|

Limits To Arbitrage

Limits to arbitrage is a theory in financial economics that, due to restrictions that are placed on funds that would ordinarily be used by rational traders to arbitrage away pricing inefficiencies, prices may remain in a non-equilibrium state for protracted periods of time. The efficient-market hypothesis assumes that whenever mispricing of a publicly traded stock occurs, an opportunity for low-risk profit is created for rational traders. The low-risk profit opportunity exists through the tool of arbitrage, which, briefly, is buying and selling differently priced items of the same value, and pocketing the difference. If a stock falls away from its equilibrium price (let us say it becomes undervalued) due to irrational trading ( noise traders), rational investors will (in this case) take a long position while going short a proxy security, or another stock with similar characteristics. Rational traders usually work for professional money management firms, and invest other p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Theory

A theory is a systematic and rational form of abstract thinking about a phenomenon, or the conclusions derived from such thinking. It involves contemplative and logical reasoning, often supported by processes such as observation, experimentation, and research. Theories can be scientific, falling within the realm of empirical and testable knowledge, or they may belong to non-scientific disciplines, such as philosophy, art, or sociology. In some cases, theories may exist independently of any formal discipline. In modern science, the term "theory" refers to Scientific theory, scientific theories, a well-confirmed type of explanation of nature, made in a way Consistency, consistent with the scientific method, and fulfilling the Scientific theory#Characteristics of theories, criteria required by modern science. Such theories are described in such a way that scientific tests should be able to provide Empirical evidence, empirical support for it, or Empirical evidence, empirical contradi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Proxy Security

Proxy may refer to: Arts, entertainment and media Fictional entities * Proxy, a mysterious humanoid lifeform in the anime ''Ergo Proxy'' * PROXY, a holodroid featured in '' Star Wars: The Force Unleashed'' * Proxy, the codename of Wendy Harris, a fictional character in the ''Batgirl'' comic book series * "Proxy", the name of a fictional character in the 2012 horror film ''Smiley'' * "Proxy", a term, specifically (but not limited to) in '' Slender: The Arrival'', for a person who is influenced or controlled by the Slender Man * Proxy, playable main protagonist in Zenless Zone Zero. Music * Proxies (band), British electronic rock band formed in 2010 * "Proxy" (song), a 2014 song by Martin Garrix * "The Proxy", a song by RJD2 on his 2002 album '' Deadringer'' Other uses in arts, entertainment and media * ''Proxy'' (film), a 2013 horror film directed by Zack Parker * ''Proxies'' (film), a 1921 silent drama film directed by George D. Baker * ''The Proxy'', a drama web series st ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Arbitrage

Arbitrage (, ) is the practice of taking advantage of a difference in prices in two or more marketsstriking a combination of matching deals to capitalize on the difference, the profit being the difference between the market prices at which the unit is traded. Arbitrage has the effect of causing prices of the same or very similar assets in different markets to converge. When used by academics in economics, an arbitrage is a transaction that involves no negative cash flow at any probabilistic or temporal state and a positive cash flow in at least one state; in simple terms, it is the possibility of a risk-free profit after transaction costs. For example, an arbitrage opportunity is present when there is the possibility to instantaneously buy something for a low price and sell it for a higher price. In principle and in academic use, an arbitrage is risk-free; in common use, as in statistical arbitrage, it may refer to ''expected'' profit, though losses may occur, and in practic ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Margin Calls

In finance, margin is the collateral that a holder of a financial instrument has to deposit with a counterparty (most often their broker or an exchange) to cover some or all of the credit risk the holder poses for the counterparty. This risk can arise if the holder has done any of the following: * Borrowed cash from the counterparty to buy financial instruments, * Borrowed financial instruments to sell them short, * Entered into a derivative contract. The collateral for a margin account can be the cash deposited in the account or securities provided, and represents the funds available to the account holder for further share trading. On United States futures exchanges, margins were formerly called performance bonds. Most of the exchanges today use SPAN ("Standard Portfolio Analysis of Risk") methodology, which was developed by the Chicago Mercantile Exchange in 1988, for calculating margins for options and futures. Margin account A margin account is a loan account with a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

1998 Russian Financial Crisis

The Russian financial crisis (also called the ruble crisis or the Russian flu) began in Russia on 17 August 1998. It resulted in the Russian government and the Russian Central Bank devaluing the Russian rouble, ruble and sovereign default, defaulting on its debt. The crisis had severe impacts on the economies of many neighboring countries. Background and course of events The Russian economy had set up a path for improvement after the Soviet Union had split into different countries. Russia was supposed to provide assistance to the former Soviet states and, as a result, imported heavily from them. In Russia, foreign loans financed domestic investments. When it was unable to pay back those foreign borrowings, the ruble devalued. In mid-1997, Russia had finally found a way out of inflation. The economic supervisors were happy about inflation coming to a standstill. Then the crisis hit, and supervisors had to implement a new policy. Both Russia and the countries that exported to i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

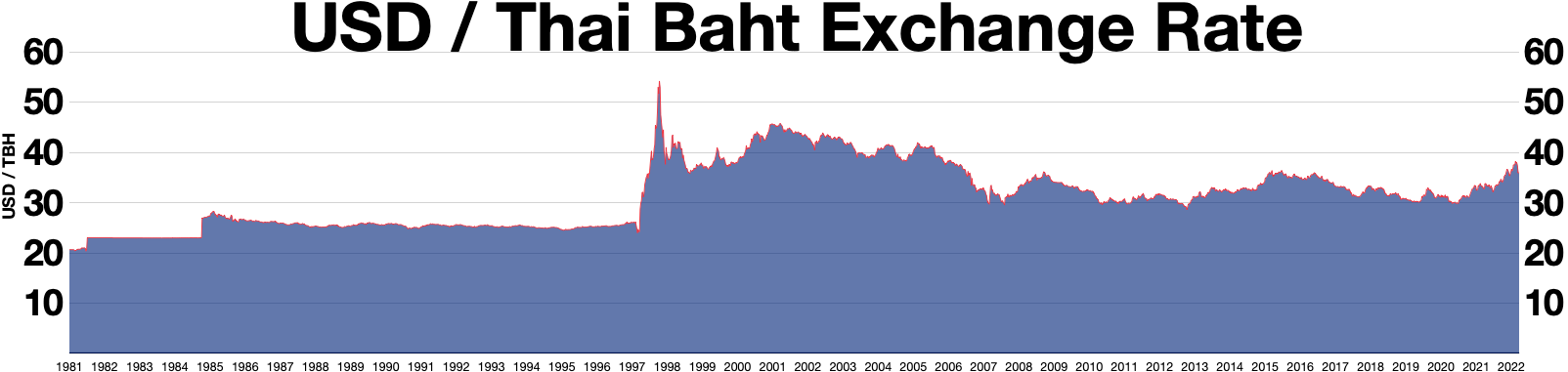

1997 Asian Financial Crisis

The 1997 Asian financial crisis gripped much of East Asia, East and Southeast Asia during the late 1990s. The crisis began in Thailand in July 1997 before spreading to several other countries with a ripple effect, raising fears of a worldwide economic meltdown due to financial contagion. However, the recovery in 1998–1999 was rapid, and worries of a meltdown quickly subsided. Originating in Thailand, where it was known as the ''Tom yum, Tom Yum Kung crisis'' () on 2 July, it followed the financial collapse of the Thai baht after the Thai government was forced to floating currency, float the baht due to lack of list of circulating currencies, foreign currency to support its currency fixed exchange rate, peg to the U.S. dollar. Capital flight ensued almost immediately, beginning an international chain reaction. At the time, Thailand had acquired a burden of foreign debt. As the crisis spread, other Southeast Asian countries and later Japan and South Korea saw slumping currencies, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Long-Term Capital Management

Long-Term Capital Management L.P. (LTCM) was a highly leveraged hedge fund. In 1998, it received a $3.6 billion bailout from a group of 14 banks, in a deal brokered and put together by the Federal Reserve Bank of New York. LTCM was founded in 1994 by John Meriwether, the former vice-chairman and head of bond trading at Salomon Brothers. Members of LTCM's board of directors included Myron Scholes and Robert C. Merton, who three years later in 1997 shared the Nobel Prize in Economics for having developed the Black–Scholes model of financial dynamics.''A financial History of the United States Volume II: 1970–2001'', Jerry W. Markham, Chapter 5: "Bank Consolidation", M. E. Sharpe, Inc., 2002 LTCM was initially successful, with annualized returns (after fees) of around 21% in its first year, 43% in its second year and 41% in its third year. However, in 1998 it lost $4.6 billion in less than four months due to a combination of high leverage and exposure to the 1997 Asian fin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Investment

Investment is traditionally defined as the "commitment of resources into something expected to gain value over time". If an investment involves money, then it can be defined as a "commitment of money to receive more money later". From a broader viewpoint, an investment can be defined as "to tailor the pattern of expenditure and receipt of resources to optimise the desirable patterns of these flows". When expenditures and receipts are defined in terms of money, then the net monetary receipt in a time period is termed cash flow, while money received in a series of several time periods is termed cash flow stream. In finance, the purpose of investing is to generate a Return (finance), return on the invested asset. The return may consist of a capital gain (profit) or loss, realised if the investment is sold, unrealised capital appreciation (or depreciation) if yet unsold. It may also consist of periodic income such as dividends, interest, or rental income. The return may also inclu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Investment Management

Investment management (sometimes referred to more generally as financial asset management) is the professional asset management of various Security (finance), securities, including shareholdings, Bond (finance), bonds, and other assets, such as real estate, to meet specified investment goals for the benefit of investors. Investors may be institutions, such as insurance companies, pension funds, corporations, charities, educational establishments, or private investors, either directly via investment contract, contracts/mandates or via collective investment schemes like mutual funds, exchange-traded funds, or REIT, Real estate investment trusts. The term ''investment management'' is often used to refer to the management of investment funds, most often specializing in private equity, private and public equity, real assets, alternative assets, and/or bonds. The more generic term ''asset management'' may refer to management of assets not necessarily primarily held for investment purpos ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Short (finance)

In finance, being short in an asset means investing in such a way that the investor will profit if the market value of the asset falls. This is the opposite of the more common Long (finance), long Position (finance), position, where the investor will profit if the market value of the asset rises. An investor that sells an asset short is, as to that asset, a short seller. There are a number of ways of achieving a short position. The most basic is physical selling short or short-selling, by which the short seller Securities lending, borrows an asset (often a security (finance), security such as a share (finance), share of stock or a bond (finance), bond) and sells it. The short seller must later buy the same amount of the asset to return it to the lender. If the market price of the asset has fallen in the meantime, the short seller will have made a profit equal to the difference in price. Conversely, if the price has risen then the short seller will bear a loss. The short seller ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Economics

Financial economics is the branch of economics characterized by a "concentration on monetary activities", in which "money of one type or another is likely to appear on ''both sides'' of a trade".William F. Sharpe"Financial Economics", in Its concern is thus the interrelation of financial variables, such as share prices, interest rates and exchange rates, as opposed to those concerning the real economy. It has two main areas of focus:Merton H. Miller, (1999). The History of Finance: An Eyewitness Account, ''Journal of Portfolio Management''. Summer 1999. asset pricing and corporate finance; the first being the perspective of providers of Financial capital, capital, i.e. investors, and the second of users of capital. It thus provides the theoretical underpinning for much of finance. The subject is concerned with "the allocation and deployment of economic resources, both spatially and across time, in an uncertain environment".See Fama and Miller (1972), ''The Theory of Finance'', ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Long (finance)

In finance, a long position in a financial instrument means the holder of the position owns a positive amount of the instrument. The holder of the position has the expectation that the financial instrument will increase in value. This is known as a bullish position. The term "long position" is often used in context of buying options contracts. Ownership When an investor holds a long position in a stock they are buying a share of ownership in a company. Depending on the type of Stock purchased this can entitle the shareholder to voting rights at shareholder meetings or dividend payments. Security In terms of a security, such as a stock or a bond, or equivalently ''to be long'' in a security, means the holder of the position owns the security, on the expectation that the security will increase in value, and will profit if the price of the security goes up. ''Going long'' a security is the more conventional practice of investing. Future Going long in a future means th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |