|

Homeowner

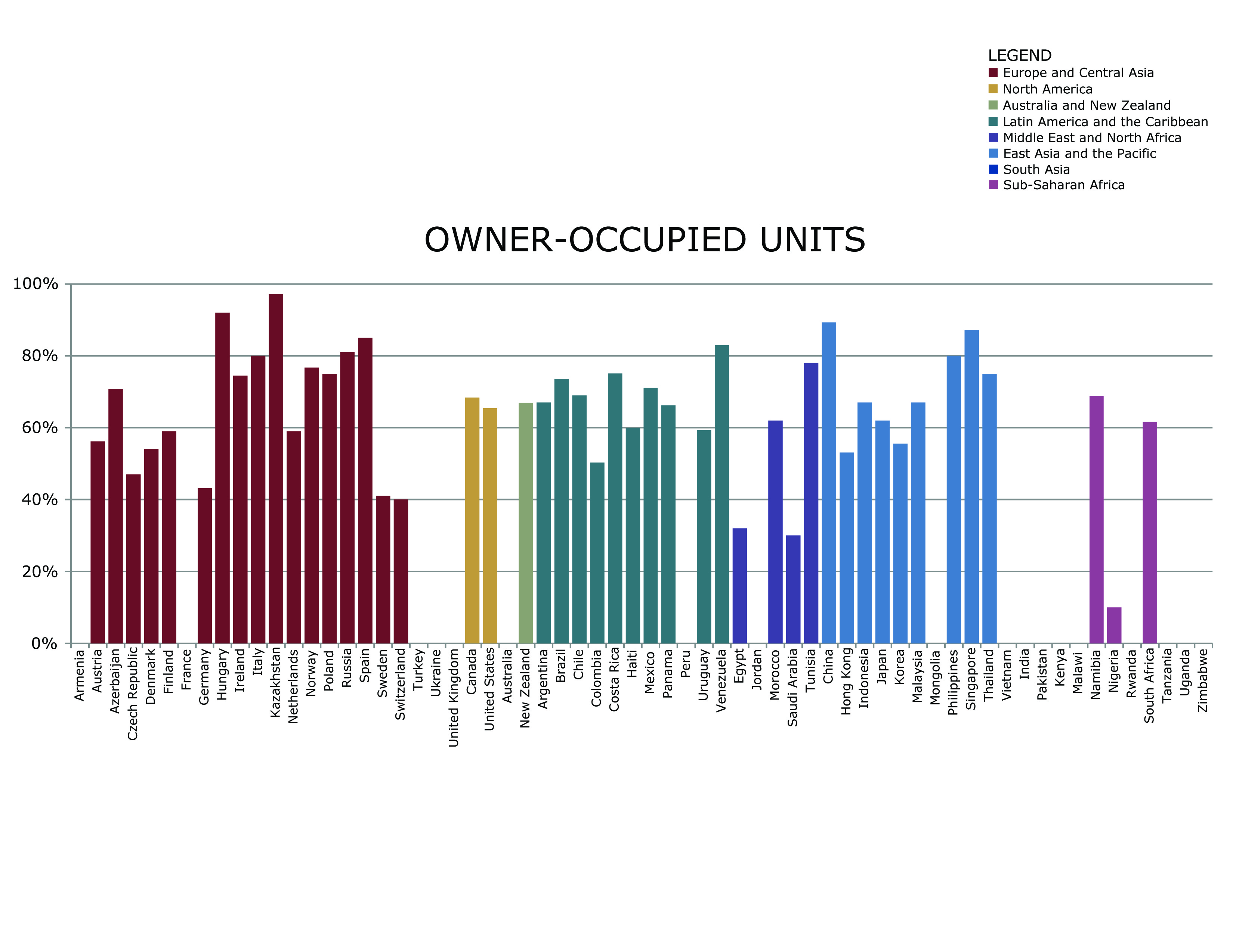

Owner-occupancy or home-ownership is a form of housing tenure in which a person, called the owner-occupier, owner-occupant, or home owner, owns the home in which they live. The home can be a house, such as a single-family house, an apartment, condominium, or a housing cooperative. In addition to providing housing, owner-occupancy also functions as a real estate investment. Acquisition Some homes are constructed by the owners with the intent to occupy. Many are inherited. A large number are purchased as new homes from a real estate developer or as an existing home from a previous landlord or owner-occupier. A house is usually the most expensive single purchase an individual or family makes and often costs several times the annual household income. Given the high cost, most individuals do not have enough savings on hand to pay the entire amount outright. In developed countries, mortgage loans are available from financial institutions in return for interest. If the homeowner fai ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Homeowner Association

A homeowner association (or homeowners' association [HOA], sometimes referred to as a property owners' association [POA], common interest development [CID], or homeowner community) is a private, Incorporation (business), legally-incorporated organization that governs a housing community, collects dues, and sets rules for its residents. HOAs are found principally in the United States, Canada, the Philippines, as well as some other countries. They are formed either ''ipso jure'' (such as in a building with multiple Owner-occupancy, owner-occupancies), or by a real estate developer for the purpose of marketing, Management, managing, and selling homes and lots in a residential subdivision. The developer may transfer control of an HOA after selling a predetermined number of lots. These legal structures, while most common in residential developments, can also be found in commercial, industrial and mixed-use developments, in which context they are referred to as POAs or CIDs instead of HO ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

2008 Financial Crisis

The 2008 financial crisis, also known as the global financial crisis (GFC), was a major worldwide financial crisis centered in the United States. The causes of the 2008 crisis included excessive speculation on housing values by both homeowners and financial institutions that led to the 2000s United States housing bubble, exacerbated by predatory lending for subprime mortgages and deficiencies in regulation. Cash out refinancings had fueled an increase in consumption that could no longer be sustained when home prices declined. The first phase of the crisis was the subprime mortgage crisis, which began in early 2007, as mortgage-backed securities (MBS) tied to U.S. real estate, and a vast web of Derivative (finance), derivatives linked to those MBS, collapsed in value. A liquidity crisis spread to global institutions by mid-2007 and climaxed with the bankruptcy of Lehman Brothers in September 2008, which triggered a stock market crash and bank runs in several countries. The crisis ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Foreclosure

Foreclosure is a legal process in which a lender attempts to recover the balance of a loan from a borrower who has Default (finance), stopped making payments to the lender by forcing the sale of the asset used as the Collateral (finance), collateral for the loan. Formally, a Mortgage law#Mortgage lender, mortgage lender (mortgagee), or other lienholder, obtains a termination of a Mortgage law#Borrower, mortgage borrower (mortgagor)'s Equity of redemption, equitable right of redemption, either by court order or by operation of law (after following a specific statutory procedure). Usually, a lender obtains a security interest from a borrower who mortgages or pledges an asset like a house to secure the loan. If the borrower default (finance), defaults and the lender tries to Repossession, repossess the property, courts of equity can grant the borrower the Equity of redemption, equitable right of redemption if the borrower repays the debt. While this equitable right exists, it is ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Condominium

A condominium (or condo for short) is an ownership regime in which a building (or group of buildings) is divided into multiple units that are either each separately owned, or owned in common with exclusive rights of occupation by individual owners. These individual units are surrounded by common areas that are jointly owned and managed by the owners of the units. The term can be applied to the building or complex itself, and is sometimes applied to individual units. The term "condominium" is mostly used in the US and Canada, but similar arrangements are used in #By country, many other countries under different names. Residential condominiums are frequently constructed as apartment buildings, referred as well as Horizontal Property. There are also rowhouse style condominiums, in which the units open directly to the outside and are not stacked. Alternatively, detached condominiums look like single-family detached home, single-family homes, but the yards (gardens), building exterio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mortgage Loan

A mortgage loan or simply mortgage (), in civil law (legal system), civil law jurisdictions known also as a hypothec loan, is a loan used either by purchasers of real property to raise funds to buy real estate, or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. The loan is "collateral (finance), secured" on the borrower's property through a process known as mortgage origination. This means that a Mortgage law, legal mechanism is put into place which allows the lender to take possession and sell the secured property ("foreclosure" or "repossession") to pay off the loan in the event the borrower defaults on the loan or otherwise fails to abide by its terms. The word ''mortgage'' is derived from a Law French term used in Legal professions in England and Wales, Britain in the Middle Ages meaning "death pledge" and refers to the pledge ending (dying) when either the obligation is fulfilled or the property is taken throu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mortgage Loans

A mortgage loan or simply mortgage (), in civil law jurisdictions known also as a hypothec loan, is a loan used either by purchasers of real property to raise funds to buy real estate, or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. The loan is " secured" on the borrower's property through a process known as mortgage origination. This means that a legal mechanism is put into place which allows the lender to take possession and sell the secured property ("foreclosure" or "repossession") to pay off the loan in the event the borrower defaults on the loan or otherwise fails to abide by its terms. The word ''mortgage'' is derived from a Law French term used in Britain in the Middle Ages meaning "death pledge" and refers to the pledge ending (dying) when either the obligation is fulfilled or the property is taken through foreclosure. A mortgage can also be described as "a borrower giving consideration in the form of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Inheritance

Inheritance is the practice of receiving private property, titles, debts, entitlements, privileges, rights, and obligations upon the death of an individual. The rules of inheritance differ among societies and have changed over time. Officially bequeathing private property and/or debts can be performed by a testator via will, as attested by a notary or by other lawful means. Terminology In law, an "heir" ( heiress) is a person who is entitled to receive a share of property from a decedent (a person who died), subject to the rules of inheritance in the jurisdiction where the decedent was a citizen, or where the decedent died or owned property at the time of death. The inheritance may be either under the terms of a will or by intestate laws if the deceased had no will. However, the will must comply with the laws of the jurisdiction at the time it was created or it will be declared invalid (for example, some states do not recognise handwritten wills as valid, or only in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Housing

Housing refers to a property containing one or more Shelter (building), shelter as a living space. Housing spaces are inhabited either by individuals or a collective group of people. Housing is also referred to as a human need and right to housing, human right, playing a critical role in shaping the quality of life for individuals, families, and communities. As a result, the quality and type of housing an individual or collective inhabits plays a large role in housing organization and housing housing policy, policy. Overview Housing is a physical structure indented for dwelling, lodging or shelter (building), shelter that homes people and provides them with a place to reside. Housing includes a wide range of sub-genres from apartments and houses to temporary shelters and emergency accommodations. Access to safe, affordable, and stable housing is essential for a person to achieve optimal health, safety, and overall well-being. Housing affects economic, social, and cultural ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Real Estate Investing

Real estate investing involves purchasing, owning, managing, renting, or selling real estate to generate profit or long-term wealth. A real estate investor or entrepreneur may participate actively or passively in real estate transactions. The primary goal of real estate investing is to increase value or generate a profit through strategic decision-making and market analysis. Investors analyze real estate projects by identifying property types, as each type requires a unique investment strategy. Valuation is a critical factor in assessing real estate investments, as it determines a property’s true worth, guiding investors in purchases, sales, financing, and risk management. Accurate valuation helps investors avoid overpaying for assets, maximize returns, and minimize financial risk. Additionally, proper valuation plays a crucial role in securing financing, as lenders use valuations to determine loan amounts and interest rates. Financing is fundamental to real estate investing, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Commodification Of Housing

Commodification of housing refers to the transformation of basic shelter, rental housing, and Owner-occupancy, homeownership into an investment vehicle or Speculation, speculative asset as opposed to a public good, human need, or the right to housing. Financialization of housing Instead of outright purchasing in cash, homes and housing units are often purchased with 15 or 30-year mortgage loanss. These can be Securitization, securitized and sold on a secondary mortgage market as packages of individual mortgages. The secondary mortgage market is considered to be the primary cause of the 2008 financial crisis as lenders made risky loans to Subprime lending, subprime borrowers who defaulted on their mortgage payments. Globalization has led to foreign nationals buying land and housing in many countries, including non-European Union, European-Union nationals buying 27,000 properties in Spain in 2023 and Chinese companies (both Mergers and acquisitions, acquisitions and companies orig ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Relocation (personal)

Relocation, also known as moving, or moving house, is the process of leaving one's dwelling and settling in another. The new location can be in the same neighborhood or a much further place in a different city or different country (immigration). It usually includes packing all belongings, transferring to the new home, unpacking, and administrative or bureaucratic tasks, such as changing registration data. An expatriate is an individual temporarily or permanently relocating to a country other than their native country. The individual relocating would be considered an immigrant in their new country. Psychological effects On the Holmes and Rahe stress scale for adults, "change of residence" is considered a stressful activity, assigned 20 points (with the death of a spouse being ranked the highest at 100), although other changes on the scale (e.g., "change in living conditions", "change in social activities") often occur as a result of relocating, making the overall stress level po ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Housing Tenure

Housing tenure is a financial arrangement and ownership structure under which someone has the right to live in a house or apartment. The most frequent forms are tenancy, in which rent is paid by the occupant to a landlord, and owner-occupancy, where the occupant owns their own home. Mixed forms of tenure are also possible. The basic forms of tenure can be subdivided, for example an owner-occupier may own a house outright, or it may be mortgaged. In the case of tenancy, the landlord may be a private individual, a non-profit organization such as a housing association, or a government body, as in public housing. Surveys used in social science research frequently include questions about housing tenure, because it is a useful proxy for income or wealth, and people are less reluctant to give information about it. Types * Owner occupancy – The person or group that occupies a house owns the building (and usually the land on which it sits). * Tenancy – A landlord who owns ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |