|

Coupon (bond)

In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond. Coupons are normally described in terms of the " coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value. For example, if a bond has a face value of $1,000 and a coupon rate of 5%, then it pays total coupons of $50 per year. Typically, this will consist of two semi-annual payments of $25 each. History The origin of the term "coupon" is that bonds were historically issued in the form of bearer certificates. Physical possession of the certificate was (deemed) proof of ownership. Several coupons, one for each scheduled interest payment, were printed on the certificate. At the date the coupon was due, the owner would detach the coupon and present it for payment (an act called "clipping the coupon"). The certificate often also contained a document called a ''talon'', which (when the orig ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mecca Temple Coupons

Mecca, officially Makkah al-Mukarramah, is the capital of Mecca Province in the Hejaz region of western Saudi Arabia; it is the Holiest sites in Islam, holiest city in Islam. It is inland from Jeddah on the Red Sea, in a narrow valley above sea level. Its metropolitan population in 2022 was 2.4million, making it the List of cities in Saudi Arabia by population, third-most populated city in Saudi Arabia after Riyadh and Jeddah. Around 44.5% of the population are Saudis, Saudi citizens and around 55.5% are Muslim world, Muslim foreigners from other countries. Pilgrims more than triple the population number every year during the Pilgrimage#Islam, pilgrimage, observed in the twelfth Islamic calendar, Hijri month of . With over 10.8 million international visitors in 2023, Mecca was one of the ten List of cities by international visitors, most visited cities in the world. Mecca is generally considered "the fountainhead and cradle of Islam". Mecca is revered in Islam as the birthp ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

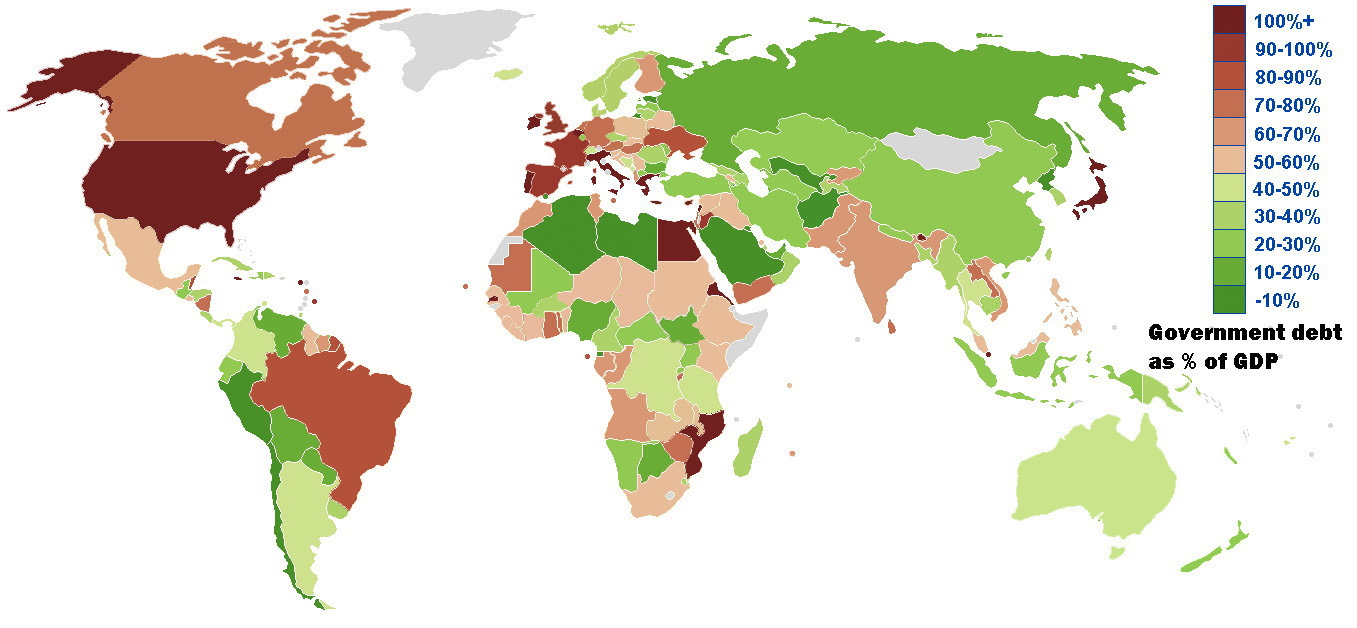

European Sovereign-debt Crisis

The euro area crisis, often also referred to as the eurozone crisis, European debt crisis, or European sovereign debt crisis, was a multi-year debt crisis and financial crisis in the European Union (EU) from 2009 until, in Greece, 2018. The eurozone member states of Greece, Portugal, Ireland, and Cyprus were unable to repay or refinance their government debt or to bailout fragile banks under their national supervision and needed assistance from other eurozone countries, the European Central Bank (ECB), and the International Monetary Fund (IMF). The crisis included the Greek government-debt crisis, the 2008–2014 Spanish financial crisis, the 2010–2014 Portuguese financial crisis, the post-2008 Irish banking crisis and the post-2008 Irish economic downturn, as well as the 2012–2013 Cypriot financial crisis. The crisis contributed to changes in leadership in Greece, Ireland, France, Italy, Portugal, Spain, Slovenia, Slovakia, Belgium, and the Netherlands as well as in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Yield Curve

In finance, the yield curve is a graph which depicts how the Yield to maturity, yields on debt instruments – such as bonds – vary as a function of their years remaining to Maturity (finance), maturity. Typically, the graph's horizontal or x-axis is a time line of months or years remaining to maturity, with the shortest maturity on the left and progressively longer time periods on the right. The vertical or y-axis depicts the annualized yield to maturity. Those who issue and trade in forms of debt, such as loans and bonds, use yield curves to determine their value. Shifts in the shape and slope of the yield curve are thought to be related to investor expectations for the economy and interest rates. Ronald Melicher and Merle Welshans have identified several characteristics of a properly constructed yield curve. It should be based on a set of securities which have differing lengths of time to maturity, and all yields should be calculated as of the same point in time. Al ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Spread (options)

In finance, a credit spread, or net credit spread is an options strategy that involves a purchase of one option and a sale of another option in the same class and expiration but different strike prices. It is designed to make a profit when the spreads between the two options ''narrows''. Investors receive a net credit for entering the position, and want the spreads to ''narrow'' or expire for profit. In contrast, an investor would have to pay to enter a debit spread. In this context, "to narrow" means that the option sold by the trader is in the money at expiration, but by an amount that is less than the net premium received, in which event the trade is profitable but by less than the maximum that would be realized if both options of the spread were to expire worthless. Bullish strategies Bullish options strategies are employed when the options trader expects the underlying stock price to move upwards. It is necessary to assess how high the stock price can go and the time fram ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit (finance)

Credit (from Latin verb ''credit'', meaning "one believes") is the trust which allows one party to provide money or resources to another party wherein the second party does not reimburse the first party immediately (thereby generating a debt), but promises either to repay or return those resources (or other materials of equal value) at a later date. The resources provided by the first party can be either property, fulfillment of promises, or performances. In other words, credit is a method of making reciprocity formal, legally enforceable, and extensible to a large group of unrelated people. The resources provided may be financial (e.g. granting a loan), or they may consist of goods or services (e.g. consumer credit). Credit encompasses any form of deferred payment. Credit is extended by a creditor, also known as a lender, to a debtor, also known as a borrower. Etymology The term "credit" was first used in English in the 1520s. The term came "from Middle French cré ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Investment Banking

Investment banking is an advisory-based financial service for institutional investors, corporations, governments, and similar clients. Traditionally associated with corporate finance, such a bank might assist in raising financial capital by underwriting or acting as the client's agent in the issuance of debt or equity securities. An investment bank may also assist companies involved in mergers and acquisitions (M&A) and provide ancillary services such as market making, trading of derivatives and equity securities FICC services (fixed income instruments, currencies, and commodities) or research (macroeconomic, credit or equity research). Most investment banks maintain prime brokerage and asset management departments in conjunction with their investment research businesses. As an industry, it is broken up into the Bulge Bracket (upper tier), Middle Market (mid-level businesses), and boutique market (specialized businesses). Unlike commercial banks and retail banks, inves ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Yield (finance)

In finance, the yield on a security is a measure of the ex-ante return to a holder of the security. It is one component of return on an investment, the other component being the change in the market price of the security. It is a measure applied to fixed income securities, common stocks, preferred stocks, convertible stocks and bonds, annuities and real estate investments. There are various types of yield, and the method of calculation depends on the particular type of yield and the type of security. Fixed income securities The coupon rate (or nominal rate) on a fixed income security is the interest that the issuer agrees to pay to the security holder each year, expressed as a percentage of the security's principal amount (par value). The current yield is the ratio of the annual interest (coupon) payment and the bond's market price. The yield to maturity is an estimate of the total rate of return anticipated to be earned by an investor who buys a bond at a given market p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Day Count Convention

In finance, a day count convention determines how interest accrues over time for a variety of investments, including bonds, notes, loans, mortgages, medium-term notes, swaps, and forward rate agreements (FRAs). This determines the number of days between two coupon payments, thus calculating the amount transferred on payment dates and also the accrued interest for dates between payments. The day count is also used to quantify periods of time when discounting a cash-flow to its present value. When a security such as a bond is sold between interest payment dates, the seller is eligible to some fraction of the coupon amount. The day count convention is used in many other formulas in financial mathematics as well. Development The need for day count conventions is a direct consequence of interest-earning investments. Different conventions were developed to address often conflicting requirements, including ease of calculation, constancy of time period (day, month, or year) and the ne ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Time Value Of Money

The time value of money refers to the fact that there is normally a greater benefit to receiving a sum of money now rather than an identical sum later. It may be seen as an implication of the later-developed concept of time preference. The time value of money refers to the observation that it is better to receive money sooner than later. Money you have today can be invested to earn a positive rate of return, producing more money tomorrow. Therefore, a dollar today is worth more than a dollar in the future. The time value of money is among the factors considered when weighing the opportunity costs of spending rather than saving or investing money. As such, it is among the reasons why interest is paid or earned: interest, whether it is on a bank deposit or debt, compensates the depositor or lender for the loss of their use of their money. Investors are willing to forgo spending their money now only if they expect a favorable net rate of return, return on their investment in the fut ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Finance

Finance refers to monetary resources and to the study and Academic discipline, discipline of money, currency, assets and Liability (financial accounting), liabilities. As a subject of study, is a field of Business administration, Business Administration wich study the planning, organizing, leading, and controlling of an organization's resources to achieve its goals. Based on the scope of financial activities in financial systems, the discipline can be divided into Personal finance, personal, Corporate finance, corporate, and public finance. In these financial systems, assets are bought, sold, or traded as financial instruments, such as Currency, currencies, loans, Bond (finance), bonds, Share (finance), shares, stocks, Option (finance), options, Futures contract, futures, etc. Assets can also be banked, Investment, invested, and Insurance, insured to maximize value and minimize loss. In practice, Financial risk, risks are always present in any financial action and entities. Due ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Zero-coupon Bond

A zero-coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond. When the bond reaches maturity, its investor receives its par (or face) value. Examples of zero-coupon bonds include US Treasury bills, US savings bonds, long-term zero-coupon bonds, and any type of coupon bond that has been stripped of its coupons. Zero coupon and deep discount bonds are terms that are used interchangeably. In contrast, an investor who has a regular bond receives income from coupon payments, which are made semi-annually or annually. The investor also receives the principal or face value of the investment when the bond matures. Some zero coupon bonds are inflation indexed, and the amount of money that will be paid to the bond holder is calculated to have a set amount of purchasing power, rather than a s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |