|

New Neoclassical Synthesis

The new neoclassical synthesis (NNS), which is occasionally referred as the New Consensus, is the fusion of the major, modern macroeconomic schools of thought – new classical macroeconomics/ real business cycle theory and early New Keynesian economics – into a consensus view on the best way to explain short-run fluctuations in the economy. This new synthesis is analogous to the neoclassical synthesis that combined neoclassical economics with Keynesian macroeconomics. The new synthesis provides the theoretical foundation for much of contemporary mainstream macroeconomics. It is an important part of the theoretical foundation for the work done by the Federal Reserve and many other central banks. Prior to the synthesis, macroeconomics was split between partial-equilibrium New Keynesian work on market imperfections demonstrated with small models and new classical work on real business cycle theory that used fully specified general equilibrium models and used changes in tech ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Macroeconomic

Macroeconomics is a branch of economics that deals with the performance, structure, behavior, and decision-making of an economy as a whole. This includes regional, national, and global economies. Macroeconomists study topics such as output/ GDP (gross domestic product) and national income, unemployment (including unemployment rates), price indices and inflation, consumption, saving, investment, energy, international trade, and international finance. Macroeconomics and microeconomics are the two most general fields in economics. The focus of macroeconomics is often on a country (or larger entities like the whole world) and how its markets interact to produce large-scale phenomena that economists refer to as aggregate variables. In microeconomics the focus of analysis is often a single market, such as whether changes in supply or demand are to blame for price increases in the oil and automotive sectors. From introductory classes in "principles of economics" through doctora ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ellen McGrattan

Ellen McGrattan is an American macroeconomist who is Professor of Economics at the University of Minnesota and past director of the Heller-Hurwicz Economics Institute, and consults for the Federal Reserve Bank of Minneapolis. McGrattan's professional honors include being a research associate at the National Bureau of Economic Research, a Fellow of the Econometric Society, a Fellow of the Society for the Advancement of Economic Theory. She is a member of the Bureau of Economic Analysis Advisory Committee, and the Minnesota Population Center Advisory Board, and formerly served as president of the Midwest Economics Association. Education McGrattan received a Bachelor of Science in economics and mathematics from Boston College, followed by a Ph.D. in economics from Stanford University in 1989. McGrattan has taught courses at Duke University, the European University Institute, the Stockholm School of Economics, the University of California, Los Angeles, the University of Pennsyl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

History Of Macroeconomic Thought

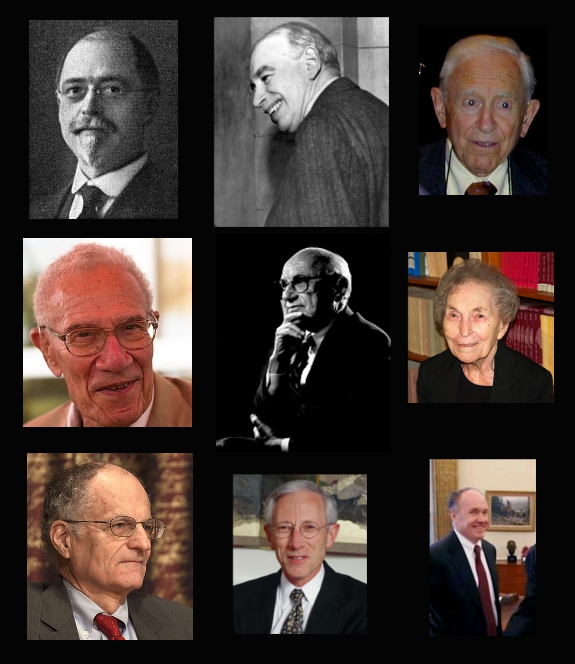

Macroeconomic theory has its origins in the study of business cycles and monetary theory. In general, early theorists believed monetary factors could not affect real factors such as real output. John Maynard Keynes attacked some of these "classical" theories and produced a general theory that described the whole economy in terms of aggregates rather than individual, microeconomic parts. Attempting to explain unemployment and recessions, he noticed the tendency for people and businesses to hoard cash and avoid investment during a recession. He argued that this invalidated the assumptions of classical economists who thought that markets always clear, leaving no surplus of goods and no willing labor left idle. The generation of economists that followed Keynes synthesized his theory with neoclassical microeconomics to form the neoclassical synthesis. Although Keynesian theory originally omitted an explanation of price levels and inflation, later Keynesians adopted the Phillips c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

New Keynesian Macroeconomics

New Keynesian economics is a school of macroeconomics that strives to provide microeconomic foundations for Keynesian economics. It developed partly as a response to criticisms of Keynesian macroeconomics by adherents of new classical macroeconomics. Two main assumptions define the New Keynesian approach to macroeconomics. Like the New Classical approach, New Keynesian macroeconomic analysis usually assumes that households and firms have rational expectations. However, the two schools differ in that New Keynesian analysis usually assumes a variety of market failures. In particular, New Keynesians assume that there is imperfect competition in price and wage setting to help explain why prices and wages can become " sticky", which means they do not adjust instantaneously to changes in economic conditions. Wage and price stickiness, and the other present descriptions of market failures in New Keynesian models, imply that the economy may fail to attain full employment. Therefore, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

New Classical Macroeconomics

New classical macroeconomics, sometimes simply called new classical economics, is a school of thought in macroeconomics that builds its analysis entirely on a neoclassical framework. Specifically, it emphasizes the importance of foundations based on microeconomics, especially rational expectations. New classical macroeconomics strives to provide neoclassical microeconomic foundations for macroeconomic analysis. This is in contrast with its rival new Keynesian school that uses microfoundations, such as price stickiness and imperfect competition, to generate macroeconomic models similar to earlier, Keynesian ones. History Classical economics is the term used for the first modern school of economics. The publication of Adam Smith's ''The Wealth of Nations'' in 1776 is considered to be the birth of the school. Perhaps the central idea behind it is on the ability of the market to be self-correcting as well as being the most superior institution in allocating resources. The cen ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Neoclassical Synthesis

The neoclassical synthesis (NCS), or neoclassical–Keynesian synthesis Mankiw, N. Gregory. "The Macroeconomist as Scientist and Engineer". '' The Journal of Economic Perspectives''. Vol. 20, No. 4 (Fall, 2006), p. 35. is an academic movement and paradigm in economics that worked towards reconciling the macroeconomic thought of John Maynard Keynes in his book '' The General Theory of Employment, Interest and Money'' (1936) with neoclassical economics. The neoclassical synthesis is a macroeconomic theory that emerged in the mid-20th century, combining the ideas of neoclassical economics with Keynesian economics. The synthesis was an attempt to reconcile the apparent differences between the two schools of thought and create a more comprehensive theory of macroeconomics. It was formulated most notably by John Hicks (1937), Franco Modigliani (1944), and Paul Samuelson (1948), who dominated economics in the post-war period and formed the mainstream of macroeconomic thought in the 1 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Potential Output

In economics, potential output (also referred to as "natural gross domestic product") refers to the highest level of real gross domestic product (potential output) that can be sustained over the long term. Actual output happens in real life while potential output shows the level that could be achieved. Limits to output Natural (physical, etc) and institutional constraints impose limits to growth. If actual GDP rises and stays above potential output, then, in a free market economy (i.e. in the absence of wage and price controls), inflation tends to increase as demand for factors of production exceeds supply. This is because of the finite supply of workers and their time, of capital equipment, and of natural resources, along with the limits of our technology and our management skills. Graphically, the expansion of output beyond the natural limit can be seen as a shift of production volume above the optimum quantity on the average cost curve. Likewise, if GDP persists below natural ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Output Gap

The GDP gap or the output gap is the difference between actual GDP or actual output and potential GDP, in an attempt to identify the current economic position over the business cycle. The measure of output gap is largely used in macroeconomic policy (in particular in the context of EU fiscal rules compliance). The GDP gap is a highly criticized notion, in particular due to the fact that the potential GDP is not an observable variable, it is instead often derived from past GDP data, which could lead to systemic downward biases."True, the output gap is an elusive concept that should never have become a gauge for conducting public policy, and it may be larger than thought."Monetary policy: lifting the veil of effectivenes Speech by Benoit Cœuré, 18 December 2019 Calculation The calculation for the output gap is (Y–Y*)/Y* where Y is actual output and Y* is potential output. If this calculation yields a positive number it is called an inflationary gap and indicates the growt ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Lucas Critique

The Lucas critique argues that it is naïve to try to predict the effects of a change in economic policy entirely on the basis of relationships observed in historical data, especially highly aggregated historical data. More formally, it states that the decision rules of Keynesian models—such as the consumption function—cannot be considered as structural in the sense of being invariant with respect to changes in government policy variables. It was named after American economist Robert Lucas's work on macroeconomic policymaking. The Lucas critique is significant in the history of economic thought as a representative of the paradigm shift that occurred in macroeconomic theory in the 1970s towards attempts at establishing micro-foundations. Thesis The Lucas critique was not new in 1976. The argument and the whole logic was first presented by Frisch (1938) and discussed by Haavelmo (1944), among others. Related ideas are expressed as Campbell's law and Goodhart's law� ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Michael Woodford (economist)

Michael Dean Woodford (born 1955) is an American macroeconomist and monetary theorist who currently teaches at Columbia University. Academic career Woodford holds B.A. from the University of Chicago (1977) and a J.D. from Yale Law School (1980). He completed his Ph.D. in economics at MIT in 1983. He began his teaching career at Columbia, and then taught at Chicago and Princeton before returning to Columbia to accept the John Bates Clark chair in 2004. He was awarded the John D. and Catherine T. MacArthur Foundation Prize Fellowship, which financed his research from 1981 to 1986. In 2007, he was awarded the Deutsche Bank Prize. and in 2024 he received the Erwin Plein Nemmers Prize in Economics. For 2024 he was awarded the BBVA Foundation Frontiers of Knowledge Award in the category of "Economics and Finance". Theoretical contributions Woodford's early research topics included sunspot equilibria, and imperfect competition. Thereafter he began to work on macroeconomic ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Neutrality Of Money

Neutrality of money is the idea that a change in the stock of money affects only nominal variables in the economy such as prices, wages, and exchange rates, with no effect on real variables, like employment, real GDP, and real consumption. Neutrality of money is an important idea in classical economics and is related to the classical dichotomy. It implies that the central bank does not affect the real economy (e.g., the number of jobs, the size of real GDP, the amount of real investment) by creating money. Instead, any increase in the supply of money would be offset by a proportional rise in prices and wages. This assumption underlies some mainstream macroeconomic models (e.g., real business cycle models). Others like monetarism view money as being neutral only in the long run. When neutrality of money coincides with zero population growth, the economy is said to rest in ''steady-state equilibrium''. Superneutrality of money is a stronger property than neutrality of money. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Technology Shock

Technology shocks are sudden changes in technology that significantly affect economic, social, political or other outcomes. In economics, the term technology shock usually refers to events in a macroeconomic model, that change the production function. Usually this is modeled with an aggregate production function that has a scaling factor. Normally reference is made to positive (i.e., productivity enhancing) technological changes, though technology shocks can also be contractionary. The term “shock” connotes the fact that technological progress is not always gradual – there can be large-scale discontinuous changes that significantly alter production methods and outputs in an industry, or in the economy as a whole. Such a technology shock can occur in many different ways. For example, it may be the result of advances in science that enable new trajectories of innovation, or may result when an existing technological alternative improves to a point that it overtakes the domina ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |