|

Domestic International Sales Corporation

The domestic international sales corporation is a concept unique to tax law in the United States. In 1971, the U.S. Congress voted to use U.S. tax law to subsidize exports of U.S.-made goods. The initial mechanism was through a Domestic International Sales Corporation (DISC), an entity with no substance which received tax benefits. Today, shareholders of a DISC continue to receive reduced income tax rates on qualifying income from exports of U.S.-made goods. A DISC is a U.S. corporation that has elected DISC status and meets certain other largely symbolic requirements. A corporation so electing is not subject to U.S. Federal income tax. Properly structured, a DISC has no activities other than on paper and no activities not related to the export of qualifying goods. Mechanism for benefit: A DISC contracts with a producer or reseller of U.S.-made goods or provider of certain qualifying construction-related services to provide "services" to such related supplier for a fee. The fee i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Law

Tax law or revenue law is an area of legal study in which public or sanctioned authorities, such as federal, state and municipal governments (as in the case of the US) use a body of rules and procedures (laws) to assess and collect taxes in a legal context. The rates and merits of the various taxes, imposed by the authorities, are attained via the political process inherent in these bodies of power, and not directly attributable to the actual domain of tax law itself. Tax law is part of public law. It covers the application of existing tax laws on individuals, entities and corporations, in areas where tax revenue is derived or levied, e.g. income tax, estate tax, business tax, employment/payroll tax, property tax, gift tax and exports/imports tax. There have been some arguments that Consumer Law, consumer law is a better way to engage in large-scale redistribution than tax law because it does not necessitate legislation and can be more efficient, given the complexities of tax l ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States

The United States of America (USA), also known as the United States (U.S.) or America, is a country primarily located in North America. It is a federal republic of 50 U.S. state, states and a federal capital district, Washington, D.C. The 48 contiguous states border Canada to the north and Mexico to the south, with the semi-exclave of Alaska in the northwest and the archipelago of Hawaii in the Pacific Ocean. The United States asserts sovereignty over five Territories of the United States, major island territories and United States Minor Outlying Islands, various uninhabited islands in Oceania and the Caribbean. It is a megadiverse country, with the world's List of countries and dependencies by area, third-largest land area and List of countries and dependencies by population, third-largest population, exceeding 340 million. Its three Metropolitan statistical areas by population, largest metropolitan areas are New York metropolitan area, New York, Greater Los Angeles, Los Angel ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Congress

The United States Congress is the legislature, legislative branch of the federal government of the United States. It is a Bicameralism, bicameral legislature, including a Lower house, lower body, the United States House of Representatives, U.S. House of Representatives, and an Upper house, upper body, the United States Senate, U.S. Senate. They both meet in the United States Capitol in Washington, D.C. Members of Congress are chosen through direct election, though vacancies in the Senate may be filled by a Governor (United States), governor's appointment. Congress has a total of 535 voting members, a figure which includes 100 United States senators, senators and 435 List of current members of the United States House of Representatives, representatives; the House of Representatives has 6 additional Non-voting members of the United States House of Representatives, non-voting members. The vice president of the United States, as President of the Senate, has a vote in the Senate ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taxation In The United States

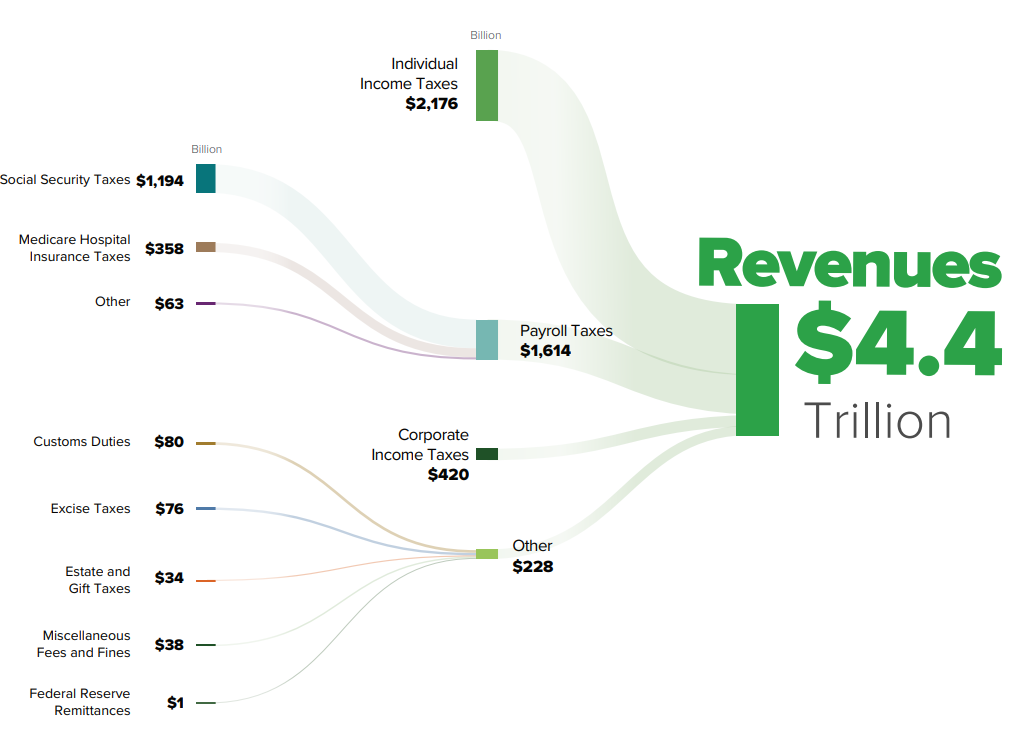

The United States has separate Federal government of the United States, federal, U.S. state, state, and Local government in the United States, local governments with taxes imposed at each of these levels. Taxes are levied on income, payroll, property, sales, Capital gains tax in the United States, capital gains, dividends, imports, estates and gifts, as well as various fees. In 2020, taxes collected by federal, state, and local governments amounted to 25.5% of GDP, below the OECD average of 33.5% of GDP. Income tax in the United States, U.S. tax and transfer policies are Progressive tax, progressive and therefore reduce effective income inequality in the United States, income inequality, as rates of tax generally increase as taxable income increases. As a group, the lowest earning workers, especially those with dependents, pay no income taxes and may actually receive a small subsidy from the federal government (from child credits and the Earned Income Tax Credit). Taxes fall m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Net Profit

In business and Accountancy, accounting, net income (also total comprehensive income, net earnings, net profit, bottom line, sales profit, or credit sales) is an entity's income minus cost of goods sold, expenses, depreciation and Amortization (accounting), amortization, interest, and taxes, and other expenses for an accounting period. It is computed as the residual of all revenues and gains less all expenses and losses for the period,Weil, Schipper, Francis. (2009) Financial Accounting: An Introduction to Concepts, Methods, and Uses. Cengage Learning and has also been defined as the net increase in Equity (finance), shareholders' equity that results from a company's operations.Weil, Schipper, Francis. (2010) Financial Accounting. Cengage Learning. It is different from gross income, which only deducts the cost of goods sold from revenue. For Household, households and individuals, net income refers to the (gross) income minus taxes and other deductions (e.g. mandatory pension cont ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Qualified Dividend

Qualified dividends, as defined by the United States Internal Revenue Code, are ordinary dividends that meet specific criteria to be taxed at the lower long-term capital gains tax rate rather than at higher tax rate for an individual's ordinary income. The rates on qualified dividends range from 0 to 23.8%. The category of qualified dividend (as opposed to an ordinary dividend) was created in the Jobs and Growth Tax Relief Reconciliation Act of 2003 – previously, there was no distinction and all dividends were either untaxed or taxed together at the same rate. To qualify for the qualified dividend rate, the payee must own the stock for a long enough time, generally 60 days for common stock and 90 days for preferred stock. To qualify for the qualified dividend rate, the dividend must also be paid by a corporation in the U.S. or with certain ties to the U.S. Requirements To be taxed at the qualified dividend rate, the dividend must: * be paid after December 31, 2002 * be ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Transfer Pricing

Transfer pricing refers to the rules and methods for pricing transactions within and between enterprises under common ownership or control. Because of the potential for cross-border controlled transactions to distort taxable income, tax authorities in many countries can adjust intragroup transfer prices that differ from what would have been charged by unrelated enterprises dealing at arm’s length (the arm’s-length principle). The OECD and World Bank recommend intragroup pricing rules based on the arm’s-length principle, and 19 of the 20 members of the G20 have adopted similar measures through bilateral treaties and domestic legislation, regulations, or administrative practice.World Bank pp. 35-51 Countries with transfer pricing legislation generally follow th''OECD Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations''in most respects, although their rules can differ on some important details. Where adopted, transfer pricing rules allow tax au ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

European Community

The European Economic Community (EEC) was a regional organisation created by the Treaty of Rome of 1957,Today the largely rewritten treaty continues in force as the ''Treaty on the functioning of the European Union'', as renamed by the Lisbon Treaty. aiming to foster economic integration among its member states. It was subsequently renamed the European Community (EC) upon becoming integrated into the Three pillars of the European Union, first pillar of the newly formed European Union (EU) in 1993. In the popular language, the singular ''European Community'' was sometimes inaccurately used in the wider sense of the plural ''European Communities'', in spite of the latter designation covering all the three constituent entities of the first pillar. The EEC was also known as the European Common Market (ECM) in the English-speaking countries, and sometimes referred to as the European Community even before it was officially renamed as such in 1993. In 2009, the EC formally ceased to ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

GATT

The General Agreement on Tariffs and Trade (GATT) is a legal agreement between many countries, whose overall purpose was to promote international trade by reducing or eliminating trade barriers such as tariffs or quotas. According to its preamble, its purpose was the "substantial reduction of tariffs and other trade barriers and the elimination of preferences, on a reciprocal and mutually advantageous basis". The GATT was first discussed during the United Nations Conference on Trade and Employment and was the outcome of the failure of negotiating governments to create the International Trade Organization (ITO). It was signed by 23 nations in Geneva on 30 October 1947, and was applied on a provisional basis 1 January 1948. It remained in effect until 1 January 1995, when the World Trade Organization (WTO) was established after agreement by 123 nations in Marrakesh on 15 April 1994, as part of the Uruguay Round Agreements. The WTO is the successor to the GATT, and the origin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tokyo Round

The Tokyo Round was a multi-year multilateral trade negotiation (MTN) between the 102 states which were parties to the General Agreement on Tariffs and Trade (GATT). The negotiations resulted in reduced tariffs and established new regulations aimed at controlling the proliferation of non-tariff barriers (NTBs) and voluntary export restrictions. The aim was further to harmonise government policies. Concessions were made on $19 billion worth of trade, and were scheduled to enter effect over eight years from 1980. The Tokyo Round concluded in April 1979. The Tokyo Round was held to be "the most comprehensive of all the seven rounds of negotiations held within the GATT since its founding in 1948". One novelty was that it covered bovine meat and dairy products. The agricultural sector Agriculture encompasses crop and livestock production, aquaculture, and forestry for food and non-food products. Agriculture was a key factor in the rise of sedentary human civilization, wh ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Foreign Sales Corporation

Foreign Sales Corporation (FSC) was a type of tax device allowed under the United States Internal Revenue Code that allowed companies to receive a reduction in U.S. federal income tax for profits derived from exports. The FSC was created in 1984 to replace the old export-promoting tax scheme, the Domestic International Sales Corporation, or DISC. An international dispute arose in 1971, when the United States introduced legislation providing for DISCs. These laws were challenged by the European Community under the GATT. The United States then counterclaimed that European tax regulations concerning extraterritorial income were also GATT-incompatible. In 1976, a GATT panel found that both DISCs and the European tax regulations were GATT-incompatible. These cases were settled, however, by the Tokyo Round Code on Subsidies and Countervailing Duties, predecessor to today's Subsidies and Countervailing Measures (SCM), and the GATT Council decided in 1981 to adopt the panel reports subj ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Extraterritorial Income Exclusion

Extraterritorial income exclusion, under the U.S. Internal Revenue Code, was the amount excluded from a taxpayer's gross income for certain transactions that generate foreign trading gross receipts. In general, foreign trading gross receipts include gross receipts from the sale, exchange, lease, rental, or other disposition of qualifying foreign trade property. Foreign trading gross receipts also include receipts from certain services provided in connection with such property, as well as engineering and architectural services for construction projects outside the United States. Extraterritorial income is the gross income of the taxpayer attributable to foreign trading gross receipts. The taxpayer reported all of its extraterritorial income on its tax return. The taxpayer used Form 8873 to calculate its exclusion from income that is qualifying foreign trade income. It was abolished when in late 2004, US President George W Bush signed the American Jobs Creation Act of 2004 which pha ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |