|

Liquidation Value

Liquidation value is the likely price of an asset when it is allowed insufficient time to sell on the open market, thereby reducing its exposure to potential buyers. Liquidation value is typically lower than fair market value. Unlike cash or other available liquid assets, certain illiquid assets, like real estate, often require a period of several months in order to obtain their fair market value in a sale, and will generally sell for a significantly lower price if a sale is forced to occur in a shorter time period. The liquidation value may be either the result of a ''forced liquidation'' or an ''orderly liquidation''. Either value assumes that the sale is consummated by a seller who is compelled to sell and assumes an exposure period which is less than market normal. The most common definition used by real estate appraisers is as followsDictionary of Real Estate Appraisal, 4th ed., Appraisal Institute, 2002 The most probable price that a specified interest in real property is lik ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fair Market Value

The fair market value of property is the price at which it would change hands between a willing and informed buyer and seller. The term is used throughout the Internal Revenue Code, as well as in bankruptcy laws, in many state laws, and by several regulatory bodies. In litigation in many jurisdictions in the United States the fair market value is determined at a hearing. In certain jurisdictions, the courts are required to hold fair market hearings, even if the borrowers or the loans guarantors waived their rights to such a hearing in the loan documents. FMV is often used for taxation purposes, determining the value of charitable donations, estate planning, and other financial transactions. The specific methods used to determine FMV may vary depending on the type of property or asset involved. Fair market value is subjective and can fluctuate based on market conditions, supply and demand, location, and other factors. Definition United States The fair market value is the pri ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cash

In economics, cash is money in the physical form of currency, such as banknotes and coins. In book-keeping and financial accounting, cash is current assets comprising currency or currency equivalents that can be accessed immediately or near-immediately (as in the case of money market accounts). Cash is seen either as a reserve for payments, in case of a structural or incidental negative cash flow or as a way to avoid a downturn on financial markets. Etymology The English word ''cash'' originally meant , and later came to have a secondary meaning . This secondary usage became the sole meaning in the 18th century. The word ''cash'' comes from the Middle French , which comes from the Old Italian , and ultimately from the Latin . History In Western Europe, after the fall of the Western Roman Empire, coins, silver jewelry and hacksilver (silver objects hacked into pieces) were for centuries the only form of money, until Venetian merchants started using silver bars for larg ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Liquidity

Liquidity is a concept in economics involving the convertibility of assets and obligations. It can include: * Market liquidity In business, economics or investment, market liquidity is a market's feature whereby an individual or firm can quickly purchase or sell an asset without causing a drastic change in the asset's price. Liquidity involves the trade-off between the ..., the ease with which an asset can be sold * Accounting liquidity, the ability to meet cash obligations when due * Funding liquidity, the availability of credit to finance the purchase of financial asset * Liquid capital, the amount of money that a firm holds * Liquidity risk, the risk that an asset will have impaired market liquidity See also * Liquid (other) * Liquidation (other) {{SIA ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Appraisal Institute

The Appraisal Institute (AI), headquartered in Chicago, Illinois, is an international association of professional real estate appraisers. It was founded in January 1991 when the American Institute of Real Estate Appraisers (AIREA) and the Society of Residential Appraisers merged. The AIREA and the Society were respectively founded in 1932 and 1935. Real estate appraisal emerged as a profession at this point in response to the crash of home values as a result of the Great Depression, building on the intellectual frameworks developed over the course of the 1920s by land value theorists like Ernest McKinley Fisher, Frederick Babcock, Homer Hoyt, and Richard T. Ely. As of February 2007, the Appraisal Institute has more than 21,000 members and 99 chapters throughout the United States, Canada, and overseas. The group publishes the ''Appraisal Journal''. See also *International Valuation Standards Committee The International Valuation Standards Council (IVSC) is an independent, n ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Marketing

Marketing is the act of acquiring, satisfying and retaining customers. It is one of the primary components of Business administration, business management and commerce. Marketing is usually conducted by the seller, typically a retailer or manufacturer. Products can be marketed to other businesses (B2B Marketing, B2B) or directly to consumers (B2C). Sometimes tasks are contracted to dedicated marketing firms, like a Media agency, media, market research, or advertising agency. Sometimes, a trade association or government agency (such as the Agricultural Marketing Service) advertises on behalf of an entire industry or locality, often a specific type of food (e.g. Got Milk?), food from a specific area, or a city or region as a tourism destination. Market orientations are philosophies concerning the factors that should go into market planning. The marketing mix, which outlines the specifics of the product and how it will be sold, including the channels that will be used to adverti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Creative Financing

In real estate, creative financing is non-traditional or uncommon means of buying land or property. The goal of creative financing is generally to purchase, or finance a property, with the buyer/investor using as little of his own money as possible, otherwise known as leveraging. Using these techniques an investor may be able to purchase multiple properties using little, or none, of his "own money". Types Hard money loans Hard money loans (abbreviated as HML) are similar to private mortgages except that they are made through a hard money lender. A hard money lender may get his financing either from his own contacts with private lenders, or financial institutions with whom he has established his own lines of credit. Hard money loans are made to real estate investors for the purpose of investing in and rehabbing real estate. Rates are a little higher than borrowing directly from a private lender, as the hard money lender may also be collecting yield spread. The hard m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

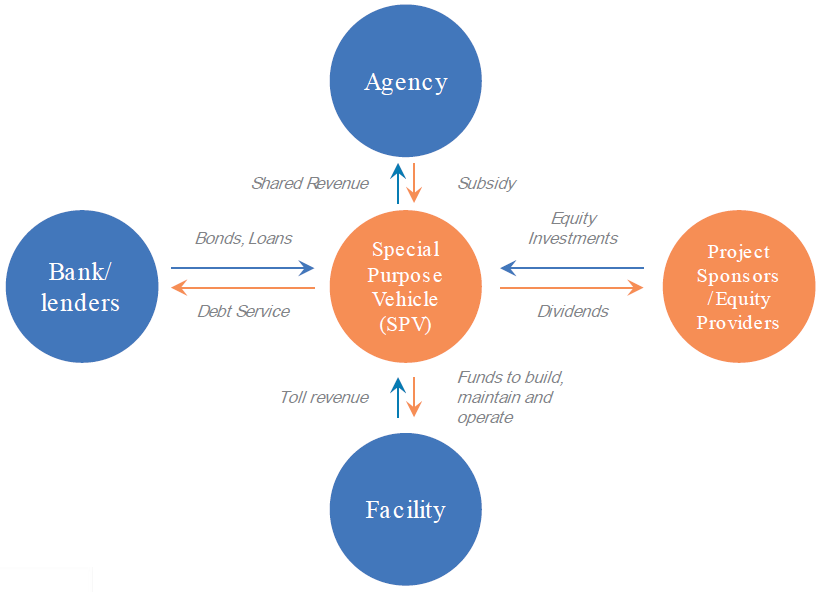

Concession (contract)

A concession or concession agreement is a grant of rights, land, property, or facility by a government, local authority, corporation, individual or other legal entity. Public services such as water supply may be operated as a concession. In the case of a public service concession, a private company enters into an agreement with the government to have the exclusive right to operate, maintain and carry out investment in a public utility (such as a water privatisation) for a given number of years. Other forms of contracts between public and private entities, namely lease contract and management contract (in the water sector often called by the French term ''affermage''), are closely related but differ from a concession in the rights of the operator and its remuneration. A lease gives a company the right to operate and maintain a public utility, but investment remains the responsibility of the public. Under a management contract the operator will collect the revenue only on behalf ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Real Estate Valuation

Real estate appraisal, home appraisal, property valuation or land valuation is the process of assessing the value of real property (usually market value). The appraisal is conducted by a Appraiser, licensed appraiser. Real estate transactions often require appraisals to ensure fairness, accuracy, and financial security for all parties involved. Appraisal reports form the basis for Mortgage, mortgage loans, settling Estate (land), estates and Divorce, divorces, taxation, etc. Sometimes an appraisal report is also used to establish a sale price for a property. Factors like size of the property, condition, age, and location play a key role in the valuation. Process for Obtaining an Appraisal Appraisals are often required by lenders for issuing or refinancing a loan. In such cases, when the borrower asks the lender for a loan or a refinance, the lender will order an appraisal. Once ordered, the borrower will have to schedule an appointment with the appraiser for the in-home visit. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Valuation (finance)

In finance, valuation is the process of determining the value of a (potential) investment, asset, or security. Generally, there are three approaches taken, namely discounted cashflow valuation, relative valuation, and contingent claim valuation. Valuations can be done for assets (for example, investments in marketable securities such as companies' shares and related rights, business enterprises, or intangible assets such as patents, data and trademarks) or for liabilities (e.g., bonds issued by a company). Valuation is a subjective exercise, and in fact, the process of valuation itself can also affect the value of the asset in question. Valuations may be needed for various reasons such as investment analysis, capital budgeting, merger and acquisition transactions, financial reporting, taxable events to determine the proper tax liability. In a business valuation context, various techniques are used to determine the (hypothetical) price that a third party would pay for a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |