|

Greenspan Put

The Greenspan put was a monetary policy response to financial crises that Alan Greenspan, former chair of the Federal Reserve, exercised beginning with the crash of 1987. Successful in addressing various crises, it became controversial as it led to periods of extreme speculation led by Wall Street investment banks overusing the put's repurchase agreements (or ''indirect'' quantitative easing) and creating successive asset price bubbles. The banks so overused Greenspan's tools that their compromised solvency in the 2008 financial crisis required Fed chair Ben Bernanke to use ''direct'' quantitative easing (the Bernanke put). The term Yellen put was used to refer to Fed chair Janet Yellen's policy of perpetual monetary looseness (i.e. low interest rates and continual quantitative easing). In Q4 2019, Fed chair Jerome Powell recreated the Greenspan put by providing repurchase agreements to Wall Street investment banks as a way to boost falling asset prices; in 2020, to combat the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Put Option

In finance, a put or put option is a derivative instrument in financial markets that gives the holder (i.e. the purchaser of the put option) the right to sell an asset (the ''underlying''), at a specified price (the ''strike''), by (or on) a specified date (the '' expiry'' or ''maturity'') to the ''writer'' (i.e. seller) of the put. The purchase of a put option is interpreted as a negative sentiment about the future value of the underlying stock. page 15 , 4.2.3 Positive and negative sentiment The term "put" comes from the fact that the owner has the right to "put up for sale" the stock or index. Puts may also be combined with other derivatives as part of more complex investment strategies, and in particular, may be useful for hedging. Holding a European put option is equivalent to holding the corresponding call option and selling an appropriate forward contract. This equivalence is called " put-call parity". Put options are most commonly used in the stock market to prot ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dot-com Bubble

The dot-com bubble (or dot-com boom) was a stock market bubble that ballooned during the late-1990s and peaked on Friday, March 10, 2000. This period of market growth coincided with the widespread adoption of the World Wide Web and the Internet, resulting in a dispensation of available venture capital and the rapid growth of valuations in new dot-com Startup company, startups. Between 1995 and its peak in March 2000, investments in the NASDAQ composite stock market index rose by 80%, only to fall 78% from its peak by October 2002, giving up all its gains during the bubble. During the dot-com crash, many online shopping companies, notably Pets.com, Webvan, and Boo.com, as well as several communication companies, such as Worldcom, NorthPoint Communications, and Global Crossing, failed and shut down. Others, like Lastminute.com, MP3.com and PeopleSound were bought out. Larger companies like Amazon (company), Amazon and Cisco Systems lost large portions of their market capitalizati ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

1997 Asian Financial Crisis

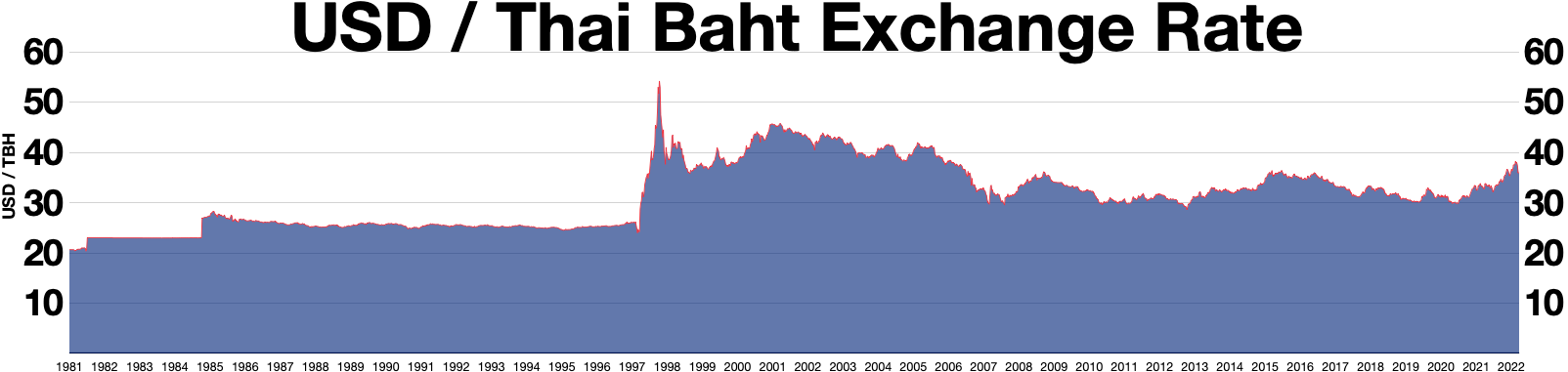

The 1997 Asian financial crisis gripped much of East Asia, East and Southeast Asia during the late 1990s. The crisis began in Thailand in July 1997 before spreading to several other countries with a ripple effect, raising fears of a worldwide economic meltdown due to financial contagion. However, the recovery in 1998–1999 was rapid, and worries of a meltdown quickly subsided. Originating in Thailand, where it was known as the ''Tom yum, Tom Yum Kung crisis'' () on 2 July, it followed the financial collapse of the Thai baht after the Thai government was forced to floating currency, float the baht due to lack of list of circulating currencies, foreign currency to support its currency fixed exchange rate, peg to the U.S. dollar. Capital flight ensued almost immediately, beginning an international chain reaction. At the time, Thailand had acquired a burden of foreign debt. As the crisis spread, other Southeast Asian countries and later Japan and South Korea saw slumping currencies, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Long Term Capital Management

Long-Term Capital Management L.P. (LTCM) was a highly leveraged hedge fund. In 1998, it received a $3.6 billion bailout from a group of 14 banks, in a deal brokered and put together by the Federal Reserve Bank of New York. LTCM was founded in 1994 by John Meriwether, the former vice-chairman and head of bond trading at Salomon Brothers. Members of LTCM's board of directors included Myron Scholes and Robert C. Merton, who three years later in 1997 shared the Nobel Prize in Economics for having developed the Black–Scholes model of financial dynamics.''A financial History of the United States Volume II: 1970–2001'', Jerry W. Markham, Chapter 5: "Bank Consolidation", M. E. Sharpe, Inc., 2002 LTCM was initially successful, with annualized returns (after fees) of around 21% in its first year, 43% in its second year and 41% in its third year. However, in 1998 it lost $4.6 billion in less than four months due to a combination of high leverage and exposure to the 1997 Asian financi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

1994 Economic Crisis In Mexico

The Mexican peso crisis was a currency crisis sparked by the Mexican government's sudden devaluation of the Mexican peso, peso against the United States dollar, U.S. dollar in December 1994, which became one of the first international financial crisis, financial crises ignited by capital flight. During the 1994 Mexican general election, 1994 presidential election, the incumbent administration embarked on an expansionary fiscal and monetary policy. The Secretariat of Finance and Public Credit (Mexico), Mexican treasury began issuing maturity (finance), short-term government debt, debt instruments denominated in domestic currency with a guaranteed repayment in U.S. dollars, attracting foreign investors. Mexico enjoyed investor consumer confidence, confidence and new access to international capital following its signing of the North American Free Trade Agreement (NAFTA). However, a Chiapas conflict, violent uprising in the state of Chiapas, as well as the assassination of the presi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gulf War

, combatant2 = , commander1 = , commander2 = , strength1 = Over 950,000 soldiers3,113 tanks1,800 aircraft2,200 artillery systems , page = https://www.govinfo.gov/content/pkg/GAOREPORTS-PEMD-96-10/pdf/GAOREPORTS-PEMD-96-10.pdf , strength2 = 1,000,000+ soldiers (~600,000 in Kuwait)5,500 tanks700+ aircraft3,000 artillery systems , casualties1 = Total:13,488 Coalition:292 killed (147 killed by enemy action, 145 non-hostile deaths)776 wounded (467 wounded in action)31 tanks destroyed/disabled28 Bradley IFVs destroyed/damaged1 M113 APC destroyed2 British Warrior APCs destroyed1 artillery piece destroyed75 aircraft destroyedKuwait:420 killed 12,000 captured ≈200 tanks destroyed/captured 850+ other armored vehicles destroyed/captured 57 aircraft lost 8 aircraft captured (Mirage F1s) 17 ships sunk, 6 captured. Acig.org. Retrieved on 12 June 2011 , casualties2 = Total:175,000–300,000+ Iraqi:20,000–50,000 killed ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Savings And Loan Crisis

The savings and loan crisis of the 1980s and 1990s (commonly dubbed the S&L crisis) was the failure of approximately a third of the savings and loan associations (S&Ls or thrifts) in the United States between 1986 and 1995. These thrifts were banks that historically specialized in fixed-rate mortgage lending. The Federal Savings and Loan Insurance Corporation (FSLIC) closed or otherwise resolved 296 thrifts from 1986 to 1989, whereupon the newly established Resolution Trust Corporation (RTC) took up these responsibilities. The two agencies closed 1,043 banks that held $519 billion in assets. The total cost of taxpayers by the end of 1999 was $123.8 billion with an additional $29.1 billion of losses imposed onto the thrift industry. Starting in 1979 and through the early 1980s, the Federal Reserve sharply increased interest rates in an effort to reduce inflation. At that time, thrifts had issued long-term loans at fixed interest rates that were lower than prevailing deposit rates ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bloomberg News

Bloomberg News (originally Bloomberg Business News) is an international news agency headquartered in New York City and a division of Bloomberg L.P. Content produced by Bloomberg News is disseminated through Bloomberg Terminals, Bloomberg Television, Bloomberg Radio, '' Bloomberg Businessweek'', '' Bloomberg Markets'', Bloomberg.com, and Bloomberg's mobile platforms. Since 2015, John Micklethwait has been editor-in-chief. History Bloomberg News was founded by Michael Bloomberg and Matthew Winkler in 1990 to deliver financial news reporting to Bloomberg Terminal subscribers. The agency was established in 1990 with a team of six people. Winkler was first editor-in-chief. In 2010, Bloomberg News included more than 2,300 editors and reporters in 72 countries and 146 news bureaus worldwide. Beginnings (1990–1995) Bloomberg Business News was created to expand the services offered through the terminals. According to Matthew Winkler, then a writer for ''The Wall Street Jo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Carry (investment)

The carry of an asset is the return obtained from holding it (if positive), or the cost of holding it (if negative) (see also Cost of carry). For instance, commodities are usually negative carry assets, as they incur storage costs or may suffer from depreciation. (Imagine corn or wheat sitting in a silo somewhere, not being sold or eaten.) But in some circumstances, appropriately hedged commodities can be positive carry assets if the forward/futures market is willing to pay sufficient premium for future delivery. This can also refer to a trade with more than one leg, where you earn the spread between borrowing a low carry asset and lending a high carry one; such as gold during a financial crisis, due to its safe haven quality. Carry trades are not usually arbitrages: pure arbitrages make money no matter what; carry trades make money only if nothing changes against the carry's favor. Interest rates carry trade/maturity transformation For instance, the traditional revenue ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Funds Rate

In the United States, the federal funds rate is the interest rate at which depository institutions (banks and credit unions) lend reserve balances to other depository institutions overnight on an collateral (finance), uncollateralized basis. Bank reserves, Reserve balances are amounts held at the Federal Reserve. Institutions with surplus balances in their accounts lend those balances to institutions in need of larger balances. The federal funds rate is an important benchmark in financial markets and central to the conduct of Monetary policy of the United States, monetary policy in the United States as it influences a wide range of market interest rates. The effective federal funds rate (EFFR) is calculated as the effective median interest rate of overnight federal funds transactions during the previous business day. It is published daily by the Federal Reserve Bank of New York. The federal funds target range is determined by a meeting of the members of the Federal Open Mar ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

SSRN

The Social Science Research Network (SSRN) is an open access research platform that functions as a repository for sharing early-stage research and the rapid dissemination of scholarly research in the social sciences, humanities, life sciences, and health sciences, among others. Elsevier bought SSRN from Social Science Electronic Publishing Inc. in May 2016. It is not an electronic journal, but rather an electronic library and search engine. History SSRN was founded in 1994 by Michael C. Jensen and Wayne Marr, both financial economists. In January 2013, SSRN was ranked the largest open-access repository in the world by Ranking Web of Repositories (an initiative of the Cybermetrics Lab, a research group belonging to the Spanish National Research Council), measured by number of PDF files, backlinks and Google Scholar results. In May 2016, SSRN was bought from Social Science Electronic Publishing Inc. by Elsevier. On 17 May 2016, the SSRN founder and chairman Michael C. Jen ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |