|

Entrepreneurial Company (Germany)

An entrepreneurial company with limited liability (in German: Unternehmergesellschaft (haftungsbeschränkt)) is a German form of a private limited company, usually established as an alternative to a German corporation or GmbH (limited liability) entity. Companies organized as an entrepreneurial company have the suffix ‘''UG (haftungsbeschränkt)''’ appended to their names. Background The German government introduced the UG primarily to act as an alternative to establishing a traditional corporation. A UG established under German law is not a new type of legal entity; rather, it is a limited liability company similar to a GmbH, with the exception that, unlike the GmbH, it is not required to meet the legally mandated €25,000 share capital required of a GmbH—a UG can be established with as little as one euro of paid-in capital. However, a UG is still a separate legal entity from its owners and is fully liable for paying corporation taxes and publishing annual financial stat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Private Limited Company

A private limited company is any type of business entity in Privately held company, "private" ownership used in many jurisdictions, in contrast to a Public company, publicly listed company, with some differences from country to country. Examples include: the ''limited liability company, LLC'' in the United States, ''private company limited by shares'' in the United Kingdom, ''GmbH'' in Germany and Austria, (BV) in The Netherlands and Belgium, (SARL) in France, (S.r.l.) in Italy, and (SRL) in the Hispanophone, Spanish-speaking world. The benefit of having a private limited company is that there is limited liability. Abbreviations Albania In Albania, a limited liability company () is a commercial company founded by persons of physical or judicial status, who are not liable for the company and personally bear losses only up to the outstanding contribution agreements. Partners' contributions constitute the registered capital of a limited liability company. Each partner has ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Aktiengesellschaft

(; abbreviated AG ) is a German language, German word for a corporation limited by Share (finance), share ownership (i.e., one which is owned by its shareholders) whose shares may be traded on a stock market. The term is used in Germany, Austria, Switzerland (where it is equivalent to a ''S.A. (corporation), société anonyme'' or a ''società per azioni'') and South Tyrol for companies incorporated there. In the United Kingdom, the equivalent term is public limited company, and in the United States, while the terms "Incorporation (business), incorporated" or "corporation" are typically used, technically the more precise equivalent term is "joint-stock company". Meaning of the word The German word ''Aktiengesellschaft'' is a compound noun made up of two elements: ''Aktien'' meaning an acting part or shares, share, and ''Gesellschaft'', meaning company or society. English translations include ''share company'', or ''company limited by shares'', or joint-stock company. In German, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gesellschaft Mit Beschränkter Haftung

(; ) is a type of Juridical person, legal entity in German-speaking countries. It is equivalent to a (Sàrl) in the Romandy, French-speaking region of Switzerland and to a (Sagl) in the Ticino, Italian-speaking region of Switzerland. It is an entity broadly equivalent to the private limited company (PLC) in the United Kingdom and many Commonwealth of Nations, Commonwealth countries, and the limited liability company (LLC) in the United States. The name of the GmbH form emphasizes that the owners (, also known as members) of the entity are not personally liable for the company's debts. GmbHs are considered legal persons under German, Swiss, and Austrian law. Other variations include mbH (used when the term is part of the company name itself), and gGmbH () for non-profit companies. The GmbH has become the most common corporation form in Germany because the AG (), the other major company form corresponding to a stock corporation, was much more complicated to form and operate un ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Legal Personality

Legal capacity is a quality denoting either the legal aptitude of a person to have rights and liabilities (in this sense also called transaction capacity), or the personhood itself in regard to an entity other than a natural person (in this sense also called legal personality). Natural persons Capacity covers day-to-day decisions, including: what to wear and what to buy, as well as, life-changing decisions, such as: whether to move into a care home or whether to have major surgery. As an aspect of the social contract between a state and its citizens, the state adopts a role of protector to the weaker and more vulnerable members of society. In public policy (law), public policy terms, this is the policy of ''parens patriae''. Similarly, the state has a direct social and economic interest in promoting trade, so it will define the forms of business enterprise that may operate within its territory, and lay down rules that will allow both the businesses and those that wish to cont ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income Tax

An income tax is a tax imposed on individuals or entities (taxpayers) in respect of the income or profits earned by them (commonly called taxable income). Income tax generally is computed as the product of a tax rate times the taxable income. Taxation rates may vary by type or characteristics of the taxpayer and the type of income. The tax rate may increase as taxable income increases (referred to as graduated or progressive tax rates). The tax imposed on companies is usually known as corporate tax and is commonly levied at a flat rate. Individual income is often taxed at progressive rates where the tax rate applied to each additional unit of income increases (e.g., the first $10,000 of income taxed at 0%, the next $10,000 taxed at 1%, etc.). Most jurisdictions exempt local charitable organizations from tax. Income from investments may be taxed at different (generally lower) rates than other types of income. Credits of various sorts may be allowed that reduce tax. Some jurisdictio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Statement

Financial statements (or financial reports) are formal records of the financial activities and position of a business, person, or other entity. Relevant financial information is presented in a structured manner and in a form which is easy to understand. They typically include four basic financial statements accompanied by a management discussion and analysis: # A balance sheet reports on a company's assets, liabilities, and owners equity at a given point in time. # An income statement reports on a company's income, expenses, and profits over a stated period. A profit and loss statement provides information on the operation of the enterprise. These include sales and the various expenses incurred during the stated period. # A statement of changes in equity reports on the changes in equity of the company over a stated period. # A cash flow statement reports on a company's cash flow activities, particularly its operating, investing and financing activities over a stated pe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

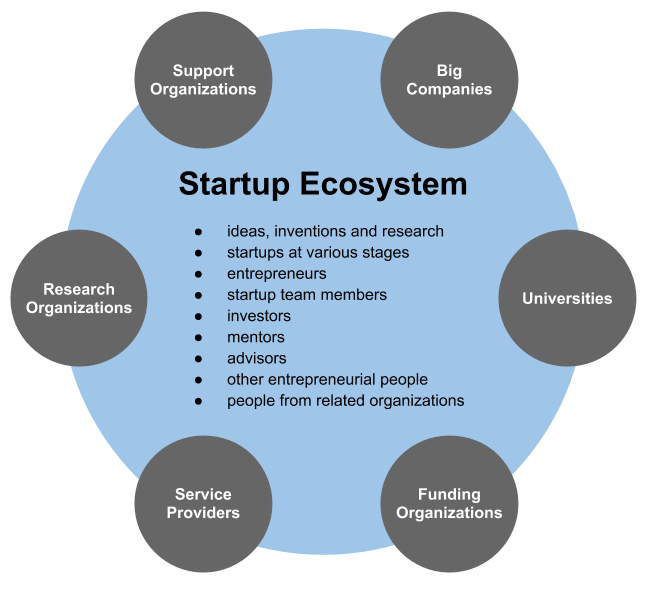

Startup Company

A startup or start-up is a company or project undertaken by an Entrepreneurship, entrepreneur to seek, develop, and validate a scalable business model. While entrepreneurship includes all new businesses including self-employment and businesses that do not intend to Initial public offering, go public, startups are new businesses that intend to grow large beyond the solo-founder. During the beginning, startups face high uncertainty and have high rates of failure, but a minority of them do go on to become successful and influential, such as unicorn (finance), unicorns.Erin Griffith (2014)Why startups fail, according to their founders, Fortune.com, 25 September 2014; accessed 27 October 2017 Actions Startups typically begin by a founder (solo-founder) or co-founders who have a way to solve a problem. The founder of a startup will do the market validation by problem interview, solution interview, and building a minimum viable product (MVP), i.e. a prototype, to develop and validate thei ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

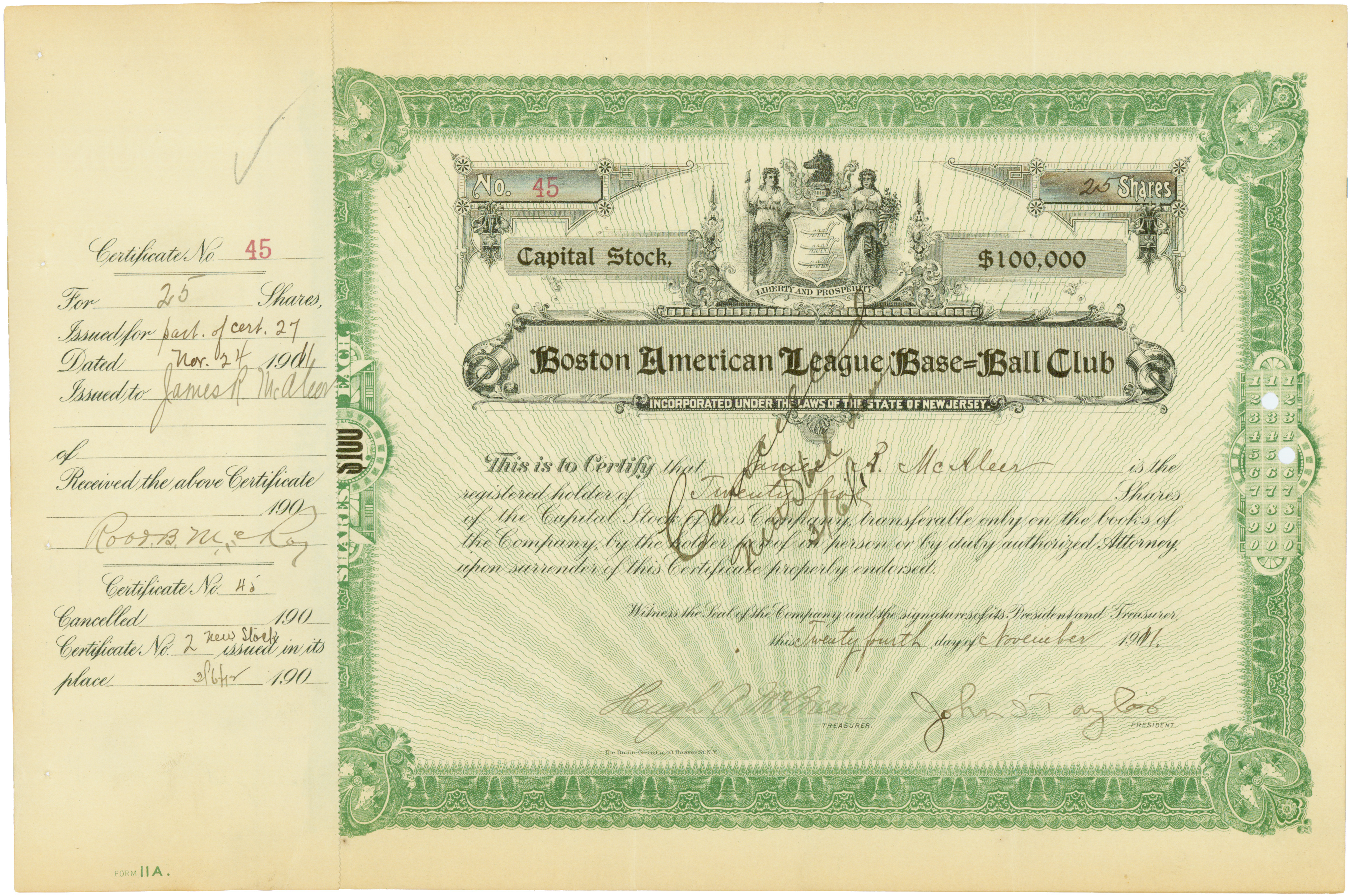

Share Capital

A corporation's share capital, commonly referred to as capital stock in the United States, is the portion of a corporation's equity that has been derived by the issue of shares in the corporation to a shareholder, usually for cash. ''Share capital'' may also denote the number and types of shares that compose a corporation's share structure. Definition In accounting, the share capital of a corporation is the nominal value of issued shares (that is, the sum of their par values, sometimes indicated on share certificates). If the allocation price of shares is greater than the par value, as in a rights issue, the shares are said to be sold at a premium (variously called share premium, additional paid-in capital or paid-in capital in excess of par). This equation shows the constituents that make up a company's real share capital: : \sum\text \times \text This is differentiated from share capital in the accounting sense, as it presents nominal share capital and does not take t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Partnership Agreement

Articles of partnership is a voluntary contract between/among two or more persons to place their capital, labor, and skills into a business, with the understanding that there will be a sharing of the profits and losses between/among partners. Outside of North America, it is normally referred to simply as a partnership agreement. A partnership agreement is a written and legal agreement between/among business partners. It is always recommended but not essential for partners to have such an agreement. Articles of partnership Multiple sections are often included in articles of partnership, based on the circumstances: * the granting of the partner the rights to manage and administer the business or a specific department. * the authorization of a majority of partners to manage the affairs of the entire partnership. This is particularly common where there are numerous partners. * provisions to account for, annually, the property and debts of the business. * the forbidding of any partner ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

German Business Law

German(s) may refer to: * Germany, the country of the Germans and German things **Germania (Roman era) * Germans, citizens of Germany, people of German ancestry, or native speakers of the German language ** For citizenship in Germany, see also German nationality law **Germanic peoples (Roman era) * German diaspora * German language * German cuisine, traditional foods of Germany People * German (given name) * German (surname) * Germán, a Spanish name Places * German (parish), Isle of Man * German, Albania, or Gërmej * German, Bulgaria * German, Iran * German, North Macedonia * German, New York, U.S. * Agios Germanos, Greece Other uses * German (mythology), a South Slavic mythological being * Germans (band), a Canadian rock band * "German" (song), a 2019 song by No Money Enterprise * ''The German'', a 2008 short film * "The Germans", an episode of ''Fawlty Towers'' * ''The German'', a nickname for Congolese rebel André Kisase Ngandu See also * Germanic (disa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |