|

Death Tax

In the United States, the estate tax is a federal tax on the transfer of the estate of a person who dies. The tax applies to property that is transferred by will or, if the person has no will, according to state laws of intestacy. Other transfers that are subject to the tax can include those made through a trust and the payment of certain life insurance benefits or financial accounts. The estate tax is part of the federal unified gift and estate tax in the United States. The other part of the system, the gift tax, applies to transfers of property during a person's life. In addition to the federal government, 12 states tax the estate of the deceased. Six states have "inheritance taxes" levied on the person who receives money or property from the estate of the deceased. The estate tax is periodically the subject of political debate. Some opponents have called it the "death tax" [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Estate Tax

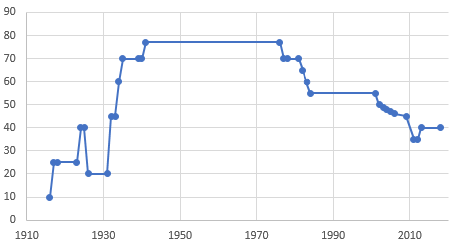

International tax law distinguishes between an estate tax and an inheritance tax. An inheritance tax is a tax paid by a person who inherits money or property of a person who has died, whereas an estate tax is a levy on the estate (money and property) of a person who has died. However, this distinction is not always observed; for example, the UK's "inheritance tax" is a tax on the assets of the deceased, and strictly speaking is therefore an estate tax. Inheritance taxes vary widely between countries. History There was a steep increase in the number of countries that implemented inheritance taxes throughout the 19th and early 20th century. From 1960 onwards, inheritance taxes declined in prevalence as numerous countries repealed theirs. For historical reasons, the term "death duty" is still used colloquially (though not legally) in the UK and some Commonwealth countries. The estate tax in the United States is sometimes referred as "death tax". Other taxation applied to inheri ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Joint Tenants With Rights Of Survivorship

In property law, a concurrent estate or co-tenancy is any of various ways in which property is owned by more than one person at a time. If more than one person owns the same property, they are commonly referred to as co-owners. Legal terminology for co-owners of real estate is either co-tenants or joint tenants, with the latter phrase signifying a right of survivorship. Most common law jurisdictions recognize tenancies in common and joint tenancies. Many jurisdictions also recognize tenancies by the entirety, which is effectively a joint tenancy between married persons. Many jurisdictions refer to a joint tenancy as a joint tenancy with right of survivorship, but they are the same, as every joint tenancy includes a right of survivorship. In contrast, a tenancy in common does not include a right of survivorship. The type of co-ownership does not affect the right of co-owners to sell their fractional interest in the property to others during their lifetimes, but it does affect ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Non-resident Alien

In law, an alien is generally any person (including an organization) who is not a citizen or a national of a specific country, although definitions and terminology differ across legal systems. Lexicology The term "alien" is derived from the Latin '. The Latin later came to mean a stranger, a foreigner, or someone not related by blood. Similar terms to "alien" in this context include ''foreigner'' and ''lander''. Categories Different countries around the world use varying terms for aliens. The following are several types of aliens: * legal alien any foreign national who is permitted under the law to be in the host country. This is a very broad category which includes travel visa holders or foreign tourists, registered refugees, temporary residents, permanent residents, and those who have relinquished their citizenship and/or nationality. Categories of legal alien include ** temporary resident alien any foreign national who has been lawfully granted permission by the gov ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Domicile (law)

In law and conflict of laws, domicile is relevant to an individual's "personal law", which includes the law that governs a person's status and their property. It is independent of a person's nationality. Although a domicile may change from time to time, a person has only one domicile, or residence, at any point in their life, no matter what their circumstances. Domicile is distinct from habitual residence, where there is less focus on future intent. As domicile is one of the connecting factors ordinarily used in common law legal systems, a person can never be left without a domicile and a domicile is acquired by everyone at birth. Generally domicile can be divided into domicile of origin, domicile of choice, and domicile by operation of law (also known as domicile of dependency). When determining the domicile of an individual, a court applies its own law and understanding of what domicile is. In some common-law countries, such as Australia and New Zealand, the concept of domic ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Internal Revenue Service

The Internal Revenue Service (IRS) is the revenue service for the Federal government of the United States, United States federal government, which is responsible for collecting Taxation in the United States, U.S. federal taxes and administering the Internal Revenue Code, the main body of the federal statutory tax law. It is an agency of the United States Department of the Treasury, Department of the Treasury and led by the Commissioner of Internal Revenue, who is appointed to a five-year term by the President of the United States. The duties of the IRS include providing tax assistance to taxpayers; pursuing and resolving instances of erroneous or fraudulent tax filings; and overseeing various benefits programs, including the Affordable Care Act. The IRS originates from the Commissioner of Internal Revenue, a federal office created in 1862 to assess the nation's first income tax to fund the American Civil War. The temporary measure funded over a fifth of the Union's war expens ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Executor

An executor is someone who is responsible for executing, or following through on, an assigned task or duty. The feminine form, executrix, is sometimes used. Executor of will An executor is a legal term referring to a person named by the maker of a will or nominated by the testator to carry out the instructions of the will. Typically, the executor is the person responsible for offering the will for probate, although it is not required that they fulfill this. The executor's duties also include handing over property to the beneficiaries as designated in the will, obtaining information of potential heirs, collecting and arranging for payment of debts of the estate and approving or disapproving creditors' claims. An executor makes sure estate taxes are calculated, necessary forms are filed, and the corresponding payments are made. They also assist the attorney with the estate. Additionally, the executor acts as a legal conveyor who designates where the donations will be sent using ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economic Growth And Tax Relief Reconciliation Act Of 2001

An economy is an area of the production, distribution and trade, as well as consumption of goods and services. In general, it is defined as a social domain that emphasize the practices, discourses, and material expressions associated with the production, use, and management of resources. A given economy is a set of processes that involves its culture, values, education, technological evolution, history, social organization, political structure, legal systems, and natural resources as main factors. These factors give context, content, and set the conditions and parameters in which an economy functions. In other words, the economic domain is a social domain of interrelated human practices and transactions that does not stand alone. Economic agents can be individuals, businesses, organizations, or governments. Economic transactions occur when two groups or parties agree to the value or price of the transacted good or service, commonly expressed in a certain currency. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Exemption

Tax exemption is the reduction or removal of a liability to make a compulsory payment that would otherwise be imposed by a ruling power upon persons, property, income, or transactions. Tax-exempt status may provide complete relief from taxes, reduced rates, or tax on only a portion of items. Examples include exemption of charitable organizations from property taxes and income taxes, veterans, and certain cross-border or multi-jurisdictional scenarios. A tax exemption is distinct and different from a tax exclusion and a tax deduction, all of which are different types of tax expenditures. A tax exemption is an income stream on which no tax is levied, such as interest income from state and local bonds, which is often exempt from federal income tax. Additionally, certain qualifying non-profit organizations are exempt from federal income tax. A tax exclusion refers to a dollar amount (or proportion of taxable income) that can be legally excluded from the taxable base income prior to a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

American Taxpayer Relief Act Of 2012

The American Taxpayer Relief Act of 2012 (ATRA) was enacted and passed by the United States Congress on January 1, 2013, and was signed into law by US President Barack Obama the next day. ATRA gave permanence to the lower rates of much of the "Bush tax cuts". The Act centers on a partial resolution to the US fiscal cliff by addressing the expiration of certain provisions of the Economic Growth and Tax Relief Reconciliation Act of 2001 and the Jobs and Growth Tax Relief Reconciliation Act of 2003 (known together as the " Bush tax cuts"), which had been temporarily extended by the Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010. The Act also addressed the activation of the Budget Control Act of 2011's budget sequestration provisions. A compromise measure, the Act gives permanence to the lower rate of much of the Bush tax cuts, while retaining the higher tax rate at upper income levels that became effective on January 1 due to the expiration of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Relief, Unemployment Insurance Reauthorization, And Job Creation Act Of 2010

The Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010 (), also known as the 2010 Tax Relief Act, was passed by the United States Congress on December 16, 2010, and signed into law by President Barack Obama on December 17, 2010. The Act centers on a temporary, two-year reprieve from the sunset provisions of the Economic Growth and Tax Relief Reconciliation Act of 2001 (EGTRRA) and the Jobs and Growth Tax Relief Reconciliation Act of 2003 (JGTRRA), together known as the " Bush tax cuts." Income taxes would have returned to Clinton administration-era rates in 2011 had Congress not passed this law. The Act also extends some provisions from the American Recovery and Reinvestment Act of 2009 (ARRA or 'the Stimulus'). The act also includes several other tax- and economy-related measures intended to have a new stimulatory effect, mostly notably an extension of unemployment benefits and a one-year reduction in the FICA payroll tax, as part of a compromise ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Charitable Organization

A charitable organization or charity is an organization whose primary objectives are philanthropy and social well-being (e.g. educational, Religion, religious or other activities serving the public interest or common good). The legal definition of a charitable organization (and of charity) varies between countries and in some instances regions of the country. The Charity regulators, regulation, the tax treatment, and the way in which charity law affects charitable organizations also vary. Charitable organizations may not use any of their funds to profit individual persons or entities. However, some charitable organizations have come under scrutiny for spending a disproportionate amount of their income to pay the salaries of their leadership. Financial figures (e.g. tax refunds, revenue from fundraising, revenue from the sale of goods and services or revenue from investment, and funds held in reserve) are indicators to assess the financial sustainability of a charity, especiall ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Internal Revenue Code

The Internal Revenue Code of 1986 (IRC), is the domestic portion of federal statutory tax law in the United States. It is codified in statute as Title 26 of the United States Code. The IRC is organized topically into subtitles and sections, covering federal income tax in the United States, payroll taxes, estate taxes, gift taxes, and excise taxes; as well as procedure and administration. The Code's implementing federal agency is the Internal Revenue Service. Origins of tax codes in the United States Prior to 1874, U.S. statutes (whether in tax law or other subjects) were not codified. That is, the acts of Congress were not organized and published in separate volumes based on the subject matter (such as taxation, bankruptcy, etc.). Codifications of statutes, including tax statutes, undertaken in 1873 resulted in the Revised Statutes of the United States, approved June 22, 1874, effective for the laws in force as of December 1, 1873. Title 35 of the Revised Statutes was ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |