|

Money Center Bank

A money center bank (also written money-center bank) is a bank or bank holding company that is a particular kind of high-end commercial bank: located in a major financial center such as New York or San Francisco, its lending operations are financed by borrowings from other banks or by issuing bonds. Money center banks tend to engage in a number of different or related businesses, such as corporate banking, investment banking, Foreign exchange service (finance), foreign exchange services, currency trading, securities trading, Derivatives market, derivatives trading, issuing credit cards, and making loans to private equity firms and to foreign governments. Money center banks have extremely large balance sheets, and are large enough and embedded enough within international finance that they are often considered to be in the "too big to fail" category. Being a money center bank does not have a firm definition, and in some cases, observers may disagree on exactly where the boundary is ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank

A bank is a financial institution that accepts Deposit account, deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets. As banks play an important role in financial stability and the economy of a country, most jurisdictions exercise a high degree of Bank regulation, regulation over banks. Most countries have institutionalized a system known as fractional-reserve banking, under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure accounting liquidity, liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, the Basel Accords. Banking in its modern sense evolved in the fourteenth century in the prosperous cities of Renaissance Italy but, in many ways, functioned as a continuation of ideas and concepts o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Deposit Account

A deposit account is a bank account maintained by a financial institution in which a customer can deposit and withdraw money. Deposit accounts can be savings accounts, current accounts or any of several other types of accounts explained below. Transactions on deposit accounts are recorded in a bank's books, and the resulting balance is recorded as a liability of the bank and represents an amount owed by the bank to the customer. In other words, the banker-customer (depositor) relationship is one of debtor-creditor. Some banks charge fees for transactions on a customer's account. Additionally, some banks pay customers interest on their account balances. Types of accounts * How banking works In banking, the verbs "deposit" and "withdraw" mean a customer paying money into, and taking money out of, an account, respectively. From a legal and financial accounting standpoint, the noun "deposit" is used by the banking industry in financial statements to describe the liability ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

HSBC

HSBC Holdings plc ( zh, t_hk=滙豐; initialism from its founding member The Hongkong and Shanghai Banking Corporation) is a British universal bank and financial services group headquartered in London, England, with historical and business links to East Asia and a multinational corporation, multinational footprint. It is the List of banks in Europe, largest Europe-based bank by total assets, ahead of BNP Paribas, with US$3.098 trillion as of September 2024. This also puts it as the List of largest banks, 7th largest bank in the world by total assets behind Bank of America, and the 3rd largest State ownership, non-state owned bank in the world. In 2021, HSBC had $10.8 trillion in assets under custodian bank, custody (AUC) and $4.9 trillion in assets under administration (AUA). HSBC traces its origin to a Hong (business), ''hong'' trading house in British Hong Kong. The bank was established in 1865 in Hong Kong and opened branches in Shanghai in the same year. It was ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

HSBC Bank USA

HSBC Bank USA, National Association, an American subsidiary of the British banking group HSBC, is a bank with its operational head office in New York City and its nominal head office in Tysons, Virginia (as designated on its charter). HSBC Bank USA, N.A. is a national bank chartered under the National Bank Act, and thus is regulated by the Office of the Comptroller of the Currency (OCC), a part of the U.S. Department of the Treasury. Although this company was established in 1850 as Marine Midland Bank, its presence dates to 1865 when HSBC entered into the American market by opening an office in San Francisco before becoming a branch in 1875. Through multiple expansions nationwide and the full acquisition of Marine Midland in 1987, the company adopted its current HSBC USA name in 1999. The company has 22 branch locations, down from the previous 148 before divesting its retail banking business to Citizens Financial Group, Cathay Bank and KeyBank in 2021. History Beginning ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

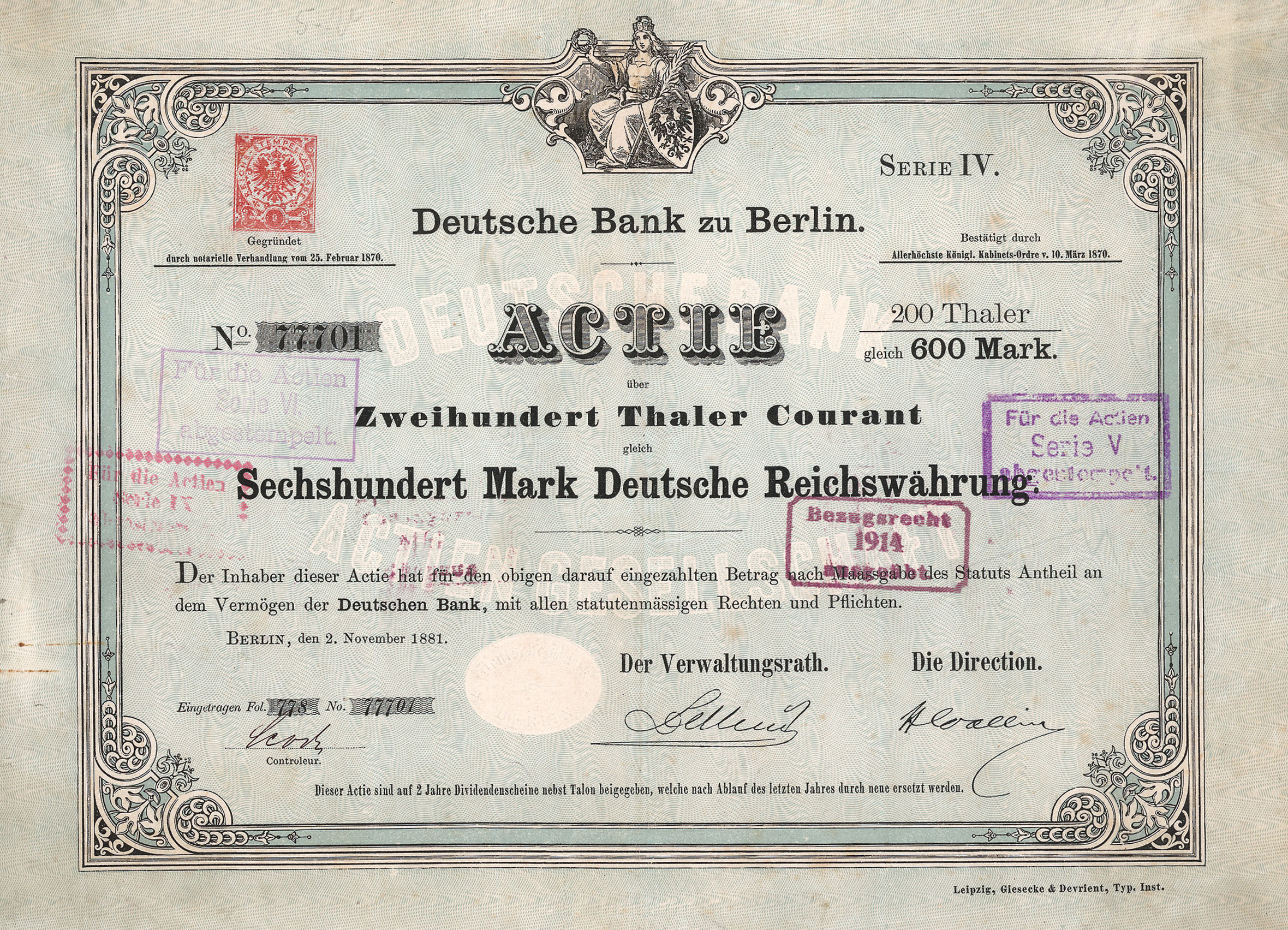

Deutsche Bank

Deutsche Bank AG (, ) is a Germany, German multinational Investment banking, investment bank and financial services company headquartered in Frankfurt, Germany, and dual-listed on the Frankfurt Stock Exchange and the New York Stock Exchange. Deutsche Bank was founded in 1870 in Berlin. From 1929 to 1937, following its merger with Disconto-Gesellschaft, it was known as ''Deutsche Bank und Disconto-Gesellschaft'' or DeDi-Bank. Other transformative acquisitions have included those of Mendelssohn & Co. in 1938, Morgan, Grenfell & Company, Morgan Grenfell in 1990, Bankers Trust in 1998, and Deutsche Postbank in 2010. As of 2018, the bank's network spanned 58 countries with a large presence in Europe, the Americas, and Asia. It is a component of the DAX stock market index and is often referred to as the List of banks in Germany, largest German banking institution, with Deutsche Bank holding the majority stake in DWS Group for combined assets of 2.2 trillion euros, rivaling even Spa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bankers Trust

Bankers Trust was a historic American banking organization. The bank merged with Alex. Brown & Sons in 1997 before being acquired by Deutsche Bank in 1999. Deutsche Bank sold the Trust and Custody division of Bankers Trust to State Street Corporation in 2003. History In 1903 a group of New York national banks formed trust company Bankers Trust to provide trust services to customers of state and national banks throughout the country on the premise that it would not lure commercial bank customers away. In addition to offering the usual trust and commercial banking functions, it also acted as a "bankers' bank" by holding the reserves of other banks and trust companies and loaning them money when they needed additional reserves due to unexpected withdrawals. Bankers Trust Company was incorporated on March 24, 1903, with an initial capital of $1.5 million. Despite technically having numerous stockholders, the voting power was held by three associates of J.P. Morgan. Thus, it was w ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Chase Manhattan Bank

JPMorgan Chase Bank, N.A., doing business as Chase, is an American national bank headquartered in New York City that constitutes the consumer and commercial banking subsidiary of the U.S. multinational banking and financial services holding company, JPMorgan Chase. The bank was known as Chase Manhattan Bank until it merged with J.P. Morgan & Co. in 2000. Chase Manhattan Bank was formed by the merger of the Chase National Bank and the Manhattan Company in 1955. The bank merged with Chemical Bank New York in 1996 and later merged with Bank One Corporation in 2004 and in 2008 acquired the deposits and most assets of Washington Mutual. In May 2023, it acquired the assets of First Republic Bank. Chase offers more than 4,701 branches and 15,000 ATMs nationwide and has 18.5 million checking accounts and 25 million debit card users as of 2023. JPMorgan Chase & Co. has 250,355 employees (as of 2016) and operates in more than 100 countries. JPMorgan Chase & Co. had assets of $3.31 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

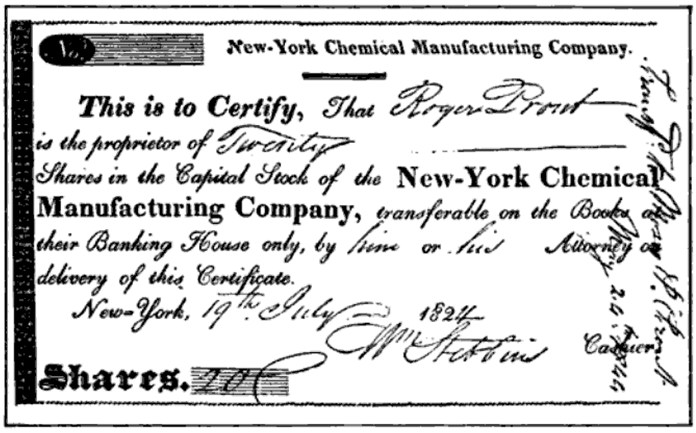

Chemical Banking Corporation

Chemical Bank, headquartered in New York City, was the principal operating subsidiary of Chemical Banking Corporation, a bank holding company. In 1996, it acquired Chase Bank, adopted the Chase name, and became the largest bank in the United States. Prior to the 1996 merger, Chemical was the third-largest bank in the U.S., with $182.9 billion in assets and more than 39,000 employees. In addition to operations in the U.S., it had a major presence in Japan, Germany, and the United Kingdom. It was active in both corporate banking as well as retail banking as well as investment banking and underwriting corporate bonds and equity. The bank was founded in 1824 as a subsidiary of the New York Chemical Manufacturing Company by Balthazar P. Melick and others; the manufacturing operations were sold by 1851. Major acquisitions by the bank included Corn Exchange Bank in 1954, Texas Commerce Bank in 1987, and Manufacturers Hanover in 1991. The bank converted to the holding company format in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Manufacturers Hanover Corporation

Manufacturers Hanover Corporation was an American bank holding company that was formed as parent of Manufacturers Hanover Trust Company (MHT or, informally, Manny Hanny), a large New York City bank formed through a merger in 1961 with ancestor companies, especially the Manufacturers Trust Company, having had a long history in New York banking going back to the 1850s. After 1969, Manufacturers Hanover Trust became a subsidiary of Manufacturers Hanover Corporation. Throughout most of its existence, Manufacturers Hanover Trust was the fourth-largest bank in the United States. MHT was both a major money center bank and heavily engaged in retail banking. As such, the bank was known for stability and was well established via its personal accounts base tied to New York branch locations as well as in having a number of large blue-chip corporate customers. It ran several memorable advertising campaigns in the 1970s and also had some prominent sports sponsorship arrangements. Over time ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Wells Fargo

Wells Fargo & Company is an American multinational financial services company with a significant global presence. The company operates in 35 countries and serves over 70 million customers worldwide. It is a systemically important financial institution according to the Financial Stability Board, and is considered one of the "Big Four (banking)#United States, Big Four Banks" in the United States, alongside JPMorgan Chase, Bank of America, and Citigroup. The company's primary subsidiary is Wells Fargo Bank, N.A., a National bank (United States), national bank that designates its Sioux Falls, South Dakota, site as its main office (and therefore is treated by most U.S. federal courts as a citizen of South Dakota).Rouse v. Wachovia Mortgage, FSB', 747 F.3d 707 (9th Cir. 2014) (citing cases on each side of circuit split and joining majority rule that a national bank is only a citizen of the state in which its main office is located). It is the List of largest banks in the U ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Of America

The Bank of America Corporation (Bank of America) (often abbreviated BofA or BoA) is an American multinational investment banking, investment bank and financial services holding company headquartered at the Bank of America Corporate Center in Charlotte, North Carolina, with investment banking and auxiliary headquarters in Manhattan. The bank was founded by the merger of NationsBank and Bank of America (1904–1998), Bank of America in 1998. It is the List of largest banks in the United States, second-largest banking institution in the United States and the second-largest bank in the world by market capitalization, both after JPMorgan Chase. Bank of America is one of the Big Four (banking)#United States, Big Four banking institutions of the United States. and one of eight systemically important financial institutions in the US. It serves about 10 percent of all American bank deposits, in direct competition with JPMorgan Chase, Citigroup, and Wells Fargo. Its primary financial se ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Citigroup

Citigroup Inc. or Citi (Style (visual arts), stylized as citi) is an American multinational investment banking, investment bank and financial services company based in New York City. The company was formed in 1998 by the merger of Citicorp, the bank holding company for Citibank, and The Travelers Companies, Travelers; Travelers was spun off from the company in 2002. Citigroup is the List of largest banks in the United States, third-largest banking institution in the United States by assets; alongside JPMorgan Chase, Bank of America, and Wells Fargo, it is one of the Big Four (banking)#United States, Big Four banking institutions of the United States. It is considered a Systemically important financial institution, systemically important bank by the Financial Stability Board, and is commonly cited as being "too big to fail". It is one of the eight global investment banks in the Bulge Bracket. Citigroup is ranked 36th on the Fortune 500, ''Fortune'' 500, and was ranked #24 in Fo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |