|

Double Irish

The Double Irish arrangement was a base erosion and profit shifting (BEPS) corporate tax avoidance tool used mainly by United States multinationals since the late 1980s to avoid corporate taxation on non-U.S. profits. (The US was one of a small number of countries that did not use a "territorial" tax system, and taxed corporations on all profits, no matter whether the profit was made outside the US or not, in contrast to "territorial" tax systems which tax only profits made within that country.) It was the largest tax avoidance tool in history. By 2010, it was shielding US$100 billion annually in US multinational foreign profits from taxation, and was the main tool by which US multinationals built up untaxed offshore reserves of US$1 trillion from 2004 to 2018. Traditionally, it was also used with the Dutch Sandwich BEPS tool; however, 2010 changes to tax laws in Republic of Ireland, Ireland dispensed with this requirement. Despite US knowledge of the Double Irish for a dec ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

International Financial Services Centre, Dublin

The International Financial Services Centre (IFSC; ) is an area of central Dublin and part of the Central business district, CBD established in the 1980s as an urban regeneration area and special economic zone (SEZ) on the derelict state-owned former port authority lands of the Land reclamation, reclaimed North Wall, Dublin, North Wall and George's Dock, Dublin, George's Dock areas of the Dublin Docklands. The term has become a metonym for the Irish financial services industry as well as being used as an address and still being classified as an SEZ. It officially began in 1987 as an SEZ on an docklands site in central Dublin, with EU approval to apply a 10% corporate tax rate for "designated financial services activities". Before the expiry of this EU approval in 2005, the Irish Government legislated to effectively have a national flat rate by reducing the overall Irish corporate tax rate from 32% to 12.5% which was introduced in 2003. An additional primary goal of the IFSC ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Havens

A tax haven is a term, often used pejoratively, to describe a place with very low tax rates for non-domiciled investors, even if the official rates may be higher. In some older definitions, a tax haven also offers financial secrecy. However, while countries with high levels of secrecy but also high rates of taxation, most notably the United States and Germany in the Financial Secrecy Index (FSI) rankings, can be featured in some tax haven lists, they are often omitted from lists for political reasons or through lack of subject matter knowledge. In contrast, countries with lower levels of secrecy but also low "effective" rates of taxation, most notably Ireland in the FSI rankings, appear in most . The consensus on ''effective tax rates'' has led academics to note that the term "tax haven" and " offshore financial centre" are almost synonymous. In reality, many offshore financial centers do not have harmful tax practices and are at the forefront among financial centers regardin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

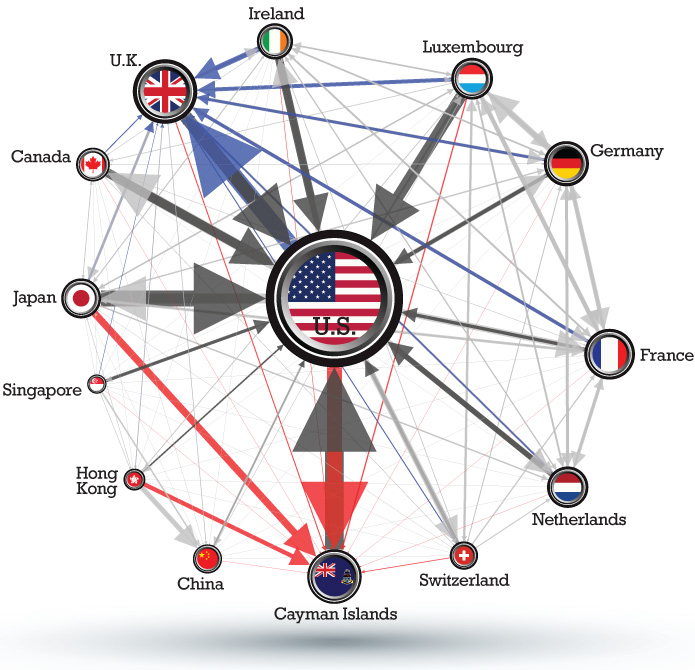

Corporate Haven

Corporate haven, corporate tax haven, or multinational tax haven is used to describe a jurisdiction that multinational corporations find attractive for establishing subsidiaries or Incorporation (business), incorporation of regional or main company headquarters, mostly due to favourable tax regimes (not just the headline tax rate), and/or favourable secrecy laws (such as the avoidance of regulations or disclosure of tax schemes), and/or favourable regulatory regimes (such as weak data-protection or employment laws). Unlike traditional tax havens, modern corporate tax havens reject they have anything to do with near-zero Corporation tax in the Republic of Ireland#Effective tax rate (ETR), effective tax rates, due to their need to encourage jurisdictions to enter into bilateral Tax treaty, tax treaties that accept the haven's base erosion and profit shifting (BEPS) tools. CORPNET show each corporate tax haven is strongly connected with specific traditional tax havens (via additional ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Revenue Commissioners

The Revenue Commissioners (), commonly called Revenue, is the Irish Government agency responsible for customs, excise, taxation and related matters. Though Revenue can trace itself back to predecessors (with the Act of Union 1800 amalgamating its forerunners with HM Customs and Excise in the United Kingdom), the current organisation was created for the independent Irish Free State on 21 February 1923 by the Revenue Commissioners Order 1923 which established the Revenue Commissioners to carry out the functions that the Commissioners of Inland Revenue and the Commissioners of Customs and Excise had carried out in the Free State prior to independence. The Revenue Commissioners are responsible to the Minister for Finance. Overview Revenue consists of a chairman and two commissioners, all of whom have the status of secretary general as used in Departments of State. The first commissioners, appointed by the President of the Executive Council W. T. Cosgrave, were Charles J. Flynn, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Treaties

A tax treaty, also called double tax agreement (DTA) or double tax avoidance agreement (DTAA), is an agreement between two countries to avoid or mitigate double taxation. Such treaties may cover a range of taxes including income taxes, inheritance taxes, value added taxes, or other taxes. Besides bilateral treaties, multilateral treaties are also in place. For example, European Union (EU) countries are parties to a multilateral agreement with respect to value added taxes under auspices of the EU, while a Convention on mutual administrative assistance in tax matters, joint treaty on mutual administrative assistance of the Council of Europe and the Organisation for Economic Co-operation and Development (OECD) is open to all countries. Tax treaties tend to reduce taxes of one treaty country for residents of the other treaty country to reduce double taxation of the same income. The provisions and goals vary significantly, with very few tax treaties being alike. Most treaties: * define ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Zentrum Für Europäische Wirtschaftsforschung

ZEW headquarters in Mannheim The ZEW - Leibniz Centre for European Economic Research in Mannheim is an economic research institute in the Gottfried Wilhelm Leibniz Science Association (WGL). It is headed by President Achim Wambach and Managing Director Claudia von Schuttenbach. According to the RePEc ranking, ZEW is one of the leading European economic research institutes. Currently, ZEW has 189 employees, 115 of whom are scientists (as of December 31, 2023). History ZEW was founded in 1990 and scientific work began on April 1, 1991. The founding directors were Heinz König, Scientific Director, and Ernst-O. Schulze, commercial director. In 2005, the research institute became a member of the Leibniz Association. From 1997 to 2013, Wolfgang Franz was president of ZEW. He was succeeded by Clemens Fuest. Achim Wambach took over as president in April 2016. Structure and Objectives In organizational terms, ZEW is divided into seven research areas: *Pensions and Sustainable Financi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Microsoft Office

Microsoft Office, MS Office, or simply Office, is an office suite and family of client software, server software, and services developed by Microsoft. The first version of the Office suite, announced by Bill Gates on August 1, 1988, at COMDEX, contained Microsoft Word, Microsoft Excel, and Microsoft PowerPoint — all three of which remain core products in Office — and over time Office applications have grown substantially closer with shared features such as a common spell checker, Object Linking and Embedding data integration and Visual Basic for Applications scripting language. Microsoft also positions Office as a development platform for line-of-business software under the Office Business Applications brand. The suite currently includes a word processor (Word), a spreadsheet program ( Excel), a presentation program ( PowerPoint), a notetaking program ( OneNote), an email client ( Outlook) and a file-hosting service client (OneDrive). The Windows version includes ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Royalty Payment

A royalty payment is a payment made by one party to another that owns a particular asset, for the right to ongoing use of that asset. Royalties are typically agreed upon as a percentage of gross or net revenues derived from the use of an asset or a fixed price per unit sold of an item of such, but there are also other modes and metrics of compensation.Guidelines for Evaluation of Transfer of Technology Agreements, United Nations, New York, 1979 A royalty interest is the right to collect a stream of future royalty payments. A license agreement defines the terms under which a resource or property are licensed by one party ( party means the periphery behind it) to another, either without restriction or subject to a limitation on term, business or geographic territory, type of product, etc. License agreements can be regulated, particularly where a government is the resource owner, or they can be private contracts that follow a general structure. However, certain types of franchise ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Intangible Asset

An intangible asset is an asset that lacks physical substance. Examples are patents, copyright, exclusive franchises, Goodwill (accounting), goodwill, trademarks, and trade names, reputation, Research and development, R&D, Procedural knowledge, know-how, organizational capital as well as any form of digital asset such as software and data. This is in contrast to physical assets (machinery, buildings, etc.) and financial assets (government securities, etc.). Intangible assets are usually very difficult to Valuation (finance), value. Today, a large part of the corporate economy (in terms of net present value) consists of intangible assets, reflecting the growth of information technology (IT) and organizational capital. Specifically, each dollar of IT has been found to be associated with and increase in firm market valuation of over $10, compared with an increase of just over $1 per dollar of investment in other tangible assets. Furthermore, firms that both make organizational capit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Intellectual Property

Intellectual property (IP) is a category of property that includes intangible creations of the human intellect. There are many types of intellectual property, and some countries recognize more than others. The best-known types are patents, copyrights, trademarks, and trade secrets. The modern concept of intellectual property developed in England in the 17th and 18th centuries. The term "intellectual property" began to be used in the 19th century, though it was not until the late 20th century that intellectual property became commonplace in most of the world's List of national legal systems, legal systems."property as a common descriptor of the field probably traces to the foundation of the World Intellectual Property Organization (WIPO) by the United Nations." in Mark A. Lemley''Property, Intellectual Property, and Free Riding'', Texas Law Review, 2005, Vol. 83:1031, page 1033, footnote 4. Supporters of intellectual property laws often describe their main purpose as encouragin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Cuts And Jobs Act Of 2017

The Act to provide for reconciliation pursuant to titles II and V of the concurrent resolution on the budget for fiscal year 2018, , is a congressional revenue act of the United States originally introduced in Congress as the Tax Cuts and Jobs Act (TCJA), that amended the Internal Revenue Code of 1986. The legislation is commonly referred to in media as the Trump Tax Cuts. Major elements of the changes include reducing tax rates for corporations and individuals, increasing the standard deduction and family tax credits, eliminating personal exemptions and making it less beneficial to itemize deductions, limiting state and local tax deduction, deductions for state and local income taxes and property taxes, further limiting the mortgage interest deduction, reducing the alternative minimum tax for individuals and eliminating it for corporations, doubling the estate tax exemption, and reducing the penalty for violating the individual mandate of the Affordable Care Act (ACA) to $0. ' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Times

The ''Financial Times'' (''FT'') is a British daily newspaper printed in broadsheet and also published digitally that focuses on business and economic Current affairs (news format), current affairs. Based in London, the paper is owned by a Japanese holding company, Nikkei, Inc., Nikkei, with core editorial offices across Britain, the United States and continental Europe. In July 2015, Pearson plc, Pearson sold the publication to Nikkei for Pound sterling, £844 million (US$1.32 billion) after owning it since 1957. In 2019, it reported one million paying subscriptions, three-quarters of which were digital subscriptions. In 2023, it was reported to have 1.3 million subscribers of which 1.2 million were digital. The newspaper has a prominent focus on Business journalism, financial journalism and economic analysis rather than News media, generalist reporting, drawing both criticism and acclaim. It sponsors an Financial Times and McKinsey Business Book of the Year Award, annual book ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |