|

High Quality Liquid Assets

Liquidity regulations are financial regulations designed to ensure that financial institutions (e.g. banks) have the necessary assets on hand in order to prevent liquidity disruptions due to changing market conditions. This is often related to reserve requirement and capital requirement but focuses on the specific liquidity risk of assets that are held. These regulations were imposed to negate liquidity risks of banks that played a prominent role in financial crises. Financial banks profit from providing liquidity and maturity transformation, which is the practice by financial institutions of borrowing money on shorter timeframes than they lend money out. In other words, using shorter-term deposits to fund longer-term loans. This can lead to bank runs during which depositors demand repayment of their demandable and maturing deposits, before the borrowers are required to repay the loans.Wall, L. D. (2015). Liquidity Regulation and Financial Stability. The result could be a liquidity ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Regulation

Financial regulation is a broad set of policies that apply to the financial sector in most jurisdictions, justified by two main features of finance: systemic risk, which implies that the failure of financial firms involves public interest considerations; and information asymmetry, which justifies curbs on freedom of contract in selected areas of financial services, particularly those that involve retail clients and/or principal–agent problems. An integral part of financial regulation is the supervision of designated financial firms and markets by specialized authorities such as securities commissions and bank supervision, bank supervisors. In some jurisdictions, certain aspects of financial supervision are delegated to self-regulatory organizations. Financial regulation forms one of three legal categories which constitutes the content of financial law, the other two being market practices and case law. History In the early modern period, the Dutch were the pioneers in finan ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Services Authority

The Financial Services Authority (FSA) was a quasi-judicial body accountable for the regulation of the financial services industry in the United Kingdom between 2001 and 2013. It was founded as the Securities and Investments Board (SIB) in 1985. Its board was appointed by the Treasury, although it operated independently of government. It was structured as a company limited by guarantee and was funded entirely by fees charged to the financial services industry. Due to perceived regulatory failure of the banks during the 2008 financial crisis, the UK government decided to restructure financial regulation and abolish the FSA. On 19 December 2012, the Financial Services Act 2012 received royal assent, abolishing the FSA with effect from 1 April 2013. Its responsibilities were then split between two new agencies: the Financial Conduct Authority and the Prudential Regulation Authority of the Bank of England. Until its abolition, Lord Turner of Ecchinswell was the FSA's chairman an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Regulation

Banking regulation and supervision refers to a form of financial regulation which subjects banks to certain requirements, restrictions and guidelines, enforced by a financial regulatory authority generally referred to as banking supervisor, with semantic variations across jurisdictions. By and large, banking regulation and supervision aims at ensuring that banks are safe and sound and at fostering market transparency between banks and the individuals and corporations with whom they conduct business. Its main component is prudential regulation and supervision whose aim is to ensure that banks are viable and resilient ("safe and sound") so as to reduce the likelihood and impact of bank failures that may trigger systemic risk. Prudential regulation and supervision requires banks to control risks and hold adequate capital as defined by capital requirements, liquidity requirements, the imposition of concentration risk (or large exposures) limits, and related reporting and public di ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Basel Accords

The Basel Accords refer to the banking supervision accords (recommendations on banking regulations) issued by the Basel Committee on Banking Supervision (BCBS). Basel I was developed through deliberations among central bankers from major countries. In 1988, the Basel Committee published a set of minimum capital requirements for banks. This is also known as the 1988 Basel Accord, and was enforced by law in the Group of Ten (G-10) countries in 1992. A new set of rules known as Basel II was developed and published in 2004 to supersede the Basel I accords. Basel III was a set of enhancements to in response to the 2008 financial crisis. It does not supersede either Basel I or II but focuses on reforms to the Basel II framework to address specific issues, including related to the risk of a bank run. The Basel Accords have been integrated into the consolidated Basel Framework, which comprises all of the current and forthcoming standards of the Basel Committee on Banking Supervisio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Crisis

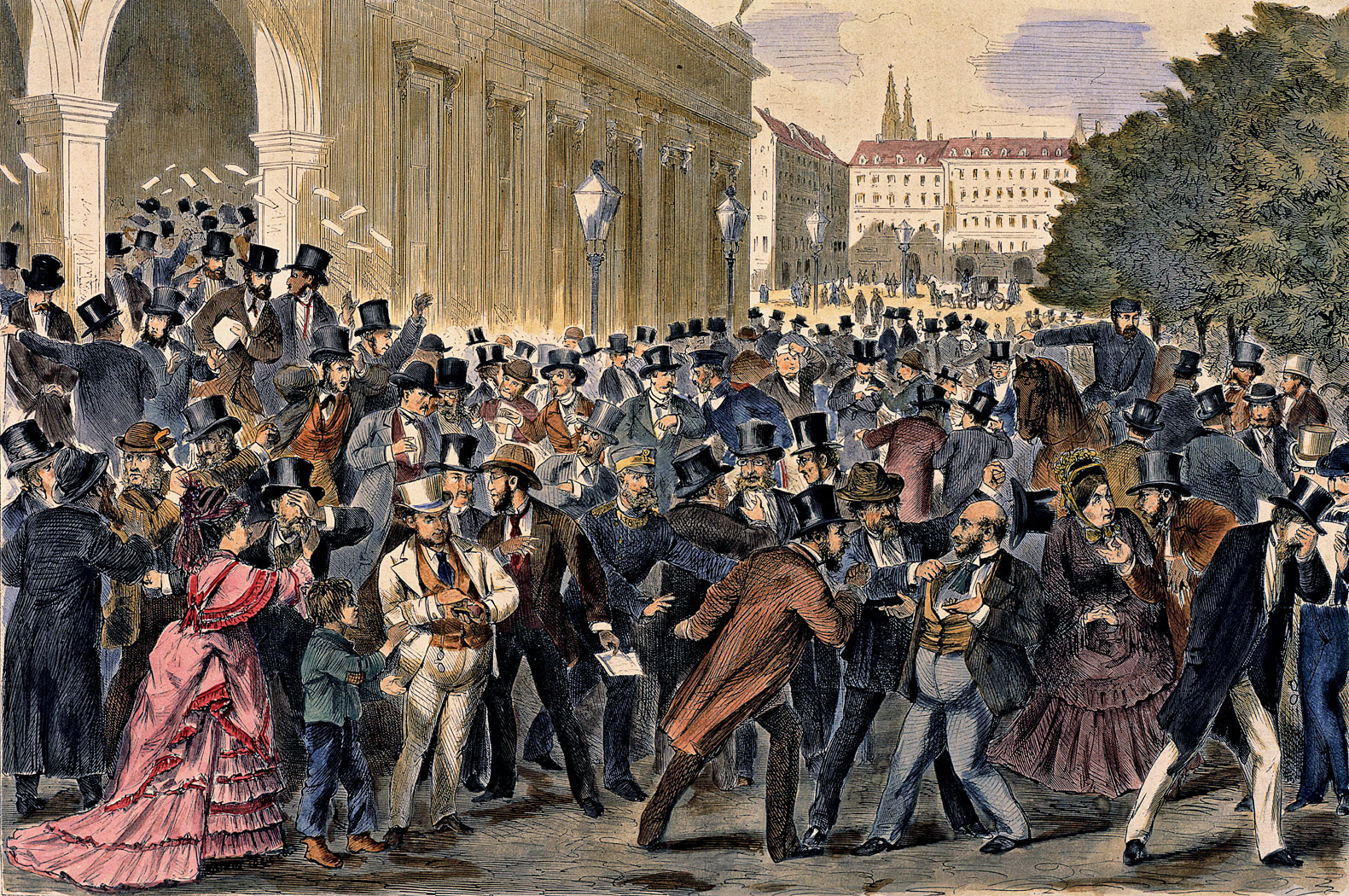

A financial crisis is any of a broad variety of situations in which some financial assets suddenly lose a large part of their nominal value. In the 19th and early 20th centuries, many financial crises were associated with Bank run#Systemic banking crises, banking panics, and many recessions coincided with these panics. Other situations that are often called financial crises include stock market crashes and the bursting of other financial Economic bubble, bubbles, currency crisis, currency crises, and sovereign defaults. Financial crises directly result in a loss of paper wealth but do not necessarily result in significant changes in the real economy (for example, the crisis resulting from the famous tulip mania bubble in the 17th century). Many economists have offered theories about how financial crises develop and how they could be prevented. There is little consensus and financial crises continue to occur from time to time. It is apparent however that a consistent feature of bo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Off-balance Sheet

In accounting, "off-balance-sheet" (OBS), or incognito leverage, usually describes an asset, debt, or financing activity not on the company's balance sheet. Total return swaps are an example of an off-balance-sheet item. Some companies may have significant amounts of off-balance-sheet assets and liabilities. For example, financial institutions often offer asset management or brokerage services to their clients. The assets managed or brokered as part of these offered services (often securities) usually belong to the individual clients directly or in trust, although the company provides management, depository or other services to the client. The company itself has no direct claim to the assets, so it does not record them on its balance sheet (they are off-balance-sheet assets), while it usually has some basic fiduciary duties with respect to the client. Financial institutions may report off-balance-sheet items in their accounting statements formally, and may also refer to "asset ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Net Stable Funding Ratio

During the 2008 financial crisis, several banks, including the UK's Northern Rock and the U.S. investment banks Bear Stearns and Lehman Brothers, suffered a liquidity crisis, due to their over-reliance on short-term wholesale funding from the interbank lending market. As a result, the G20 launched an overhaul of banking regulation known as Basel III. In addition to changes in capital requirements, Basel III also contains two entirely new liquidity requirements: the net stable funding ratio (NSFR) and the liquidity coverage ratio (LCR). On October 31, 2014, the Basel Committee on Banking Supervision issued its final Net Stable Funding Ratio (it was initially proposed in 2010 and re-proposed in January 2014). Both ratios are landmark requirements: it is planned that they will apply to all banks worldwide if they are engaged in international banking. Background The net stable funding ratio has been proposed within Basel III, the new set of capital and liquidity requirements for ban ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Liquidity Coverage Ratio

Basel III is the third of three Basel Accords, a framework that sets international standards and minimums for bank capital requirements, stress tests, liquidity regulations, and leverage, with the goal of mitigating the risk of bank runs and bank failures. It was developed in response to the deficiencies in financial regulation revealed by the 2008 financial crisis and builds upon the standards of Basel II, introduced in 2004, and Basel I, introduced in 1988. The Basel III requirements were published by the Basel Committee on Banking Supervision in 2010, and began to be implemented in major countries in 2012. Implementation of the Fundamental Review of the Trading Book (FRTB), published and revised between 2013 and 2019, has been completed only in some countries and is scheduled to be completed in others in 2025 and 2026. Implementation of the Basel III: Finalising post-crisis reforms (also known as Basel 3.1 or Basel III Endgame), introduced in 2017, was extended several tim ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Basel Committee On Banking Supervision

The Basel Committee on Banking Supervision (BCBS) is a committee of banking supervisory authorities that was established by the central bank governors of the Group of Ten (G10) countries in 1974. The committee expanded its membership in 2009 and then again in 2014. As of 2019, the BCBS has 45 members from 28 jurisdictions, consisting of central banks and authorities with responsibility of banking regulation. The committee agrees on standards for bank capital, liquidity and funding. Those standards are non-binding high-level principles. Members are expected but not obliged to undertake effort to implement them e.g. through domestic regulation. Overview The committee provides a forum for regular cooperation on banking supervisory matters. Its objective is to enhance understanding of key supervisory issues and improve the quality of banking supervision worldwide. The committee frames guidelines and standards in different areas – some of the better known among them are the inte ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

2008 Financial Crisis

The 2008 financial crisis, also known as the global financial crisis (GFC), was a major worldwide financial crisis centered in the United States. The causes of the 2008 crisis included excessive speculation on housing values by both homeowners and financial institutions that led to the 2000s United States housing bubble, exacerbated by predatory lending for subprime mortgages and deficiencies in regulation. Cash out refinancings had fueled an increase in consumption that could no longer be sustained when home prices declined. The first phase of the crisis was the subprime mortgage crisis, which began in early 2007, as mortgage-backed securities (MBS) tied to U.S. real estate, and a vast web of Derivative (finance), derivatives linked to those MBS, collapsed in value. A liquidity crisis spread to global institutions by mid-2007 and climaxed with the bankruptcy of Lehman Brothers in September 2008, which triggered a stock market crash and bank runs in several countries. The crisis ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Reserve Requirement

Reserve requirements are central bank regulations that set the minimum amount that a commercial bank must hold in liquid assets. This minimum amount, commonly referred to as the Bank reserves, commercial bank's reserve, is generally determined by the central bank on the basis of a specified proportion of Deposit account, deposit liabilities of the bank. This rate is commonly referred to as the cash reserve ratio or shortened as reserve ratio. Though the definitions vary, the commercial bank's reserves normally consist of currency, cash held by the bank and stored physically in the bank vault (vault cash), plus the amount of the bank's balance in that bank's account with the central bank. A bank is at liberty to hold in reserve sums above this minimum requirement, commonly referred to as ''excess reserves''. In some areas such as the euro area and the UK, tightening of reserve requirements in the home country is found to be associated with higher lending by foreign branches. Fo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Discount Window

Discount may refer to: Arts and entertainment * Discount (band), punk rock band that formed in Vero Beach, Florida in 1995 and disbanded in 2000 * ''Discount'' (film), French comedy-drama film * "Discounts" (song), 2020 single by American rapper Cupcakke Economics and business * Discounts and allowances, reductions in the basic prices of goods or services *Discounting In finance, discounting is a mechanism in which a debtor obtains the right to delay payments to a creditor, for a defined period of time, in exchange for a charge or fee.See "Time Value", "Discount", "Discount Yield", "Compound Interest", "Effici ..., a financial mechanism in which a debtor obtains the right to delay payments to a creditor * Delay discounting, the decrease in perceived value of receiving a good at a later date compared with receiving it at an earlier date * Discount store {{disambiguation ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |