|

Deficit Hawk

Deficit hawk is a political slang term in the English speaking world for people who place great emphasis on keeping government budgets under control. 'Hawk' can be used to describe someone calling for harsh or pain-inducing measures (alluding to the predatory nature of hawks in the natural world) in many political contexts; in the specific context of deficit reduction, the term is more commonly applied to those advocating for cuts in government spending than to those supporting increases in taxes. Economist and opinion writer Paul Krugman has popularized the use of "deficit scold" in place of deficit hawk. According to Krugman, a columnist of ''The New York Times'', " the Peter G. Peterson Foundation is deficit-scold central; Peterson funding lies behind much of the movement." Deficit hawks often warn that unsustainable fiscal policies could lead to investors losing confidence in U.S. government bonds, which would in turn force an increase in interest rates. Krugman has dismiss ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Slang

A slang is a vocabulary (words, phrases, and linguistic usages) of an informal register, common in everyday conversation but avoided in formal writing and speech. It also often refers to the language exclusively used by the members of particular in-groups in order to establish group identity, exclude outsiders, or both. The word itself came about in the 18th century and has been defined in multiple ways since its conception, with no single technical usage in linguistics. Etymology of the word ''slang'' In its earliest attested use (1756), the word ''slang'' referred to the vocabulary of "low" or "disreputable" people. By the early nineteenth century, it was no longer exclusively associated with disreputable people, but continued to be applied to usages below the level of standard educated speech. In Scots dialect it meant "talk, chat, gossip", as used by Aberdeen poet William Scott in 1832: "The slang gaed on aboot their war'ly care." In northern English dialect it me ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dean Baker

Dean Baker (born July 13, 1958) is an American macroeconomist who co-founded the Center for Economic and Policy Research (CEPR) with Mark Weisbrot. Baker has been credited as one of the first economists to have identified the 2007–08 United States housing bubble. Early life and education Baker was born into a Jewish family and grew up in the Lake View neighborhood of Chicago, Illinois. In 1981, Baker graduated from Swarthmore College with a bachelor's degree in history with minors in economics and philosophy. In 1983, he received a master's degree in economics from the University of Denver. In 1988, he received a PhD from the University of Michigan in economics. Economics career Baker was a lecturer at the University of Michigan from 1988 to 1989 and an assistant professor of economics at Bucknell University from 1989 to 1992. From 1992 to 1998, he was an economist at the Economic Policy Institute. During this time, he published a paper with Mark Weisbrot in a journal of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Federal Budget

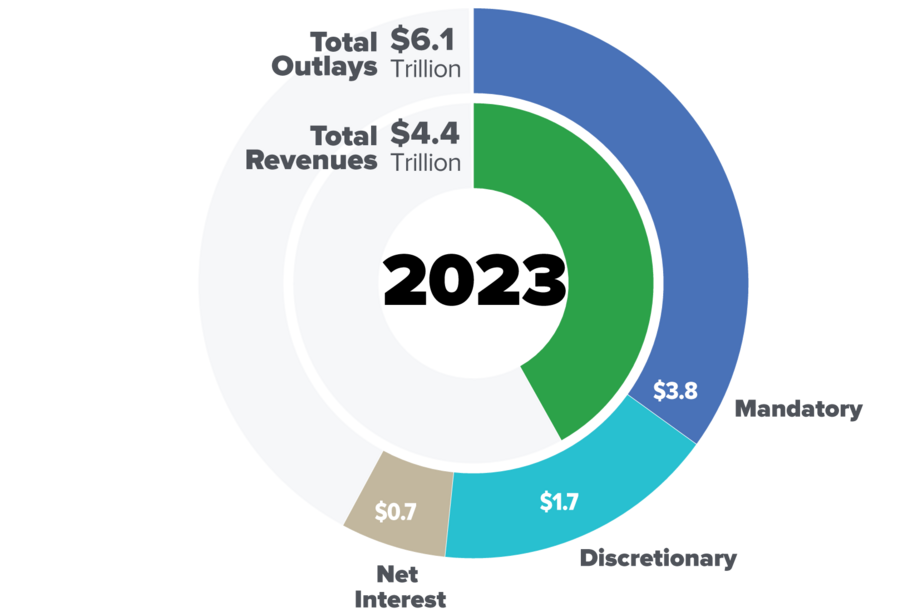

The United States budget comprises the spending and revenues of the U.S. federal government. The budget is the financial representation of the priorities of the government, reflecting historical debates and competing economic philosophies. The government primarily spends on healthcare, retirement, and defense programs. The non-partisan Congressional Budget Office provides extensive analysis of the budget and its economic effects. The budget typically contains more spending than revenue, the difference adding to the federal debt each year. CBO estimated in February 2024 that federal debt held by the public is projected to rise from 99 percent of GDP in 2024 to 116 percent in 2034 and would continue to grow if current laws generally remained unchanged. Over that period, the growth of interest costs and mandatory spending outpaces the growth of revenues and the economy, driving up debt. Those factors persist beyond 2034, pushing federal debt higher still, to 172 percent of G ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

PAYGO

PAYGO (Pay As You GO) is the practice of financing expenditures with Collective investment scheme, funds that are currently available rather than borrowed. Budgeting The PAYGO compels new spending or tax changes not to add to the federal debt. Not to be confused with pay-as-you-go financing, which is when a government saves up money to fund a specific project. Under the PAYGO rules, a new proposal must either be "budget neutral" or offset with savings derived from existing funds. The goal of this is to require those in control of the budget to engage in the diligence of prioritizing expenses and exercising fiscal restraint. An important example of such a system is the use of PAYGO in both the statutes of the U.S. Government and the rules in the U.S. Congress. First enacted as part of the Budget Enforcement Act of 1990 (which was incorporated as Title XIII of the Omnibus Budget Reconciliation Act of 1990), PAYGO required all increases in direct spending or revenue decreases to be o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fiscal Policy

In economics and political science, fiscal policy is the use of government revenue collection ( taxes or tax cuts) and expenditure to influence a country's economy. The use of government revenue expenditures to influence macroeconomic variables developed in reaction to the Great Depression of the 1930s, when the previous laissez-faire approach to economic management became unworkable. Fiscal policy is based on the theories of the British economist John Maynard Keynes, whose Keynesian economics theorised that government changes in the levels of taxation and government spending influence aggregate demand and the level of economic activity. Fiscal and monetary policy are the key strategies used by a country's government and central bank to advance its economic objectives. The combination of these policies enables these authorities to target inflation and to increase employment. In modern economies, inflation is conventionally considered "healthy" in the range of 2%–3%. Add ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fiscal Council

A fiscal council is an independent body set up by a government to evaluate its government spending, expenditure and tax policy. Typically, councils are staffed by economists and statisticians who do not have the ability to set policy, but provide advice to governments and the public on the economic effects of government budgets and Public policy, policy proposals. Some fiscal councils also provide economic forecasting. Fiscal councils evaluate government's fiscal policies, plans and performance publicly and independently, against macroeconomic objectives related to the long-term sustainability of public finances, short-to-medium-term macroeconomic stability, and other official objectives. History Several fiscal councils arose following the 2008 financial crisis with the intention of avoiding debt crises and alleviating the problem of deficit bias, which is a tendency of governments to allow increasing long-term deficits. Analysis from the International Monetary Fund proposes that ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fiscal Conservatism

In American political theory, fiscal conservatism or economic conservatism is a political and economic philosophy regarding fiscal policy and fiscal responsibility with an ideological basis in capitalism, individualism, limited government, and ''laissez-faire'' economics.M. O. Dickerson et al., ''An Introduction to Government and Politics: A Conceptual Approach'' (2009) p. 129. Fiscal conservatives advocate tax cuts, reduced government spending, free markets, deregulation, privatization, free trade, and minimal government debt. Fiscal conservatism follows the same philosophical outlook as classical liberalism. This concept is derived from economic liberalism. The term has its origins in the era of the American New Deal during the 1930s as a result of the policies initiated by modern liberals, when many classical liberals started calling themselves conservatives as they did not wish to be identified with what was passing for liberalism in the United States. In the United ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Citizens Against Government Waste

Citizens Against Government Waste (CAGW) is a non-profit 501(c)(3) organization in the United States. It functions as a "government watchdog" and advocacy group for fiscally conservative causes. The Council for Citizens Against Government Waste (CCAGW) is the lobbying arm of CAGW, organized as a section 501(c)(4) organization and therefore is permitted to engage in direct lobbying activities. According to its website, "CAGW is a private, non-partisan, non-profit organization representing more than one million members and supporters nationwide. CAGW's stated mission is to eliminate waste, mismanagement, and inefficiency in the federal government." History CAGW was founded in 1984 by industrialist J. Peter Grace and syndicated columnist Jack Anderson. Grace was chairman of President Ronald Reagan's Grace Commission (also known as the President's Private Sector Survey on Cost Control). CAGW is located in Washington, D.C. Thomas A. Schatz has been president since 1992. Public ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Balance Of Payments

In international economics, the balance of payments (also known as balance of international payments and abbreviated BOP or BoP) of a country is the difference between all money flowing into the country in a particular period of time (e.g., a quarter or a year) and the outflow of money to the rest of the world. In other words, it is economic transactions between countries during a period of time. These financial transactions are made by individuals, firms and government bodies to compare receipts and payments arising out of trade of goods and services. The balance of payments consists of three primary components: the current account, the financial account, and the capital account. The current account reflects a country's net income, while the financial account reflects the net change in ownership of national assets. The capital account reflects a part that has little effect on the total, and represents the sum of unilateral capital account transfers, and the acquisitions and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Balanced Budget Amendment

A balanced budget amendment or debt brake is a constitutional rule requiring that a state cannot spend more than its income. It requires a balance between the projected receipts and expenditures of the government. Balanced-budget provisions have been added to the constitutions of Germany, Hong Kong, Italy, Poland, Slovenia, Spain and Switzerland, among others, as well as to the constitutions of most U.S. states. In the United States, the Republican Party has in the past advocated but no longer advocates for the introduction of a balanced budget amendment to the United States Constitution. Balanced budget amendments are defended with arguments that they reduce deficit spending and constrain politicians from making irresponsible short-term spending decisions when they are in office. Research shows that balanced budget amendments lead to greater fiscal discipline. However, there is substantial agreement among economists that ''strict annual'' balanced budget amendments have harm ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Balanced Budget

A balanced budget (particularly that of a government) is a budget in which revenues are equal to expenditures. Thus, neither a budget deficit nor a budget surplus exists (the accounts "balance"). More generally, it is a budget that has no budget deficit, but could possibly have a budget surplus. A ''cyclically'' balanced budget is a budget that is not necessarily balanced year-to-year but is balanced over the economic cycle, running a surplus in boom years and running a deficit in lean years, with these offsetting over time. Balanced budgets and the associated topic of budget deficits are a contentious point within academic economics and within politics. Some economists argue that moving from a budget deficit to a balanced budget decreases interest rates, increases investment, shrinks trade deficits and helps the economy grow faster in the longer term. Other economists, especially (but not limited to) those associated with Modern Monetary Theory (MMT), downplay the need for ba ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |