|

Laddering

Laddering is an investment technique that requires investors to purchase multiple financial products with different maturity dates. Benefits Laddering avoids the risk of reinvesting a large portion of assets in an unfavorable financial environment. Each "rung" of the ladder is a bond of a specific maturity date and the "height" of the ladder is the difference between the shortest maturity bond and the longest maturity bond. The more rungs in the ladder (10 or more is recommended), the better the diversification, the more stable the yield, and the higher the average yield. For example, a person has both a 2015 matured CD and a 2018 matured CD. Even if the interest rate is low in 2015 when one certificate is to be renewed, half of the income is locked in until 2018. Laddering can free up capital as needed. A person may purchase a shorter term bond in the event that he needs the capital soon to fund his children's tuition while purchasing other longer term bonds that mature later ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Certificate Of Deposit

A certificate of deposit (CD) is a time deposit, a financial product commonly sold by banks, thrift institutions, and credit unions in the United States. CDs differ from savings accounts in that the CD has a specific, fixed term (often one, three, or six months, or one to five years) and usually, a fixed interest rate. The bank expects the CD to be held until maturity, at which time they can be withdrawn and interest paid. Like savings accounts, CDs are insured "money in the bank" (in the US up to $250,000) and thus, up to the local insured deposit limit, virtually risk free. In the US, CDs are insured by the Federal Deposit Insurance Corporation (FDIC) for banks and by the National Credit Union Administration (NCUA) for credit unions. In exchange for the customer depositing the money for an agreed term, institutions usually offer higher interest rates than they do on accounts that customers can withdraw from on demand—though this may not be the case in an inverted yiel ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Investment

Investment is the dedication of money to purchase of an asset to attain an increase in value over a period of time. Investment requires a sacrifice of some present asset, such as time, money, or effort. In finance, the purpose of investing is to generate a return from the invested asset. The return may consist of a gain (profit) or a loss realized from the sale of a property or an investment, unrealized capital appreciation (or depreciation), or investment income such as dividends, interest, or rental income, or a combination of capital gain and income. The return may also include currency gains or losses due to changes in the foreign currency exchange rates. Investors generally expect higher returns from riskier investments. When a low-risk investment is made, the return is also generally low. Similarly, high risk comes with a chance of high losses. Investors, particularly novices, are often advised to diversify their portfolio. Diversification has the statistical eff ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Maturity (finance)

In finance, maturity or maturity date is the date on which the final payment is due on a loan or other financial instrument, such as a bond or term deposit, at which point the principal (and all remaining interest) is due to be paid. Most instruments have a ''fixed maturity date'' which is a specific date on which the instrument matures. Such instruments include fixed interest and variable rate loans or debt instruments, however called, and other forms of security such as redeemable preference shares, provided their terms of issue specify a maturity date. It is similar in meaning to "redemption date". Some instruments have ''no fixed maturity date'' which continue indefinitely (unless repayment is agreed between the borrower and the lenders at some point) and may be known as "perpetual stocks". Some instruments have a range of possible maturity dates, and such stocks can usually be repaid at any time within that range, as chosen by the borrower. A ''serial maturity'' is whe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Diversification (finance)

In finance, diversification is the process of allocating capital in a way that reduces the exposure to any one particular asset or risk. A common path towards diversification is to reduce risk or volatility by investing in a variety of assets. If asset prices do not change in perfect synchrony, a diversified portfolio will have less variance than the weighted average variance of its constituent assets, and often less volatility than the least volatile of its constituents. Diversification is one of two general techniques for reducing investment risk. The other is hedging. Examples The simplest example of diversification is provided by the proverb "Don't put all your eggs in one basket". Dropping the basket will break all the eggs. Placing each egg in a different basket is more diversified. There is more risk of losing one egg, but less risk of losing all of them. On the other hand, having a lot of baskets may increase costs. In finance, an example of an undiversified por ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Interest Rate

An interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed (called the principal sum). The total interest on an amount lent or borrowed depends on the principal sum, the interest rate, the compounding frequency, and the length of time over which it is lent, deposited, or borrowed. The annual interest rate is the rate over a period of one year. Other interest rates apply over different periods, such as a month or a day, but they are usually annualized. The interest rate has been characterized as "an index of the preference . . . for a dollar of present ncomeover a dollar of future income." The borrower wants, or needs, to have money sooner rather than later, and is willing to pay a fee—the interest rate—for that privilege. Influencing factors Interest rates vary according to: * the government's directives to the central bank to accomplish the government's goals * the currency of the principal sum lent or borrowed * ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bond (finance)

In finance, a bond is a type of security under which the issuer ( debtor) owes the holder ( creditor) a debt, and is obliged – depending on the terms – to repay the principal (i.e. amount borrowed) of the bond at the maturity date as well as interest (called the coupon) over a specified amount of time. The interest is usually payable at fixed intervals: semiannual, annual, and less often at other periods. Thus, a bond is a form of loan or IOU. Bonds provide the borrower with external funds to finance long-term investments or, in the case of government bonds, to finance current expenditure. Bonds and stocks are both securities, but the major difference between the two is that (capital) stockholders have an equity stake in a company (i.e. they are owners), whereas bondholders have a creditor stake in a company (i.e. they are lenders). As creditors, bondholders have priority over stockholders. This means they will be repaid in advance of stockholders, but will rank b ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tuition

Tuition payments, usually known as tuition in American English and as tuition fees in Commonwealth English, are fees charged by education institutions for instruction or other services. Besides public spending (by governments and other public bodies), private spending via tuition payments are the largest revenue sources for education institutions in some countries. In most developed countries, especially countries in Scandinavia and Continental Europe, there are no or only nominal tuition fees for all forms of education, including university and other higher education.Garritzmann, Julian L., 2016. ''The Political Economy of Higher Education Finance. The Politics of Tuition Fees and Subsidies in OECD countries, 1945-2015''. Basingstoke: Palgrave Macmillan. Payment methods Some of the methods used to pay for tuition include: * Scholarship * Bursary * Company sponsorship or funding * Grant * Government student loan * Educational 7 (private) * Family (parental) money * Savings ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

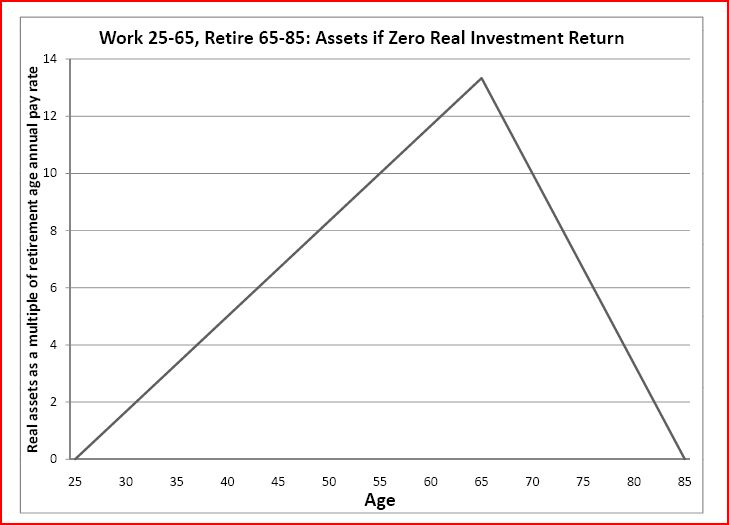

Retirement

Retirement is the withdrawal from one's position or occupation or from one's active working life. A person may also semi-retire by reducing work hours or workload. Many people choose to retire when they are elderly or incapable of doing their job due to health reasons. People may also retire when they are eligible for private or public pension benefits, although some are forced to retire when bodily conditions no longer allow the person to work any longer (by illness or accident) or as a result of legislation concerning their positions. In most countries, the idea of retirement is of recent origin, being introduced during the late-nineteenth and early-twentieth centuries. Previously, low life expectancy, lack of social security and the absence of pension arrangements meant that most workers continued to work until their death. Germany was the first country to introduce retirement benefits in 1889. Nowadays, most developed countries have systems to provide pensions on retiremen ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Yield Curve

In finance, the yield curve is a graph which depicts how the Yield to maturity, yields on debt instruments - such as bonds - vary as a function of their years remaining to Maturity (finance), maturity. Typically, the graph's horizontal or x-axis is a time line of months or years remaining to maturity, with the shortest maturity on the left and progressively longer time periods on the right. The vertical or y-axis depicts the annualized yield to maturity. Those who issue and trade in forms of debt, such as loans and bonds, use yield curves to determine their value. Shifts in the shape and slope of the yield curve are thought to be related to investor expectations for the economy and interest rates. Ronald Melicher and Merle Welshans have identified several characteristics of a properly constructed yield curve. It should be based on a set of securities which have differing lengths of time to maturity, and all yields should be calculated as of the same point in time. All se ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

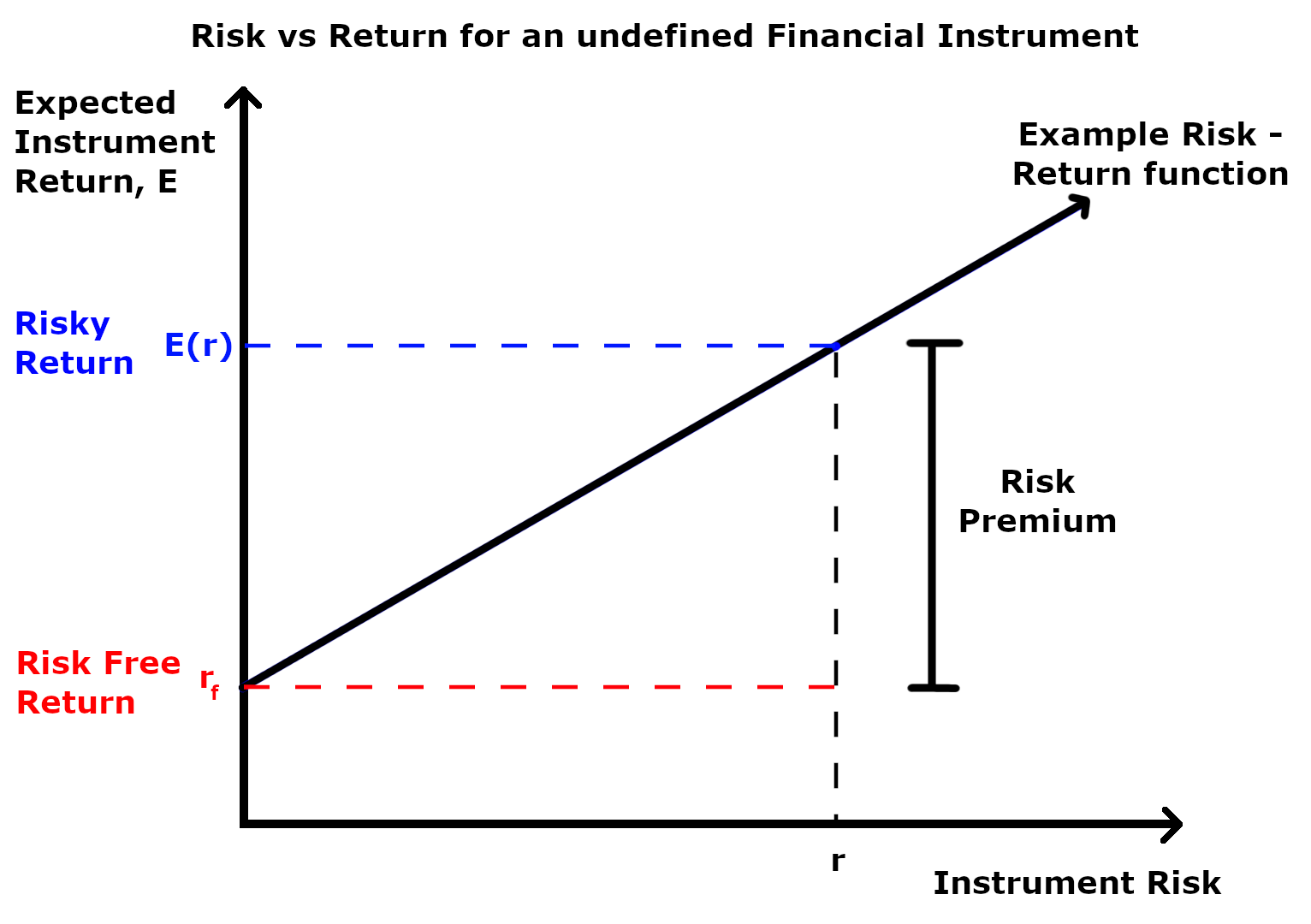

Risk Premium

A risk premium is a measure of excess return that is required by an individual to compensate being subjected to an increased level of risk. It is used widely in finance and economics, the general definition being the expected risky return less the risk-free return, as demonstrated by the formula below. Risk \ premium = E(r) - r_f Where E(r) is the risky expected rate of return and r_f is the risk-free return. The inputs for each of these variables and the ultimate interpretation of the risk premium value differs depending on the application as explained in the following sections. Regardless of the application, the market premium can be volatile as both comprising variables can be impacted independent of each other by both cyclical and abrupt changes. This means that the market premium is dynamic in nature and ever-changing. Additionally, a general observation regardless of application is that the risk premium is larger during economic downturns and during periods of increased ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)