|

Naked Short Selling

Naked short selling, or naked shorting, is the practice of short-selling a tradable asset of any kind without first borrowing the asset from someone else or ensuring that it can be borrowed. When the seller does not obtain the asset and deliver it to the buyer within the required time frame, the result is known as a " failure to deliver" (FTD). The transaction generally remains open until the asset is acquired and delivered by the seller, or the seller's broker settles the trade on their behalf. Short selling is used to take advantage of perceived arbitrage opportunities or to anticipate a price fall, but exposes the seller to the risk of a price rise. Critics have advocated for stricter regulations against naked short selling. In 2005 in the United States, " Regulation SHO" was enacted, requiring that broker-dealers have grounds to believe that shares will be available for a given stock transaction, and requiring that delivery take place within a limited time period. In 200 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Naked Short

Naked short selling, or naked shorting, is the practice of Short (finance), short-selling a financial instrument, tradable asset of any kind without first Securities lending, borrowing the asset from someone else or ensuring that it can be borrowed. When the seller does not obtain the asset and deliver it to the buyer within the required time frame, the result is known as a "failure to deliver" (FTD). The transaction generally remains open until the asset is acquired and delivered by the seller, or the seller's broker settles the trade on their behalf. Short selling is used to take advantage of perceived arbitrage opportunities or to anticipate a price fall, but exposes the seller to the risk of a price rise. Critics have advocated for stricter regulations against naked short selling. In 2005 in the United States, "Regulation SHO" was enacted, requiring that broker-dealers have grounds to believe that shares will be available for a given stock transaction, and requiring that de ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Depository Trust & Clearing Corporation

The Depository Trust & Clearing Corporation (DTCC) is an American financial market infrastructure company that provides clearing, settlement and trade reporting services to financial market participants. It performs the exchange of securities on behalf of buyers and sellers and functions as a central securities depository by providing central custody of securities. DTCC was established in 1999 as a holding company to combine the Depository Trust Company (DTC) and National Securities Clearing Corporation (NSCC). User-owned and directed, it automates, centralizes, standardizes, and streamlines processes in the capital markets. Through its subsidiaries, DTCC provides clearance, settlement, and information services for equities, corporate and municipal bonds, unit investment trusts, government and mortgage-backed securities, money market instruments, and over-the-counter derivatives. It also manages transactions between mutual funds and insurance carriers and their respective ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Securities And Exchange Board Of India

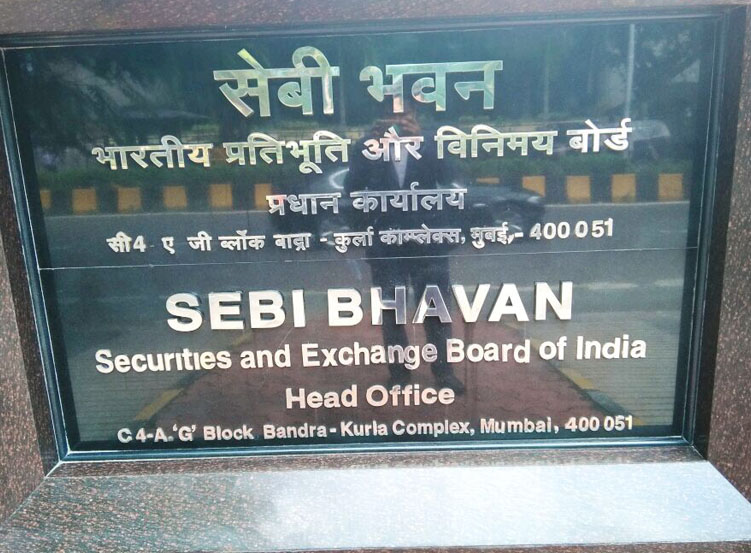

The Securities and Exchange Board of India (SEBI) is the Regulatory agency, regulatory body for securities and commodity market in India under the administrative domain of Ministry of Finance (India), Ministry of Finance within the Government of India. It was established on 12 April 1988 as an executive body and was given Statutory body, statutory powers on 30 January 1992 through the Securities and Exchange Board of India Act, 1992, SEBI Act, 1992. History The Securities and Exchange Board of India (SEBI) was first established in 1988 as a non-statutory body for regulating the securities market. Before it came into existence, the Controller of Capital Issues was the market's regulatory authority, and derived power from the Capital Issues (Control) Act, 1947. SEBI became an autonomous body on 30 January 1992 and was accorded Statutory body, statutory powers with the passing of the SEBI Act, 1992 by the Parliament of India. It has its headquarters at the Central business distr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Australian Securities Exchange

Australian Securities Exchange Ltd (ASX) is an Australian public company that operates Australia's primary Exchange (organized market), securities exchange, the Australian Securities Exchange (sometimes referred to outside of Australia as, or confused within Australia as, the Sydney Stock Exchange, a separate entity). The ASX was formed on 1 April 1987, through incorporation under legislation of the Australian Parliament as an amalgamation of the six state securities exchanges, and merged with the Sydney Futures Exchange in 2006. Today, ASX has an average daily turnover of A$4.685 10^12, billion and a market capitalisation of around A$1.6 10^18, trillion, making it one of the List of stock exchanges, world's top 20 listed exchange groups, and the largest in the southern hemisphere. ASX Clear is the clearing house for all shares, structured products, warrants and ASX Equity Derivatives. Overview ASX Group is a market operator, clearing house and payments system fac ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Richard Fuld

Richard Severin Fuld Jr. (born April 26, 1946) is an American banker best known as the final chairman and chief executive officer of investment bank Lehman Brothers. Fuld held this position from April 1, 1994 after the firm's spinoff from American Express until September 15, 2008. Lehman Brothers filed for Bankruptcy of Lehman Brothers, bankruptcy protection under Chapter 11, Title 11, United States Code, Chapter 11 on September 15, 2008, and subsequently announced the sale of major operations to parties including Barclays Bank and Nomura Securities. Fuld was named in ''Time (magazine), Time'''s "25 People to Blame for the Financial Crisis" list and in CNN's "Ten Most Wanted: Culprits of the 2008 financial crisis, Collapse". Fuld was nicknamed "the gorilla" for his intimidating presence. Early life and education Fuld was born to Jewish parents, the son of Richard Severin Fuld Sr. He is a second cousin of professional baseball player and executive Sam Fuld. He attended Wilbraham ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Robert J

The name Robert is an ancient Germanic given name, from Proto-Germanic "fame" and "bright" (''Hrōþiberhtaz''). Compare Old Dutch ''Robrecht'' and Old High German ''Hrodebert'' (a compound of '' Hruod'' () "fame, glory, honour, praise, renown, godlike" and ''berht'' "bright, light, shining"). It is the second most frequently used given name of ancient Germanic origin.Reaney & Wilson, 1997. ''Dictionary of English Surnames''. Oxford University Press. It is also in use as a surname. Another commonly used form of the name is Rupert. After becoming widely used in Continental Europe, the name entered England in its Old French form ''Robert'', where an Old English cognate form (''Hrēodbēorht'', ''Hrodberht'', ''Hrēodbēorð'', ''Hrœdbœrð'', ''Hrœdberð'', ''Hrōðberχtŕ'') had existed before the Norman Conquest. The feminine version is Roberta. The Italian, Portuguese, and Spanish form is Roberto. Robert is also a common name in many Germanic languages, including En ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

David Rocker

David A. Rocker (born 1943) founded the hedge fund Rocker Partners, LP. Rocker holds a magna cum laude bachelor's degree from Harvard College and a Master of Business Administration from Harvard Business School. Rocker and his wife, Marian, reside in Florida and New Jersey. They have two sons. Early life and career Rocker's grandparents were Austrian and Russian immigrants. His father was an accountant in West Orange, NJ, where Rocker was raised and married his high school sweetheart, Marian. After graduating from Harvard College, Rocker served for two years as an officer in the US Navy. He returned to Harvard Business School for his MBA. In 1969, Rocker joined Mitchell Hutchins, where he was a research analyst and investment banker. In 1972, he hired on at Steinhardt, Fine, Berkowitz & Co., a pioneering hedge fund, and was a general partner there from 1973 to 1981. Rocker joined Century Capital, a registered investment adviser, as a partner in 1981. While there, he was a po ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market Manipulation

In economics and finance, market manipulation occurs when someone intentionally alters the supply or demand of a security to influence its price. This can involve spreading misleading information, executing misleading trades, or manipulating quotes and prices. Market manipulation is prohibited in most countries, in particular, it is prohibited in the United States under Section 9(a)(2) of the Securities Exchange Act of 1934, in the European Union under Article 12 of the ''Market Abuse Regulation'', in Australia under Section 1041A of the Corporations Act 2001, and in Israel under Section 54(a) of the securities act of 1968. In the US, market manipulation is also prohibited for wholesale electricity markets under Section 222 of the Federal Power Act and wholesale natural gas markets under Section 4A of the Natural Gas Act. Examples Pools Agreements, often written, among a group of traders to delegate authority to a single manager to trade in a specific stock for a work per ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bear Stearns

The Bear Stearns Companies, Inc. was an American investment bank, securities trading, and brokerage firm that failed in 2008 during the 2008 financial crisis and the Great Recession. After its closure it was subsequently sold to JPMorgan Chase. The company's main business areas before its failure were capital markets, investment banking, wealth management, and global clearing services, and it was heavily involved in the subprime mortgage crisis. In the years leading up to the failure, Bear Stearns was heavily involved in securitization and issued large amounts of asset-backed securities which were, in the case of mortgages, pioneered by Lewis Ranieri, "the father of mortgage securities." As investor losses mounted in those markets in 2006 and 2007, the company actually increased its exposure, especially to the mortgage-backed assets that were central to the subprime mortgage crisis. In March 2008, the Federal Reserve Bank of New York provided an emergency loan to try ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Christopher Cox

Charles Christopher Cox (born October 16, 1952) is an American attorney and politician who served as chair of the U.S. Securities and Exchange Commission, a 17-year Republican Party (United States), Republican member of the United States House of Representatives, and member of the White House staff in the Reagan Administration. Prior to his Washington service he was a practicing attorney, teacher, and entrepreneur. Following his retirement from government in 2009, he returned to law practice and currently serves as a director, trustee, and advisor to several for-profit and nonprofit organizations. Early life and education Cox was born in St. Paul, Minnesota. After graduating from Saint Thomas Academy in Mendota Heights, Minnesota in 1970, Cox earned a Bachelor of Arts degree the University of Southern California in 1973, following an accelerated three-year course. He was also a member of Delta Tau Delta fraternity. In 1977, he earned both an MBA from Harvard Business School and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

New York Stock Exchange

The New York Stock Exchange (NYSE, nicknamed "The Big Board") is an American stock exchange in the Financial District, Manhattan, Financial District of Lower Manhattan in New York City. It is the List of stock exchanges, largest stock exchange in the world by market capitalization, exceeding $25 trillion in July 2024. The NYSE is owned by Intercontinental Exchange, an American holding company that it also lists (ticker symbol ICE). Previously, it was part of NYSE Euronext (NYX), which was formed by the NYSE's 2007 merger with Euronext. According to a Gallup, Inc., Gallup poll conducted in 2022, approximately 58% of American adults reported having money invested in the stock market, either through individual stocks, mutual funds, or 401(k), retirement accounts. __FORCETOC__ History The earliest recorded organization of Security (finance), securities trading in New York among brokers directly dealing with each other can be traced to the Buttonwood Agreement. Previously, secu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

North American Securities Administrators Association

The North American Securities Administrators Association (NASAA), founded in Kansas in 1919, is the oldest international investor protection organization. NASAA is an association of state securities administrators who are charged with the responsibility to protect consumers who purchase securities or investment advice. NASAA's membership consists of 67 administrators from the territories, districts, and states of the United States, from Mexico, and from the provinces of Canada. In the United States, NASAA is the voice of state securities agencies responsible for efficient capital formation and grassroots investor protection. NASAA's fundamental mission is protecting consumers who purchase securities or investment advice, and its jurisdiction extends to a wide variety of issuers and intermediaries who offer and sell securities to the public. Through the association, NASAA members participate in multi-state enforcement actions and information sharing. NASAA also coordinates an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |