|

Health Reimbursement Account

A Health Reimbursement Arrangement, also known as a Health Reimbursement Account (HRA), is a type of US employer-funded health benefit plan that reimburses employees for out-of-pocket medical expenses and, in limited cases, to pay for health insurance Health insurance or medical insurance (also known as medical aid in South Africa) is a type of insurance that covers the whole or a part of the risk of a person incurring medical expenses. As with other types of insurance, risk is shared among ma ... plan premiums. An HRA is not truly an account, since it does not place funds under a separate legal title. Instead, it is an agreement under which the employee can submit qualified health expenses to the employer for reimbursement. Following implementation of the Affordable Care Act, HRAs must be integrated with a qualified employer-sponsored group health insurance plan to avoid excise tax penalties. Using a Health Reimbursement Arrangement yields "tax advantages to offset health c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Health Insurance

Health insurance or medical insurance (also known as medical aid in South Africa) is a type of insurance that covers the whole or a part of the risk of a person incurring medical expenses. As with other types of insurance, risk is shared among many individuals. By estimating the overall risk of health risk and health system expenses over the risk pool, an insurer can develop a routine finance structure, such as a monthly premium or payroll tax, to provide the money to pay for the health care benefits specified in the insurance agreement. The benefit is administered by a central organization, such as a government agency, private business, or not-for-profit entity. According to the Health Insurance Association of America, health insurance is defined as "coverage that provides for the payments of benefits as a result of sickness or injury. It includes insurance for losses from accident, medical expense, disability, or accidental death and dismemberment". A health insurance policy i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Legal Title

In property law, title is an intangible construct representing a bundle of rights in a piece of property in which a party may own either a legal interest or equitable interest. The rights in the bundle may be separated and held by different parties. It may also refer to a formal document, such as a deed, that serves as evidence of ownership. Conveyancing, Conveyance of the document (transfer of title to the property) may be required in order to transfer ownership in the property to another person. Title is distinct from Possession (law), possession, a right that often accompanies ownership but is not necessarily sufficient to prove it (for example Adverse possession, squatting). In many cases, possession and title may each be transferred independently of the other. For real property, land registration and recording (real estate), recording provide public notice of ownership information. ''Possession (law), Possession'' is the actual holding of a thing, whether or not one has any ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Affordable Care Act

The Affordable Care Act (ACA), formally known as the Patient Protection and Affordable Care Act (PPACA) and informally as Obamacare, is a landmark U.S. federal statute enacted by the 111th United States Congress and signed into law by President Barack Obama on March 23, 2010. Together with amendments made to it by the Health Care and Education Reconciliation Act of 2010, it represents the U.S. healthcare system's most significant regulatory overhaul and expansion of coverage since the enactment of Medicare (United States), Medicare and Medicaid in 1965. Most of the act remains in effect. The ACA's major provisions came into force in 2014. By 2016, the uninsured share of the population had roughly halved, with estimates ranging from 20 to 24 million additional people covered. The law also enacted a host of Healthcare industry#Delivery of services, delivery system reforms intended to constrain healthcare costs and improve quality. After it came into effect, increases in overall ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Health Insurance Marketplace

In the United States, health insurance marketplaces, also called health exchanges, are organizations in each state through which people can purchase health insurance. People can purchase health insurance that complies with the Patient Protection and Affordable Care Act (ACA, known colloquially as "Obamacare") at ACA health exchanges, where they can choose from a range of government-regulated and standardized health care plans offered by the insurers participating in the exchange. ACA health exchanges were fully certified and operational by January 1, 2014, under federal law. Enrollment in the marketplaces started on October 1, 2013, and continued for six months. 8.02 million people had signed up through the health insurance marketplaces. An additional 4.8 million joined Medicaid. Enrollment for 2015 began on November 15, 2014, and ended on December 15, 2014. As of April 14, 2020, 11.41 million people had signed up through the health insurance marketplaces. Private non-ACA heal ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cafeteria Plan

A cafeteria plan or cafeteria system is a type of employee benefit plan offered in the United States pursuant to Section 125 of the Internal Revenue Code. Its name comes from the earliest versions of such plans, which allowed employees to choose between different types of benefits, similar to the ability of a customer to choose among available items in a cafeteria. Qualified cafeteria plans are excluded from gross income. To qualify, a cafeteria plan must allow employees to choose from two or more benefits consisting of cash or qualified benefit plans. The Internal Revenue Code explicitly excludes deferred compensation plans from qualifying as a cafeteria plan subject to a gross income exemption. Section 125 also provides two exceptions. If the cafeteria plan discriminates in favor of highly compensated employees, the highly compensated employees will be required to report their cafeteria plan benefits as income. The second exception is that if "the statutory nontaxable benefi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

High Deductible Health Plan

High may refer to: Science and technology * Height * High (atmospheric), a high-pressure area * High (computability), a quality of a Turing degree, in computability theory * High (tectonics), in geology an area where relative tectonic uplift took or takes place * Substance intoxication, also known by the slang description "being high" * Sugar high, a misconception about the supposed psychological effects of sucrose Music Performers * High (musical group), a 1974–1990 Indian rock group * The High, an English rock band formed in 1989 Albums * ''High'' (The Blue Nile album) or the title song, 2004 * ''High'' (Flotsam and Jetsam album), 1997 * ''High'' (New Model Army album) or the title song, 2007 * ''High'' (Royal Headache album) or the title song, 2015 * ''High'' (Keith Urban album), 2024 * ''High'' (EP), by Jarryd James, or the title song, 2016 Songs * "High" (Alison Wonderland song), 2018 * "High" (The Chainsmokers song), 2022 * "High" (The Cure song), 1992 * "Hi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Flexible Spending Account

In the United States, a flexible spending account (FSA), also known as a flexible spending arrangement, is one of a number of tax-advantaged financial accounts, resulting in payroll tax savings. One significant disadvantage to using an FSA is that funds not used by the end of the plan year are forfeited to the employer, known as the "use it or lose it" rule. Under the terms of the Affordable Care Act however a plan may permit an employee to carry over up to $660 into the following year without losing the funds but this does not apply to all plans and some plans may have lower limits. The most common type of flexible spending account, the medical expense FSA (also medical FSA or health FSA), is similar to a health savings account (HSA) or a Health Reimbursement Account, health reimbursement account (HRA). However, while HSAs and HRAs are almost exclusively used as components of a consumer-driven health care plan, medical FSAs are commonly offered with more traditional health plans ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Consolidated Omnibus Budget Reconciliation Act Of 1985

The Consolidated Omnibus Budget Reconciliation Act of 1985 (COBRA) is a law passed by the U.S. Congress on a reconciliation basis and signed by President Ronald Reagan that, among other things, mandates an insurance program which gives some employees the ability to continue health insurance coverage after leaving employment. COBRA includes amendments to the Employee Retirement Income Security Act of 1974 (ERISA). The law deals with a great variety of subjects, such as tobacco price supports, railroads, private pension plans, emergency department treatment, disability insurance, and the postal service, but it is perhaps best known for Title X, which amends the Internal Revenue Code and the Public Health Service Act to deny income tax deductions to employers (generally those with 20 or more full-time equivalent employees) for contributions to a group health plan unless such plan meets certain continuing coverage requirements. The violation for failing to meet those criteria ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

ERISA

The Employee Retirement Income Security Act of 1974 (ERISA) (, codified in part at ) is a U.S. federal tax and labor law that establishes minimum standards for pension plans in private industry. It contains rules on the federal income tax effects of transactions associated with employee benefit plans. ERISA was enacted to protect the interests of employee benefit plan participants and their beneficiaries by: * Requiring the disclosure of financial and other information concerning the plan to beneficiaries; * Establishing standards of conduct for plan fiduciaries; * Providing for appropriate remedies and access to the federal courts. ERISA is sometimes used to refer to the full body of laws that regulate employee benefit plans, which are mainly in the Internal Revenue Code and ERISA itself. Responsibility for interpretation and enforcement of ERISA is divided among the Department of Labor, the Department of the Treasury (particularly the Internal Revenue Service), and th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

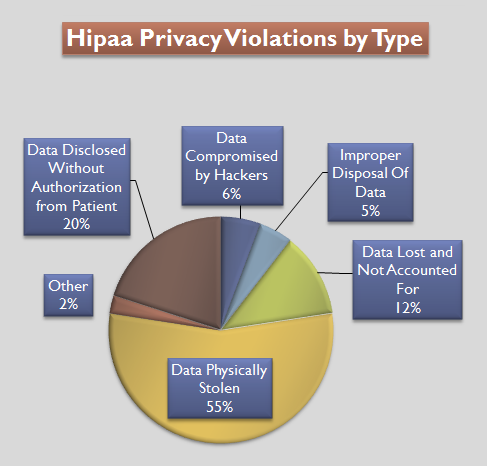

HIPAA

The Health Insurance Portability and Accountability Act of 1996 (HIPAA or the Kennedy– Kassebaum Act) is a United States Act of Congress enacted by the 104th United States Congress and signed into law by President Bill Clinton on August 21, 1996. It aimed to alter the transfer of healthcare information, stipulated the guidelines by which personally identifiable information maintained by the healthcare and healthcare insurance industries should be protected from fraud and theft, and addressed some limitations on healthcare insurance coverage. It generally prohibits healthcare providers and businesses called covered entities from disclosing protected information to anyone other than a patient and the patient's authorized representatives without their consent. The bill does not restrict patients from receiving information about themselves (with limited exceptions). Furthermore, it does not prohibit patients from voluntarily sharing their health information however they choose, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Centers For Medicare And Medicaid Services

The Centers for Medicare & Medicaid Services (CMS) is a federal agency within the United States Department of Health and Human Services (HHS) that administers the Medicare program and works in partnership with state governments to administer Medicaid, the Children's Health Insurance Program (CHIP), and health insurance portability standards. In addition to these programs, CMS has other responsibilities, including the administrative simplification standards from the Health Insurance Portability and Accountability Act of 1996 (HIPAA), quality standards in long-term care facilities (more commonly referred to as nursing homes) through its survey and certification process, clinical laboratory quality standards under the Clinical Laboratory Improvement Amendments, and oversight of HealthCare.gov. CMS was previously known as the Health Care Financing Administration (HCFA) until 2001. CMS actively inspects and reports on every nursing home in the United States. This includes mai ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporate Taxation In The United States

Corporate tax is imposed in the United States at the federal, most state, and some local levels on the income of entities treated for tax purposes as corporations. Since January 1, 2018, the nominal federal corporate tax rate in the United States of America is a flat 21% following the passage of the Tax Cuts and Jobs Act of 2017. State and local taxes and rules vary by jurisdiction, though many are based on federal concepts and definitions. Taxable income may differ from book income both as to timing of income and tax deductions and as to what is taxable. The corporate Alternative Minimum Tax was also eliminated by the 2017 reform, but some states have alternative taxes. Like individuals, corporations must file tax returns every year. They must make quarterly estimated tax payments. Groups of corporations controlled by the same owners may file a consolidated return. Some corporate transactions are not taxable. These include most formations and some types of mergers, acqui ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |