|

Jameel Ahmed

Jameel Ahmad is a Pakistani banker who has served as the Governor of the State Bank of Pakistan since August 2022. Education Ahmed completed his MBA from the University of the Punjab in 1988 and is a Fellow Member of the Institute of Cost & Management Accountants of Pakistan (FCMA) since 1994, Fellow Member of the Institute of Bankers Pakistan (FIBP) since 1993, and Fellow Member of the Institute of Corporate Secretaries of Pakistan (FCIS) since 1992. Career Ahmed held various senior positions at the State Bank of Pakistan and the Saudi Central Bank. His association with the State Bank of Pakistan dates back to 1991, where he served in various capacities, including Deputy Governor and executive director. As the Deputy Governor (Banking and Financial Markets & Reserve Management) at the State Bank of Pakistan, Ahmed introduced a risk-based methodology for bank supervision, issued and implemented the latest international Basel capital adequacy standards, and established a deposi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

State Bank Of Pakistan

The State Bank of Pakistan (SBP) ( ur, ) is the Central Bank of Pakistan. Its Constitution, as originally laid down in the State Bank of Pakistan Order 1948, remained basically unchanged until 1 January 1974, when the bank was Nationalized and the scope of its functions was considerably enlarged. The State Bank of Pakistan Act 1956, with subsequent amendments, forms the basis of its operations today. The headquarters are located in the financial capital of the country in Karachi. The bank has a fully owned subsidiary with the name SBP Banking Services Corporation (SBP-BSC), the operational arm of the Central Bank with Branch Office in 16 cities across Pakistan, including the capital Islamabad and the four Provincial Capitals Lahore, Karachi, Peshawar, Quetta. The State Bank of Pakistan has other fully owned subsidiaries as well: National Institute of Banking and Finance, the training arm of the bank providing training to Commercial Banks, the Deposit Protection Corporation, a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Basel Committee On Banking Supervision

The Basel Committee on Banking Supervision (BCBS) is a committee of banking supervisory authorities that was established by the central bank governors of the Group of Ten (G10) countries in 1974. The committee expanded its membership in 2009 and then again in 2014. As of 2019, the BCBS has 45 members from 28 jurisdictions, consisting of central banks and authorities with responsibility of banking regulation. Overview The committee provides a forum for regular cooperation on banking supervisory matters. Its objective is to enhance understanding of key supervisory issues and improve the quality of banking supervision worldwide. The committee frames guidelines and standards in different areas – some of the better known among them are the international standards on capital adequacy, the Core Principles for Effective Banking Supervision and the Concordat on cross-border banking supervision. The committee's Secretariat is located at the Bank for International Settlements (BIS) in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Governors Of The State Bank Of Pakistan

Here is a list of the governors of the State Bank of Pakistan. List of governors See also * State Bank of Pakistan * Planning Commission (Pakistan) * Economy of Pakistan References Profile of Past Governors of State Bank of Pakistan {{Economy of Pakistan topics Pakistani government officials Pakistan Pakistan ( ur, ), officially the Islamic Republic of Pakistan ( ur, , label=none), is a country in South Asia. It is the world's List of countries and dependencies by population, fifth-most populous country, with a population of almost 24 ... Governors of the State Bank of Pakistan Governors of the State Bank of Pakistan ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Living People

Related categories * :Year of birth missing (living people) / :Year of birth unknown * :Date of birth missing (living people) / :Date of birth unknown * :Place of birth missing (living people) / :Place of birth unknown * :Year of death missing / :Year of death unknown * :Date of death missing / :Date of death unknown * :Place of death missing / :Place of death unknown * :Missing middle or first names See also * :Dead people * :Template:L, which generates this category or death years, and birth year and sort keys. : {{DEFAULTSORT:Living people 21st-century people People by status ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

International Monetary Fund

The International Monetary Fund (IMF) is a major financial agency of the United Nations, and an international financial institution, headquartered in Washington, D.C., consisting of 190 countries. Its stated mission is "working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world." Formed in 1944, started on 27 December 1945, at the Bretton Woods Conference primarily by the ideas of Harry Dexter White and John Maynard Keynes, it came into formal existence in 1945 with 29 member countries and the goal of reconstructing the international monetary system. It now plays a central role in the management of balance of payments difficulties and international financial crises. Countries contribute funds to a pool through a quota system from which countries experiencing balance of payments problems can borrow money. , the fund had XDR 477 billi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Islamic Financial Services Board

The Islamic Financial Services Board (IFSB) is an international standard-setting body of regulatory and supervisory agencies that promotes the soundness and stability of the Islamic financial services industry, covering banking, capital market and insurance. In advancing this mission, the IFSB promotes the development of a prudent and transparent Islamic financial services industry through introducing new, or adapting existing international standards consistent with Sharî'ah principles, and recommend them for adoption. The IFSB was originally established to serve banking sector regulators and central banks. However, in 2004–2005, the IFSB mandate was extended to include supervisors and regulators of insurance and securities markets. History The IFSB was founded by "a consortium of central banks" and the Islamic Development Bank in 2002 and began operations on 10 March 2003. The country of its location, Malaysia, passed a special law the same year —the Islamic Financial ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Stability Board

The Financial Stability Board (FSB) is an international body that monitors and makes recommendations about the global financial system. It was established after the G20 London summit in April 2009 as a successor to the Financial Stability Forum (FSF). The Board includes all G20 major economies, FSF members, and the European Commission. Hosted and funded by the Bank for International Settlements, the board is based in Basel, Switzerland, and is established as a not-for-profit association under Swiss law. The FSB represented the G20 leaders' first major international institutional innovation. U.S. Treasury Secretary Tim Geithner has described it as "in effect, a fourth pillar" of the architecture of global economic governance. The FSB has been assigned a number of important tasks, working alongside the International Monetary Fund, World Bank, and the World Trade Organization. Unlike most multilateral financial institutions, the FSB lacks a legal form and any formal power, gi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

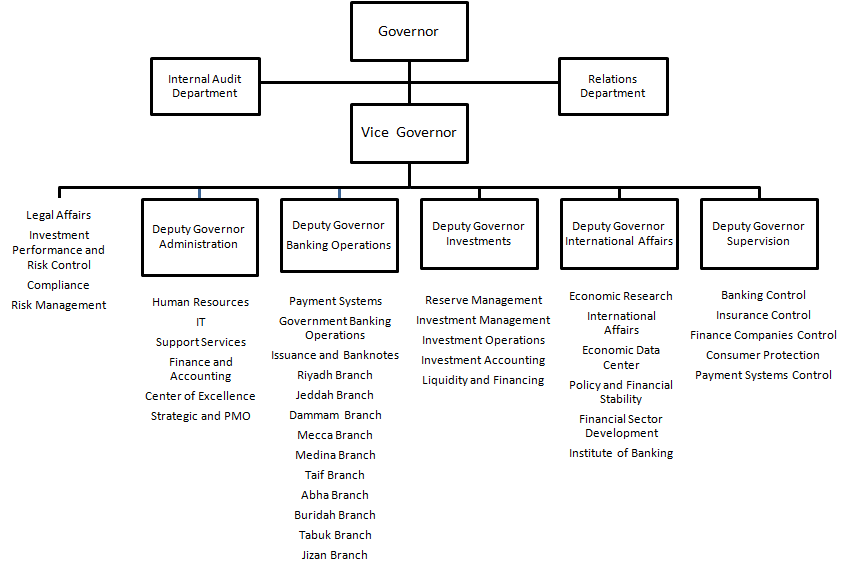

Saudi Central Bank

The Saudi Central Bank ( ar, البنك المركزي السعودي), previously known as the Saudi Arabian Monetary Authority (SAMA; ar, link=no, مؤسسة النقد العربي السعودي), established in 1952, is the central bank of the Kingdom of Saudi Arabia. After the name change in 2020, the Saudi Central Bank continued to use the same acronym (SAMA). History Prior to the establishment of the Saudi Central Bank, the Saudi Hollandi Bank, a branch of the Netherlands Trading Society from 1926 acted as a de facto central bank. It kept the Kingdom's gold reserves and received oil revenues on behalf of the Saudi Arabian government. In 1928 it assisted in the establishment of a new Saudi silver coin, commissioned by King Abdulaziz which became the Kingdom's first independent currency. The Saudi Hollandia Bank handed over its responsibilities to the SAMA when it was established in 1952 and became a model for other foreign banks in the kingdom. The building's current ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Reza Baqir

Reza Baqir is a Pakistani economist who served as the 20th Governor of the State Bank of Pakistan, from 4 May 2019 to 4 May 2022. Early life and education Reza Baqir was born to a Punjabi family in Vehari. His father Chaudhary Sharif Baqir was a very well known Barrister of Law and joined the PPP in 1988 and ran for the seat of National Assembly. Baqir received his early education from Aitchison College, Lahore. He graduated from Harvard University magna cum laudeAB economics), and later obtained a PhD in economics at the University of California, Berkeley.Syed Raza Hassan (May 4, 2019),Pakistan appoints IMF official as new c.bank governor amid bailout talks''Reuters''. Career Before his political career, Dr. Baqir held numerous positions in the International Monetary Fund (IMF). These included being the Mission Chief for Romania and Bulgaria. He was also the IMF's Senior Resident Representative. In 2019, President Arif Alvi appointed Baqir governor of the State Bank of Pakist ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Institute Of Corporate Secretaries Of Pakistan

Institute of Corporate Secretaries of Pakistan (ICSP) () was established on 22 November 1973 as a company limited by guarantee, under the then Indian Companies Act 1913, later substituted by the Companies Ordinance 1984. Since incorporation, the ICSP is functioning as the only recognized professional body of corporate secretaries which is imparting professional education and prudence in the areas of secretarial practice. Besides, equipping the students with knowledge for meeting challenges of modern corporate and financial world, the ICSP is also providing commands in the subjects of corporate & business laws, corporate governance, accounting, administration, management, human resource, business ethics and information technology. As a matter of fact the Corporate Secretaries should have caliber to chart a course of action or take decisions in accordance with regulations, legislations, precedents, traditions, best practices and to oversee that the operations of the organization ar ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Institute Of Bankers Pakistan

The Institute of Bankers Pakistan (IBP), ( ur, ) established in 1951, is Pakistan's premier banking training institute, which aims to develop and groom a cadre of banking and financial services professionals on continuous basis. It is an ISO-9001-2000 Certified Organization. IBP has its head office in Karachi. Mission statement IBP ''"To train and develop a sound human resource base for the financial sector and to work for continuous learning, adaptation and application of knowledge." Management of the institute The management of the institute rests with the Council, which in effect operates as a board of governors. The governor of the Central Bank, State Bank of Pakistan, is the ''ex officio'' president of the institute. The chief executives of major local and foreign commercial banks are members of the Council and are elected by the IBP members for a three years term. The chairman of the Council has the right to nominate one IBP fellow with a distinguished record of performan ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |