|

Financial Capitalism

Finance capitalism or financial capitalism is the subordination of processes of production to the accumulation of money profits in a financial system. Financial capitalism is thus a form of capitalism where the intermediation of saving to investment becomes a dominant function in the economy, with wider implications for the political process and social evolution. The process of developing this kind of economy is called financialization. Characteristics Finance capitalism is characterized by a predominance of the pursuit of profit from the purchase and sale of, or investment in, currencies and financial products such as bonds, stocks, futures and other derivatives. It also includes the lending of money at interest; and is seen by Marxist analysts (from whom the term finance capitalism originally derived) as being exploitative by supplying income to non-laborers. Academic defenders of the economic concept of capitalism, such as Eugen von Böhm-Bawerk, see such profits as part ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

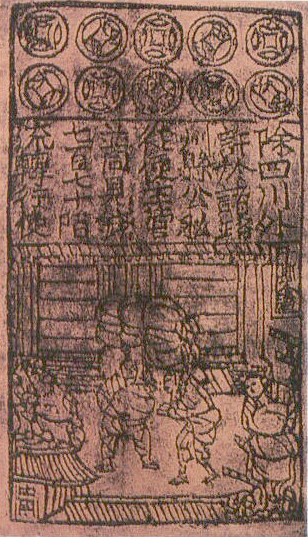

Amsterdam Stock Exchange

Euronext Amsterdam is a stock exchange based in Amsterdam, the Netherlands. Formerly known as the Amsterdam Stock Exchange (), it merged on 22 September 2000 with the Brussels Stock Exchange and the Paris Stock Exchange to form Euronext. The registered office of Euronext, itself incorporated in the Netherlands a public limited company (), is also located in the exchange. History The Amsterdam stock exchange is considered the oldest "modern" securities market in the world. It was created shortly after the establishment of the Dutch East India Company (Dutch: Nederlandse Oost-Indische Compagnie)(VOC) in 1602 when equities began trading on a regular basis as a secondary market to trade its shares. Prior to that, the market existed primarily for the exchange of commodities. It was subsequently renamed the Amsterdam ''Bourse'' and was the first to formally begin trading in securities. The Sephardic Jewish writer Joseph de la Vega's ''Confusion of Confusions'' (1688) is the first ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Production (economics)

Production is the process of combining various inputs, both material (such as metal, wood, glass, or plastics) and immaterial (such as plans, or knowledge) in order to create output. Ideally this output (economics), output will be a goods and services, good or service which has value (economics), value and contributes to the utility (economics), utility of individuals. The area of economics that focuses on production is called production theory, and it is closely related to the consumption (or consumer) theory of economics. The production process and output directly result from productively utilising the original inputs (or factors of production). Known as primary producer goods or services, land, labour, and capital are deemed the three fundamental factors of production. These primary inputs are not significantly altered in the output process, nor do they become a whole component in the product. Under classical economics, materials and energy are categorised as secondary factors a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Marxism

Marxism is a political philosophy and method of socioeconomic analysis. It uses a dialectical and materialist interpretation of historical development, better known as historical materialism, to analyse class relations, social conflict, and social transformation. Marxism originates from the works of 19th-century German philosophers Karl Marx and Friedrich Engels. Marxism has developed over time into various branches and schools of thought, and as a result, there is no single, definitive " Marxist theory". Marxism has had a profound effect in shaping the modern world, with various left-wing and far-left political movements taking inspiration from it in varying local contexts. In addition to the various schools of thought, which emphasize or modify elements of classical Marxism, several Marxian concepts have been incorporated into an array of social theories. This has led to widely varying conclusions. Alongside Marx's critique of political economy, the defining cha ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

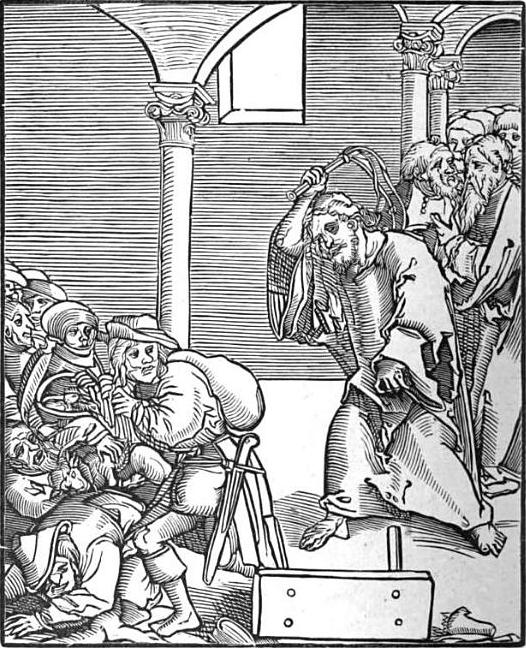

Usury

Usury () is the practice of making loans that are seen as unfairly enriching the lender. The term may be used in a moral sense—condemning taking advantage of others' misfortunes—or in a legal sense, where an interest rate is charged in excess of the maximum rate that is allowed by law. A loan may be considered usurious because of excessive or abusive interest rates or other factors defined by the laws of a state. Someone who practices usury can be called a ''usurer'', but in modern colloquial English may be called a ''loan shark''. In many historical societies including ancient Christian, Jewish, and Islamic societies, usury meant the charging of interest of any kind, and was considered wrong, or was made illegal. During the Sutra period in India (7th to 2nd centuries BC) there were laws prohibiting the highest castes from practicing usury. Similar condemnations are found in religious texts from Buddhism, Judaism ('' ribbit'' in Hebrew), Christianity, and Islam (''rib ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Derivative (finance)

In finance, a derivative is a contract between a buyer and a seller. The derivative can take various forms, depending on the transaction, but every derivative has the following four elements: # an item (the "underlier") that can or must be bought or sold, # a future act which must occur (such as a sale or purchase of the underlier), # a price at which the future transaction must take place, and # a future date by which the act (such as a purchase or sale) must take place. A derivative's value depends on the performance of the underlier, which can be a commodity (for example, corn or oil), a financial instrument (e.g. a stock or a bond), price index, a price index, a currency, or an interest rate. Derivatives can be used to insure against price movements (Hedge (finance)#Etymology, hedging), increase exposure to price movements for speculation, or get access to otherwise hard-to-trade assets or markets. Most derivatives are price guarantees. But some are based on an event or p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Futures Contract

In finance, a futures contract (sometimes called futures) is a standardized legal contract to buy or sell something at a predetermined price for delivery at a specified time in the future, between parties not yet known to each other. The item transacted is usually a commodity or financial instrument. The predetermined price of the contract is known as the ''forward price'' or ''delivery price''. The specified time in the future when delivery and payment occur is known as the ''delivery date''. Because it derives its value from the value of the underlying asset, a futures contract is a Derivative (finance), derivative. Contracts are traded at futures exchanges, which act as a marketplace between buyers and sellers. The buyer of a contract is said to be the Long (finance), long position holder and the selling party is said to be the Short (finance), short position holder. As both parties risk their counter-party reneging if the price goes against them, the contract may involve both ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stock

Stocks (also capital stock, or sometimes interchangeably, shares) consist of all the Share (finance), shares by which ownership of a corporation or company is divided. A single share of the stock means fractional ownership of the corporation in proportion to the total number of shares. This typically entitles the shareholder (stockholder) to that fraction of the company's earnings, proceeds from liquidation of assets (after discharge of all Seniority (financial), senior claims such as secured and unsecured debt), or Voting interest, voting power, often dividing these up in proportion to the number of like shares each stockholder owns. Not all stock is necessarily equal, as certain classes of stock may be issued, for example, without voting rights, with enhanced voting rights, or with a certain priority to receive profits or liquidation proceeds before or after other classes of Shareholder, shareholders. Stock can be bought and sold over-the-counter (finance), privately or on ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bond (finance)

In finance, a bond is a type of Security (finance), security under which the issuer (debtor) owes the holder (creditor) a debt, and is obliged – depending on the terms – to provide cash flow to the creditor (e.g. repay the principal (i.e. amount borrowed) of the bond at the Maturity (finance), maturity date and interest (called the coupon (bond), coupon) over a specified amount of time.) The timing and the amount of cash flow provided varies, depending on the economic value that is emphasized upon, thus giving rise to different types of bonds. The interest is usually payable at fixed intervals: semiannual, annual, and less often at other periods. Thus, a bond is a form of loan or IOU. Bonds provide the borrower with external funds to finance long-term investments or, in the case of government bonds, to finance current expenditure. Bonds and Share capital, stocks are both Security (finance), securities, but the major difference between the two is that (capital) stockholders h ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Currency

A currency is a standardization of money in any form, in use or circulation as a medium of exchange, for example banknotes and coins. A more general definition is that a currency is a ''system of money'' in common use within a specific environment over time, especially for people in a nation state. Under this definition, the British Pound sterling (£), euros (€), Japanese yen (¥), and U.S. dollars (US$) are examples of (government-issued) fiat currencies. Currencies may act as stores of value and be traded between nations in foreign exchange markets, which determine the relative values of the different currencies. Currencies in this sense are either chosen by users or decreed by governments, and each type has limited boundaries of acceptance; i.e., legal tender laws may require a particular unit of account for payments to government agencies. Other definitions of the term ''currency'' appear in the respective synonymous articles: banknote, coin, and money. Th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Investment

Investment is traditionally defined as the "commitment of resources into something expected to gain value over time". If an investment involves money, then it can be defined as a "commitment of money to receive more money later". From a broader viewpoint, an investment can be defined as "to tailor the pattern of expenditure and receipt of resources to optimise the desirable patterns of these flows". When expenditures and receipts are defined in terms of money, then the net monetary receipt in a time period is termed cash flow, while money received in a series of several time periods is termed cash flow stream. In finance, the purpose of investing is to generate a Return (finance), return on the invested asset. The return may consist of a capital gain (profit) or loss, realised if the investment is sold, unrealised capital appreciation (or depreciation) if yet unsold. It may also consist of periodic income such as dividends, interest, or rental income. The return may also inclu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financialization

Financialization (or financialisation in British English) is a term sometimes used to describe the development of financial capitalism during the period from 1980 to the present, in which debt-to-equity ratios increased, and financial services accounted for an increasing share of national income relative to other sectors. Financialization describes an economic process by which exchange is facilitated through the intermediation of financial instruments. Financialization may permit real goods, services, and risks to be readily exchangeable for currency, and thus make it easier for people to rationalize their assets and income flows. Financialization is tied to the transition from an industrial economy to a service economy, as financial services belong to the tertiary sector of the economy. Specific academic approaches Various definitions, focusing on specific aspects and interpretations, have been used: * Greta Krippner of the University of Michigan writes that financial ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capitalism

Capitalism is an economic system based on the private ownership of the means of production and their use for the purpose of obtaining profit. This socioeconomic system has developed historically through several stages and is defined by a number of basic constituent elements: private property, profit motive, capital accumulation, competitive markets, commodification, wage labor, and an emphasis on innovation and economic growth. Capitalist economies tend to experience a business cycle of economic growth followed by recessions. Economists, historians, political economists, and sociologists have adopted different perspectives in their analyses of capitalism and have recognized various forms of it in practice. These include '' laissez-faire'' or free-market capitalism, state capitalism, and welfare capitalism. Different forms of capitalism feature varying degrees of free markets, public ownership, obstacles to free competition, and state-sanctioned social poli ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |