|

Life-cycle Cost

Whole-life cost is the total cost of ownership over the life of an asset. The concept is also known as life-cycle cost (LCC) or lifetime cost, and is commonly referred to as "cradle to grave" or "womb to tomb" costs. Costs considered include the financial cost which is relatively simple to calculate and also the environmental and social costs which are more difficult to quantify and assign numerical values. Typical areas of expenditure which are included in calculating the whole-life cost include planning, design, construction and acquisition, operations, maintenance, renewal and rehabilitation, depreciation and cost of finance and replacement or disposal. Financial Whole-life cost analysis is often used for option evaluation when procuring new assets and for decision-making to minimize whole-life costs throughout the life of an asset. It is also applied to comparisons of actual costs for similar asset types and as feedback into future design and acquisition decisions. The prim ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Total Cost Of Ownership

Total cost of ownership (TCO) is a financial estimate intended to help buyers and owners determine the direct and indirect costs of a product or service. It is a management accounting concept that can be used in full cost accounting or even ecological economics where it includes social costs. For manufacturing, as TCO is typically compared with doing business overseas, it goes beyond the initial manufacturing cycle time and cost to make parts. TCO includes a variety of cost of doing business items, for example, ship and re-ship, and opportunity costs, while it also considers incentives developed for an alternative approach. Incentives and other variables include tax credits, common language, expedited delivery, and customer-oriented supplier visits. Use of concept TCO, when incorporated in any financial benefit analysis, provides a cost basis for determining the total economic value of an investment. Examples include: return on investment, internal rate of return, economic v ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Disaster Preparedness

Emergency management (also Disaster management) is a science and a system charged with creating the framework within which communities reduce vulnerability to hazards and cope with disasters. Emergency management, despite its name, does not actually focus on the management of emergencies; emergencies can be understood as minor events with limited impacts and are managed through the day-to-day functions of a community. Instead, emergency management focuses on the management of disasters, which are events that produce more impacts than a community can handle on its own. The management of disasters tends to require some combination of activity from individuals and households, organizations, local, and/or higher levels of government. Although many different terminologies exist globally, the activities of emergency management can be generally categorized into preparedness, response, mitigation, and recovery, although other terms such as disaster risk reduction and prevention are also co ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financing

Funding is the act of providing resources to finance a need, program, or project. While this is usually in the form of money, it can also take the form of effort or time from an organization or company. Generally, this word is used when a firm uses its internal reserves to satisfy its necessity for cash, while the term financing is used when the firm acquires capital from external sources. Sources of funding include credit, venture capital, donations, grants, savings, subsidies, and taxes. Funding methods such as donations, subsidies, and grants that have no direct requirement for return of investment are described as "soft funding" or "crowdfunding". Funding that facilitates the exchange of equity ownership in a company for capital investment via an online funding portal per the Jumpstart Our Business Startups Act (alternately, the "JOBS Act of 2012") (U.S.) is known as equity crowdfunding. Funds can be allocated for either short-term or long-term purposes. Economics In ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Market

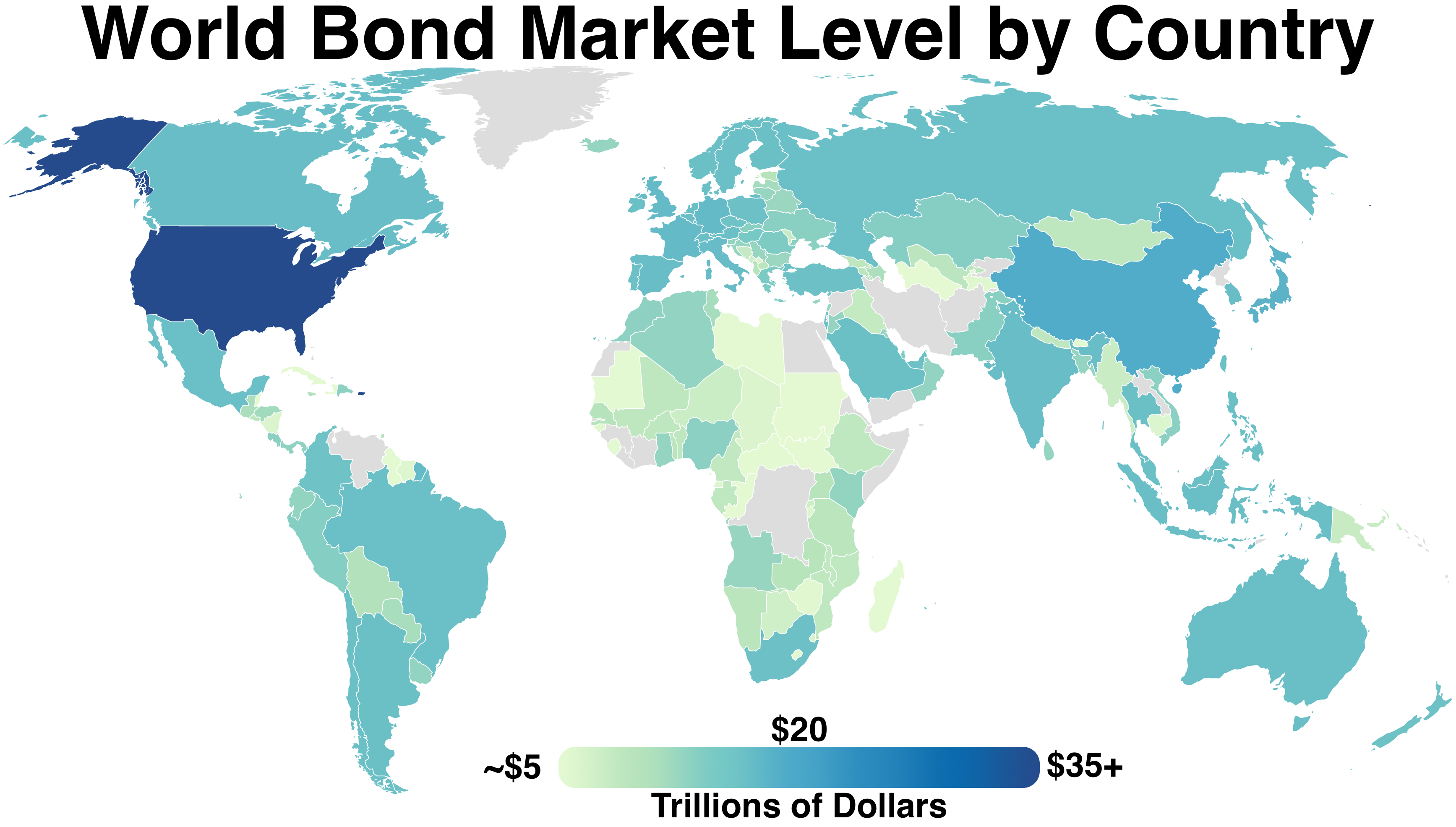

The bond market (also debt market or credit market) is a financial market in which participants can issue new debt, known as the primary market, or buy and sell debt securities, known as the secondary market. This is usually in the form of bonds, but it may include notes, bills, and so on for public and private expenditures. The bond market has largely been dominated by the United States, which accounts for about 39% of the market. In 2021, the size of the bond market (total debt outstanding) was estimated to be $119 trillion worldwide and $46 trillion for the US market, according to the Securities Industry and Financial Markets Association (SIFMA). Bonds and bank loans form what is known as the ''credit market''. The global credit market in aggregate is about three times the size of the global equity market. Bank loans are not securities under the U.S. Securities and Exchange Act, but bonds typically are and are therefore more highly regulated. Bonds are typically not secured ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Investment

Investment is traditionally defined as the "commitment of resources into something expected to gain value over time". If an investment involves money, then it can be defined as a "commitment of money to receive more money later". From a broader viewpoint, an investment can be defined as "to tailor the pattern of expenditure and receipt of resources to optimise the desirable patterns of these flows". When expenditures and receipts are defined in terms of money, then the net monetary receipt in a time period is termed cash flow, while money received in a series of several time periods is termed cash flow stream. In finance, the purpose of investing is to generate a return on the invested asset. The return may consist of a capital gain (profit) or loss, realised if the investment is sold, unrealised capital appreciation (or depreciation) if yet unsold. It may also consist of periodic income such as dividends, interest, or rental income. The return may also include currency gains ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Automobile

A car, or an automobile, is a motor vehicle with wheels. Most definitions of cars state that they run primarily on roads, Car seat, seat one to eight people, have four wheels, and mainly transport private transport#Personal transport, people rather than cargo. There are around one billion cars in use worldwide. The French inventor Nicolas-Joseph Cugnot built the first steam-powered road vehicle in 1769, while the Swiss inventor François Isaac de Rivaz designed and constructed the first internal combustion-powered automobile in 1808. The modern car—a practical, marketable automobile for everyday use—was invented in 1886, when the German inventor Carl Benz patented his Benz Patent-Motorwagen. Commercial cars became widely available during the 20th century. The 1901 Oldsmobile Curved Dash and the 1908 Ford Model T, both American cars, are widely considered the first mass-produced and mass-affordable cars, respectively. Cars were rapidly adopted in the US, where they replac ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Rapid Economic Justification

Rapid(s) or RAPID may refer to: Hydrological features * Rapids, sections of a river with turbulent water flow * Rapid Creek (Iowa River tributary), Iowa, United States * Rapid Creek (South Dakota), United States, namesake of Rapid City Sports teams * SK Rapid Wien, an Austrian club * FC Rapid Ghidighici, a Moldovan club * SK Rapid, a Norwegian club * FC Rapid București, a Romanian club * FK Rapid Bratislava, a Slovak club * SV Rapid Marburg, a Yugoslav former club that today would be Slovene * Colorado Rapids, an American team Transportation * ''Rapid'' (brig), the ship that brought William Light's surveying party to South Australia in 1836 * The Rapid, popular name of RTA Rapid Transit, the rail transit service of Cleveland and surrounding Cuyahoga County, Ohio * The Rapid, a bus system in the Greater Grand Rapids, Michigan area * Rapid (San Diego), a BRT system serving the Greater San Diego region in California * Rapid Rail, a rapid transit operator in Malaysia ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Return On Information Technology

Return may refer to: In business, economics, and finance * Return on investment (ROI), the financial gain after an expense. * Rate of return, the financial term for the profit or loss derived from an investment * Tax return, a blank document or template supplied by a government for use in the reporting of tax information * Product return, the process of bringing back merchandise to a retailer for a refund or exchange * Returns (economics), the benefit distributed to the owner of a factor of production * Abnormal return, denoting the difference in behaviour between one stock and the overall stock market * Taxes, where tax returns are forms submitted to taxation authorities In technology * Return (architecture), the receding edge of a flat face * Carriage return, a key on an alphanumeric keyboard commonly equated with the "enter" key * Return statement, a computer programming statement that ends a subroutine and resumes execution where the subroutine was called * Return code, a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economic Value Added

In accounting, as part of financial statements analysis, economic value added is an estimate of a firm's economic profit, or the value created in excess of the Required rate of return, required return of the types of companies, company's shareholders. EVA is the net profit less the capital charge ($) for raising the firm's capital. The idea is that value is created when the return on the firm's economic capital employed exceeds the cost of that capital. This amount can be determined by making adjustments to Generally accepted accounting principles, GAAP accounting. There are potentially over 160 adjustments but in practice, only several key ones are made, depending on the company and its industry. Calculation EVA is net operating profit after taxes (or NOPAT) less a capital charge, the latter being the product of the cost of capital and the economic capital. The basic formula is: : \begin \text & = ( \text - \text ) \cdot (\text - \text) \\[8pt] & = \text - \text \cdot (\text - \ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Internal Rate Of Return

Internal rate of return (IRR) is a method of calculating an investment's rate of return. The term ''internal'' refers to the fact that the calculation excludes external factors, such as the risk-free rate, inflation, the cost of capital, or financial risk. The method may be applied either ex-post or ex-ante. Applied ex-ante, the IRR is an estimate of a future annual rate of return. Applied ex-post, it measures the actual achieved investment return of a historical investment. It is also called the discounted cash flow rate of return (DCFROR)Project Economics and Decision Analysis, Volume I: Deterministic Models, M.A.Main, Page 269 or yield rate. Definition (IRR) The IRR of an investment or project is the "annualized effective compounded return rate" or rate of return that sets the net present value (NPV) of all cash flows (both positive and negative) from the investment equal to zero. Equivalently, it is the interest rate at which the net present value of the future cash fl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Return On Investment

Return on investment (ROI) or return on costs (ROC) is the ratio between net income (over a period) and investment (costs resulting from an investment of some resources at a point in time). A high ROI means the investment's gains compare favorably to its cost. As a performance measure, ROI is used to evaluate the efficiency of an investment or to compare the efficiencies of several different investments.Return On Investment – ROI , Investopedia as accessed 8 January 2013 In economic terms, it is one way of relating profits to capital invested. Purpose In business, ...[...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

E-waste

Electronic waste (or e-waste) describes discarded electrical or electronic devices. It is also commonly known as waste electrical and electronic equipment (WEEE) or end-of-life (EOL) electronics. Used electronics which are destined for refurbishment, reuse, resale, salvage recycling through material recovery, or disposal are also considered e-waste. Informal processing of e-waste in developing countries can lead to adverse human health effects and environmental pollution. The growing consumption of electronic goods due to the Digital Revolution and innovations in science and technology, such as bitcoin, has led to a global e-waste problem and hazard. The rapid exponential increase of e-waste is due to frequent new model releases and unnecessary purchases of electrical and electronic equipment (EEE), short innovation cycles and low recycling rates, and a drop in the average life span of computers. Electronic scrap components, such as CPUs, contain potentially harmful materials ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |