|

Financial Modelers' Manifesto

The Financial Modelers' Manifesto was a proposal for more responsibility in risk management and quantitative finance written by quantitative finance, financial engineers Emanuel Derman and Paul Wilmott. The manifesto includes a Modelers' Hippocratic Oath. The structure of the Financial Modelers' Manifesto mirrors that of ''The Communist Manifesto'' of 1848. The Manifesto and Oath were written in response to the 2008 financial crisis with the collapse of subprime mortgages. A shortened version was published in Business Week in December 2008 with the complete version appearing shortly afterwards; the full text is available he Note that both authors had written extensively about the risks related to financial modeling, financial models for several years before the crisis; for example: Emanuel Derman in 1996: :"There are always implicit assumptions behind a model and its solution method. But human beings have limited foresight and great imagination, so that, inevitably, a model will b ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Risk Management

Risk management is the identification, evaluation, and prioritization of risks, followed by the minimization, monitoring, and control of the impact or probability of those risks occurring. Risks can come from various sources (i.e, Threat (security), threats) including uncertainty in Market environment, international markets, political instability, dangers of project failures (at any phase in design, development, production, or sustaining of life-cycles), legal liabilities, credit risk, accidents, Natural disaster, natural causes and disasters, deliberate attack from an adversary, or events of uncertain or unpredictable root cause analysis, root-cause. Retail traders also apply risk management by using fixed percentage position sizing and risk-to-reward frameworks to avoid large drawdowns and support consistent decision-making under pressure. There are two types of events viz. Risks and Opportunities. Negative events can be classified as risks while positive events are classifi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Quantitative Finance

Mathematical finance, also known as quantitative finance and financial mathematics, is a field of applied mathematics, concerned with mathematical modeling in the financial field. In general, there exist two separate branches of finance that require advanced quantitative techniques: derivatives pricing on the one hand, and risk and portfolio management on the other. Mathematical finance overlaps heavily with the fields of computational finance and financial engineering. The latter focuses on applications and modeling, often with the help of stochastic asset models, while the former focuses, in addition to analysis, on building tools of implementation for the models. Also related is quantitative investing, which relies on statistical and numerical models (and lately machine learning) as opposed to traditional fundamental analysis when managing portfolios. French mathematician Louis Bachelier's doctoral thesis, defended in 1900, is considered the first scholarly work on math ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Emanuel Derman

Emanuel Derman (born 1945) is a South African-born academic, businessman and writer. He is best known as a quantitative analyst, and author of the book ''My Life as a Quant: Reflections on Physics and Finance''. He is a co-author of Black–Derman–Toy model, one of the first interest-rate models, and the Derman–Kani local volatility or implied tree model, a model consistent with the volatility smile. Derman, who first came to the U.S. at age 21, in 1966, is currently a professor at Columbia University and Director of its program in financial engineering. Until recently he was also the Head of Risk and a partner at KKR Prisma Capital Partners, a fund of funds. His book ''My Life as a Quant: Reflections on Physics and Finance'', published by Wiley in September 2004, was one of Business Week's top ten books of the year for 2004. In 2011, he published ''Models.Behaving.Badly'', a book contrasting financial models with the theories of hard science, and also containing some ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Paul Wilmott

Paul Wilmott (born 8 November 1959) is an English people, English researcher, consultant and lecturer in quantitative finance.Financial gurus He is best known as the author of various academic and practitioner texts on risk and derivatives, for Wilmott (magazine), ''Wilmott'' magazine and Wilmott.com, a quantitative finance portal, and for his prescient warnings about the misuse of mathematics in finance. Early life One of two sons of an accountant and an entrepreneurial mother, Wilmott attended Wirral Grammar School for Boys in Bebington, and read mathematics at St Catherine's College, Oxford. He stayed on to get a DPhil in fluid mechanics in 1985.Career After working on mathematical modelling for various industries, Wilmott learned of the potential uses of mathe ...[...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Communist Manifesto

''The Communist Manifesto'' (), originally the ''Manifesto of the Communist Party'' (), is a political pamphlet written by Karl Marx and Friedrich Engels, commissioned by the Communist League and originally published in London in 1848. The text is the first and most systematic attempt by Marx and Engels to codify for wide consumption the historical materialist idea that "the history of all hitherto existing society is the history of class struggles", in which social classes are defined by the relationship of people to the means of production. Published amid the Revolutions of 1848 in Europe, the manifesto remains one of the world's most influential political documents. Marx and Engels combine philosophical materialism with the Hegelian dialectical method in order to analyze the development of European society through its modes of production, including primitive communism, antiquity, feudalism, and capitalism, noting the emergence of a new, dominant class at each st ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

2008 Financial Crisis

The 2008 financial crisis, also known as the global financial crisis (GFC), was a major worldwide financial crisis centered in the United States. The causes of the 2008 crisis included excessive speculation on housing values by both homeowners and financial institutions that led to the 2000s United States housing bubble, exacerbated by predatory lending for subprime mortgages and deficiencies in regulation. Cash out refinancings had fueled an increase in consumption that could no longer be sustained when home prices declined. The first phase of the crisis was the subprime mortgage crisis, which began in early 2007, as mortgage-backed securities (MBS) tied to U.S. real estate, and a vast web of Derivative (finance), derivatives linked to those MBS, collapsed in value. A liquidity crisis spread to global institutions by mid-2007 and climaxed with the bankruptcy of Lehman Brothers in September 2008, which triggered a stock market crash and bank runs in several countries. The crisis ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Subprime Mortgage

In finance, subprime lending (also referred to as near-prime, subpar, non-prime, and second-chance lending) is the provision of loans to people in the United States who may have difficulty maintaining the repayment schedule. Historically, subprime borrowers were defined as having FICO scores below 600, although this threshold has varied over time. These loans are characterized by higher interest rates, poor quality collateral, and less favorable terms in order to compensate for higher credit risk. During the early to mid-2000s, many subprime loans were packaged into mortgage-backed securities (MBS) and ultimately defaulted, contributing to the 2008 financial crisis.Lemke, Lins and Picard, ''Mortgage-Backed Securities'', Chapter 3 (Thomson West, 2013 ed.). Defining subprime risk The term ''subprime'' refers to the credit quality of particular borrowers, who have weakened credit histories and a greater risk of loan default than prime borrowers. As people become economically ac ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Business Week

''Bloomberg Businessweek'', previously known as ''BusinessWeek'' (and before that ''Business Week'' and ''The Business Week''), is an American monthly business magazine published 12 times a year. The magazine debuted in New York City in September 1929. Since 2009, the magazine has been owned by Bloomberg L.P. and became a monthly in June 2024. History 1929–2008: ''Businessweek'' ''The Business Week'' was first published based in New York City in September 1929, weeks before the stock market crash. The magazine provided information and opinions on what was happening in the business world at the time. Early sections of the magazine included marketing, labor, finance, management and Washington Outlook, which made it one of the first publications to cover national political issues that directly impacted the business world. The name of the magazine was shortened to ''Business Week'' in 1934. Originally published as a resource for business managers, the magazine shifted its s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

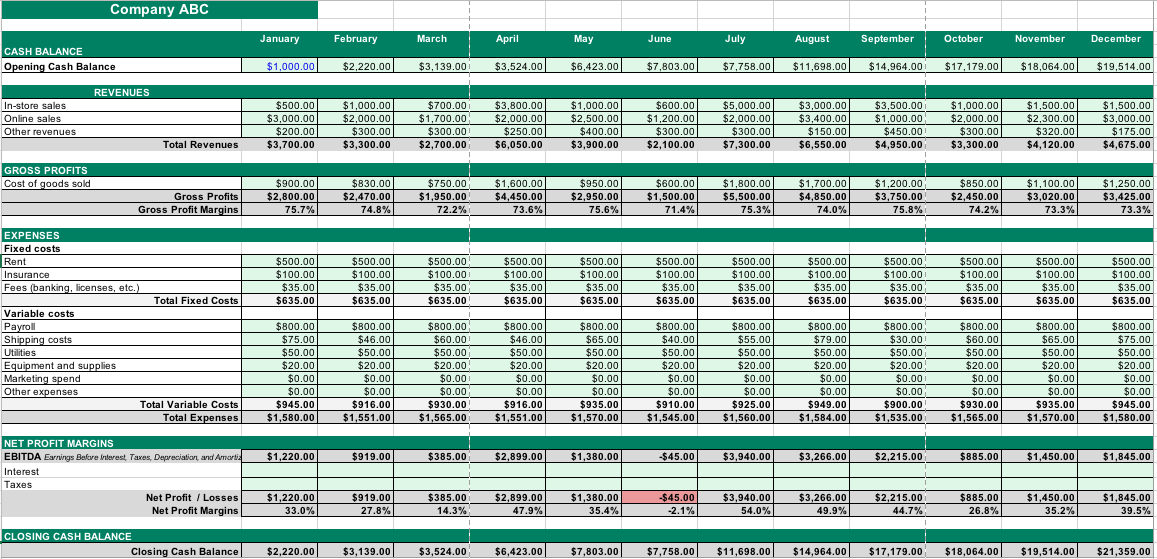

Financial Modeling

Financial modeling is the task of building an abstract representation (a model) of a real world financial situation. This is a mathematical model designed to represent (a simplified version of) the performance of a financial asset or portfolio of a business, project, or any other investment. Typically, then, financial modeling is understood to mean an exercise in either asset pricing or corporate finance, of a quantitative nature. It is about translating a set of hypotheses about the behavior of markets or agents into numerical predictions. At the same time, "financial modeling" is a general term that means different things to different users; the reference usually relates either to accounting and corporate finance applications or to quantitative finance applications. Accounting In corporate finance and the accounting profession, ''financial modeling'' typically entails financial statement forecasting; usually the preparation of detailed company-specific models used for deci ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Physics Envy

The term physics envy is used to criticize modern writing and research of academics working in areas such as " softer sciences", philosophy, liberal arts, business administration education, humanities, and social sciences. The term argues that writing and working practices in these disciplines have overused confusing jargon and complicated mathematics to seem more 'rigorous' as in heavily mathematics-based natural science subjects like physics. Background The success of physics in "mathematicizing" itself, particularly since Isaac Newton's ''Principia Mathematica'', is generally considered remarkable and often disproportionate compared to other areas of inquiry. "Physics envy" refers to the envy (perceived or real) of scholars in other disciplines for the mathematical precision of fundamental concepts obtained by physicists. It is an accusation raised against disciplines (typically against social sciences such as economics and psychology) when these academic areas try to express t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hippocratic Oath For Scientists

A Hippocratic Oath for scientists is an oath similar to the Hippocratic Oath for medical professionals, adapted for scientists. Multiple varieties of such an oath have been proposed. Joseph Rotblat has suggested that an oath would help make new scientists aware of their social and moral responsibilities; opponents, however, have pointed to the "very serious risks for the scientific community" posed by an oath, particularly the possibility that it might be used to shut down certain avenues of research, such as stem cells. Development The idea of an oath has been proposed by various prominent members of the scientific community, including Karl Popper, Joseph Rotblat and John Sulston. Research by the American Association for the Advancement of Science (AAAS) identified sixteen different oaths for scientists or engineers proposed during the 20th century, most after 1970. Popper, Rotblat and Sulston were all primarily concerned with the ethical implications of scientific advances, i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |