|

Mortgages

A mortgage loan or simply mortgage (), in civil law jurisdictions known also as a hypothec loan, is a loan used either by purchasers of real property to raise funds to buy real estate, or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. The loan is " secured" on the borrower's property through a process known as mortgage origination. This means that a legal mechanism is put into place which allows the lender to take possession and sell the secured property (" foreclosure" or " repossession") to pay off the loan in the event the borrower defaults on the loan or otherwise fails to abide by its terms. The word ''mortgage'' is derived from a Law French term used in Britain in the Middle Ages meaning "death pledge" and refers to the pledge ending (dying) when either the obligation is fulfilled or the property is taken through foreclosure. A mortgage can also be described as "a borrower giving consideration in the fo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Commercial Mortgage

A commercial mortgage is a mortgage loan secured by commercial property, such as an office building, shopping center, industrial warehouse, or apartment complex. The proceeds from a commercial mortgage are typically used to acquire, refinance, or redevelop commercial property. Commercial mortgages are structured to meet the needs of the borrower and the lender. Key terms include the loan amount (sometimes referred to as "loan proceeds"), interest rate, term (sometimes referred to as the "maturity"), amortization schedule, and prepayment flexibility. Commercial mortgages are generally subject to extensive underwriting and due diligence prior to closing. The lender's underwriting process may include a financial review of the property and the property owner (or "sponsor"), as well as commissioning and review of various third-party reports, such as an real estate appraisal, appraisal. There were $3.1 trillion of commercial and multifamily mortgages outstanding in the U.S. as of Ju ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mortgage Law

A mortgage is a legal instrument of the common law which is used to create a security interest in real property held by a lender as a security for a debt, usually a mortgage loan. '' Hypothec'' is the corresponding term in civil law jurisdictions, albeit with a wider sense, as it also covers non-possessory lien. A mortgage in itself is not a debt, it is the lender's security for a debt. It is a transfer of an interest in land (or the equivalent) from the owner to the mortgage lender, on the condition that this interest will be returned to the owner when the terms of the mortgage have been satisfied or performed. In other words, the mortgage is a security for the loan that the lender makes to the borrower. The word is a Law French term meaning "dead pledge," originally only referring to the Welsh mortgage (''see below''), but in the later Middle Ages was applied to all gages and reinterpreted by folk etymology to mean that the pledge ends (dies) either when the obligati ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Foreclosure

Foreclosure is a legal process in which a lender attempts to recover the balance of a loan from a borrower who has Default (finance), stopped making payments to the lender by forcing the sale of the asset used as the Collateral (finance), collateral for the loan. Formally, a Mortgage law#Mortgage lender, mortgage lender (mortgagee), or other lienholder, obtains a termination of a Mortgage law#Borrower, mortgage borrower (mortgagor)'s Equity of redemption, equitable right of redemption, either by court order or by operation of law (after following a specific statutory procedure). Usually, a lender obtains a security interest from a borrower who mortgages or pledges an asset like a house to secure the loan. If the borrower default (finance), defaults and the lender tries to Repossession, repossess the property, courts of equity can grant the borrower the Equity of redemption, equitable right of redemption if the borrower repays the debt. While this equitable right exists, it is ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Building Society

A building society is a financial institution owned by its members as a mutual organization, which offers banking institution, banking and related financial services, especially savings and mortgage loan, mortgage lending. They exist in the United Kingdom, Australia and New Zealand, and formerly in Ireland and several Commonwealth countries, including South Africa as mutual banks. They are similar to credit unions, but rather than promoting thrift and offering unsecured and business loans, the purpose of a building society is to provide home mortgages to members. Borrowers and depositors are society members, setting policy and appointing directors on a one-member, one-vote basis. Building societies often provide other retail banking services, such as current accounts, credit cards and personal loans. The term "building society" first arose in the 19th century in Kingdom of Great Britain, Great Britain from cooperative banking, cooperative savings groups. In the United Kingdom, bu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bankruptcy

Bankruptcy is a legal process through which people or other entities who cannot repay debts to creditors may seek relief from some or all of their debts. In most jurisdictions, bankruptcy is imposed by a court order, often initiated by the debtor. Bankrupt is not the only legal status that an insolvent person may have, meaning the term ''bankruptcy'' is not a synonym for insolvency. Etymology The word ''bankruptcy'' is derived from Italian language, Italian , literally meaning . The term is often described as having originated in Renaissance Italy, where there allegedly existed the tradition of smashing a banker's bench if he defaulted on payment. However, the existence of such a ritual is doubted. History In Ancient Greece, bankruptcy did not exist. If a man owed and he could not pay, he and his wife, children or servants were forced into "debt slavery" until the creditor recouped losses through their Manual labour, physical labour. Many city-states in ancient Greece lim ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Union

A credit union is a member-owned nonprofit organization, nonprofit cooperative financial institution. They may offer financial services equivalent to those of commercial banks, such as share accounts (savings accounts), share draft accounts (checking account, cheque accounts), credit cards, Credit (finance), credit, share term certificates (Certificate of deposit, certificates of deposit), and online banking. Normally, only a member of a credit union may deposit account, deposit or loan, borrow money. In several African countries, credit unions are commonly referred to as ''SACCOs'' (''savings and credit co-operatives''). Worldwide, credit union systems vary significantly in their total assets and average institution asset size, ranging from volunteer operations with a handful of members to institutions with hundreds of thousands of members and assets worth billions of US dollars. In 2018, the number of members in credit unions worldwide was 375 million, with over 100 millio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Collateral (finance)

In lending agreements, collateral is a borrower's pledge of specific property to a lender, to secure repayment of a loan. The collateral serves as a lender's protection against a borrower's default and so can be used to offset the loan if the borrower fails to pay the principal and interest satisfactorily under the terms of the lending agreement. The protection that collateral provides generally allows lenders to offer a lower interest rate on loans that have collateral. The reduction in interest rate can be up to several percentage points, depending on the type and value of the collateral. For example, the Annual Percentage Rate (APR) on an unsecured loan is often much higher than on a secured loan or logbook loan. If a borrower defaults on a loan (due to insolvency or another event), that borrower loses the property pledged as collateral, with the lender then becoming the owner of the property. In a typical mortgage loan transaction, for instance, the real estate ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

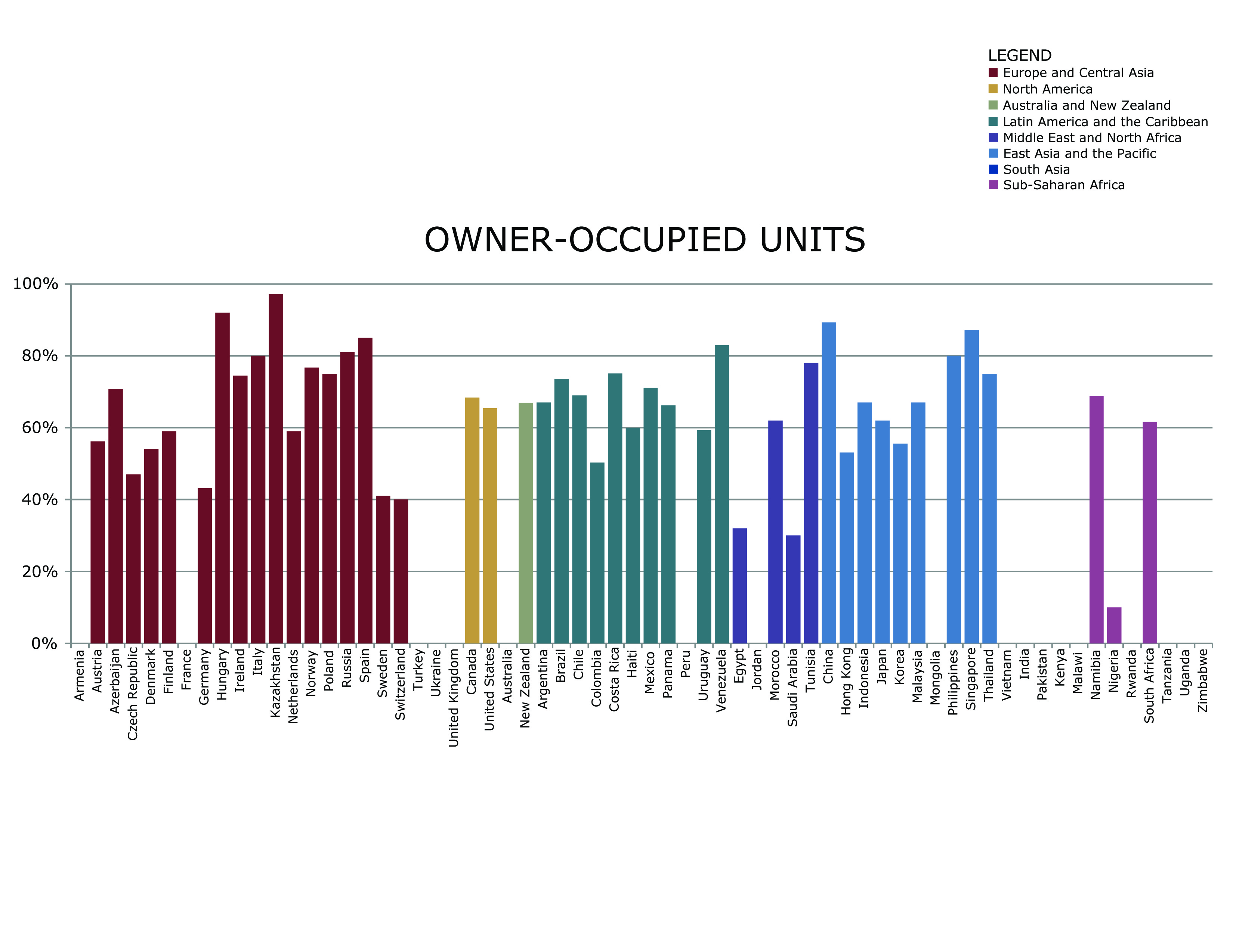

Home Ownership

Owner-occupancy or home-ownership is a form of housing tenure in which a person, called the owner-occupier, owner-occupant, or home owner, owns the home in which they live. The home can be a house, such as a single-family house, an apartment, condominium, or a housing cooperative. In addition to providing housing, owner-occupancy also functions as a real estate investment. Acquisition Some homes are constructed by the owners with the intent to occupy. Many are inherited. A large number are purchased as new homes from a real estate developer or as an existing home from a previous landlord or owner-occupier. A house is usually the most expensive single purchase an individual or family makes and often costs several times the annual household income. Given the high cost, most individuals do not have enough savings on hand to pay the entire amount outright. In developed countries, mortgage loans are available from financial institutions in return for interest. If the homeowner ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Insolvency

In accounting, insolvency is the state of being unable to pay the debts, by a person or company ( debtor), at maturity; those in a state of insolvency are said to be ''insolvent''. There are two forms: cash-flow insolvency and balance-sheet insolvency. Cash-flow insolvency is when a person or company has enough assets to pay what is owed, but does not have the appropriate form of payment. For example, a person may own a large house and a valuable car, but not have enough liquid assets to pay a debt when it falls due. Cash-flow insolvency can usually be resolved by negotiation. For example, the bill collector may wait until the car is sold and the debtor agrees to pay a penalty. Balance-sheet insolvency is when a person or company does not have enough assets to pay all of their debts. The person or company might enter bankruptcy, but not necessarily. Once a loss is accepted by all parties, negotiation is often able to resolve the situation without bankruptcy. A company ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

30 Year Mortgage Calculator

3 (three) is a number, numeral and digit. It is the natural number following 2 and preceding 4, and is the smallest odd prime number and the only prime preceding a square number. It has religious and cultural significance in many societies. Evolution of the Arabic digit The use of three lines to denote the number 3 occurred in many writing systems, including some (like Roman and Chinese numerals) that are still in use. That was also the original representation of 3 in the Brahmic (Indian) numerical notation, its earliest forms aligned vertically. However, during the Gupta Empire the sign was modified by the addition of a curve on each line. The Nāgarī script rotated the lines clockwise, so they appeared horizontally, and ended each line with a short downward stroke on the right. In cursive script, the three strokes were eventually connected to form a glyph resembling a with an additional stroke at the bottom: ३. The Indian digits spread to the Caliphate in the 9 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Property Law

Property law is the area of law that governs the various forms of ownership in real property (land) and personal property. Property refers to legally protected claims to resources, such as land and personal property, including intellectual property. Property can be exchanged through Contract, contract law, and if property is violated, one could sue under Tort, tort law to protect it. The concept, idea or philosophy of property underlies all property law. In some jurisdictions, historically all property was owned by the monarch and it devolved through feudal land tenure or other feudal systems of loyalty and fealty. Theory The word ''property'', in everyday usage, refers to an object (or objects) owned by a person—a car, a book, or a cellphone—and the relationship the person has to it. In law, the concept acquires a more nuanced rendering. Factors to consider include the nature of the object, the relationship between the person and the object, the relationship between a numbe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |