|

Depreciation

In accountancy, depreciation is a term that refers to two aspects of the same concept: first, the actual decrease of fair value of an asset, such as the decrease in value of factory equipment each year as it is used and wear, and second, the allocation in accounting statements of the original cost of the assets to periods in which the assets are used (depreciation with the matching principle). Depreciation is thus the decrease in the value of assets and the method used to reallocate, or "write down" the cost of a tangible asset (such as equipment) over its useful life span. Businesses depreciate long-term assets for both accounting and tax purposes. The decrease in value of the asset affects the balance sheet of a business or entity, and the method of depreciating the asset, accounting-wise, affects the net income, and thus the income statement that they report. Generally, the cost is allocated as depreciation expense among the periods in which the asset is expected to be used. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Depreciation Recapture

Depreciation recapture is the USA Internal Revenue Service (IRS) procedure for collecting income tax on a gain realized by a taxpayer when the taxpayer disposes of an asset that had previously provided an offset to ordinary income for the taxpayer through depreciation. In other words, because the IRS allows a taxpayer to deduct the depreciation of an asset from the taxpayer's ordinary income, the taxpayer has to report any gain from the disposal of the asset (up to the recomputed basis) as ordinary income, not as a capital gain. Depreciation recapture most commonly applies when dealing with the sale of improved real estate (such as rental property), as the value of real estate generally increases over time while the improvements are subject to depreciation. Depreciation recapture in the USA is governed by sections 1245 and 1250 of the Internal Revenue Code (IRC). Any gain over the recomputed basis will be taxed as a capital gain in accordance with section 1231 of the IRC. This ar ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

MACRS

The Modified Accelerated Cost Recovery System (MACRS) is the current tax depreciation system in the United States. Under this system, the capitalized cost (basis) of tangible property is recovered over a specified life by annual deductions for depreciation. The lives are specified broadly in the Internal Revenue Code. The Internal Revenue Service (IRS) publishes detailed tables of lives by classes of assets. The deduction for depreciation is computed under one of two methods (declining balance switching to straight line or straight line) at the election of the taxpayer, with limitations. SeIRS Publication 946for a 120-page guide to MACRS. History Tax deductions for depreciation have been allowed in the U.S. since the inception of the income tax. Prior to 1971, these deductions could be computed in a variety of manners over a wide range of lives, under old Bulletin F. In 1971, Congress introduced the Class Life Asset Depreciation Range (ADR) system in an attempt to simplif ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Matching Principle

In accrual accounting, the matching principle instructs that an expense should be reported in the same period in which the corresponding revenue is earned, and is associated with accrual accounting and the revenue recognition principle states that revenues should be recorded during the period in which they are earned, regardless of when the transfer of cash occurs. By recognizing costs in the period they are incurred, a business can see how much money was spent to generate revenue, reducing "noise" from timing mismatch between when costs are incurred and when revenue is realized. Conversely, cash basis accounting calls for the recognition of an expense when the cash is paid, regardless of when the expense was actually incurred.Accounting Principles by Wild, Shaw, Chiappetta If no cause-and-effect relationship exists (''e.g.,'' a sale is impossible), costs are recognized as expenses in the accounting period they expired: ''i.e.,'' when have been used up or consumed (''e.g.,'' of sp ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Deduction

Tax deduction is a reduction of income that is able to be taxed and is commonly a result of expenses, particularly those incurred to produce additional income. Tax deductions are a form of tax incentives, along with exemptions and tax credits. The difference between deductions, exemptions, and credits is that deductions and exemptions both reduce taxable income, while credits reduce tax. Above and below the line Above and below the line refers to items above or below adjusted gross income, which is item 37 on the tax year 2017 1040 tax form. Tax deductions above the line lessen adjusted gross income, while deductions below the line can only lessen taxable income if the aggregate of those deductions exceeds the standard deduction, which in tax year 2018 in the U.S., for example, was $12,000 for a single taxpayer and $24,000 for married couple. Limitations Often, deductions are subject to conditions, such as being allowed only for expenses incurred that produce current benefits. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income Statement

An income statement or profit and loss accountProfessional English in Use - Finance, Cambridge University Press, p. 10 (also referred to as a ''profit and loss statement'' (P&L), ''statement of profit or loss'', ''revenue statement'', ''statement of financial performance'', ''earnings statement'', ''statement of earnings'', ''operating statement'', or ''statement of operations'') is one of the financial statements of a company and shows the company's revenues and expenses during a particular period. It indicates how the revenues (also known as the ''“top line”'') are transformed into the net income or net profit (the result after all revenues and expenses have been accounted for). The purpose of the income statement is to show managers and investors whether the company made money (profit) or lost money (loss) during the period being reported. An income statement represents a period of time (as does the cash flow statement). This contrasts with the balance sheet, which rep ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

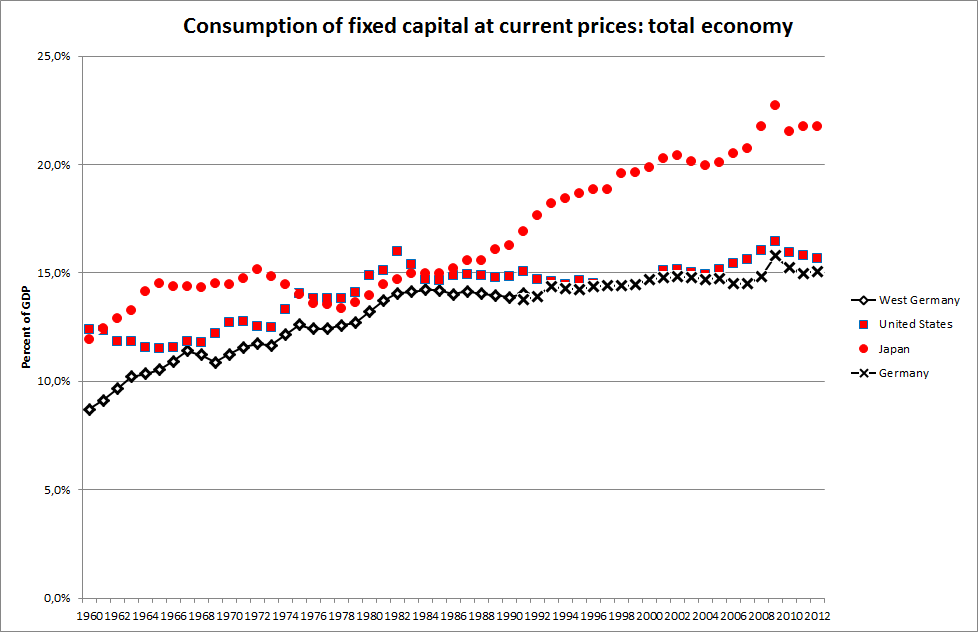

Consumption Of Fixed Capital

Consumption of fixed capital (CFC) is a term used in business accounts, tax assessments and national accounts for depreciation of fixed assets. CFC is used in preference to "depreciation" to emphasize that fixed capital is used up in the process of generating new output, and because unlike depreciation it is not valued at historic cost but at current market value (so-called "economic depreciation"); CFC may also include other expenses incurred in using or installing fixed assets beyond actual depreciation charges. Normally the term applies only to ''producing'' enterprises, but sometimes it applies also to real estate assets. CFC refers to a depreciation charge (or "write-off") against the gross income of a producing enterprise, which reflects the decline in value of fixed capital being operated with. Fixed assets will decline in value after they are purchased for use in production, due to wear and tear, changed market valuation and possibly market obsolescence. Thus, CFC represen ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Allowance

Capital allowances is the practice of allowing tax payers to get tax relief on capital expenditure by allowing it to be deducted against their annual taxable income. Generally, expenditure qualifying for capital allowances will be incurred on specified capital assets, with the deduction available normally spread over many years. The term is used in the UK and in Ireland. Capital allowances are a replacement of accounting depreciation, which is not generally an allowable deduction in UK and Irish tax returns. Capital allowances can therefore be considered a form of 'tax depreciation', a term more widely used in other tax jurisdictions such as the US. If capital expenditure does not qualify for a form of capital allowance, then it means that the business gets no immediate tax relief on such expenditure. Categories of asset Capital allowances were introduced in the UK in 1946 and may be claimed for: * plant and machinery * structures and buildings * business premises reno ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Asset

In financial accounting, an asset is any resource owned or controlled by a business or an economic entity. It is anything (tangible or intangible) that can be used to produce positive economic value. Assets represent value of ownership that can be converted into cash (although cash itself is also considered an asset). The balance sheet of a firm records the monetaryThere are different methods of assessing the monetary value of the assets recorded on the Balance Sheet. In some cases, the ''Historical Cost'' is used; such that the value of the asset when it was bought in the past is used as the monetary value. In other instances, the present fair market value of the asset is used to determine the value shown on the balance sheet. value of the assets owned by that firm. It covers money and other valuables belonging to an individual or to a business. Assets can be grouped into two major classes: tangible assets and intangible assets. Tangible assets contain various subclasses ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Amortization (accounting)

In accounting, amortization refers to expensing the acquisition cost minus the residual value of intangible assets in a systematic manner over their estimated "useful economic lives" so as to reflect their consumption, expiry, and obsolescence, or other decline in value as a result of use or the passage of time. The term amortization can also refer to the completion of that process, as in "the amortization of the tower was expected in 1734". Depreciation is a corresponding concept for tangible assets. Methodologies for allocating amortization to each accounting period are generally the same as these for depreciation. However, many intangible assets such as goodwill or certain brands may be deemed to have an indefinite useful life and are therefore not subject to amortization (although goodwill is subjected to an impairment test every year). While theoretically amortization is used to account for the decreasing value of an intangible asset over its useful life, in practice m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |