|

Ledgers

A ledger is a book or collection of accounts in which accounting transactions are recorded. Each account has: * an opening or brought-forward balance; *a list of transactions, each recorded as either a debit or credit in separate columns (usually with a counter-entry on another page) *and an ending or closing, or carry-forward, balance. Overview The ledger is a permanent summary of all amounts entered in supporting journals (day books) which list individual transactions by date. Usually every transaction, or a total of a series of transactions, flows from a journal to one or more ledgers. Depending on the company's bookkeeping procedures, all journals may be totaled and the totals posted to the relevant ledger each month. At the end of the accounting period, the company's financial statements are generated from summary totals in the ledgers. Ledgers include: *Sales ledger (debtors ledger): records accounts receivable. This ledger records the financial transactions between ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Distributed Ledger

A distributed ledger (also called a shared ledger or distributed ledger technology or DLT) is a system whereby replicated, shared, and synchronized digital data is geographically spread (distributed) across many sites, countries, or institutions. Its fundamental rationale is Argumentum ad populum whereby its veracity relies on a popular or majority of nodes to force the system to agree. In contrast to a centralized database, a distributed ledger does not require a central administrator, and consequently does not have a Single point of failure, single (central) point-of-failure. In general, a distributed ledger requires a peer-to-peer, peer-to-peer (P2P) computer network and Consensus (computer science), consensus algorithms so that the ledger is reliably replicated across distributed computer nodes (servers, clients, etc.). The most common form of distributed ledger technology is the blockchain (commonly associated with the bitcoin cryptocurrency), which can either be on a public or ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Debits And Credits

Debits and credits in double-entry bookkeeping are entries made in account ledgers to record changes in value resulting from business transactions. A debit entry in an account represents a transfer of value ''to'' that account, and a credit entry represents a transfer ''from'' the account. Each transaction transfers value from credited accounts to debited accounts. For example, a tenant who writes a rent cheque to a landlord would enter a credit for the bank account on which the cheque is drawn, and a debit in a rent expense account. Similarly, the landlord would enter a credit in the rent income account associated with the tenant and a debit for the bank account where the cheque is deposited. Debits typically increase the value of assets and expense accounts and reduce the value of liabilities, equity, and revenue accounts. Conversely, credits typically increase the value of liability, equity, and revenue account and reduce the value of asset and expense accounts. Debit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

General Ledger

In bookkeeping, a general ledger is a bookkeeping ledger in which accounting data are posted from General journal, journals and aggregated from subledgers, such as accounts payable, accounts receivable, cash management, fixed assets, purchasing and projects. A general ledger may be maintained on paper, on a computer, or in the cloud. A ledger account is created for each account in the chart of accounts for an organization and is classified into account categories, such as income, expense, assets, liabilities, and equity; the collection of all these accounts is known as the general ledger. The general ledger holds financial and non-financial data for an organization. Each account in the general ledger consists of one or more pages. It includes details such as the date of sale, invoice number, customer details, and the amount due. This ledger helps businesses track outstanding receivables and manage cash flow efficiently. An organization's statement of financial position and the i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bookkeeping

Bookkeeping is the recording of financial transactions, and is part of the process of accounting in business and other organizations. It involves preparing source documents for all transactions, operations, and other events of a business. Transactions include purchases, sales, receipts and payments by an individual person, organization or corporation. There are several standard methods of bookkeeping, including the single-entry bookkeeping system, single-entry and double-entry bookkeeping system, double-entry bookkeeping systems. While these may be viewed as "real" bookkeeping, any process for recording financial transactions is a bookkeeping process. The person in an organisation who is employed to perform bookkeeping functions is usually called the bookkeeper (or book-keeper). They usually write the ''#Daybooks, daybooks'' (which contain records of sales, purchases, receipts, and payments), and document each financial transaction, whether cash or credit, into the correct d ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Balance (accounting)

In banking and accounting, the balance is the amount of money owed (or due) on an account. In bookkeeping, "balance" is the difference between the sum of debit entries and the sum of credit entries entered into an account during a financial period. When total debits exceed the total credits, the account indicates a debit balance. The opposite is true when the total credit exceeds total debits, the account indicates a credit balance. If the debit/credit totals are equal, the balances are considered zeroed out. In an accounting period, "balance" reflects the net value of assets and liabilities to better understand balance in the accounting equation. Balancing the books refers to the primary balance sheet equation of: : Assets In financial accounting, an asset is any resource owned or controlled by a business or an economic entity. It is anything (tangible or intangible) that can be used to produce positive economic value. Assets represent value of ownership that can b ... = liab ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

General Journal

A general journal is a Bookkeeping#Daybooks, daybook or subsidiary journal in which transactions relating to adjustment entries, opening stock, depreciation, accounting errors etc. are recorded. The Source document (accounting), source documents for general journal entries may be journal vouchers, copies of management reports and invoices. Journals are prime entry books, and may also be referred to as ''books of original entry'', from when transactions were written in a journal before they were manually posted to accounts in the general ledger or a subsidiary ledger. It is where Double-entry bookkeeping system, double-entry bookkeeping entries are recorded by debiting one or more accounts and Debits and credits, crediting another one or more accounts with the same total amount. The total amount debited and the total amount credited should always be equal, thereby ensuring the accounting equation is maintained. In manual accounting information systems, a variety of special journa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sales Ledger

A sales journal is a specialized accounting journal and it is also a prime entry book used in an accounting system to keep track of the sales of items that customers(debtors) have purchased of an accounts receivable account and crediting revenue on the credit side. It differs from the cash receipts journal in that the latter will serve to book sales when cash is received. The sales journal is used to record all of the company sales on credit. Most often these sales are made up of inventory sales or other merchandise sales. Notice that only credit sales of inventory and merchandise items are recorded in the sales journal. Cash sales of inventory are recorded in the cash receipts journal. Both cash and credit sales of non-inventory or merchandise are recorded in the general journal A general journal is a Bookkeeping#Daybooks, daybook or subsidiary journal in which transactions relating to adjustment entries, opening stock, depreciation, accounting errors etc. are recorded. The So ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Specialized Journals

Special journals (in the field of accounting) are specialized lists of financial transaction records which accountants call journal entries. In contrast to a general journal, each special journal records transactions of a specific type, such as sales or purchases. For example, when a company purchases merchandise from a vendor, and then in turn sells the merchandise to a customer, the purchase is recorded in one journal and the sale is recorded in another. Types of special journals The types of Special Journals that a business uses are determined by the nature of the business. Special journals are designed as a simple way to record the most frequently occurring transactions. There are four types of Special Journals that are frequently used by merchandising businesses: Sales journals, Cash receipts journals, Purchases journals, and Cash payments journals. Sales journal Sales journals record transactions that involve sales purely on credit. Source documents here would prob ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

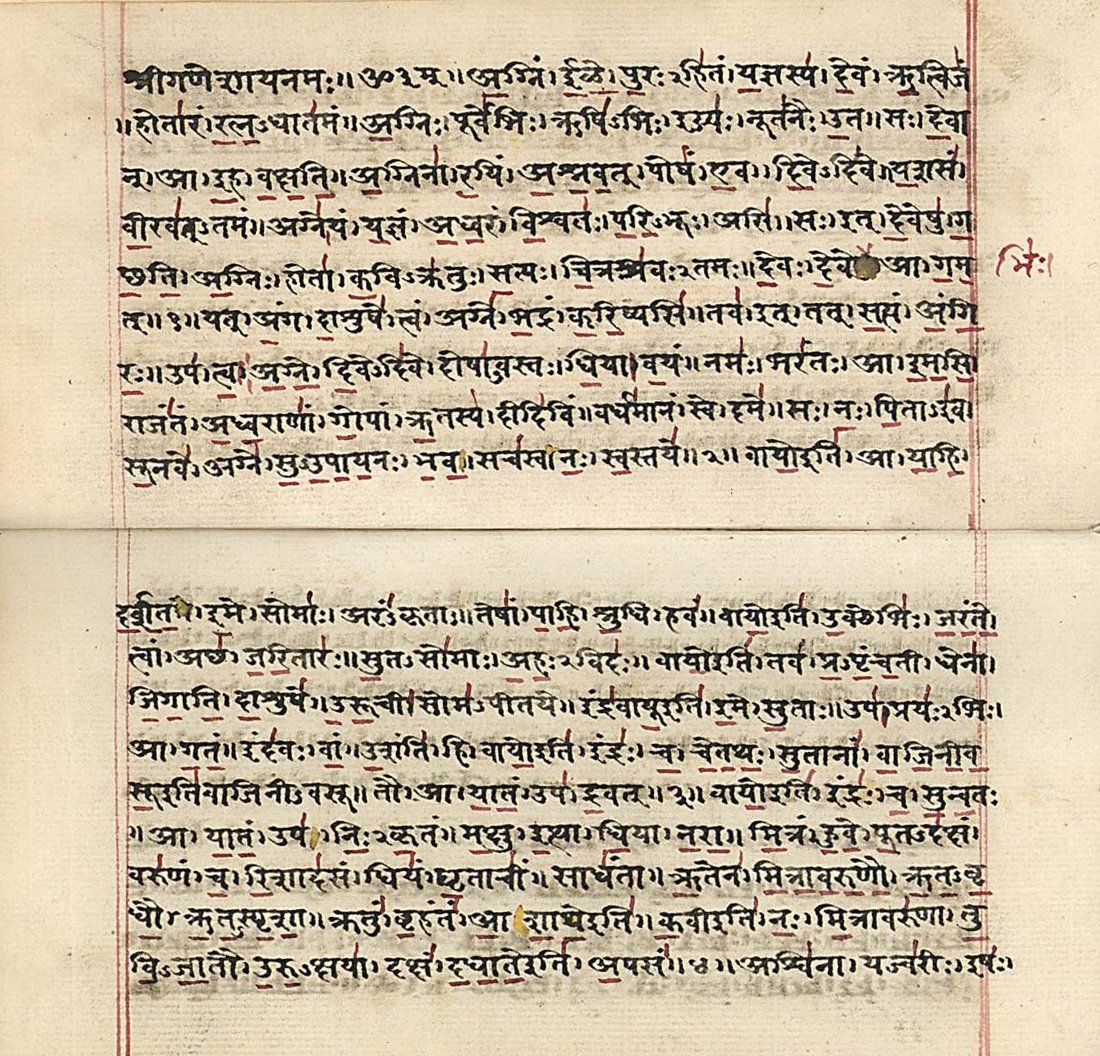

Scripture

Religious texts, including scripture, are texts which various religions consider to be of central importance to their religious tradition. They often feature a compilation or discussion of beliefs, ritual practices, moral commandments and laws, ethical conduct, spiritual aspirations, and admonitions for fostering a religious community. Within each religion, these texts are revered as authoritative sources of guidance, wisdom, and divine revelation. They are often regarded as sacred or holy, representing the core teachings and principles that their followers strive to uphold. Etymology and nomenclature According to Peter Beal, the term ''scripture'' – derived from (Latin) – meant "writings anuscriptsin general" prior to the medieval era, and was then "reserved to denote the texts of the Old and New Testaments of the Bible". Beyond Christianity, according to the ''Oxford World Encyclopedia'', the term ''scripture'' has referred to a text accepted to contain the "sacr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Digital Data

Digital data, in information theory and information systems, is information represented as a string of Discrete mathematics, discrete symbols, each of which can take on one of only a finite number of values from some alphabet (formal languages), alphabet, such as letters or digits. An example is a text document, which consists of a string of alphanumeric characters. The most common form of digital data in modern information systems is ''binary data'', which is represented by a string of binary digits (bits) each of which can have one of two values, either 0 or 1. Digital data can be contrasted with ''analog data'', which is represented by a value from a continuous variable, continuous range of real numbers. Analog data is transmitted by an analog signal, which not only takes on continuous values but can vary continuously with time, a continuous real-valued function of time. An example is the air pressure variation in a sound wave. The word ''digital'' comes from the same sour ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |