|

Market Reversal

Market Reversal in Finance is a type of a price retracement in which the value completely goes back to the beginning of the measured trading period. One of the worst market reversals in global finance is the bull rally from 2003 which peaked in 2007 and collapsed which is now popularly known as The Great Recession The Great Recession was a period of marked general decline, i.e. a recession, observed in national economies globally that occurred from late 2007 into 2009. The scale and timing of the recession varied from country to country (see map). At t .... References As used by journalists: *https://www.wsj.com/articles/what-is-a-reversal-vs-correction-1452482743 *https://www.cnbc.com/2016/01/20/why-the-wild-market-reversal.html *http://www.nasdaq.com/article/5-possible-indicators-of-a-market-reversal-cm608229 *http://money.cnn.com/2016/06/27/investing/brexit-consequences-2-trillion-lost/ {{finance-stub Financial markets ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Price

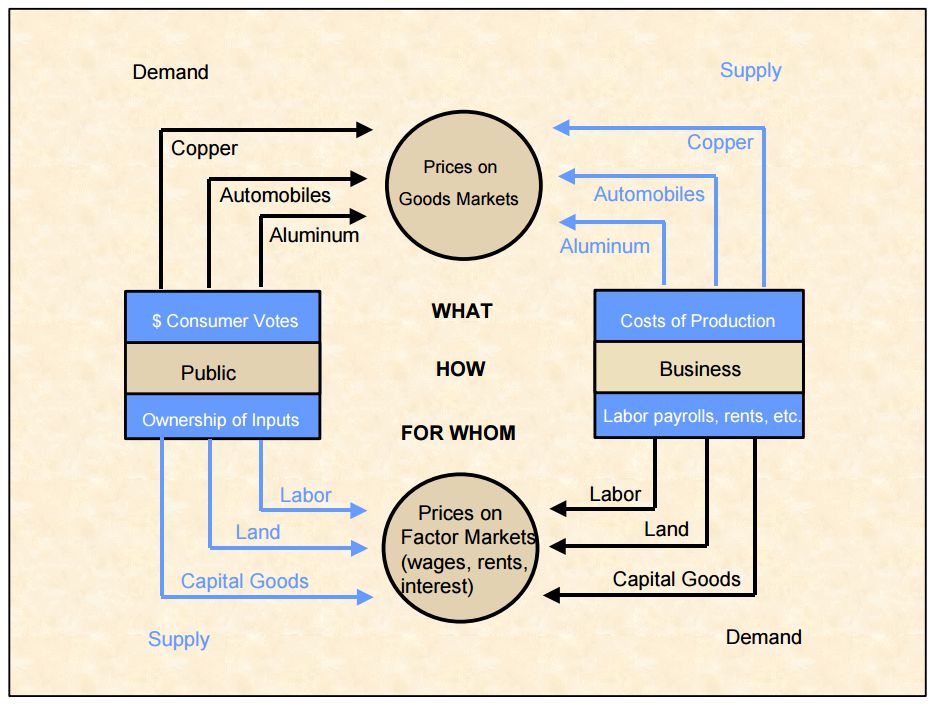

A price is the (usually not negative) quantity of payment or compensation given by one party to another in return for goods or services. In some situations, the price of production has a different name. If the product is a "good" in the commercial exchange, the payment for this product will likely be called its "price". However, if the product is "service", there will be other possible names for this product's name. For example, the graph on the bottom will show some situations A good's price is influenced by production costs, supply of the desired item, and demand for the product. A price may be determined by a monopolist or may be imposed on the firm by market conditions. Price can be quoted to currency, quantities of goods or vouchers. * In modern economies, prices are generally expressed in units of some form of currency. (More specifically, for raw materials they are expressed as currency per unit weight, e.g. euros per kilogram or Rands per KG.) * Although ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Retracement (finance)

Retracement in finance is a complete or partial reversal of the price of a security or a derivative from its current trend, thereby creating a temporary counter-trend. Not to be confused with Fibonacci Retracement, market correction A market correction is a rapid change in the nominal price of a commodity, after a barrier to free trade has been removed and the free market establishes a new equilibrium price. It may also refer to several of these single-commodity corrections ... and/or market reversal, which are the most popular types of retracements. References As used by journalists: *http://www.marketwatch.com/story/trust-the-streak-this-is-more-than-just-some-bear-market-rally-2016-03-21 *http://www.chicagotribune.com/news/sns-wp-blm-currency-comment-8c2c2374-f0ff-11e5-a2a3-d4e9697917d1-20160323-story.html *https://www.cnbc.com/2016/03/21/is-the-pain-trade-still-higher.html {{finance-stub Financial markets ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Great Recession

The Great Recession was a period of marked general decline, i.e. a recession, observed in national economies globally that occurred from late 2007 into 2009. The scale and timing of the recession varied from country to country (see map). At the time, the International Monetary Fund (IMF) concluded that it was the most severe economic and financial meltdown since the Great Depression. One result was a serious disruption of normal international relations. The causes of the Great Recession include a combination of vulnerabilities that developed in the financial system, along with a series of triggering events that began with the bursting of the United States housing bubble in 2005–2012. When housing prices fell and homeowners began to abandon their mortgages, the value of mortgage-backed securities held by investment banks declined in 2007–2008, causing several to collapse or be bailed out in September 2008. This 2007–2008 phase was called the subprime mortgage crisis. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |