|

HDFC Life

HDFC Life Insurance Company Limited ( d/b/a HDFC Life) is a long-term life insurance provider headquartered in Mumbai, offering individual and group insurance services. The company was incorporated on 14 August 2000. History The company is a joint venture between Housing Development Finance Corporation Ltd (HDFC), one of India's leading housing finance institutions and Abrdn, a global investment company. As of 31 March 2020, the promoters; HDFC Ltd. and Standard Life (Mauritius Holdings) 2006 Ltd. hold a 51.69% and 34.75% stake in HDFC Life respectively. The remaining equity is held by public shareholders. HDFC Life obtained the certificate of commencement of business on 12 October 2000 and a certificate of registration from Insurance Regulatory and Development Authority of India (IRDAI) to undertake the life insurance business on 23 October 2000. HDFC Life has 467 branches and is present in 980+ cities, villages, and towns in India and supported by 16,544 employees. Th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Public Company

A public company is a company whose ownership is organized via shares of share capital, stock which are intended to be freely traded on a stock exchange or in over-the-counter (finance), over-the-counter markets. A public (publicly traded) company can be listed on a stock exchange (listing (finance), listed company), which facilitates the trade of shares, or not (unlisted public company). In some jurisdictions, public companies over a certain size must be listed on an exchange. In most cases, public companies are ''private'' enterprises in the ''private'' sector, and "public" emphasizes their reporting and trading on the public markets. Public companies are formed within the legal systems of particular states and so have associations and formal designations, which are distinct and separate in the polity in which they reside. In the United States, for example, a public company is usually a type of corporation, though a corporation need not be a public company. In the United Kin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Insurance Regulatory And Development Authority Of India

The Insurance Regulatory and Development Authority of India (IRDAI) is an autonomous and statutory body under the jurisdiction of Ministry of Finance, Government of India. It is tasked with regulating and licensing the insurance and re-insurance industries in India. It was constituted by the Insurance Regulatory and Development Authority Act, 1999, an Act of Parliament passed by the Government of India. The agency's headquarters are in Hyderabad, Telangana, where it moved from Delhi in 2001. The Insurance regulatory and Development Authority of India has directed Health Insurance providers to develop specialized policies to cater to the needs of senior citizens and also establish dedicated channels for addressing their grievances and claims. With effect from 1 April 2024, IRDAI has removed the age limit for purchasing health insurance policies.Earlier, 65 years was the age limit for buying new health insurance policies IRDAI is a 10-member body including the chairman, five ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

HDFC International Life And Re

HDFC International Life and Re Company Limited (HDFC International Life & Re) is a first life reinsurance company based in the Dubai International Financial Centre (DIFC), UAE. It is a wholly owned international subsidiary of HDFC Life and was incorporated on 10 January 2016 under the previous Companies Law DIFC Law No. 2 of 2009, registration number 2067. HDFC international Life & Re had received its regulatory license from the Dubai Financial Services Authority ("DFSA") effective on January 31, 2016, and is regulated by Dubai Financial Services Authority (DFSA). The company established its overseas branch office at GIFT City, IFSCA in Gujarat India in 2023 to offer US denominated Life & Health and Travel insurance solutions to non resident and resident Indians. Geographical reach The company with a registered paid up capital of US$29.5 million, is licensed and regulated by the DFSA to undertake life reinsurance business in the UAE and provide risk-transfer solutions, prudent ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Insurance Regulatory And Development Authority

The Insurance Regulatory and Development Authority of India (IRDAI) is an autonomous and statutory body under the jurisdiction of Ministry of Finance, Government of India. It is tasked with regulating and licensing the insurance and re-insurance industries in India. It was constituted by the Insurance Regulatory and Development Authority Act, 1999, an Act of Parliament passed by the Government of India. The agency's headquarters are in Hyderabad, Telangana, where it moved from Delhi in 2001. The Insurance regulatory and Development Authority of India has directed Health Insurance providers to develop specialized policies to cater to the needs of senior citizens and also establish dedicated channels for addressing their grievances and claims. With effect from 1 April 2024, IRDAI has removed the age limit for purchasing health insurance policies.Earlier, 65 years was the age limit for buying new health insurance policies IRDAI is a 10-member body including the chairman, five ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Educational Loan

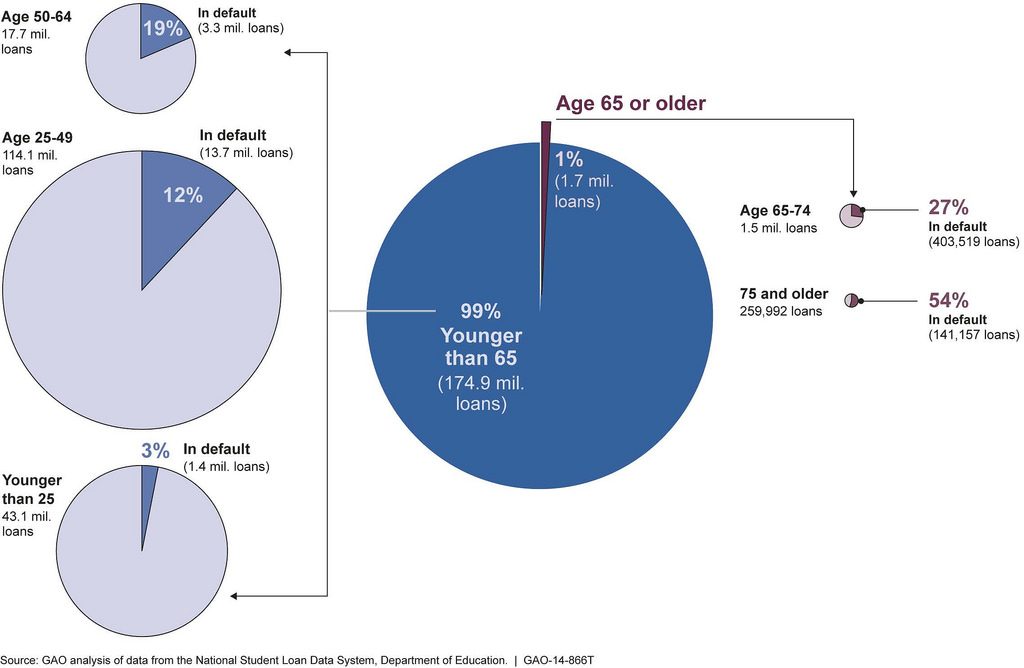

A student loan is a type of loan designed to help students pay for post-secondary education and the associated fees, such as tuition, books and supplies, and living expenses. It may differ from other types of loans in the fact that the interest rate may be substantially lower and the repayment schedule may be deferred while the student is still in school. It also differs in many countries in the strict laws regulating renegotiating and bankruptcy. This article highlights the differences of the student loan system in several major countries. Australia Tertiary student places in Australia are usually funded through the HECS-HELP scheme. This funding is in the form of loans that are not normal debts. They are repaid over time via a supplementary tax, using a sliding scale based on taxable income. As a consequence, loan repayments are only made when the former student has income to support the repayments. Discounts are available for early repayment. The scheme is available to cit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Asset Management

Asset management is a systematic approach to the governance and realization of all value for which a group or entity is responsible. It may apply both to tangible assets (physical objects such as complex process or manufacturing plants, infrastructure, buildings or equipment) and to intangible assets (such as intellectual property, goodwill or financial assets). Asset management is a systematic process of developing, operating, maintaining, upgrading, and disposing of assets in the most cost-effective manner (including all costs, risks, and performance attributes). Theory of asset management primarily deals with the periodic matter of improving, maintaining or in other circumstances assuring the economic and capital value of an asset over time. The term is commonly used in engineering, the business world, and public infrastructure sectors to ensure a coordinated approach to the optimization of costs, risks, service/performance, and sustainability. The term has traditionally ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

General Insurance

General insurance or non-life insurance policy, including automobile and homeowners policies, provide payments depending on the loss from a particular financial event. General insurance is typically defined as any insurance that is not determined to be life insurance. It is called property and casualty insurance in the United States and Canada and non-life insurance in Continental Europe. In the United Kingdom, insurance is broadly divided into three areas: personal lines, commercial lines and London market. The London market insures large commercial risks such as supermarkets, football players, corporation risks, and other very specific risks. It consists of a number of insurers, reinsurers, P&I Clubs, brokers and other companies that are typically physically located in the City of London. Lloyd's of London is a big participant in this market. The London market also participates in personal lines and commercial lines, domestic and foreign, through reinsurance. Commercia ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banking

A bank is a financial institution that accepts Deposit account, deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets. As banks play an important role in financial stability and the economy of a country, most jurisdictions exercise a high degree of Bank regulation, regulation over banks. Most countries have institutionalized a system known as fractional-reserve banking, under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure accounting liquidity, liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, the Basel Accords. Banking in its modern sense evolved in the fourteenth century in the prosperous cities of Renaissance Italy but, in many ways, functioned as a continuation of ideas and concepts o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Housing

Housing refers to a property containing one or more Shelter (building), shelter as a living space. Housing spaces are inhabited either by individuals or a collective group of people. Housing is also referred to as a human need and right to housing, human right, playing a critical role in shaping the quality of life for individuals, families, and communities. As a result, the quality and type of housing an individual or collective inhabits plays a large role in housing organization and housing housing policy, policy. Overview Housing is a physical structure indented for dwelling, lodging or shelter (building), shelter that homes people and provides them with a place to reside. Housing includes a wide range of sub-genres from apartments and houses to temporary shelters and emergency accommodations. Access to safe, affordable, and stable housing is essential for a person to achieve optimal health, safety, and overall well-being. Housing affects economic, social, and cultural ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Small Finance Bank

Small finance banks (SFB) are a type of niche banks in India. Banks with a SFB license can provide basic banking service of acceptance of deposits and lending. The aim behind these is to provide financial inclusion to sections of the economy not being served by other banks, such as small business units, small and marginal farmers, micro and small industries and unorganised sector entities. Summary of regulations * Existing non-banking financial companies (NBFC), microfinance institutions (MFI) and local area banks (LAB) can apply to become small finance banks. * They can be promoted either by individuals, corporate, trusts or societies. * They are established as public limited companies in the private sector under the Companies Act, 2013. * They are governed by the provisions of Reserve Bank of India Act, 1934, Banking Regulation Act, 1949 and other relevant statutes. * The banks will not be restricted to any region. * They were set up with the twin objectives of providing an i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Microfinance Institution

Microfinance consists of financial services targeting individuals and small businesses (SMEs) who lack access to conventional banking and related services. Microfinance includes microcredit, the provision of small loans to poor clients; savings and checking accounts; microinsurance; and payment systems, among other services. Microfinance product and services in MFI include: # Savings # Microcredit # Microinsurance # Microleasing and # Fund transfer/remittance. Microfinance services are designed to reach excluded customers, usually low income population segments, possibly socially marginalized, or geographically more isolated, and to help them become self-sufficient.Peck Christen, Robert; Rosenberg, Richard; Jayadeva, Veena. ''Financial institutions with a double-bottom line: Implications for the future of microfinance''. CGAP, Occasional Papers series, July 2004, pp. 2–3. ID Ghana is an example of a microfinance institution. Microfinance initially had a limited definiti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

RBL Bank

RBL Bank, formerly known as Ratnakar Bank Limited, is an Indian private sector bank founded in 1943 and headquartered in Mumbai. It offers services across five verticals: corporate banking, commercial banking, branch banking and retail liabilities, retail assets, and treasury and financial markets operations. History On 6 August 1943, Ratnakar Bank was founded as a regional bank in Maharashtra with two branches in Kolhapur and Sangli by Babgonda Bhujgonda Patil from Sangli and Gangappa Siddappa Chougule from Kolhapur. It mainly served small and medium enterprises (SMEs) and business merchants in the Kolhapur-Sangli belt. The bank was incorporated in Kolhapur district on 14 June 1943 as Ratnakar Bank Limited. In 1959, the bank was categorized as a scheduled commercial bank as per the Reserve Bank of India Act, 1934. During this decade, it was referred to as an NH4 Bank. In 1970, it received a banking license from the Reserve Bank of India (RBI). In July 2010, Vishwavir Ahu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |