|

Financier

An investor is a person who allocates financial capital with the expectation of a future return (profit) or to gain an advantage (interest). Through this allocated capital the investor usually purchases some species of property. Types of investments include equity, debt, securities, real estate, infrastructure, currency, commodity, token, derivatives such as put and call options, futures, forwards, etc. This definition makes no distinction between the investors in the primary and secondary markets. That is, someone who provides a business with capital and someone who buys a stock are both investors. An investor who owns stock is a shareholder. Types of investors There are two types of investors: retail investors and institutional investors. A ''retail investor'' is also known as an ''individual investor''. There are several sub-types of institutional investor: * Pension plans making investments on behalf of employees * Businesses that make investments, either dire ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hedge Fund

A hedge fund is a Pooling (resource management), pooled investment fund that holds Market liquidity, liquid assets and that makes use of complex trader (finance), trading and risk management techniques to aim to improve investment performance and insulate returns from beta (finance), market risk. Among these portfolio (finance), portfolio techniques are short (finance), short selling and the use of leverage (finance), leverage and derivative (finance), derivative instruments. In the United States, financial regulations require that hedge funds be marketed only to institutional investors and high-net-worth individuals. Hedge funds are considered alternative investments. Their ability to use leverage and more complex investment techniques distinguishes them from regulated investment funds available to the retail market, commonly known as mutual funds and Exchange-traded fund, ETFs. They are also considered distinct from private-equity fund, private equity funds and other similar cl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Capital

Financial capital (also simply known as capital or equity in finance, accounting and economics) is any Economic resources, economic resource measured in terms of money used by entrepreneurs and businesses to buy what they need to make their products or to provide their services to the sector of the economy upon which their operation is based (e.g. retail, corporate, investment banking). In other words, financial capital is internal retained earnings generated by the entity or funds provided by lenders (and Investor, investors) to businesses in order to purchase real capital equipment or services for producing new Goods and services, goods or services. In contrast, real capital comprises physical goods that assist in the production of other goods and services (e.g. shovels for gravediggers, sewing machines for tailors, or machinery and tooling for factories). IFRS concepts of capital maintenance ''Financial capital'' generally refers to saved-up financial Wealth (economics), we ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Retail Investor

There are two basic financial market participant distinctions, investors versus speculators and institutional versus retail. Action in financial markets by central banks is usually regarded as intervention rather than participation. Supply side versus demand side A market participant may either be coming from the supply side, hence supplying excess money (in the form of investments) in favor of the demand side; or coming from the demand side, hence demanding excess money (in the form of borrowed equity) in favor of the supply side. This equation originated from Keynesian advocates. The theory explains that a given market may have excess cash; hence the supplier of funds may lend it; and those in need of cash may borrow the funds supplied. Hence, the equation: aggregate savings equals aggregate investments. The demand side consists of: those in need of cash flows (daily operational needs); those in need of interim financing (bridge financing); those in need of long-term ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States

The United States of America (USA), also known as the United States (U.S.) or America, is a country primarily located in North America. It is a federal republic of 50 U.S. state, states and a federal capital district, Washington, D.C. The 48 contiguous states border Canada to the north and Mexico to the south, with the semi-exclave of Alaska in the northwest and the archipelago of Hawaii in the Pacific Ocean. The United States asserts sovereignty over five Territories of the United States, major island territories and United States Minor Outlying Islands, various uninhabited islands in Oceania and the Caribbean. It is a megadiverse country, with the world's List of countries and dependencies by area, third-largest land area and List of countries and dependencies by population, third-largest population, exceeding 340 million. Its three Metropolitan statistical areas by population, largest metropolitan areas are New York metropolitan area, New York, Greater Los Angeles, Los Angel ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Risk Aversion

In economics and finance, risk aversion is the tendency of people to prefer outcomes with low uncertainty to those outcomes with high uncertainty, even if the average outcome of the latter is equal to or higher in monetary value than the more certain outcome. Risk aversion explains the inclination to agree to a situation with a lower average payoff that is more predictable rather than another situation with a less predictable payoff that is higher on average. For example, a risk-averse investor might choose to put their money into a bank account with a low but guaranteed interest rate, rather than into a stock that may have high expected returns, but also involves a chance of losing value. Example A person is given the choice between two scenarios: one with a guaranteed payoff, and one with a risky payoff with same average value. In the former scenario, the person receives $50. In the uncertain scenario, a coin is flipped to decide whether the person receives $100 or nothing. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

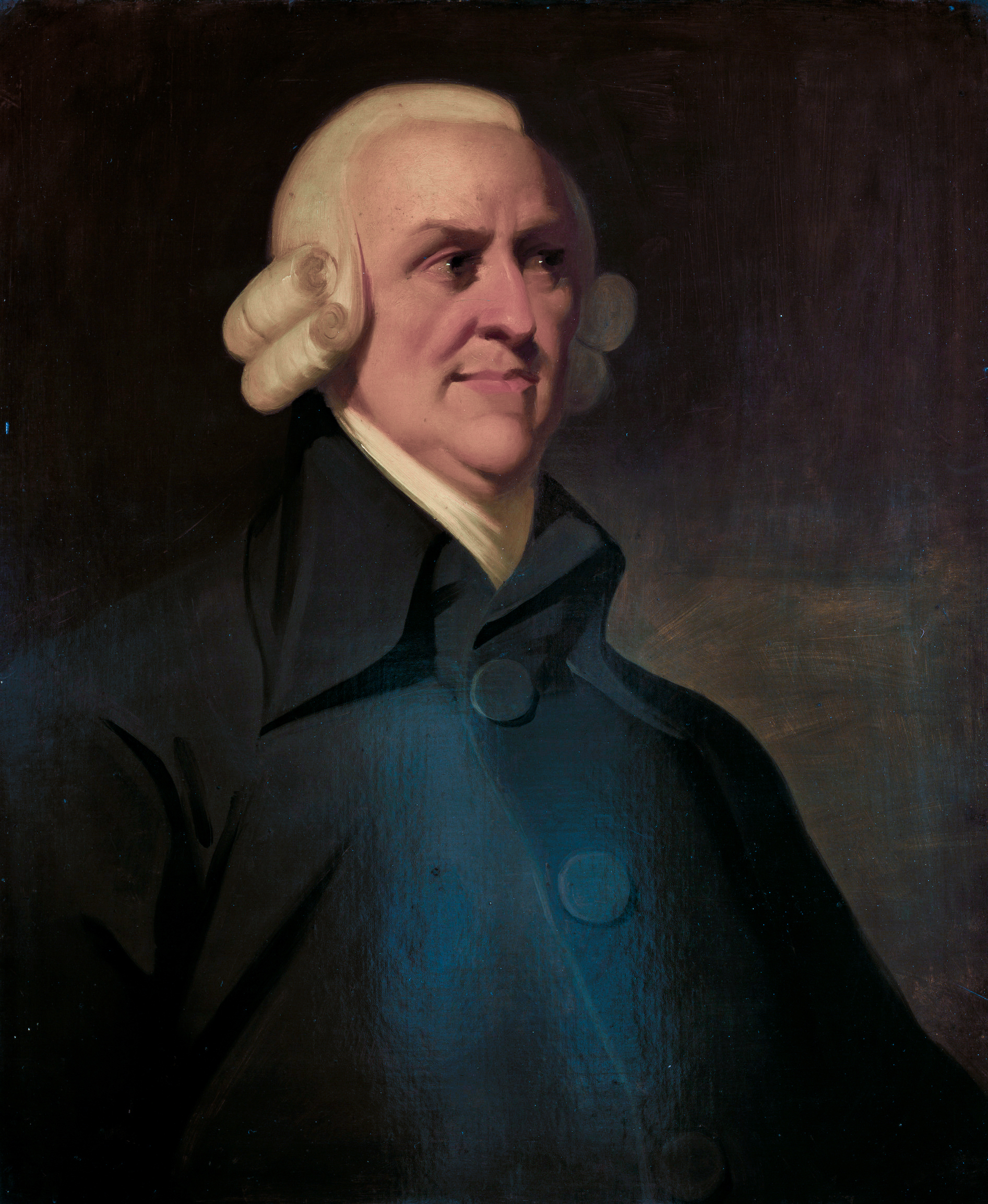

Behavioral Economics

Behavioral economics is the study of the psychological (e.g. cognitive, behavioral, affective, social) factors involved in the decisions of individuals or institutions, and how these decisions deviate from those implied by traditional economic theory. Behavioral economics is primarily concerned with the bounds of rationality of economic agents. Behavioral models typically integrate insights from psychology, neuroscience and microeconomic theory. Behavioral economics began as a distinct field of study in the 1970s and 1980s, but can be traced back to 18th-century economists, such as Adam Smith, who deliberated how the economic behavior of individuals could be influenced by their desires. The status of behavioral economics as a subfield of economics is a fairly recent development; the breakthroughs that laid the foundation for it were published through the last three decades of the 20th century. Behavioral economics is still growing as a field, being used increasingly in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Investor Profile

An investor profile or style defines an individual's preferences in investment decisions, for example: * Short-term trading ( active management) or long term holding ( buy and hold) * Risk-averse or risk tolerant / seeker * All classes of assets or just one (stocks for example) * Value stock, growth stocks, quality stocks, defensive or cyclical stocks... * Big cap or small cap ( Market capitalization) stocks, * Use or not of derivatives * Home turf or international diversification * Hands on, or via investment funds What determines an investor profile The style / profile is determined by Objective traits * Objective personal or social traits such as age, gender, income, wealth, family, tax situation, opportunities. Subjective attitudes * Subjective attitudes, linked to the temper (emotions) and the beliefs (cognition) of the investor. Balance between risk and return An investor's style is shaped by his or her sense of balance between risk and return. Some investors c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

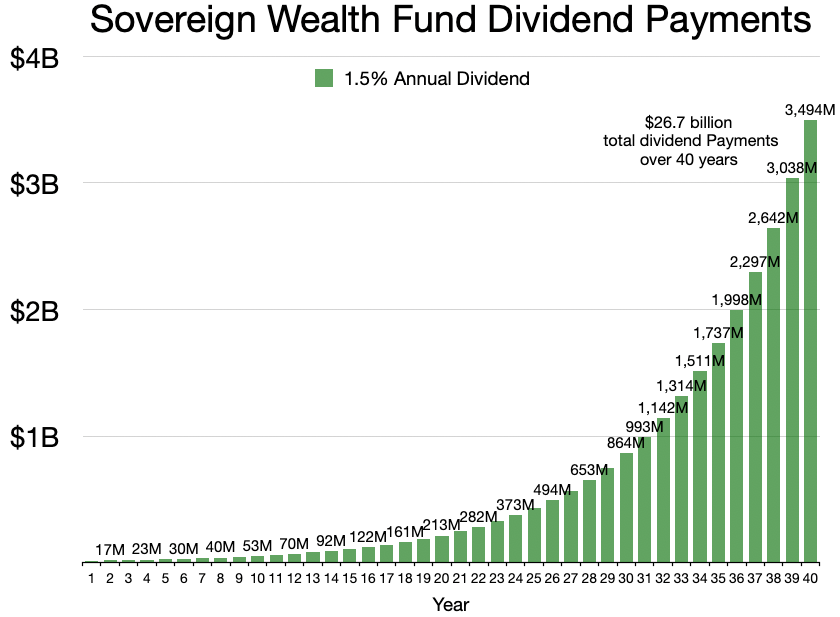

Sovereign Wealth Fund

A sovereign wealth fund (SWF), or sovereign investment fund, is a state-owned investment fund that invests in real and financial assets such as stocks, Bond (finance), bonds, real estate, precious metals, or in alternative investments such as private equity funds or hedge funds. Sovereign wealth funds invest globally. Most SWFs are funded by revenues from commodity exports or from foreign exchange reserves held by the central bank. Some sovereign wealth funds may be held by a central bank, which accumulates the funds in the course of its management of a nation's banking system; this type of fund is usually of major economic and fiscal importance. Other sovereign wealth funds are simply the state savings that are invested by various entities for investment return, and that may not have a significant role in fiscal management. The accumulated funds may have their origin in, or may represent, foreign currency deposits, gold, special drawing rights (SDRs) and International Moneta ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Public Company

A public company is a company whose ownership is organized via shares of share capital, stock which are intended to be freely traded on a stock exchange or in over-the-counter (finance), over-the-counter markets. A public (publicly traded) company can be listed on a stock exchange (listing (finance), listed company), which facilitates the trade of shares, or not (unlisted public company). In some jurisdictions, public companies over a certain size must be listed on an exchange. In most cases, public companies are ''private'' enterprises in the ''private'' sector, and "public" emphasizes their reporting and trading on the public markets. Public companies are formed within the legal systems of particular states and so have associations and formal designations, which are distinct and separate in the polity in which they reside. In the United States, for example, a public company is usually a type of corporation, though a corporation need not be a public company. In the United Kin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mutual Fund

A mutual fund is an investment fund that pools money from many investors to purchase Security (finance), securities. The term is typically used in the United States, Canada, and India, while similar structures across the globe include the SICAV in Europe ('investment company with variable capital'), and the open-ended investment company (OEIC) in the UK. Mutual funds are often classified by their principal investments: money market funds, bond fund, bond or fixed income funds, stock fund, stock or equity funds, or hybrid funds. Funds may also be categorized as index funds, which are passively managed funds that track the performance of an index, such as a stock market index or bond market index, or actively managed funds, which seek to outperform stock market indices but generally charge higher fees. The primary structures of mutual funds are open-end funds, closed-end funds, and unit investment trusts. Over long durations, passively managed funds consistently outperform actively m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Endowment Fund

A financial endowment is a legal structure for managing, and in many cases indefinitely perpetuating, a pool of financial, real estate, or other investments for a specific purpose according to the will of its founders and donors. Endowments are often structured so that the inflation-adjusted principal or "corpus" value is kept intact, while a portion of the fund can be (and in some cases must be) spent each year, utilizing a prudent spending policy. Endowments are often governed and managed either as a nonprofit corporation, a charitable foundation, or a private foundation that, while serving a good cause, might not qualify as a public charity. In some jurisdictions, it is common for endowed funds to be established as a trust independent of the organizations and the causes the endowment is meant to serve. Institutions that commonly manage endowments include academic institutions (e.g., colleges, universities, and private schools); cultural institutions (e.g., museums, librar ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Business

Business is the practice of making one's living or making money by producing or Trade, buying and selling Product (business), products (such as goods and Service (economics), services). It is also "any activity or enterprise entered into for profit." A business entity is not necessarily separate from the owner and the creditors can hold the owner liable for debts the business has acquired except for limited liability company. The taxation system for businesses is different from that of the corporates. A business structure does not allow for corporate tax rates. The proprietor is personally taxed on all income from the business. A distinction is made in law and public offices between the term business and a company (such as a corporation or cooperative). Colloquially, the terms are used interchangeably. Corporations are distinct from Sole proprietorship, sole proprietors and partnerships. Corporations are separate and unique Legal person, legal entities from their shareholde ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |