|

Leveraged Buyout

A leveraged buyout (LBO) is the acquisition of a company using a significant proportion of borrowed money (Leverage (finance), leverage) to fund the acquisition with the remainder of the purchase price funded with private equity. The assets of the acquired company are often used as collateral for the financing, along with any equity contributed by the acquiror. While corporate acquisitions often employ leverage to finance the purchase of the target, the term "leveraged buyout" is typically only employed when the acquiror is a financial sponsor (a private equity investment firm). The use of debt, which normally has a lower cost of capital than Equity (finance), equity, serves to reduce the overall cost of financing for the acquisition and enhance returns for the private equity investor. The equity investor can increase their projected returns by employing more leverage, creating incentives to maximize the proportion of debt relative to equity (i.e., debt-to-equity ratio). Whi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Leverage (finance)

In finance, leverage, also known as gearing, is any technique involving borrowing funds to buy an investment. Financial leverage is named after a lever in physics, which amplifies a small input force into a greater output force. Financial leverage uses borrowed money to augment the available capital, thus increasing the funds available for (perhaps risky) investment. If successful this may generate large amounts of profit. However, if unsuccessful, there is a risk of not being able to pay back the borrowed money. Normally, a lender will set a limit on how much risk it is prepared to take, and will set a limit on how much leverage it will permit. It would often require the acquired asset to be provided as collateral security for the loan. Leverage can arise in a number of situations. Securities like options and futures are effectively leveraged bets between parties where the principal is implicitly borrowed and lent at interest rates of very short treasury bills.Mock, E. J., R. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

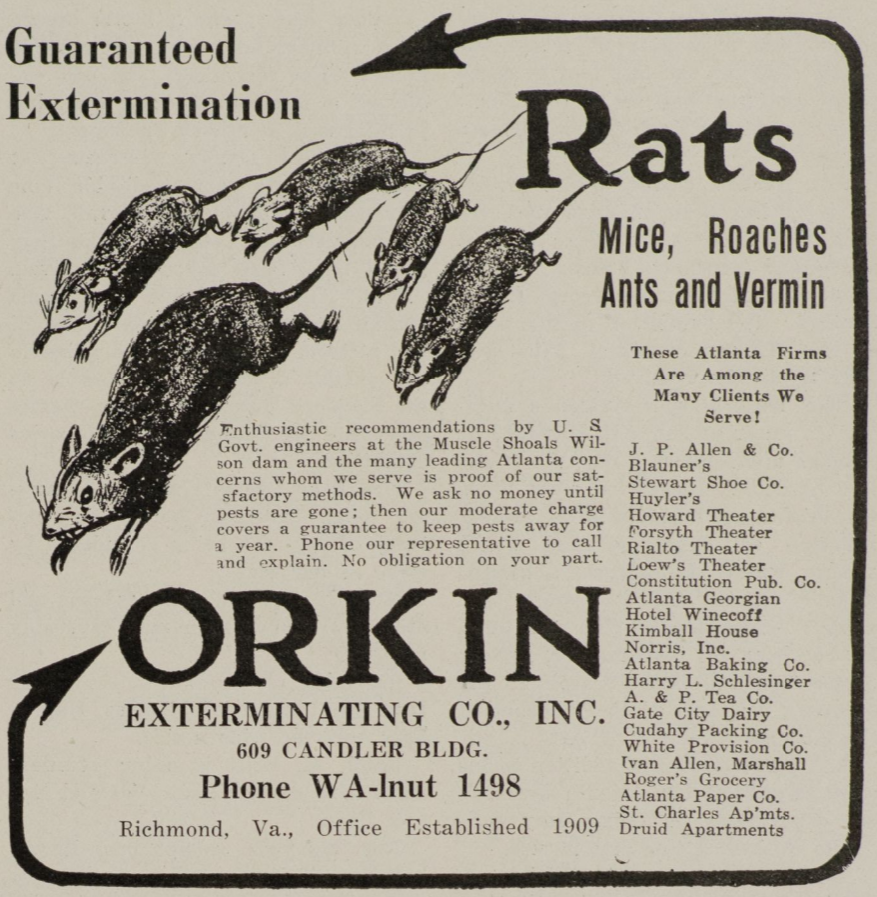

Orkin

Orkin is an American pest control company that was founded in 1901 by Otto Orkin. Since 1964, the company has been owned by Rollins Inc. Orkin has held research collaborations with universities around the country and with organizations like the Centers for Disease Control and Prevention (CDC) dating back to 1990 for pest biology research and pest-related disease studies. History Otto the Rat Man Orkin was founded in Walnutport, Pennsylvania in 1901 by Otto Orkin, who began selling rat poison door-to-door at age 14. One of six children of a Latvian immigrant family, Orkin was responsible since an early age for shooting and poisoning rats to keep them out of the family's food stores and away from their farm animals. Kirk, p.11 At age 12, Orkin began experimenting with different methods to poison rats in order to discover the most effective ones. Kirk, p.12 At the age of 14 Orkin borrowed 50 cents from his parents to buy arsenic in bulk, and he began consulting with apothecari ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

George R

George may refer to: Names * George (given name) * George (surname) People * George (singer), American-Canadian singer George Nozuka, known by the mononym George * George Papagheorghe, also known as Jorge / GEØRGE * George, stage name of Giorgio Moroder * George, son of Andrew I of Hungary Places South Africa * George, South Africa, a city ** George Airport United States * George, Iowa, a city * George, Missouri, a ghost town * George, Washington, a city * George County, Mississippi * George Air Force Base, a former U.S. Air Force base located in California Computing * George (algebraic compiler) also known as 'Laning and Zierler system', an algebraic compiler by Laning and Zierler in 1952 * GEORGE (computer), early computer built by Argonne National Laboratory in 1957 * GEORGE (operating system), a range of operating systems (George 1–4) for the ICT 1900 range of computers in the 1960s * GEORGE (programming language), an autocode system invented by Charles L ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bear Stearns

The Bear Stearns Companies, Inc. was an American investment bank, securities trading, and brokerage firm that failed in 2008 during the 2008 financial crisis and the Great Recession. After its closure it was subsequently sold to JPMorgan Chase. The company's main business areas before its failure were capital markets, investment banking, wealth management, and global clearing services, and it was heavily involved in the subprime mortgage crisis. In the years leading up to the failure, Bear Stearns was heavily involved in securitization and issued large amounts of asset-backed securities which were, in the case of mortgages, pioneered by Lewis Ranieri, "the father of mortgage securities." As investor losses mounted in those markets in 2006 and 2007, the company actually increased its exposure, especially to the mortgage-backed assets that were central to the subprime mortgage crisis. In March 2008, the Federal Reserve Bank of New York provided an emergency loan to try ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Henry Kravis

Henry Roberts Kravis (born January 6, 1944) is an American businessman, investor, and philanthropist.Forbes: The World's Billionaires - Henry Kravis September 2015 He is a co-founder of the private equity and investment firm Kohlberg Kravis Roberts. His lavish lifestyle has been criticized by activists looking to reform private equity regulations and restrict the practice of leveraged buyouts he pioneered. His buyout of RJR Nabisco was portrayed in the Barbarians at the Gate, 1989 book and Barbarians at the Gate (film), 1993 film ''Barbarians at the Gate''. Early life Kravis was born into a American Jews, Jewish family in Tulsa, Oklahoma, the son of Bessie (née Roberts) and Raymond F. Kravis, a successful Tulsa oil engineer who ...[...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Jerome Kohlberg, Jr

Jerome (; ; ; – 30 September 420), also known as Jerome of Stridon, was an early Christian priest, confessor, theologian, translator, and historian; he is commonly known as Saint Jerome. He is best known for his translation of the Bible into Latin (the translation that became known as the Vulgate) and his commentaries on the whole Bible. Jerome attempted to create a translation of the Old Testament based on a Hebrew version, rather than the Septuagint, as prior Latin Bible translations had done. His list of writings is extensive. In addition to his biblical works, he wrote polemical and historical essays, always from a theologian's perspective. Jerome was known for his teachings on Christian moral life, especially those in cosmopolitan centers such as Rome. He often focused on women's lives and identified how a woman devoted to Jesus should live her life. This focus stemmed from his close patron relationships with several prominent female ascetics who were members of af ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Onex Corporation

Onex Corporation is a Canadian investment management firm founded by Gerry Schwartz in 1984. In September 2024, it had $50 billion dollars under management. History Schwartz founded Onex in 1984 and took the company public in 1987. In June 2007, General Motors sold Allison Transmission to financial investors Carlyle Group and Onex Corporation. In 2010, Onex and the Canada Pension Plan acquired English engineering firm Tomkins, though Onex only held 14% of shares. At the end of 2017, Onex acquired SMG. The company was sold off in 2019 to merge with AEG Facilities to form ASM Global. In 2019, Onex acquired Gluskin Sheff, a Toronto-based wealth management firm. In May 2020, Onex blamed a first-quarter net loss of $1.1 billion US dollars on the COVID-19 pandemic The COVID-19 pandemic (also known as the coronavirus pandemic and COVID pandemic), caused by severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2), began with an disease outbreak, outbreak o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gerry Schwartz

Gerald W. Schwartz, OC (born 1941) is the founder and chairman of Onex Corporation. Schwartz has a net worth of US$1.5 billion, according to ''Forbes'' magazine. Early life and career Schwartz was born in Winnipeg, Manitoba. He graduated from Kelvin High School in Winnipeg. He received his B.A. and LL.B. degrees from the University of Manitoba where he became an active brother of the Sigma Alpha Mu fraternity. He later received an MBA degree from Harvard University in 1970. In the 1970s, Schwartz worked at Bear Stearns, where he was mentored by Jerome Kohlberg, Jr., who later became a founding partner in Kohlberg Kravis Roberts. Schwartz left Bear Stearns by 1977, returning to Canada. Along with Izzy Asper, Schwartz co-founded CanWest Global Communications in 1977. In 1983, Schwartz founded Onex Corporation. Schwartz has been a director of Scotiabank since 1999. In 2021, Schwartz's net worth was estimated at US$1.5 billion, making him one of the wealthiest people in C ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Saul Steinberg (business)

Saul Phillip Steinberg (August 13, 1939December 7, 2012) Note that this source, and the majority, spell his middle name ''Phillip'', while others spell it ''Philip''. was an American businessman and financier. He became a millionaire before his 30th birthday and a billionaire before his 40th birthday. He started a computer leasing company (Leasco), which he used in an audacious and successful takeover of the much larger Reliance Insurance Company in 1968. He was best known for his unsuccessful attempts to take over Chemical Bank in 1969 and Walt Disney Productions in 1984.Berkman, Johanna"Fall of the House of Steinberg" ''New York'', June 19, 2000 Early life Steinberg was born to a Jewish family on August 13, 1939, and grew up in Brooklyn, New York, the son of Julius and Anne Cohen Steinberg. He had one brother, Robert Steinberg, and two sisters, Roni Sokoloff and Lynda Jurist.Eaton, Leslie ''The New York Times'', September 9, 2000 Steinberg finished a degree from the Wharton ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Nelson Peltz

Nelson Peltz (born June 24, 1942) is an American billionaire businessman and investor. He is a founding partner, together with Peter W. May and Edward P. Garden, of Trian Partners, an alternative investment management fund based in New York. He is non-executive chairman of Wendy's Company, Sysco, and The Madison Square Garden Company. He is a former director of H.J. Heinz Company, Mondelēz International, and Ingersoll Rand and a former CEO of Triangle Industries. Early life and education Peltz was born to a Jewish family in 1942 in Brooklyn, New York, the son of Claire (''née'' Wechsler; 1905–2007) and Maurice Herbert Peltz (1901–1977). He was the youngest of their three children, and grew up in the East New York, Brooklyn#Cypress Hills, Cypress Hills section of Brooklyn, a sub-section of the East New York neighborhood. He attended Horace Mann School in the Bronx. Peltz attended the undergraduate program at the Wharton School of the University of Pennsylvania starting in 1 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Triarc

The Wendy's Company is an American fast food corporation and the holding company for Wendy's and First Kitchen. Originally founded as the Deisel-Wemmer Company, it is sourced in Dublin, Ohio. The company's principal subsidiary, Wendy's International, is the franchisor of Wendy's restaurants. Wendy's International Wendy's International, Inc. is the franchisor of Wendy's restaurants and the former parent company of Wendy's. It also owned Tim Hortons, Baja Fresh, and had a 70 percent stake in Cafe Express. The corporate headquarters is located in Dublin, Ohio, a suburb of Columbus. Wendy's International is owned by the Wendy's Company. The Tim Hortons chain was spun off by Wendy's into a separate company in September 2006. The Baja Fresh chain was sold in October 2006. On September 15, 2008, the purchase of Wendy's International, Inc. by Triarc Companies, Inc. was approved by shareholders. On September 30, the merger was completed, with Triarc being renamed to Wendy's ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Victor Posner

Victor Posner (September 18, 1918 – February 11, 2002) was an American businessman. He was one of the highest-paid business executives of his generation. He was a pioneer of the leveraged buyout and became notorious for asset stripping. Early life Posner was born in Baltimore, Maryland, one of nine children of Russian-Jewish grocers Morris and Mary Posner. Though he left school at age 13, he claimed to have earned his first million dollars by the age of 21 by investing in real estate, although financial records do not confirm this. Career Taking advantage of the post-World War II demand for housing in America, in 1948, he developed land and built houses in the Baltimore area, and by 1952, was building more than 1,100 dwellings per year. In 1954, he moved to Miami Beach, Florida, where he continued to invest in real estate and publicly traded companies. He became the head of numerous companies over his career, including Security Management Corporation (owner of rental ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |