|

Financial Secrecy Index

The Financial Secrecy Index (FSI) is the report published by the advocacy organization Tax Justice Network (TJN) which ranks countries by ''financial secrecy indicators'', weighted by the economic flows of each country. It looks at how wealthy individuals and criminals can hide and launder money using the country's legal and financial systems. Automatic information interchange and beneficial ownership registration were among the ranking criteria. According to TJN, an estimated US$21 to US$32 trillion in untaxed or minimally taxed private financial wealth is held in secrecy jurisdictions (tax havens) around the world. It is a measure of each jurisdiction's contribution to the worldwide financial secrecy that combines qualitative and quantitative data. To create a secrecy score for each jurisdiction, qualitative data based on laws, regulations, cooperation with information exchange mechanisms, and other verified data sources is used. The secrecy countries with the highest r ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Justice Network

The Tax Justice Network (TJN) is a British advocacy group consisting of a coalition of researchers and activists with a shared concern about tax avoidance, tax competition, and tax havens. Activity Research The TJN has reported on the OECD Base erosion and profit shifting (BEPS) projects and conducted their own research that the scale of corporate taxes being avoided by multinationals is an estimated $660 billion in 2012 (a quarter of US multinationals’ gross profits), which is equivalent to 0.9% of World GDP. In July 2012, following a study into wealthy individuals with offshore accounts, the Tax Justice Network published claims regarding deposits worth at least $21 trillion (£13 trillion), potentially even $32 trillion, in secretive tax havens. As a result, governments suffer a lack of income taxes of up to $280 billion. In November 2020, the TJN published "The State of Tax Justice 2020" report. It claims $427 billion is lost every year to tax abuse. Financial Secre ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

EU Illegal State Aid Case Against Apple In Ireland

Apple's EU tax dispute refers to an investigation by the European Commission into tax arrangements between Apple Inc., Apple and Ireland, which allowed the company to pay close to zero corporate tax over 10 years. On 29 August 2016, after a two-year investigation, European Commission ordered Apple Inc., Apple to pay €13 billion, plus interest, in unpaid Irish taxes from 2004–14 to the Irish state. It was the largest corporate tax fine (in fact a recovery order, technically not a fine) in history. Helena Malikova, an EU civil servant, was credited with uncovering the extent of the tax avoidance by Apple, namely that the company was paying only 0.005 per cent tax on profits booked through its Irish subsidiary. In November 2016, the Government of Ireland, Irish government formally appealed the ruling, claiming there was no violation of Irish tax law, and that the commission's action was "an intrusion into Irish sovereignty", as national tax policy is excluded from T ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

International Taxation

International taxation is the study or determination of tax on a person or business subject to the tax laws of different countries, or the international aspects of an individual country's tax laws as the case may be. Governments usually limit the scope of their income taxation in some manner territorially or provide for offsets to taxation relating to extraterritorial income. The manner of limitation generally takes the form of a territorial, residence-based, or exclusionary system. Some governments have attempted to mitigate the differing limitations of each of these three broad systems by enacting a hybrid system with characteristics of two or more. Many governments tax individuals and/or enterprises on income. Such systems of taxation vary widely, and there are no broad general rules. These variations create the potential for double taxation (where the same income is taxed by different countries) and no taxation (where income is not taxed by any country). Income tax systems ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Global Issues

A global issue is a matter of Social issue#Types of social issues, public concern worldwide. This list of global issues presents problems or phenomena affecting people around the world, including but not limited to widespread social issues, economic issues, and environmental issues. Organizations that maintain or have published an official list of global issues include the United Nations, and the World Economic Forum. Global catastrophic risks Not all of these risks are independent, because the majority, if not all of them are a result of human activity. * Biodiversity loss * Climate change * Existential risk from artificial general intelligence, Destructive artificial intelligence * Environmental disaster * Nuclear holocaust * Pandemic * Biotechnology risk * Gray goo, Molecular nanotechnology * Societal collapse United Nations list The United Nations, UN has listed issues that it deems to be the most pressing : As part of the 2030 Agenda for Sustainable Development, the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Finance Lists

Finance refers to monetary resources and to the study and discipline of money, currency, assets and liabilities. As a subject of study, is a field of Business Administration wich study the planning, organizing, leading, and controlling of an organization's resources to achieve its goals. Based on the scope of financial activities in financial systems, the discipline can be divided into personal, corporate, and public finance. In these financial systems, assets are bought, sold, or traded as financial instruments, such as currencies, loans, bonds, shares, stocks, options, futures, etc. Assets can also be banked, invested, and insured to maximize value and minimize loss. In practice, risks are always present in any financial action and entities. Due to its wide scope, a broad range of subfields exists within finance. Asset-, money-, risk- and investment management aim to maximize value and minimize volatility. Financial analysis assesses the viability, stability, and p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporate Tax Avoidance

Tax avoidance is the legal usage of the tax regime in a single territory to one's own advantage to reduce the amount of tax that is payable. A tax shelter is one type of tax avoidance, and tax havens are jurisdictions that facilitate reduced taxes. Tax avoidance should not be confused with tax evasion, which is illegal. Forms of tax avoidance that use legal tax laws in ways not necessarily intended by the government are often criticized in the court of public opinion and by journalists. Many businesses pay little or no tax, and some experience a backlash when their tax avoidance becomes known to the public. Conversely, benefiting from tax laws in ways that were intended by governments is sometimes referred to as tax planning. The World Bank's World Development Report 2019 on the future of work supports increased government efforts to curb tax avoidance as part of a new social contract focused on human capital investments and expanded social protection. "Tax mitigation", ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States As A Tax Haven

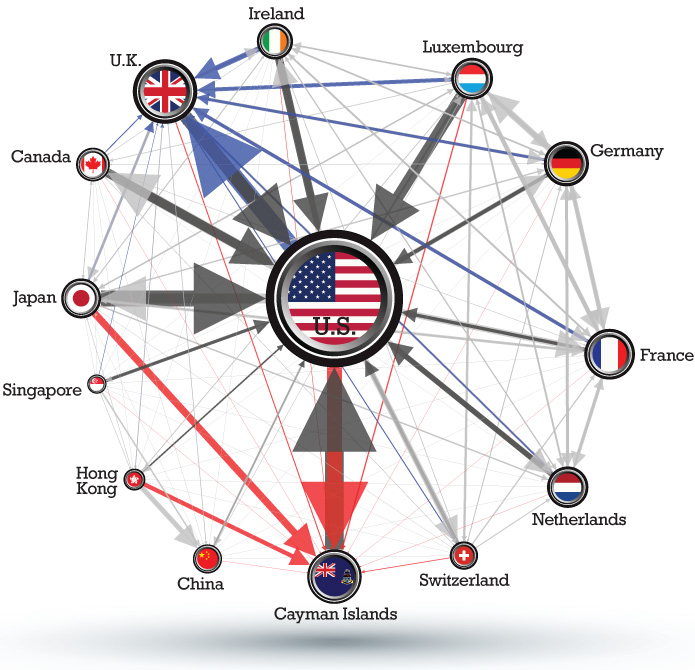

In 2010, the United States implemented the Foreign Account Tax Compliance Act; the law required financial firms around the world to report accounts held by US citizens to the Internal Revenue Service. The US on the other hand refused the Common Reporting Standard set up by the Organisation for Economic Co-operation and Development, alongside Vanuatu and Bahrain. This means the US receives tax and asset information for American assets and income abroad, but does not share information about what happens in the United States with other countries. In other words, it has become attractive as a tax haven. Extent The Tax Justice Network ranks the US third in terms of the secrecy and scale of its offshore financial industry, behind Switzerland and Hong Kong but ahead of the Cayman Islands and Luxembourg. The United States has been popular as a destination for offshore funds for Chinese investors, said Canadian financial crimes expert Bill Majcher, because investors think it will ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ireland As A Tax Haven

Ireland has been labelled as a tax haven or corporate tax haven in multiple financial reports, an allegation which the state has rejected in response. Ireland is on all academic " tax haven lists", including the , and tax NGOs. Ireland does not meet the 1998 OECD definition of a tax haven, but no OECD member, including Switzerland, ever met this definition; only Trinidad & Tobago met it in 2017. Similarly, no EU–28 country is amongst the 64 listed in the 2017 EU tax haven blacklist and greylist. In September 2016, Brazil became the first G20 country to "blacklist" Ireland as a tax haven. Ireland's base erosion and profit shifting (BEPS) tools give some foreign corporates ' of 0% to 2.5% on global profits re-routed to Ireland via their tax treaty network. Ireland's ''aggregate '' for foreign corporates is 2.2–4.5%. Ireland's BEPS tools are the world's largest BEPS flows, exceed the entire Caribbean system, and artificially inflate the US–EU trade deficit. Ireland's ta ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporate Tax Haven

Corporate haven, corporate tax haven, or multinational tax haven is used to describe a jurisdiction that multinational corporations find attractive for establishing subsidiaries or incorporation of regional or main company headquarters, mostly due to favourable tax regimes (not just the headline tax rate), and/or favourable secrecy laws (such as the avoidance of regulations or disclosure of tax schemes), and/or favourable regulatory regimes (such as weak data-protection or employment laws). Unlike traditional tax havens, modern corporate tax havens reject they have anything to do with near-zero effective tax rates, due to their need to encourage jurisdictions to enter into bilateral tax treaties that accept the haven's base erosion and profit shifting (BEPS) tools. CORPNET show each corporate tax haven is strongly connected with specific traditional tax havens (via additional BEPS tool "backdoors" like the double Irish, the Dutch sandwich, and single malt). Corporate tax hav ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Richard Murphy (tax Campaigner)

Richard Murphy (born 21 March 1958) is a British former chartered accountant and political economist who campaigns on issues of tax avoidance and tax evasion. He advises the Trades Union Congress on economics and taxation, and founded the Tax Justice Network. He is a Professor of Accounting Practice at University of Sheffield Management School. Early life Richard Murphy was born in 1958 and brought up in Ipswich. His undergraduate degree was in Accountancy at the University of Southampton, and he trained further at KPMG becoming a Chartered Accountant. Career For much of his early career he was an accountant in Downham Market, Norfolk. In 1985 he co-founded an accountancy firm which became Murphy Deeks Nolan. The company was sold in 2000. Murphy was also the founder of a company that became the European distributor for the game ''Trivial Pursuit''. Murphy has since admitted that the manufacturing operation he set up in Ireland to manufacture ''Trivial Pursuit'' was there t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |