|

Funeral Payment

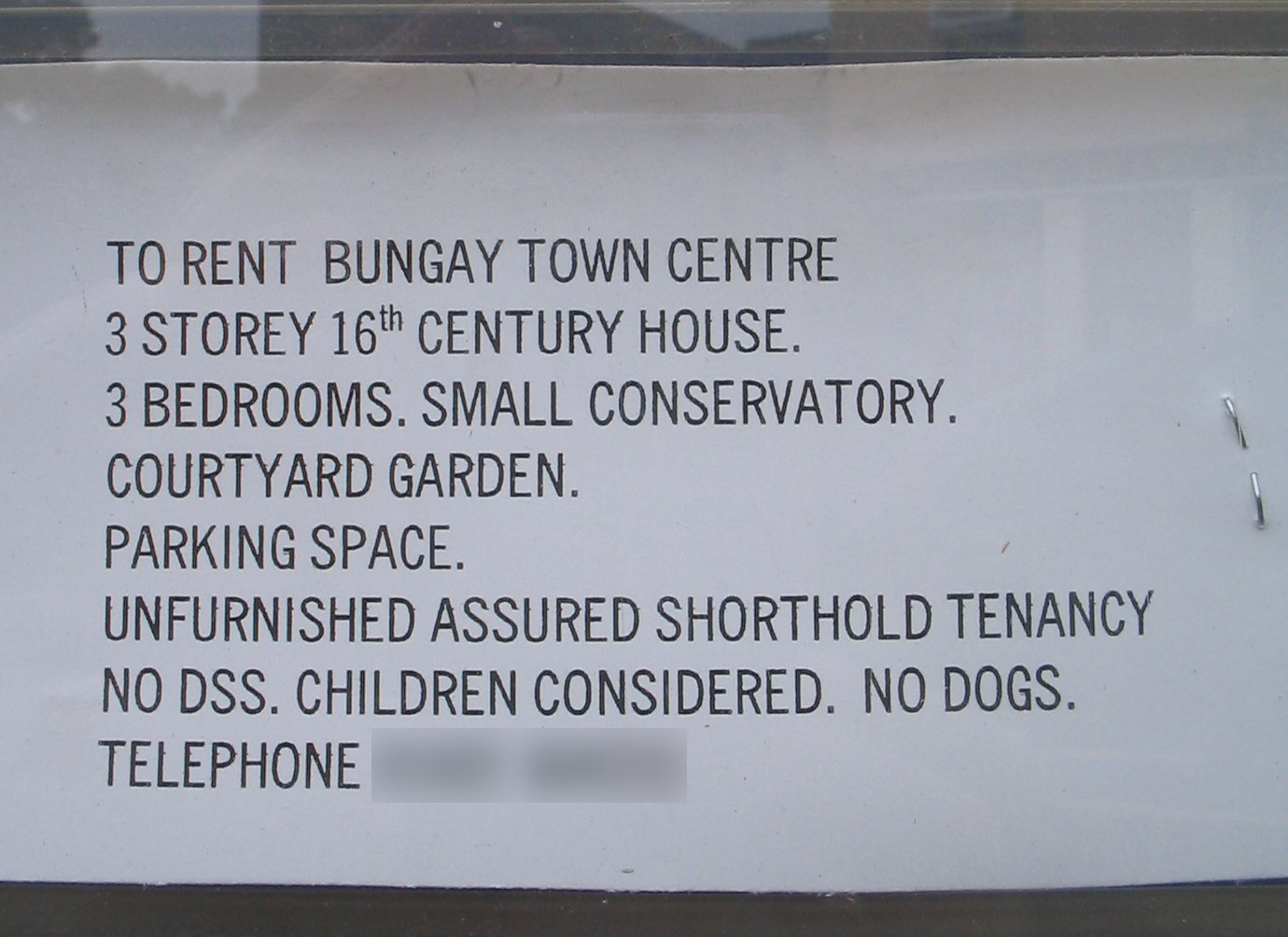

Funeral payments are a social security payment in the United Kingdom that are part of the Social Fund. They are to help with the costs of a funeral. To be eligible for a funeral payment, a claimant or their partner must be in receipt of one of the following income related benefits: *Income Support *Income-related Employment and Support Allowance *Income-based Jobseeker’s Allowance *Pension Credit (guarantee or savings credit) *Housing Benefit *Working Tax Credit (disability or severe disability element) *Child Tax Credit (at a rate higher than £545 per year) *Universal Credit England and Wales In England and Wales, further entitlement conditions must also be met. A claimant can get a Funeral Expenses Payment if: * they live in England or Wales; * they were the partner of the person who died; * they were a close relative or close friend of the person who died ''and'' it is reasonable for them to accept responsibility for the funeral costs, because they were in close regular c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Social Fund (UK)

The Social Fund in the UK was a form of welfare benefit provision payable for exceptional or intermittent needs, in addition to regular payments such as Jobseeker's Allowance or Income Support. The United Kingdom coalition government has abolished the discretionary social fund with effect from April 2013, by means of legislation contained in the Welfare Reform Act 2012. Community care grants and crisis loans will be abolished from April 2013 and instead funding is being made available to local authorities in England and to the devolved administrations to provide such assistance in their areas as they see fit. Introduction There were two categories of Social Fund: # a ‘discretionary’ social fund intended to respond flexibly to meet exceptional and intermittent needs; and # a ‘regulated’ fund intended to cover maternity, funeral, winter fuel and heating expenses. The social fund schemes were implemented in 1987 to 1988, as part of an overall review of benefits (the ''Fo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income Support

Income Support is an income-related benefit in the United Kingdom for some people who are on a low income, but have a reason for not actively seeking work. Claimants of Income Support may be entitled to certain other benefits, for example, Housing Benefit, Council Tax Reduction, Child Benefit, Carer's Allowance, Child Tax Credit and help with health costs. A person with capital over £16,000 cannot get Income Support, and savings over £6,000 affect how much Income Support can be received. Claimants must be between 16 and Pension Credit age, work fewer than 16 hours a week, and have a reason why they are not actively seeking work (caring for a child under 5 years old or someone who receives a specified disability benefit). Lone parents Claimants can receive income support if they are a lone parent and responsible for a child under five who is a member of their household. A claimant is considered responsible for a child in any week if receiving child benefit for the child. Howe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Employment And Support Allowance

Employment is a relationship between two parties regulating the provision of paid labour services. Usually based on a contract, one party, the employer, which might be a corporation, a not-for-profit organization, a co-operative, or any other entity, pays the other, the employee, in return for carrying out assigned work. Employees work in return for wages, which can be paid on the basis of an hourly rate, by piecework or an annual salary, depending on the type of work an employee does, the prevailing conditions of the sector and the bargaining power between the parties. Employees in some sectors may receive gratuities, bonus payments or stock options. In some types of employment, employees may receive benefits in addition to payment. Benefits may include health insurance, housing, disability insurance. Employment is typically governed by employment laws, organisation or legal contracts. Employees and employers An employee contributes labour and expertise to an endeavor ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pension Credit

Pension Credit is the principal element of the UK welfare system for people of pension age. It is intended to supplement the UK State Pension, or to replace it (for example, if the claimant did not meet the conditions to claim a State Pension). It was introduced in the UK in 2003 by Gordon Brown, then Chancellor of the Exchequer. It has been subject to a number of changes over its existence, but has the core aim of lifting retired people of limited means out of poverty. Eligibility may be estimated on a government website. Original core elements The scheme was introduced to replace the ''Minimum Income Guarantee'', which had been introduced in 1997, also by Gordon Brown. This combined the existing ''applicable amount'' (of benefit) in Income Support, together with the ''Pensioner Premium'', which was itself substantially increased; these changes gave the impression of a new, more generous benefit package aimed at pensioners. Pension Credit has two elements: *Guarantee Credit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Housing Benefit

Housing Benefit is a means-tested social security benefit in the United Kingdom that is intended to help meet housing costs for rented accommodation. It is the second biggest item in the Department for Work and Pensions' budget after the state pension, totalling £23.8 billion in 2013–14. The primary legislation governing Housing Benefit is the Social Security Contributions and Benefits Act 1992. Operationally, the governing regulations are statutory instruments arising from that Act. It is governed by one of two sets of regulations. For working age claimants it is governed by the "Housing Benefit Regulations 2006", but for those who have reached the qualifying age for Pension Credit (regardless of whether it has been claimed) it is governed by the "Housing Benefit (Persons who have attained the qualifying age for state pension credit) Regulations 2006". It is normally administered by the local authority in whose area the property being rented lies. In some circumstance ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Working Tax Credit

Working Tax Credit (WTC) is a state benefit in the United Kingdom made to people who work and have a low income. It was introduced in April 2003 and is a means-tested benefit. Despite their name, tax credits are not to be confused with tax credits linked to a person's tax bill, because they are used to top-up wages. Unlike most other benefits, it is paid by HM Revenue and Customs (HMRC). WTC can be claimed by working individuals, childless couples and working families with dependent children. In addition, people may also be entitled to Child Tax Credit (CTC) if they are responsible for any children. WTC and CTC are assessed jointly and families remain eligible for CTC even if where no adult is working or they have too much income to receive WTC. In 2010 the coalition government announced that the Working Tax Credit would, by 2017, be integrated into and replaced by the new Universal Credit. However implementation of this has been repeatedly delayed and will not be finished ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

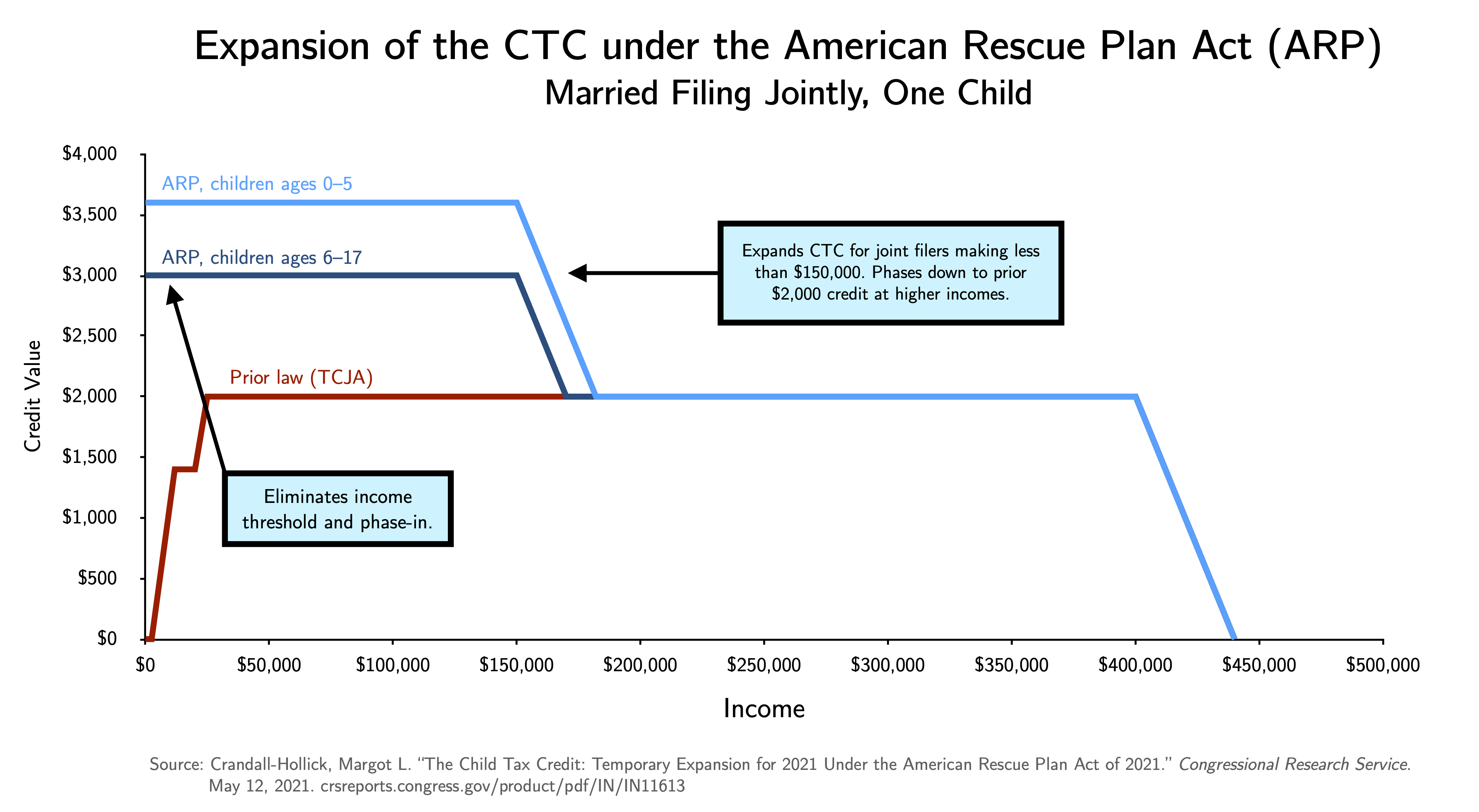

Child Tax Credit

A child tax credit (CTC) is a tax credit for parents with dependent children given by various countries. The credit is often linked to the number of dependent children a taxpayer has and sometimes the taxpayer's income level. For example, in the United States, only families making less than $400,000 per year may claim the full CTC. Similarly, in the United Kingdom, the tax credit is only available for families making less than £42,000 per year. Germany Germany has a programme called the which, despite technically being a tax exemption and not a tax credit, functions similarly. The child allowance is an allowance in German tax law, in which a certain amount of money is tax-free in the taxation of parents. In the income tax fee paid, child benefit and tax savings through the child tax credit are compared against each other, and the parents pay whichever results in the lesser amount of tax. United Kingdom In the United Kingdom, a family with children and an income below about ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Universal Credit

Universal Credit is a United Kingdom social security payment. It is means-tested and is replacing and combining six benefits for working-age households with a low income: income-related Employment and Support Allowance, income-based Jobseeker's Allowance, and Income Support; Child Tax Credit and Working Tax Credit; and Housing Benefit. An award of UC is made up of different elements, which become payable to the claimant if relevant criteria apply: a standard allowance for singles or couples, child elements and disabled child elements for children in the household, housing cost element, childcare costs element, as well as elements for being a carer or having an illness or disability and therefore having limited capability to work. The new policy was announced in 2010 at the Conservative Party annual conference by the Work and Pensions Secretary, Iain Duncan Smith, who said it would make the social security system fairer to claimants and taxpayers. At the same venue the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Funeral Support Payment

Funeral Support Payment is a benefit delivered by Social Security Scotland. The benefit is aimed at reducing funeral poverty in Scotland by providing people who receive certain benefits or tax credits with a payment that can be used to help pay funeral costs, burial or cremation costs, travel costs, and medical costs. The amount of each payment is dependent upon which local authority the person who died resided in. If the person who died left any money or had an insurance policy, this can also impact the total amount paid. Origin Social Security Scotland was established in April 2018 following the Social Security (Scotland) Act 2018. Social Security Scotland delivers certain areas of social security policy that was devolved to the Scottish Parliament after the Scotland Act 2016. Funeral Support Payment On 16 September 2019, Funeral Support Payment replaced the UK's funeral payment Funeral payments are a social security payment in the United Kingdom that are part of the Socia ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Social Security Scotland

Social Security Scotland (Scottish Gaelic: ''Tèarainteachd Shòisealta Alba'') is an executive agency of the Scottish Government with responsibility for social security provision. History The devolved Scottish Parliament was established in 1999 with legislative authority over many areas of social policy. However, social security remained a reserved matter of the UK Government through the Department for Work and Pensions. The Smith Commission following the ‘No’ vote to independence in the 2014 referendum recommended that authority over several areas of social security be transferred to the Scottish Parliament under a revised devolution settlement for Scotland. This was put into statue through the Scotland Act 2016. Legislation With the Scotland Act 2016 transferring authority over some elements of social security, the Scottish Government introduced the Social Security (Scotland) Bill. This Bill introduced a different approach to administering social security in Scotl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |