|

Lodgement (finance)

In Ireland a lodgement is an amount lodged to a bank account or paid into a bank account via a "lodgement slip" or "paying in" slip. In India a lodgement is commonly used for proofs of tax deduction. A "lodgement vendor" is one who will verify proofs (rental receipts, medical receipts) to ensure that they are eligible for deduction as per the rules of Income Tax in India. In Australia the electronic placing of personal tax returns A tax return is a form on which a person or organization presents an account of income and circumstances, used by the tax authorities to determine liability for tax. Tax returns are usually processed by each country's tax authority, known as a ... with the authorities is described as the electronic lodgment (note: alternative spelling) of tax returns. [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Anglo Irish Bank

Anglo Irish Bank was an Republic of Ireland, Irish bank headquartered in Dublin from 1964 to 2011. It began to wind down after nationalisation in 2009. In July 2011 Anglo Irish merged with the Irish Nationwide Building Society, forming a new company named the Irish Bank Resolution Corporation. Michael Noonan (Fine Gael politician), Michael Noonan, the Minister for Finance (Ireland), Minister for Finance stated that the name change was important in order to remove "the negative international references associated with the appalling failings of both institutions and their previous managements". Anglo Irish mainly dealt in business and commercial banking, and had only a limited retail presence in the major Irish cities. It also had wealth management and treasury divisions. Anglo Irish had operations in Austria, Switzerland, the Isle of Man, the United Kingdom, and the United States. The bank's heavy exposure to property lending, with most of its loan book being to builders and pro ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Deduction

A tax deduction or benefit is an amount deducted from taxable income, usually based on expenses such as those incurred to produce additional income. Tax deductions are a form of tax incentives, along with exemptions and tax credits. The difference between deductions, exemptions, and credits is that deductions and exemptions both reduce taxable income, while credits reduce tax. Above and below the line Above and below the line refers to items above or below adjusted gross income, which is item 37 on the tax year 2017 1040 tax form. Tax deductions above the line lessen adjusted gross income, while deductions below the line can only lessen taxable income if the aggregate of those deductions exceeds the standard deduction, which in tax year 2018 in the U.S., for example, was $12,000 for a single taxpayer and $24,000 for married couple. Limitations Often, deductions are subject to conditions, such as being allowed only for expenses incurred that produce current benefits. Capital ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income Tax

An income tax is a tax imposed on individuals or entities (taxpayers) in respect of the income or profits earned by them (commonly called taxable income). Income tax generally is computed as the product of a tax rate times the taxable income. Taxation rates may vary by type or characteristics of the taxpayer and the type of income. The tax rate may increase as taxable income increases (referred to as graduated or progressive tax rates). The tax imposed on companies is usually known as corporate tax and is commonly levied at a flat rate. Individual income is often taxed at progressive rates where the tax rate applied to each additional unit of income increases (e.g., the first $10,000 of income taxed at 0%, the next $10,000 taxed at 1%, etc.). Most jurisdictions exempt local charitable organizations from tax. Income from investments may be taxed at different (generally lower) rates than other types of income. Credits of various sorts may be allowed that reduce tax. Some jurisdictio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

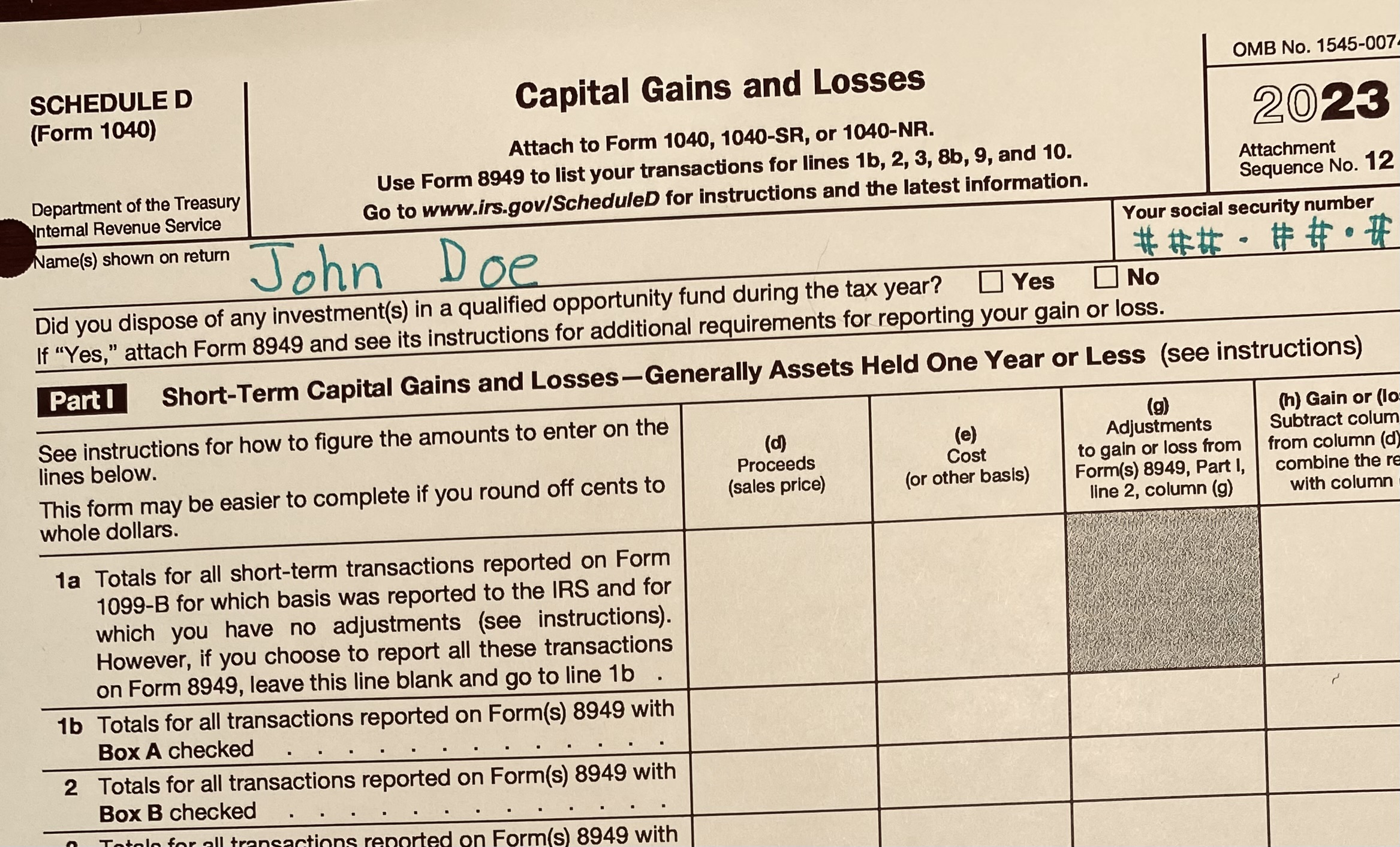

Tax Returns

A tax return is a form on which a person or organization presents an account of income and circumstances, used by the tax authorities to determine liability for tax. Tax returns are usually processed by each country's tax authority, known as a revenue service, such as the Internal Revenue Service in the United States, the State Taxation Administration in China, and HM Revenue and Customs in the United Kingdom. Preparing the tax return A tax return reports income, expenses, tax payments made during the year and other relevant information to the taxing authority. It helps to determine whether a tax refund is due. This will depend on whether a person has overpaid on taxes, or was late in paying tax for previous years. A person or organization may not be required to file a tax return depending on circumstances, which are different in each country. Generally, a tax return does not need to be filed if income is less than a certain amount, but other factors such as the type of inco ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |