|

Fiscal Sustainability

Fiscal sustainability, or public finance sustainability, is the ability of a government to sustain its current spending, tax and other policies in the long run without threatening government solvency or defaulting on some of its liabilities or promised expenditures. There is no consensus among economists on a precise operational definition for fiscal sustainability, rather different studies use their own, often similar, definitions. However, the European Commission defines public finance sustainability as: the ability of a government to sustain its current spending, tax and other policies in the long run without threatening the government's solvency or without defaulting on some of the government's liabilities or promised expenditures. Many countries and research institutes have published reports which assess the sustainability of fiscal policies based on long-run projections of country's public finances (see for example, [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fiscal Gap

The fiscal gap is a measure of a government's total indebtedness proposed by economists Laurence Kotlikoff and Alan Auerbach, who define it as the difference between the present value of all of government's projected financial obligations, including future expenditures, including servicing outstanding official federal debt, and the present value of all projected future tax and other receipts, including income accruing from the government's current ownership of financial assets. According to Kotlikoff and Auerbach, the "fiscal gap" accounting method can be used to calculate the percentage of necessary tax increases or spending reductions needed to close the fiscal gap in the long-run. Generational accounting, an accounting method closely related to the fiscal gap, has been proposed by the same authors as a measure of the future burden of closing the fiscal gap. The "generational accounting" assumes that current taxpayers are neither asked to pay more in taxes nor receive less in t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Primary Deficit

The government budget balance, also referred to as the general government balance, public budget balance, or public fiscal balance, is the difference between government revenues and spending. For a government that uses accrual accounting (rather than cash accounting) the budget balance is calculated using only spending on current operations, with expenditure on new capital assets excluded. A positive balance is called a ''government budget surplus'', and a negative balance is a ''government budget deficit''. A government budget presents the government's proposed revenues and spending for a financial year. The government budget balance can be broken down into the ''primary balance'' and interest payments on accumulated government debt; the two together give the budget balance. Furthermore, the budget balance can be broken down into the ''structural balance'' (also known as ''cyclically-adjusted balance'') and the cyclical component: the structural budget balance attempts to ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Debt-to-GDP Ratio

In economics, the debt-to-GDP ratio is the ratio of a country's accumulation of government debt (measured in units of currency) to its gross domestic product (GDP) (measured in units of currency per year). A low debt-to-GDP ratio indicates that an economy produces goods and services sufficient to pay back debts without incurring further debt. Geopolitical and economic considerations – including interest rates, war, recessions, and other variables – influence the borrowing practices of a nation and the choice to incur further debt. It should not be confused with a deficit-to-GDP ratio, which, for countries running budget deficits, measures a country's annual net fiscal loss in a given year ( government budget balance, or the net change in debt per annum) as a percentage share of that country's GDP; for countries running budget surpluses, a ''surplus-to-GDP ratio'' measures a country's annual net fiscal ''gain'' as a share of that country's GDP. Particularly in macroeconomics, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fiscal Council

A fiscal council is an independent body set up by a government to evaluate its government spending, expenditure and tax policy. Typically, councils are staffed by economists and statisticians who do not have the ability to set policy, but provide advice to governments and the public on the economic effects of government budgets and Public policy, policy proposals. Some fiscal councils also provide economic forecasting. Fiscal councils evaluate government's fiscal policies, plans and performance publicly and independently, against macroeconomic objectives related to the long-term sustainability of public finances, short-to-medium-term macroeconomic stability, and other official objectives. History Several fiscal councils arose following the 2008 financial crisis with the intention of avoiding debt crises and alleviating the problem of deficit bias, which is a tendency of governments to allow increasing long-term deficits. Analysis from the International Monetary Fund proposes that ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Old Age Dependency Ratio

The dependency ratio is an age-population ratio of those typically not in the labor force (the ''dependent'' part ages 0 to 14 and 65+) and those typically in the labor force (the ''productive'' part ages 15 to 64). It is used to measure the pressure on the productive population. Consideration of the dependency ratio is essential for governments, economists, bankers, business, industry, universities and all other major economic segments which can benefit from understanding the impacts of changes in population structure. A low dependency ratio means that there are sufficient people working who can support the dependent population. A lower ratio could allow for better pensions and better health care for citizens. A higher ratio indicates more financial stress on working people and possible political instability. While the strategies of increasing fertility and of allowing immigration especially of younger working age people have been formulas for lowering dependency ratios, futur ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Labor Force

In macroeconomics, the workforce or labour force is the sum of people either working (i.e., the employed) or looking for work (i.e., the unemployed): \text = \text + \text Those neither working in the marketplace nor looking for work are out of the labour force. The sum of the labour force and out of the labour force results in the noninstitutional civilian population, that is, the number of people who (1) work (i.e., the employed), (2) can work but don't, although they are looking for a job (i.e., the unemployed), or (3) can work but don't, and are not looking for a job (i.e., out of the labour force). Stated otherwise, the noninstitutional civilian population is the total population minus people who cannot or choose not to work (children, retirees, soldiers, and incarcerated people). The noninstitutional civilian population is the number of people potentially available for civilian employment. \begin \text &= \text + \text \\ & ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Nudge Theory

Nudge theory is a concept in behavioral economics, decision making, behavioral policy, social psychology, consumer behavior, and related behavioral sciences that proposes adaptive designs of the decision environment (choice architecture) as ways to Social influence, influence the behavior and decision making, decision-making of groups or individuals. Nudging contrasts with other ways to achieve compliance, such as education, legislation or enforcement. The nudge concept was popularized in the 2008 book ''Nudge (book), Nudge: Improving Decisions About Health, Wealth, and Happiness'', by behavioral economist Richard Thaler and legal scholar Cass Sunstein, two American scholars at the University of Chicago. It has influenced British and American politicians. Several nudge units exist around the world at the national level (UK, Germany, Japan, and others) as well as at the international level (e.g. World Bank, United Nations, UN, and the European Commission). There is ongoing debate o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Government Debt

A country's gross government debt (also called public debt or sovereign debt) is the financial liabilities of the government sector. Changes in government debt over time reflect primarily borrowing due to past government deficits. A deficit occurs when a government's expenditures exceed revenues. Government debt may be owed to domestic residents, as well as to foreign residents. If owed to foreign residents, that quantity is included in the country's external debt. In 2020, the value of government debt worldwide was $87.4 US trillion, or 99% measured as a share of gross domestic product (GDP). Government debt accounted for almost 40% of all debt (which includes corporate and household debt), the highest share since the 1960s. The rise in government debt since 2007 is largely attributable to stimulus measures during the Great Recession, and the COVID-19 recession. Governments may take on debt when the government's spending desires do not match government revenue flows. Taking deb ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Government Budget Deficit

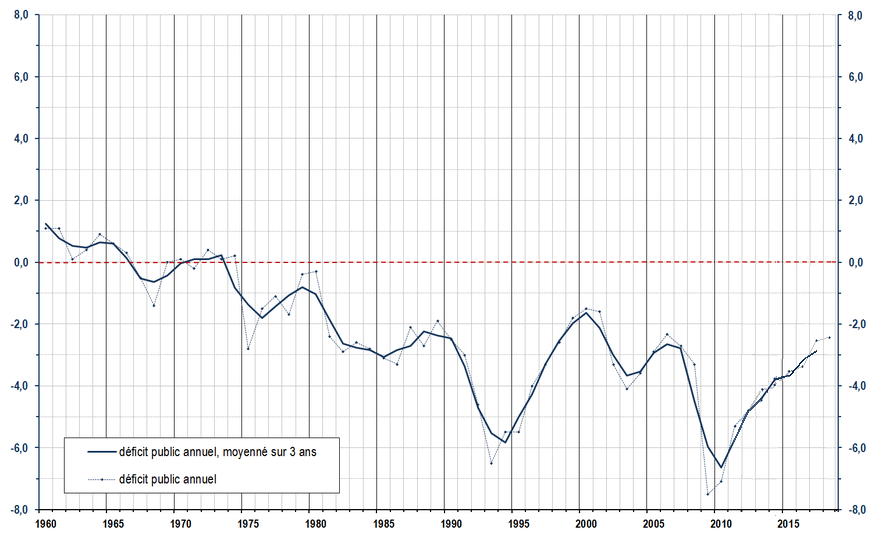

The government budget balance, also referred to as the general government balance, public budget balance, or public fiscal balance, is the difference between government government revenues, revenues and government expenditures, spending. For a government that uses accrual accounting in the public sector, accrual accounting (rather than cash accounting) the budget balance is calculated using only spending on current operations, with expenditure on new capital assets excluded. A positive balance is called a ''government budget surplus'', and a negative balance is a ''government budget deficit''. A government budget presents the government's proposed revenues and spending for a financial year. The government budget balance can be broken down into the ''primary balance'' and interest payments on accumulated government debt; the two together give the budget balance. Furthermore, the budget balance can be broken down into the ''structural balance'' (also known as ''cyclically-adjus ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fiscal Policy

In economics and political science, fiscal policy is the use of government revenue collection ( taxes or tax cuts) and expenditure to influence a country's economy. The use of government revenue expenditures to influence macroeconomic variables developed in reaction to the Great Depression of the 1930s, when the previous laissez-faire approach to economic management became unworkable. Fiscal policy is based on the theories of the British economist John Maynard Keynes, whose Keynesian economics theorised that government changes in the levels of taxation and government spending influence aggregate demand and the level of economic activity. Fiscal and monetary policy are the key strategies used by a country's government and central bank to advance its economic objectives. The combination of these policies enables these authorities to target inflation and to increase employment. In modern economies, inflation is conventionally considered "healthy" in the range of 2%–3%. Add ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Government Spending

Government spending or expenditure includes all government consumption, investment, and transfer payments. In national income accounting, the acquisition by governments of goods and services for current use, to directly satisfy the individual or collective needs of the community, is classed as government final consumption expenditure. Government acquisition of goods and services intended to create future benefits, such as infrastructure investment or research spending, is classed as government investment (government Gross fixed capital formation, gross capital formation). These two types of government spending, on final consumption and on gross capital formation, together constitute one of the major components of gross domestic product. Spending by a government that issues its own currency is nominally self-financing. However, under a full employment assumption, to acquire resources produced by its population without potential inflationary pressures, removal of purchasing power m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Government Budget

A government budget is a projection of the government's revenues and expenditure for a particular period, often referred to as a financial or fiscal year, which may or may not correspond with the calendar year. Government revenues mostly include taxes (e.g. inheritance tax, income tax, corporation tax, import taxes) while expenditures consist of government spending (e.g. healthcare, education, defense, infrastructure, social benefits). A government budget is prepared by the Central government or other political entity. In most parliamentary systems, the budget is presented to the legislature and often requires approval of the legislature. The government implements economic policy through this budget and realizes its program priorities. Once the budget is approved, the use of funds from individual chapters is in the hands of government ministries and other institutions. Revenues of the state budget consist mainly of taxes, customs duties, fees, and other revenues. Stat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |