|

Market Monetarism

Market monetarism is a school of macroeconomics that advocates that central banks use a nominal GDP level target instead of inflation, unemployment, or other measures of economic activity, with the goal of mitigating demand shocks such as those experienced during the 2008 financial crisis and the 2021–2023 inflation surge. Market monetarists criticize the fallacy that low interest rates always correspond to easy money. Market monetarists are sceptical about fiscal stimulus, noting that it is usually offset by monetary policy. Distinctive features Market monetarists prefer to target the market forecast of future nominal income due to their twin beliefs that rational expectations are crucial to policy, and that markets react instantly to changes in their expectations about future policy, without the "long and variable lags" postulated by Milton Friedman. In contrast to traditional monetarists, market monetarists do not believe that money supply or commodity prices such as go ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Macroeconomics

Macroeconomics is a branch of economics that deals with the performance, structure, behavior, and decision-making of an economy as a whole. This includes regional, national, and global economies. Macroeconomists study topics such as output (economics), output/Gross domestic product, GDP (gross domestic product) and national income, unemployment (including Unemployment#Measurement, unemployment rates), price index, price indices and inflation, Consumption (economics), consumption, saving, investment (macroeconomics), investment, Energy economics, energy, international trade, and international finance. Macroeconomics and microeconomics are the two most general fields in economics. The focus of macroeconomics is often on a country (or larger entities like the whole world) and how its markets interact to produce large-scale phenomena that economists refer to as aggregate variables. In microeconomics the focus of analysis is often a single market, such as whether changes in supply or ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

International Review Of Economics & Finance

The ''International Review of Economics & Finance'' is a peer-reviewed academic journal that covers research in theoretical and empirical international economics, macroeconomics and financial economics. The journal was established in 1992 and is published by Elsevier. It publishes academic research papers analyzing the real and the financial sectors of open and closed economies. Abstracting and indexing The journal is abstracted and indexed by ABI/Inform, ''Journal of Economic Literature'', and the Social Sciences Citation Index. According to the ''Journal Citation Reports'', the journal has a 2020 impact factor The impact factor (IF) or journal impact factor (JIF) of an academic journal is a type of journal ranking. Journals with higher impact factor values are considered more prestigious or important within their field. The Impact Factor of a journa ... of 2.5 References External links * {{DEFAULTSORT:International Review of Economics and Finance Elsevier academic j ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Economist

''The Economist'' is a British newspaper published weekly in printed magazine format and daily on Electronic publishing, digital platforms. It publishes stories on topics that include economics, business, geopolitics, technology and culture. Mostly written and edited in London, it has other editorial offices in the United States and in major cities in continental Europe, Asia, and the Middle East. The newspaper has a prominent focus on data journalism and interpretive analysis over News media, original reporting, to both criticism and acclaim. Founded in 1843, ''The Economist'' was first circulated by Scottish economist James Wilson (businessman), James Wilson to muster support for abolishing the British Corn Laws (1815–1846), a system of import tariffs. Over time, the newspaper's coverage expanded further into political economy and eventually began running articles on current events, finance, commerce, and British politics. Throughout the mid-to-late 20th century, it greatl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

University Of Hong Kong

The University of Hong Kong (HKU) is a public research university in Pokfulam, Hong Kong. It was founded in 1887 as the Hong Kong College of Medicine for Chinese by the London Missionary Society and formally established as the University of Hong Kong in 1911. It is the oldest tertiary institution in Hong Kong. The university was established and proposed by Governor Sir Frederick Lugard in an effort to compete with the other Great Powers opening universities in China. The university's governance consists of three bodies: the Court, the Council, and the Senate. These three bodies all have their own separate roles. The Court acts as the overseeing and legislative body of the university, the Council acts as governing body of the University, and the Senate as the principal academic authority of the university. The university currently has ten academic faculties and 20 residential halls and colleges for its students, with English being its main medium of instruction and asses ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bentley University

Bentley University is a private university in Waltham, Massachusetts, United States. It was founded in 1917 as a school of accounting and finance in Boston's Back Bay, Boston, Back Bay neighborhood. Bentley has one undergraduate school which offers 17 business majors and 14 arts and sciences majors, as well as 39 minors. Its graduate school offers five master's degrees, an MBA with eight disciplines, and three PhD programs. While Bentley's main campus hosts almost all of its services, the university also has another campus one mile north. The North Campus hosts four residential buildings. History Bentley University was founded in 1917 as the Bentley School of Accounting and Finance by Harry C. Bentley, after leaving his position as professor at the College of Business Administration at Boston University in late 1916. Thirty students attended Bentley's first class on February 26, 1917 in a room secured by Bentley at 30 Huntington Avenue. For the 1920-1921 school year, Bentley lea ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Scott Sumner

Scott B. Sumner (born 1955) is an American economist. He was previously the Director of the Program on Monetary Policy at the Mercatus Center at George Mason University, a Research Fellow at the Independent Institute, and a professor at Bentley University in Waltham, Massachusetts. His economics blog, ''The Money Illusion'', popularized the idea of nominal GDP targeting, which says that the Federal Reserve and other central banks should target nominal GDP, real GDP growth plus the rate of inflation, to better "induce the correct level of business investment". In May 2012, Chicago Fed President Charles L. Evans became the first sitting member of the Federal Open Market Committee (FOMC) to endorse the idea. After Ben Bernanke's announcement of a new round of quantitative easing on September 13, 2012, which open-endedly committed the FOMC to purchase $40 billion agency mortgage-backed securities per month until the "labor market improves substantially", some media outlets be ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economist

An economist is a professional and practitioner in the social sciences, social science discipline of economics. The individual may also study, develop, and apply theories and concepts from economics and write about economic policy. Within this field there are many sub-fields, ranging from the broad philosophy, philosophical theory, theories to the focused study of minutiae within specific Market (economics), markets, macroeconomics, macroeconomic analysis, microeconomics, microeconomic analysis or financial statement analysis, involving analytical methods and tools such as econometrics, statistics, Computational economics, economics computational models, financial economics, regulatory impact analysis and mathematical economics. Professions Economists work in many fields including academia, government and in the private sector, where they may also "study data and statistics in order to spot trends in economic activity, economic confidence levels, and consumer attitudes. They ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fiat Money

Fiat money is a type of government-issued currency that is not backed by a precious metal, such as gold or silver, nor by any other tangible asset or commodity. Fiat currency is typically designated by the issuing government to be legal tender, and is authorized by government regulation. Since the end of the Bretton Woods system in 1976 by the Jamaica Accords, the major currencies in the world are fiat money. Fiat money generally does not have intrinsic value and does not have use value. It has value only because the individuals who use it as a unit of account or, in the case of currency, a medium of exchange agree on its value. They trust that it will be accepted by merchants and other people as a means of payment for liabilities. Fiat money is an alternative to commodity money, which is a currency that has intrinsic value because it contains, for example, a precious metal such as gold or silver which is embedded in the coin. Fiat also differs from representative mone ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

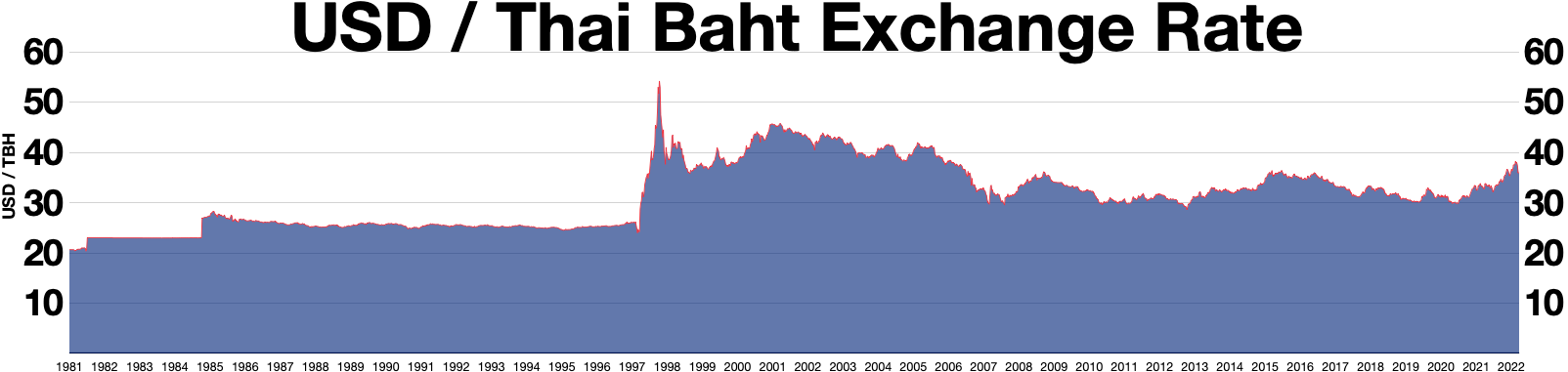

1997 Asian Financial Crisis

The 1997 Asian financial crisis gripped much of East Asia, East and Southeast Asia during the late 1990s. The crisis began in Thailand in July 1997 before spreading to several other countries with a ripple effect, raising fears of a worldwide economic meltdown due to financial contagion. However, the recovery in 1998–1999 was rapid, and worries of a meltdown quickly subsided. Originating in Thailand, where it was known as the ''Tom yum, Tom Yum Kung crisis'' () on 2 July, it followed the financial collapse of the Thai baht after the Thai government was forced to floating currency, float the baht due to lack of list of circulating currencies, foreign currency to support its currency fixed exchange rate, peg to the U.S. dollar. Capital flight ensued almost immediately, beginning an international chain reaction. At the time, Thailand had acquired a burden of foreign debt. As the crisis spread, other Southeast Asian countries and later Japan and South Korea saw slumping currencies, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Interest On Bank Reserves

Reserve requirements are central bank regulations that set the minimum amount that a commercial bank must hold in liquid assets. This minimum amount, commonly referred to as the commercial bank's reserve, is generally determined by the central bank on the basis of a specified proportion of deposit liabilities of the bank. This rate is commonly referred to as the cash reserve ratio or shortened as reserve ratio. Though the definitions vary, the commercial bank's reserves normally consist of cash held by the bank and stored physically in the bank vault (vault cash), plus the amount of the bank's balance in that bank's account with the central bank. A bank is at liberty to hold in reserve sums above this minimum requirement, commonly referred to as ''excess reserves''. In some areas such as the euro area and the UK, tightening of reserve requirements in the home country is found to be associated with higher lending by foreign branches. For this reason, the reserve ratio is some ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Quantitative Easing

Quantitative easing (QE) is a monetary policy action where a central bank purchases predetermined amounts of government bonds or other financial assets in order to stimulate economic activity. Quantitative easing is a novel form of monetary policy that came into wide application following the 2008 financial crisis. It is used to mitigate an economic recession when inflation is very low or negative, making standard monetary policy ineffective. Quantitative tightening (QT) does the opposite, where for monetary policy reasons, a central bank sells off some portion of its holdings of government bonds or other financial assets. Similar to conventional Open market operation, open-market operations used to implement monetary policy, a central bank implements quantitative easing by buying financial assets from commercial banks and other financial institutions, thus raising the prices of those financial assets and lowering their Yield (finance), yield, while simultaneously increasing the m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Real Interest Rate

The real interest rate is the rate of interest an investor, saver or lender receives (or expects to receive) after allowing for inflation. It can be described more formally by the Fisher equation, which states that the real interest rate is approximately the nominal interest rate minus the inflation rate. If, for example, an investor were able to lock in a 5% interest rate for the coming year and anticipated a 2% rise in prices, they would expect to earn a real interest rate of 3%. The expected real interest rate is not a single number, as different investors have different expectations of future inflation. Since the inflation rate over the course of a loan is not known initially, volatility in inflation represents a risk to both the lender and the borrower. In the case of contracts stated in terms of the nominal interest rate, the real interest rate is known only at the end of the period of the loan, based on the realized inflation rate; this is called the ex-post real int ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |