|

IMS Health

IMS Health was an American company that provided information, services and technology for the healthcare industry. IMS stood for Intercontinental Medical Statistics. It was the largest vendor of U.S. physician prescribing data. IMS Health was founded in 1954 by Bill Frohlich and David Dubow with Arthur Sackler having a hidden ownership stake. In 2010, IMS Health was taken private by TPG Capital, CPP Investment Board and Leonard Green & Partners. The company went public on April 4, 2014, and began trading on the NYSE under the symbol IMS. IMS Health was headquartered in Danbury, Connecticut. Over 2016 Quintiles and IMS Health merged, and the resulting company was named QuintilesIMS, which was renamed to IQVIA in 2017. Business model IMS Health was best known for its collection of healthcare information spanning sales, de-identified prescription data, medical claims, electronic medical records and social media. IMS Health's products and services were used by companies to develo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Subsidiary

A subsidiary, subsidiary company, or daughter company is a company (law), company completely or partially owned or controlled by another company, called the parent company or holding company, which has legal and financial control over the subsidiary company. Unlike regional branches or divisions, subsidiaries are considered to be distinct entities from their parent companies; they are required to follow the laws of where they are incorporated, and they maintain their own executive leadership. Two or more subsidiaries primarily controlled by same entity/group are considered to be sister companies of each other. Subsidiaries are a common feature of modern business, and most multinational corporations organize their operations via the creation and purchase of subsidiary companies. Examples of holding companies are Berkshire Hathaway, Jefferies Financial Group, The Walt Disney Company, Warner Bros. Discovery, and Citigroup, which have subsidiaries involved in many different Industry (e ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

S&P 500

The Standard and Poor's 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 leading companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices and includes approximately 80% of the total market capitalization of U.S. public companies, with an aggregate market cap of more than $49.8 trillion as of March 31, 2025. The S&P 500 index is a Free-float weighted/ capitalization-weighted index. As of April 2025, the ten largest companies on the list of S&P 500 companies accounted for approximately 35% of the market capitalization of the index and were, in order of highest to lowest weighting: Apple (6.4%), Microsoft (6.2%), Nvidia (6.0%), Amazon.com (3.8%), Alphabet (3.6%, including both class A & C shares), Meta Platforms (2.7%), Berkshire Hathaway (2.0%), Broadcom (1.8%), Tesla (1.6%), and JPMorgan Chase (1.4%). The components that have increased their dividends in 25 consecutive ye ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Customer Relationship Management

Customer relationship management (CRM) is a strategic process that organizations use to manage, analyze, and improve their interactions with customers. By leveraging data-driven insights, CRM helps businesses optimize communication, enhance customer satisfaction, and drive sustainable growth. CRM systems compile data from a range of different communication channels, including a company's website, telephone (which many services come with a softphone), email, live chat, marketing materials and more recently, social media. They allow businesses to learn more about their target audiences and how to better cater to their needs, thus retaining customers and driving sales growth. CRM may be used with past, present or potential customers. The concepts, procedures, and rules that a corporation follows when communicating with its consumers are referred to as CRM. This complete connection covers direct contact with customers, such as sales and service-related operations, forecasting, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

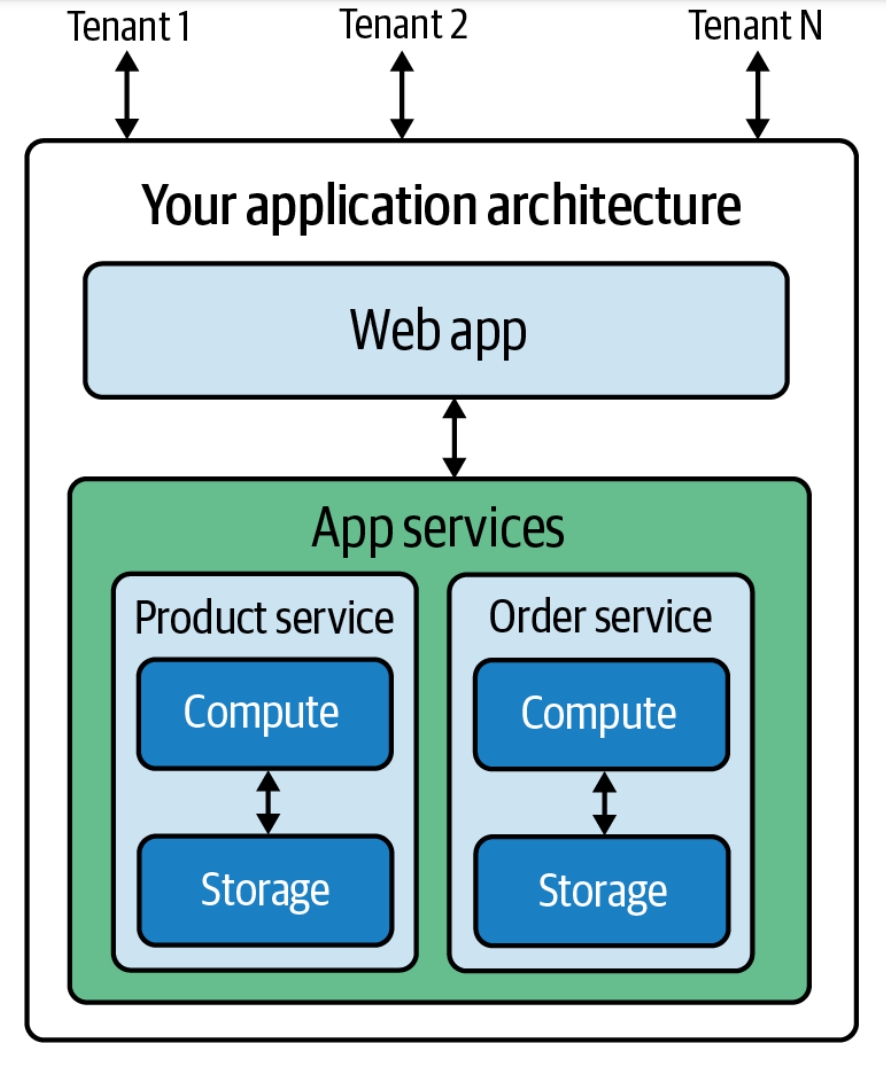

SaaS

Software as a service (SaaS ) is a cloud computing service model where the provider offers use of application software to a client and manages all needed physical and software resources. SaaS is usually accessed via a web application. Unlike other software delivery models, it separates "the possession and ownership of software from its use". SaaS use began around 2000, and by 2023 was the main form of software application deployment. Unlike most self-hosted software products, only one version of the software exists and only one operating system and configuration is supported. SaaS products typically run on rented infrastructure as a service (IaaS) or platform as a service (PaaS) systems including hardware and sometimes operating systems and middleware, to accommodate rapid increases in usage while providing instant and continuous availability to customers. SaaS customers have the abstraction of limitless computing resources, while economy of scale drives down the cost. SaaS ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mergers And Acquisitions

Mergers and acquisitions (M&A) are business transactions in which the ownership of a company, business organization, or one of their operating units is transferred to or consolidated with another entity. They may happen through direct absorption, a merger, a tender offer or a hostile takeover. As an aspect of strategic management, M&A can allow enterprises to grow or downsize, and change the nature of their business or competitive position. Technically, a is the legal consolidation of two business entities into one, whereas an occurs when one entity takes ownership of another entity's share capital, equity interests or assets. From a legal and financial point of view, both mergers and acquisitions generally result in the consolidation of assets and liabilities under one entity, and the distinction between the two is not always clear. Most countries require mergers and acquisitions to comply with antitrust or competition law. In the United States, for example, the Cl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Benchmarking

Benchmarking is the practice of comparing business processes and performance metrics to industry bests and best practices from other companies. Dimensions typically measured are Project management triangle, quality, time and cost. Benchmarking is used to measure performance using a specific Performance indicator, indicator (cost per unit of measure, productivity per unit of measure, cycle time of x per unit of measure or defects per unit of measure) resulting in a metric of performance that is then compared to others. Also referred to as "best practice benchmarking" or "process benchmarking", this process is used in management in which organizations evaluate various aspects of their processes in relation to best-practice companies' processes, usually within a peer group defined for the purposes of comparison. This then allows organizations to develop plans on how to make improvements or adapt specific best practices, usually with the aim of increasing some aspect of performance. B ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Clinical Trial

Clinical trials are prospective biomedical or behavioral research studies on human subject research, human participants designed to answer specific questions about biomedical or behavioral interventions, including new treatments (such as novel vaccines, pharmaceutical drug, drugs, medical nutrition therapy, dietary choices, dietary supplements, and medical devices) and known interventions that warrant further study and comparison. Clinical trials generate data on dosage, safety and efficacy. They are conducted only after they have received institutional review board, health authority/ethics committee approval in the country where approval of the therapy is sought. These authorities are responsible for vetting the risk/benefit ratio of the trial—their approval does not mean the therapy is 'safe' or effective, only that the trial may be conducted. Depending on product type and development stage, investigators initially enroll volunteers or patients into small Pilot experiment, pi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

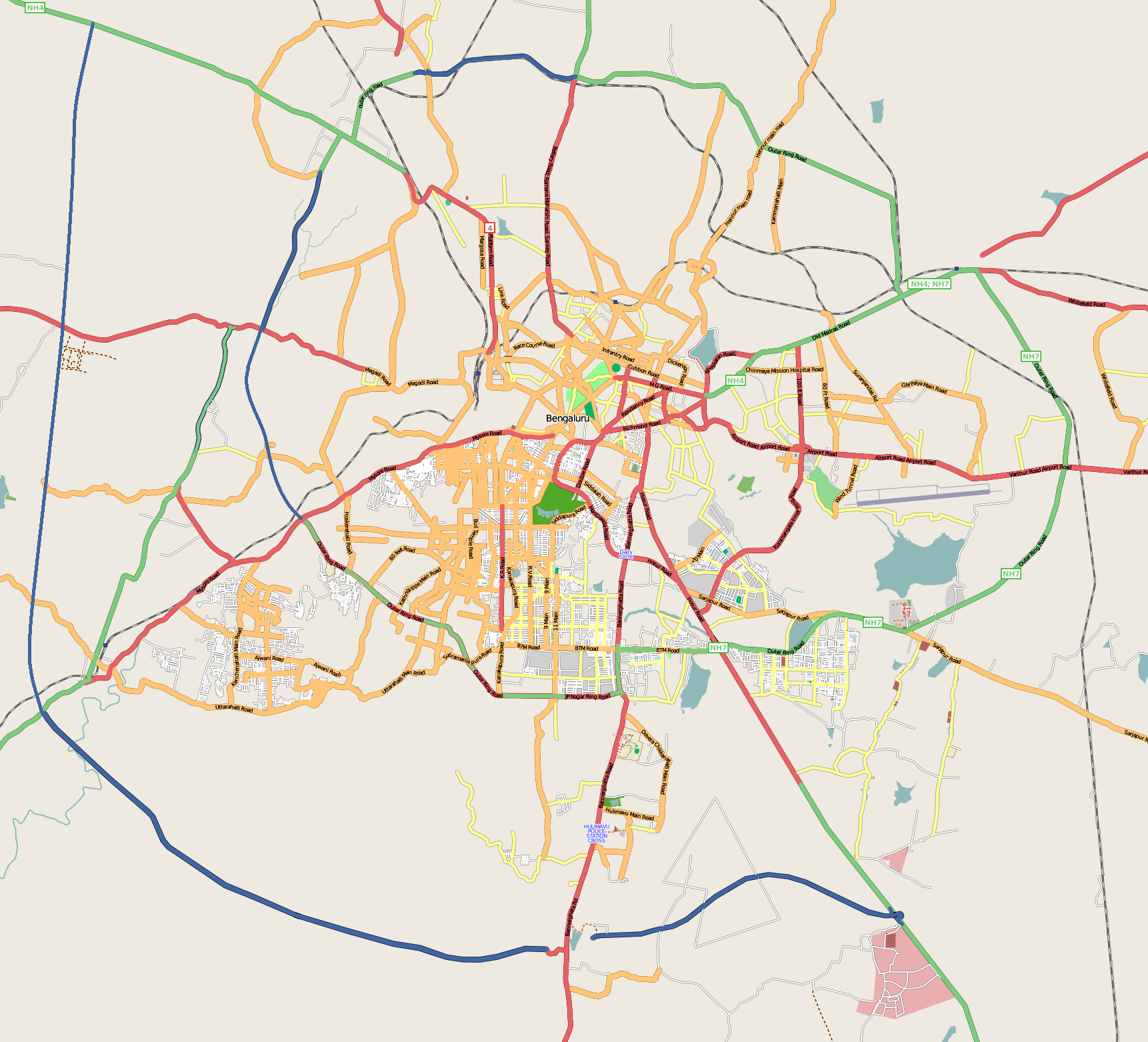

Bangalore

Bengaluru, also known as Bangalore (List of renamed places in India#Karnataka, its official name until 1 November 2014), is the Capital city, capital and largest city of the southern States and union territories of India, Indian state of Karnataka. As per the 2011 Census of India, 2011 census, the city had a population of 8.4 million, making it the List of cities in India by population, third most populous city in India and the most populous in South India. The Bengaluru metropolitan area had a population of around 8.5 million, making it the List of million-plus urban agglomerations in India, fifth most populous urban agglomeration in the country. It is located near the center of the Deccan Plateau, at a height of above sea level. The city is known as India's "Garden City", due to its parks and greenery. Archaeological artifacts indicate that the human settlement in the region happened as early as 4000 Common Era, BCE. The first mention of the name "Bengalooru" is from an ol ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Leonard Green & Partners

Leonard Green & Partners, L.P. (LGP) is an American private equity investment firm founded in 1989 and based in Los Angeles. The firm specializes in private equity investments. LGP has invested in over 95 companies since its inception, including Petco and The Container Store. In June 2024, Leonard Green and Partners ranked 18th in Private Equity International's PEI 300 ranking among the world's largest private equity firms. History Leonard Green was founded by Leonard I. Green in 1989 after separating from Gibbons, Green and van Amerongen Ltd. (Gibbons Green), a bank which he had co-founded in 1969 with Edward Gibbons and Lewis van Amerongen. Leonard Green died in 2002, leaving the firm to be run by John G. Danhakl, Peter J. Nolan and Jonathan D. Sokoloff. The firm's predecessor, Gibbons Green, was among the earliest practitioners of the leveraged and management buyout. Gibbons Green purchased several companies, including Purex Industries in 1982, Budget Rent a Car from Tra ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

CPP Investment Board

The Canada Pension Plan Investment Board (CPPIB; ), operating as CPP Investments (), is a Canadian Crown corporation established by way of the 1997 ''Canada Pension Plan Investment Board Act'' to oversee and invest the funds contributed to and held by the Canada Pension Plan (CPP). CPP Investments is one of the world's largest investors in private equity, having invested over US$28.1 billion between 2010 and 2014 alone. Despite being a Crown corporation, CPPIB is not considered a sovereign wealth fund because it operates at arm's length from the Government of Canada and solely manages CPP contributions paid by workers and employers, not public funds. As of March 31, 2025, the CPP Investment Board manages over C$714 billion in assets under management for the Canada Pension Plan on behalf of 22 million Canadians. Canadians contributed $15.9 billion to the fund from individual payroll deductions in fiscal 2024. CPP Investments is one of Canada's top eight pension funds, nickname ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

TPG Capital

TPG Inc., previously known as Texas Pacific Group and TPG Capital, is an American private equity firm based in Fort Worth, Texas. TPG manages investment funds in growth capital, venture capital, public equity, and debt investments. The firm invests in a range of industries including consumer/retail, media and telecommunications, industrials, technology, travel, leisure, and health care. TPG became a public company in January 2022, trading on the NASDAQ under the ticker symbol “TPG”. History and notable investments Founding and early history Texas Pacific Group, later TPG Capital, was founded in 1992 by David Bonderman, James Coulter and William S. Price III. Prior to founding TPG, Bonderman and Coulter had worked for Robert Bass, making leveraged buyout investments during the 1980s. In 1993, Coulter and Bonderman partnered with GE Capital vice president of strategic planning and business development William S. Price III to complete the buyout of Continental Air ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dow Jones Sustainability Index

The Dow Jones Sustainability Indices (DJSI) launched in 1999, are a family of indices evaluating the sustainability performance of thousands of companies trading publicly, operated under a strategic partnership between S&P Dow Jones Indices and RobecoSAM (Sustainable Asset Management) of the S&P Dow Jones Indices. They are the longest-running global sustainability benchmarks worldwide and have become the key reference point in sustainability investing for investors and companies alike. In 2012, S&P Dow Jones Indices was formed via the merger of S&P Indices and Dow Jones Indexes. The DJSI is based on an analysis of corporate economic, environmental and social performance, assessing issues such as corporate governance, risk management, branding, climate change mitigation, supply chain standards and labor practices. The trend is to reject companies that do not operate in a sustainable and ethical manner. It includes general as well as industry-specific sustainability criteria for each ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |