|

National Pension System

The National Pension System (NPS) is a defined-contribution pension system in India regulated by the Pension Fund Regulatory and Development Authority (PFRDA) which is under the jurisdiction of the Ministry of Finance of the Government of India. National Pension System Trust (NPS Trust) was established by PFRDA as per the provisions of the Indian Trusts Act of 1882 to take care of the assets and funds under this scheme for the best interest of the subscriber. NPS Trust is the registered owner of all assets under the NPS architecture which is held for the benefit of the subscribers under NPS. The securities are purchased by Pension Funds on behalf of, and in the name of the Trustees, however individual NPS subscribers remain the beneficial owner of the securities, assets, and funds. NPS Trust, under the NPS Trust regulations, is responsible for monitoring the operational and functional activities of NPS intermediaries’ viz. custodian, Pension Funds, Trustee Bank, Centra ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Old Pension Scheme

Old Pension Scheme (OPS) in India was abolished as a part of pension reforms by Government of India, Union Government. Repealed from 1 January 2004, it had a Defined benefit pension plan, defined-benefit (DB) pension of half the Last Pay Drawn (LPD) at the time of retirement along with components like Dearness allowance, Dearness Allowances (DA) etc. OPS was an unfunded pension scheme financed on a pay-as-you-go (PAYG) basis in which current revenues of the government funded the pension benefit for its retired employees. Old Pension Scheme was replaced by a restructured defined-contribution (DC) pension scheme called the National Pension System. The Union Government's pension liabilities in Budget Estimate 2022-2023 on account of Old Pension Scheme for existing retirees is ₹2.07 lakh crore. The cost of pension for all State Government's combined Budget Estimate 2022-2023 is ₹4,63,436.9 Crores. History The practice of pension payment to retired employees is evident in Coloni ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

2017 Union Budget Of India

The 2017 Union Budget of India is the Union budget of India for the financial year 2017-2018. It was presented before the parliament on 1 February 2017 by the Finance Minister of India, Arun Jaitley with (US$336.39 billion) budget size. The printing of the budget documents began with a traditional ''Halwa ceremony'' in January 2017. Further, Railway budget of India was merged with the Union budget and classification of plan and non-plan expenditure was done away starting from the year 2017 by Narendra Modi led Government of India. Background It was the first budget after major changes in the Indian economy like Goods and Services Tax (India) and 2016 Indian banknote demonetisation. The core objective of the budget for 2017-18 was to "Transform, Energise and Clean (TEC) India": * Transform the quality of governance and quality of life of our people * Energise various sections of society, especially the youth and the vulnerable, and enable them to unleash their true poten ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax-advantaged Savings Plans In India

Tax advantage refers to the economic bonus which applies to certain accounts or investments that are, by statute, tax-reduced, tax-deferred, or tax-free. Examples of tax-advantaged accounts and investments include retirement plans, education savings accounts, medical savings accounts, and government bonds. Governments establish tax advantages to encourage private individuals to contribute money when it is considered to be in the public interest. Benefits Tax advantages provide an incentive to engage in certain investments and accounts, functioning like a government subsidy. For example, individual retirement accounts are tax-advantaged since they are tax-deferred. By encouraging investment in these accounts, there is a reduced need for the government to support citizens later in life by spending money on welfare or other government expenses. Capital gains tax rate benefits may also spur investment. Types of tax-advantaged accounts and investments Retirement plans The most ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Public Pension Funds

In public relations and communication science, publics are groups of individual people, and the public (a.k.a. the general public) is the totality of such groupings. This is a different concept to the sociological concept of the ''Öffentlichkeit'' or public sphere. The concept of a public has also been defined in political science, psychology, marketing, and advertising. In public relations and communication science, it is one of the more ambiguous concepts in the field. Although it has definitions in the theory of the field that have been formulated from the early 20th century onwards, and suffered more recent years from being blurred, as a result of conflation of the idea of a public with the notions of audience, market segment, community, constituency, and stakeholder. Etymology and definitions The name "public" originates with the Latin '' publicus'' (also '' poplicus''), from ''populus'', to the English word ' populace', and in general denotes some mass population ("the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Unified Pension Scheme

The Unified Pension Scheme (UPS), introduced by the Government of India in 2024 as an optional pension scheme along with the National Pension System (NPS) for the government employees, it aims to provide a comprehensive and centralised pension system for Central government employees. The scheme is designed to consolidate various existing pension schemes, offering a more equitable and efficient approach to retirement benefits. Background There have been long pending demands from the Central Government employees to introduce a more comprehensive pension system. Various opposition parties and leaders have raised the issue several times in their election speeches for the reintroduction of the Old Pension Scheme Old Pension Scheme (OPS) in India was abolished as a part of pension reforms by Government of India, Union Government. Repealed from 1 January 2004, it had a Defined benefit pension plan, defined-benefit (DB) pension of half the Last Pay Drawn ... (OPS). References {{ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Individual Retirement Account

An individual retirement account (IRA) in the United States is a form of pension provided by many financial institutions that provides tax advantages for retirement savings. It is a trust that holds investment assets purchased with a taxpayer's earned income for the taxpayer's eventual benefit in old age. An individual retirement account is a type of individual retirement arrangement as described in IRS Publication 590, ''Individual Retirement Arrangements (IRAs)''. Other arrangements include individual retirement annuities and employer-established benefit trusts. Types There are several types of IRAs: * Traditional IRA – Contributions are mostly tax-deductible (often simplified as "money is deposited before tax" or "contributions are made with pre-tax assets"), no transactions within the IRA are taxed, and withdrawals in retirement are taxed as income (except for those portions of the withdrawal corresponding to contributions that were not deducted). Depending upon the nature ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Retirement Plans In The United States

A retirement plan is a financial arrangement designed to replace employment income upon retirement. These plans may be set up by employers, insurance companies, trade unions, the government, or other institutions. United States Congress, Congress has expressed a desire to encourage responsible retirement planning by granting favorable tax treatment to a wide variety of plans. Federal tax aspects of retirement plans in the United States are based on provisions of the Internal Revenue Code and the plans are regulated by the United States Department of Labor, Department of Labor under the provisions of the Employee Retirement Income Security Act (ERISA). Types of retirement plans Retirement plans are classified as either Defined benefit pension plan, defined benefit plans or Defined contribution plan, defined contribution plans, depending on how benefits are determined. In a defined benefit (or pension) plan, benefits are calculated using a fixed formula that typically factors in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Roth IRA

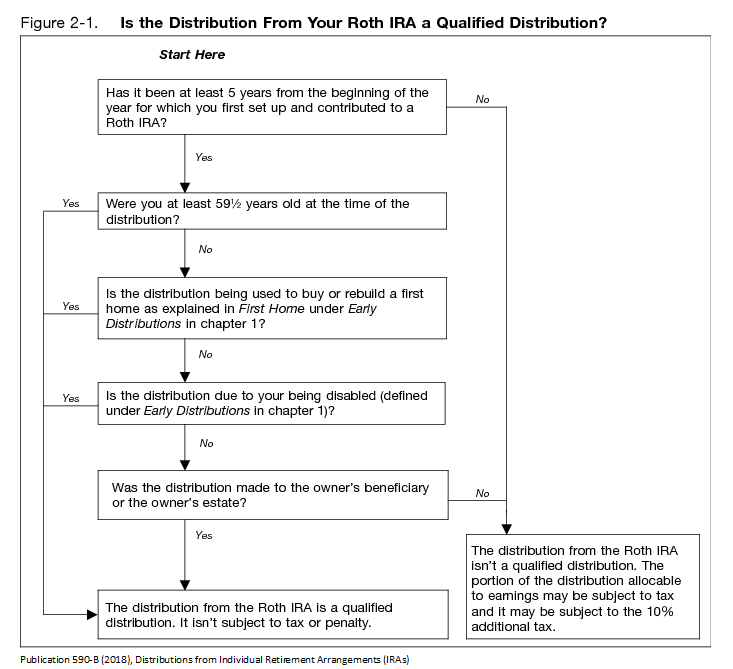

A Roth IRA is an individual retirement account (IRA) under United States law that is generally not Taxation in the United States, taxed upon distribution, provided certain conditions are met. The principal difference between Roth IRAs and most other tax-advantaged retirement plans is that rather than granting an income tax reduction for contributions to the retirement plan, qualified withdrawals from the Roth IRA plan are tax-free, and growth in the account is tax-free. The Roth IRA was introduced as part of the Taxpayer Relief Act of 1997 and is named for Senator William Roth. Overview A Roth IRA can be an individual retirement account containing investments in securities, usually common stock, common stocks and bond (finance), bonds, often through mutual fund, mutual funds (although other investments, including derivatives, notes, Certificate of deposit, certificates of deposit, and real estate are possible). A Roth IRA can also be an individual retirement Annuity (US financial p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

401(k)

In the United States, a 401(k) plan is an employer-sponsored, defined-contribution, personal pension (savings) account, as defined in subsection 401(k) of the U.S. Internal Revenue Code. Periodic employee contributions come directly out of their paychecks, and may be matched by the employer. This pre-tax option is what makes 401(k) plans attractive to employees, and many employers offer this option to their (full-time) workers. 401(k) payable is a general ledger account that contains the amount of 401(k) plan pension payments that an employer has an obligation to remit to a pension plan administrator. This account is classified as a payroll liability, since the amount owed should be paid within one year. There are two types: traditional and Roth 401(k). For Roth accounts, contributions and withdrawals have no impact on income tax. For traditional accounts, contributions may be deducted from taxable income and withdrawals are added to taxable income. There are limits to contribut ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mutual Fund

A mutual fund is an investment fund that pools money from many investors to purchase Security (finance), securities. The term is typically used in the United States, Canada, and India, while similar structures across the globe include the SICAV in Europe ('investment company with variable capital'), and the open-ended investment company (OEIC) in the UK. Mutual funds are often classified by their principal investments: money market funds, bond fund, bond or fixed income funds, stock fund, stock or equity funds, or hybrid funds. Funds may also be categorized as index funds, which are passively managed funds that track the performance of an index, such as a stock market index or bond market index, or actively managed funds, which seek to outperform stock market indices but generally charge higher fees. The primary structures of mutual funds are open-end funds, closed-end funds, and unit investment trusts. Over long durations, passively managed funds consistently outperform actively m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Equity-linked Savings Scheme

An Equity Linked Savings Scheme, popularly known as ELSS, is a type of diversified equity scheme which comes, with a lock-in period of three years, offered by mutual funds in India. They offer tax benefits under the Section 80C of Income Tax Act 1961. ELSSes can be invested using both SIP (Systematic Investment Plan) and lump sums investment options. There is a three years lock-in period, and thus has better liquidity compared to other options like NSC and Public Provident Fund (India), Public Provident Fund. Mutual funds are subjective to fluctuations in the market. Features * Investment Options: ELSS investment can be made in SIPs as well as on a lump sum basis. * Lock-in Period: These have a lock-in period of three years which is much more flexible than NSC and PPF. * Market Exposure: ELSS funds majorly invest in Equity (finance), equity and related instruments, they are highly exposed to market risks hence very volatile. * Tax Benefits: Investment of up to ₹1,50,000 every fin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |