|

Mobile Payments In India

Mobile payments is a mode of payment using mobile phones. Instead of using methods like cash, cheque, and credit card, a customer can use a mobile phone to transfer money or to pay for goods and services. A customer can transfer money or pay for goods and services by sending an SMS, using a Java application over GPRS, a Wireless Application Protocol, WAP service, over IVR or other mobile communication technologies. In India, this service is bank-led. Customers wishing to avail themselves of this service will have to register with banks which provide this service. Currently, this service is being offered by several major banks and is expected to grow further. National Payments Corporation of India, Mobile Payment Forum of India (MPFI) is the umbrella organisation which is responsible for deploying mobile payments in India. India is the world's largest-growing mobile payments market. Mobile payment surpassed credit card transactions in 2021, clocking an annual value greater than $1 tr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mobile Payments

Mobile payment, also referred to as mobile money, mobile money transfer and mobile wallet, is any of various payment processing services operated under financial regulations and performed from or via a mobile device. Instead of paying with cash, cheque, or credit card, a consumer can use a payment app on a mobile device to pay for a wide range of services and digital or hard goods. Although the concept of using non-coin-based currency systems has a long history, it is only in the 21st century that the technology to support such systems has become widely available. Mobile payments began adoption in Japan in the 2000s and later all over the world in different ways. The first patent exclusively defined "Mobile Payment System" was filed in 2000. In a developing country, mobile payment solutions can be deployed as a means of extending services of financial institutions to the community known as the "unbanked" or "underbanked", which is estimated to be as much as 50 percent of the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

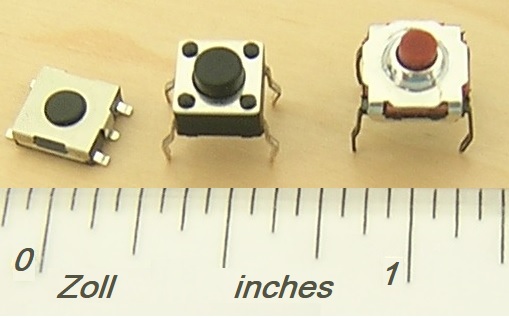

Switch

In electrical engineering, a switch is an electrical component that can disconnect or connect the conducting path in an electrical circuit, interrupting the electric current or diverting it from one conductor to another. The most common type of switch is an electromechanical device consisting of one or more sets of movable electrical contacts connected to external circuits. When a pair of contacts is touching current can pass between them, while when the contacts are separated no current can flow. Switches are made in many different configurations; they may have multiple sets of contacts controlled by the same knob or actuator, and the contacts may operate simultaneously, sequentially, or alternately. A switch may be operated manually, for example, a light switch or a keyboard button, or may function as a sensing element to sense the position of a machine part, liquid level, pressure, or temperature, such as a thermostat. Many specialized forms exist, such as the toggle swit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Account

A bank account is a financial account maintained by a bank or other financial institution in which the financial transaction A financial transaction is an Contract, agreement, or communication, between a buyer and seller to exchange goods, Service (economics), services, or assets for payment. Any transaction involves a change in the status of the finances of two or mo ...s between the bank and a customer are recorded. Each financial institution sets the terms and conditions for each type of account it offers, which are classified in commonly understood types, such as deposit accounts, credit card accounts, current accounts, loan accounts or many other types of account. A customer may have more than one account. Once an account is opened, funds entrusted by the customer to the financial institution on deposit are recorded in the account designated by the customer. Funds can be withdrawn from the accounts in accordance with their terms and conditions. The financial transac ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Deposit Account

A deposit account is a bank account maintained by a financial institution in which a customer can deposit and withdraw money. Deposit accounts can be savings accounts, current accounts or any of several other types of accounts explained below. Transactions on deposit accounts are recorded in a bank's books, and the resulting balance is recorded as a liability of the bank and represents an amount owed by the bank to the customer. In other words, the banker-customer (depositor) relationship is one of debtor-creditor. Some banks charge fees for transactions on a customer's account. Additionally, some banks pay customers interest on their account balances. Types of accounts * How banking works In banking, the verbs "deposit" and "withdraw" mean a customer paying money into, and taking money out of, an account, respectively. From a legal and financial accounting standpoint, the noun "deposit" is used by the banking industry in financial statements to describe the liability ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Unique Identification Authority Of India

Aadhaar (Hindi: आधार, ) is a twelve-digit unique identity number that can be obtained voluntarily by all residents of India, based on their biometrics and demographic data. The data is collected by the Unique Identification Authority of India (UIDAI), a statutory authority established in January 2016 by the Government of India, under the jurisdiction of the Ministry of Electronics and Information Technology, following the provisions of the Aadhaar (Targeted Delivery of Financial and other Subsidies, benefits and services) Act, 2016. Aadhaar is the world's largest biometric ID system. As of May 2023, more than 99.9% of India's adult population had been issued Aadhaar IDs. World Bank Chief Economist Paul Romer described Aadhaar as "the most sophisticated ID programme in the world". Considered a proof of residence and not a proof of citizenship, Aadhaar does not itself grant any rights to domicile in India. In June 2017, the Home Ministry clarified that Aadhaar is not ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Know Your Customer

Know your customer (KYC) guidelines and regulations in financial services require professionals to verify the identity, suitability, and risks involved with maintaining a business relationship with a customer. The procedures fit within the broader scope of anti-money laundering (AML) and counter terrorism financing (CTF) regulations. KYC processes are also employed by companies of all sizes for the purpose of ensuring their proposed customers, agents, consultants, or distributors are anti-bribery compliant and are actually who they claim to be. Banks, insurers, export creditors, and other financial institutions are increasingly required to make sure that customers provide detailed due-diligence information. Initially, these regulations were imposed only on the financial institutions, but now the non-financial industry, fintech, virtual assets dealers, and even non-profit organizations are included in regulations in many countries. Requirements In the United States, the Fin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mahatma Gandhi National Rural Employment Guarantee Act

Mahatma Gandhi National Rural Employment Guarantee Act 2005 or MGNREGA, popularly known as Manrega, earlier known as the National Rural Employment Guarantee Act or NREGA, is an Indian social welfare measure that aims to guarantee the 'right to work'. This act was passed on 23 August 2005 and was implemented in February 2006 under the UPA government of Prime Minister Manmohan Singh following the tabling of the bill in parliament by the Minister for Rural Development Raghuvansh Prasad Singh. It aims to enhance livelihood security in rural areas by providing at least 100 days of assured and guaranteed wage employment in a financial year to at least one member of every Indian rural household whose adult members volunteer to do unskilled manual work. Women are guaranteed one half of the jobs made available under the MGNREGA and efforts are made to ensure that cross the limit of 50%. Another aim of MGNREGA is to create durable assets (such as roads, canals, ponds and wells). Employme ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Two-factor Authentication

Multi-factor authentication (MFA; two-factor authentication, or 2FA) is an electronic authentication method in which a user is granted access to a website or Application software, application only after successfully presenting two or more distinct types of evidence (or Authentication#Authentication factors, factors) to an authentication mechanism. MFA protects personal data—which may include personal identification or financial assets—from being accessed by an unauthorized third party that may have been able to discover, for example, a single password. Usage of MFA has increased in recent years. Security issues which can cause the bypass of MFA are #Fatigue attack, fatigue attacks, phishing and SIM swap scam, SIM swapping. Accounts with MFA enabled are significantly less likely to be compromised. Authentication factors Authentication takes place when someone tries to log into a computer resource (such as a computer network, device, or application). The resource requires ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Internet

The Internet (or internet) is the Global network, global system of interconnected computer networks that uses the Internet protocol suite (TCP/IP) to communicate between networks and devices. It is a internetworking, network of networks that consists of Private network, private, public, academic, business, and government networks of local to global scope, linked by a broad array of electronic, Wireless network, wireless, and optical networking technologies. The Internet carries a vast range of information resources and services, such as the interlinked hypertext documents and Web application, applications of the World Wide Web (WWW), email, electronic mail, internet telephony, streaming media and file sharing. The origins of the Internet date back to research that enabled the time-sharing of computer resources, the development of packet switching in the 1960s and the design of computer networks for data communication. The set of rules (communication protocols) to enable i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Automated Teller Machine

An automated teller machine (ATM) is an electronic telecommunications device that enables customers of financial institutions to perform financial transactions, such as cash withdrawals, deposits, funds transfers, balance inquiries or account information inquiries, at any time and without the need for direct interaction with bank staff. ATMs are known by a variety of other names, including automatic teller machines (ATMs) in the United States (sometimes RAS syndrome, redundantly as "ATM machine"). In Canada, the term automated banking machine (ABM) is also used, although ATM is also very commonly used in Canada, with many Canadian organizations using ATM rather than ABM. In British English, the terms cashpoint, cash machine and hole in the wall are also used. ATMs that are Independent ATM deployer, not operated by a financial institution are known as "White-label ABMs, white-label" ATMs. Using an ATM, customers can access their bank deposit or credit accounts in order to make ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mobile App

A mobile application or app is a computer program or software application designed to run on a mobile device such as a smartphone, phone, tablet computer, tablet, or smartwatch, watch. Mobile applications often stand in contrast to desktop applications which are designed to run on desktop computers, and web applications which run in mobile web browsers rather than directly on the mobile device. Apps were originally intended for productivity assistance such as email, calendar, and contact databases, but the public demand for apps caused rapid expansion into other areas such as mobile games, factory automation, GPS and location-based services, order-tracking, and ticket purchases, so that there are now millions of apps available. Many apps require Internet access. Apps are generally downloaded from app stores, which are a type of digital distribution platforms. The term "app", short for "Application software, application", has since become very popular; in 2010, it was listed as " ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |