinecures have historically provided a potent tool for governments or monarchs to distribute patronage, while recipients are able to store up titles and easy salaries. A sinecure can also be given to an individual whose primary job is in another office, but requires a sinecure title to perform that job. For example, the Government House Leader in Canada is often given a sinecure ministry position so that they may become a member of the Cabinet. Similar examples are the Lord Keeper of the Privy ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ñoqui

In Argentina and Uruguay, a ''ñoqui'' (English: gnocchi) is a person who is legally registered as a worker, usually for the government, and receives a monthly wage, but who performs little or no work. Such individuals are called ''ñoquis'' because many Argentines and Uruguayans traditionally eat ñoquis on the 29th day of every month, around the time when people receive their monthly paychecks. People may hold ''ñoqui'' positions for several reasons. Some are the recipients of political favors and/or nepotism, while others work to promote partisan agendas instead of performing their nominal duties. Still others are disabled or continue to receive paychecks by mistake, such as the dead, retired, or those who have moved on to other positions. A 2015 study by KPMG estimated that 5 to 7 percent of Argentine public sector employees were ''ñoquis'', which would be more than 200,000 individuals each receiving an average monthly salary of 8,000 pesos. History Upon taking office a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ghost Soldiers

Ghost soldiers or ghost battalions refers to absentee army troops whose names appear on military rolls, but who are not actually in military service, generally in order to divert part of the soldiers' salaries to an influential local entity such as army officers or others. Soldiers may equally benefit from the corruption scheme by returning to their civilian occupations and routines while gaining marginal income. The practice, however, weakens the military and makes it susceptible to military offensives and major defeats since leaders ignore the true number of available troops at their disposal on various frontlines. Severe occurrences of ghost soldiers have been cited in Vietnam, Iraq, Afghanistan, Syria, Somalia, and other countries with dramatic military, humanitarian, and historic consequences. Transnational In a 2008 transnational analysis, John Hudson and Philip Jones found a negative correlation between a country's level of corruption and the cost per soldiers. Indeed, an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Featherbedding

Featherbedding is the practice of hiring more workers than are needed to perform a given job, or to adopt work procedures which appear pointless, complex and time-consuming merely to employ additional workers. The term " make-work" is sometimes used as a synonym for featherbedding. The term "featherbedding" is usually used by management to describe behaviors and rules sought by workers.William Gomberg, "Featherbedding: An Assertion of Property Rights," ''Annals of the American Academy of Political and Social Science,'' 333:1 (1961). The term may equally apply to mid- and upper-level management, particularly in regard to top-heavy and "bloated" levels of middle- and upper-level management. Featherbedding has also been occasionally used to describe rent-seeking behavior by corporations in response to economic regulation. Etymology The term "featherbedding" originally referred to any person who is pampered, coddled, or excessively rewarded. The term originated in the use of feathers ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Avoidance

Tax avoidance is the legal usage of the tax regime in a single territory to one's own advantage to reduce the amount of tax that is payable. A tax shelter is one type of tax avoidance, and tax havens are jurisdictions that facilitate reduced taxes. Tax avoidance should not be confused with tax evasion, which is illegal. Forms of tax avoidance that use legal tax laws in ways not necessarily intended by the government are often criticized in the court of public opinion and by journalists. Many businesses pay little or no tax, and some experience a backlash (sociology), backlash when their tax avoidance becomes known to the public. Conversely, benefiting from tax laws in ways that were intended by governments is sometimes referred to as tax planning. The World Bank's World Development Report 2019 on the future of work supports increased government efforts to curb tax avoidance as part of a new social contract focused on human capital investments and expanded social protection. "T ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Evasion

Tax evasion or tax fraud is an illegal attempt to defeat the imposition of taxes by individuals, corporations, trusts, and others. Tax evasion often entails the deliberate misrepresentation of the taxpayer's affairs to the tax authorities to reduce the taxpayer's tax liability, and it includes dishonest tax reporting, declaring less income, profits or gains than the amounts actually earned, overstating deductions, bribing authorities and hiding money in secret locations. Tax evasion is an activity commonly associated with the informal economy. One measure of the extent of tax evasion (the "tax gap") is the amount of unreported income, which is the difference between the amount of income that the tax authority requests be reported and the actual amount reported. In contrast, tax avoidance is the legal use of tax laws to reduce one's tax burden. Both tax evasion and tax avoidance can be viewed as forms of tax noncompliance, as they describe a range of activities that intend to ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Progressive Income Tax

A progressive tax is a tax in which the tax rate increases as the taxable amount increases. The term ''progressive'' refers to the way the tax rate progresses from low to high, with the result that a taxpayer's average tax rate is less than the person's marginal tax rate. The term can be applied to individual taxes or to a tax system as a whole. Progressive taxes are imposed in an attempt to reduce the tax incidence of people with a lower ability to pay, as such taxes shift the incidence increasingly to those with a higher ability-to-pay. The opposite of a progressive tax is a regressive tax, such as a sales tax, where the poor pay a larger proportion of their income compared to the rich (for example, spending on groceries and food staples varies little against income, so poor pay similar to rich even while latter has much higher income). The term is frequently applied in reference to personal income taxes, in which people with lower income pay a lower percentage of that income ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |