|

Dividend Tax

A dividend tax is a tax imposed by a jurisdiction on dividends paid by a corporation to its shareholders (stockholders). The primary tax liability is that of the shareholder, though a tax obligation may also be imposed on the corporation in the form of a withholding tax. In some cases the withholding tax may be the extent of the tax liability in relation to the dividend. A dividend tax is in addition to any tax imposed directly on the corporation on its profits. Some jurisdictions do not tax dividends. To avoid a dividend tax being levied, a corporation may distribute surplus funds to shareholders by way of a share buy-back. These, however, are normally treated as capital gains, but may offer tax benefits when the tax rate on capital gains is lower than the tax rate on dividends. Another potential strategy is for a corporation not to distribute surplus funds to shareholders, who benefit from an increase in the value of their shareholding. These may also be subject to capital gain ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dividend

A dividend is a distribution of profits by a corporation to its shareholders, after which the stock exchange decreases the price of the stock by the dividend to remove volatility. The market has no control over the stock price on open on the ex-dividend date, though more often than not it may open higher. When a corporation earns a profit or surplus, it is able to pay a portion of the profit as a dividend to shareholders. Any amount not distributed is taken to be re-invested in the business (called retained earnings). The current year profit as well as the retained earnings of previous years are available for distribution; a corporation is usually prohibited from paying a dividend out of its capital. Distribution to shareholders may be in cash (usually by bank transfer) or, if the corporation has a dividend reinvestment plan, the amount can be paid by the issue of further shares or by share repurchase. In some cases, the distribution may be of assets. The dividend received by ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Internal Revenue Service

The Internal Revenue Service (IRS) is the revenue service for the Federal government of the United States, United States federal government, which is responsible for collecting Taxation in the United States, U.S. federal taxes and administering the Internal Revenue Code, the main body of the federal statutory tax law. It is an agency of the United States Department of the Treasury, Department of the Treasury and led by the Commissioner of Internal Revenue, who is appointed to a five-year term by the President of the United States. The duties of the IRS include providing tax assistance to taxpayers; pursuing and resolving instances of erroneous or fraudulent tax filings; and overseeing various benefits programs, including the Affordable Care Act. The IRS originates from the Commissioner of Internal Revenue, a federal office created in 1862 to assess the nation's first income tax to fund the American Civil War. The temporary measure funded over a fifth of the Union's war expens ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Patient Protection And Affordable Care Act

A patient is any recipient of health care services that are performed by healthcare professionals. The patient is most often ill or injured and in need of treatment by a physician, nurse, optometrist, dentist, veterinarian, or other health care provider. Etymology The word patient originally meant 'one who suffers'. This English noun comes from the Latin word , the present participle of the deponent verb, , meaning , and akin to the Greek verb ( ) and its cognate noun (). This language has been construed as meaning that the role of patients is to passively accept and tolerate the suffering and treatments prescribed by the healthcare providers, without engaging in shared decision-making about their care. Outpatients and inpatients An outpatient (or out-patient) is a patient who attends an outpatient clinic with no plan to stay beyond the duration of the visit. Even if the patient will not be formally admitted with a note as an outpatient, their attendance is stil ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

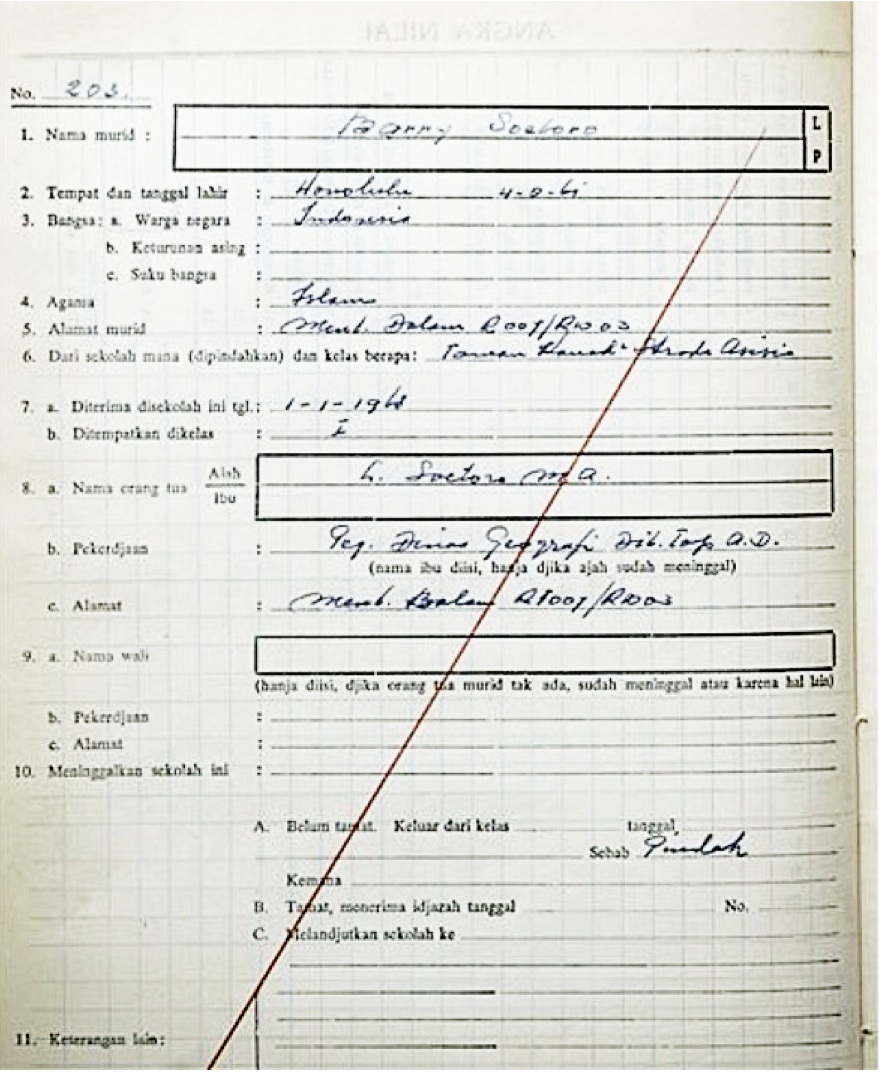

Barack Obama

Barack Hussein Obama II (born August 4, 1961) is an American politician who was the 44th president of the United States from 2009 to 2017. A member of the Democratic Party, he was the first African American president in American history. Obama previously served as a U.S. senator representing Illinois from 2005 to 2008 and as an Illinois state senator from 1997 to 2004. Born in Honolulu, Hawaii, Obama graduated from Columbia University in 1983 with a Bachelor of Arts degree in political science and later worked as a community organizer in Chicago. In 1988, Obama enrolled in Harvard Law School, where he was the first black president of the ''Harvard Law Review''. He became a civil rights attorney and an academic, teaching constitutional law at the University of Chicago Law School from 1992 to 2004. In 1996, Obama was elected to represent the 13th district in the Illinois Senate, a position he held until 2004, when he successfully ran for the U.S. Senate. In the 2008 pre ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Increase Prevention And Reconciliation Act Of 2005

The Tax Increase Prevention and Reconciliation Act of 2005 (or TIPRA, , ) is an American law, which was enacted on May 17, 2006. This bill prevents several tax provisions from sunsetting in the near future. The two most notable pieces of the bill are the extension of the reduced tax rates on capital gains and dividends and extension of the alternative minimum tax (AMT) tax reduction. Legislative history The U.S. House of Representatives approved the bill as , 244–185, and the U.S. Senate approved it 54-44, largely along party lines, with most Republicans supporting and most Democrats opposing. Excerpts from Detailed Summary of Conference Report Two-Year Extension of Reduced Rates on Capital Gains and Dividends Under current law, long-term capital gains and dividend income are taxed at a maximum rate of 15 percent through 2008. For taxpayers in the 10 and 15 percent tax brackets, the tax rate is 5 percent through 2007 and zero in 2008. The Conference Report extends the rat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Rate Schedule (federal Income Tax)

A rate schedule is a chart that helps United States taxpayers determine their federal income tax for a particular year.Samuel A. Donaldson, ''Federal Income Taxation of Individuals: Cases, Problems and Materials'', 2nd Edition (St. Paul: Thomson/West, 2007), 8-9.Internal Revenue Service, United States Department of the Treasury, "2007 Federal Tax Rate Schedules," https://www.irs.gov/pub/irs-prior/i1040tt--2007.pdf. Another name for "rate schedule" is "rate table". Origin The origin of the current rate schedules is the Internal Revenue Code of 1986 (IRC), which is separately published as Title 26 of the United States Code. With that law, the U.S. Congress created four types of rate tables, all of which are based on a taxpayer's filing status (e.g., "married individuals filing joint returns," "heads of households"). Each year the United States Internal Revenue Service (IRS) updates rate schedules in accordance with guidelines that Congress established in the IRC. In general, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Gain

Capital gain is an economic concept defined as the profit earned on the sale of an asset which has increased in value over the holding period. An asset may include tangible property, a car, a business, or intangible property such as shares. A capital gain is only possible when the selling price of the asset is greater than the original purchase price. In the event that the purchase price exceeds the sale price, a capital loss occurs. Capital gains are often subject to taxation, of which rates and exemptions may differ between countries. The history of capital gain originates at the birth of the modern economic system and its evolution has been described as complex and multidimensional by a variety of economic thinkers. The concept of capital gain may be considered comparable with other key economic concepts such as profit and rate of return; however, its distinguishing feature is that individuals, not just businesses, can accrue capital gains through everyday acquisition a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The White House

The White House is the official residence and workplace of the president of the United States. Located at 1600 Pennsylvania Avenue NW in Washington, D.C., it has served as the residence of every U.S. president since John Adams in 1800 when the national capital was moved from Philadelphia. "The White House" is also used as a metonym to refer to the Executive Office of the President of the United States. The residence was designed by Irish-born architect James Hoban in the Neoclassical style. Hoban modeled the building on Leinster House in Dublin, a building which today houses the Oireachtas, the Irish legislature. Constructed between 1792 and 1800, its exterior walls are Aquia Creek sandstone painted white. When Thomas Jefferson moved into the house in 1801, he and architect Benjamin Henry Latrobe added low colonnades on each wing to conceal what then were stables and storage. In 1814, during the War of 1812, the mansion was set ablaze by British forces in the burning ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Amount Realized

Amount realized, in US federal income tax law, is defined by section 1001(b) of Internal Revenue Code. It is one of two variables in the formula used to compute gains and losses to determine gross income for income tax purposes. The excess of the amount realized over the adjusted basis is the amount of realized gain (if positive) or realized loss (if negative). Computation of gain and loss is governed by section 1001(a) of the Code. Statutory definition Section 1001(b) defines the amount realized as "the sum of any money received plus the fair market value of the property (other than money) received." Generally, it is the value of what the taxpayer receives in the exchange. Calculating amount realized To have an "amount realized" there must be a kind of exchange, known as a "realization event." The first step in calculating the amount realized is determining when an exchange that qualifies as a "realization event" has occurred. Section 1001 requires that it be an exchange through ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market Capitalization

Market capitalization, sometimes referred to as market cap, is the total value of a publicly traded company's outstanding common shares owned by stockholders. Market capitalization is equal to the market price per common share multiplied by the number of common shares outstanding. Description Market capitalization is sometimes used to rank the size of companies. It measures only the equity component of a company's capital structure, and does not reflect management's decision as to how much debt (or leverage) is used to finance the firm. A more comprehensive measure of a firm's size is enterprise value (EV), which gives effect to outstanding debt, preferred stock, and other factors. For insurance firms, a value called the embedded value (EV) has been used. It is also used in ranking the relative size of stock exchanges, being a measure of the sum of the market capitalizations of all companies listed on each stock exchange. The total capitalization of stock markets or eco ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Comprehensive Income

In company financial reporting in the United States, comprehensive income (or comprehensive earnings) "includes all changes in equity during a period except those resulting from investments by owners and distributions to owners". Because that use excludes the effects of changing ownership interest, an economic measure of comprehensive income is necessary for financial analysis from the shareholders' point of view (all changes in equity except those resulting from investment by or distribution to owners). Accounting Comprehensive income is defined by the Financial Accounting Standards Board, or FASB, as “the change in equity et assetsof a business enterprise during a period from transactions and other events and circumstances from non-owner sources. It includes all changes in equity during a period except those resulting from investments by owners and distributions to owners.” Comprehensive income is the sum of net income and other items that must bypass the income statement ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Planning

Tax avoidance is the legal usage of the tax regime in a single territory to one's own advantage to reduce the amount of tax that is payable. A tax shelter is one type of tax avoidance, and tax havens are jurisdictions that facilitate reduced taxes. Tax avoidance should not be confused with tax evasion, which is illegal. Forms of tax avoidance that use legal tax laws in ways not necessarily intended by the government are often criticized in the court of public opinion and by journalists. Many businesses pay little or no tax, and some experience a backlash when their tax avoidance becomes known to the public. Conversely, benefiting from tax laws in ways that were intended by governments is sometimes referred to as tax planning. The World Bank's World Development Report 2019 on the future of work supports increased government efforts to curb tax avoidance as part of a new social contract focused on human capital investments and expanded social protection. "Tax mitigation", "tax ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |