|

Country By Country Reporting Rules

Country-by-Country Reporting (CbCR, with the related report pertaining to a particular entity referred to as a Country-by-Country report or CbC report) is an international initiative pioneered by the OECD. It establishes a reporting standard for multinational enterprises (MNEs) with total consolidated group revenues > EUR 750 million containing key tax-related information including financial information and information on employees and non-cash tangible assets. Under the OECD rules, the information is to be exchanged between the tax authorities of the exchanging countries. However, the EU adopted legislation to make Country-by-Country reports publicly available after 2024. History Country-by-Country Reporting was initially proposed in 2003 as an accounting standard. The proposal emanated originally from the Tax Justice Network. The key component was information that would allow reconciliation of financial statements across different national jurisdictions. The initiative was init ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

OECD

The Organisation for Economic Co-operation and Development (OECD; , OCDE) is an international organization, intergovernmental organization with 38 member countries, founded in 1961 to stimulate economic progress and international trade, world trade. It is a forum (legal), forum whose member countries describe themselves as committed to democracy and the market economy, providing a platform to compare policy experiences, seek answers to common problems, identify good practices, and coordinate domestic and international policies of its members. The majority of OECD members are generally regarded as developed country, developed countries, with High-income economy, high-income economies, and a very high Human Development Index. their collective population is 1.38 billion people with an average life expectancy of 80 years and a median age of 40, against a global average of 30. , OECD Member countries collectively comprised 62.2% of list of countries by GDP (nominal), global nom ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Multinational Corporation

A multinational corporation (MNC; also called a multinational enterprise (MNE), transnational enterprise (TNE), transnational corporation (TNC), international corporation, or stateless corporation, is a corporate organization that owns and controls the production of goods or services in at least one country other than its home country. Control is considered an important aspect of an MNC to distinguish it from international portfolio investment organizations, such as some international mutual funds that invest in corporations abroad solely to diversify financial risks. Most of the current largest and most influential companies are Public company, publicly traded multinational corporations, including Forbes Global 2000, ''Forbes'' Global 2000 companies. History Colonialism The history of multinational corporations began with the history of colonialism. The first multinational corporations were founded to set up colonial "factories" or port cities. The two main examples were the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Country By Country Reporting Requirements

A country is a distinct part of the world, such as a state, nation, or other political entity. When referring to a specific polity, the term "country" may refer to a sovereign state, state with limited recognition, constituent country, or dependent territory. Most sovereign states, but not all countries, are members of the United Nations. There is no universal agreement on the number of "countries" in the world, since several states have disputed sovereignty status or limited recognition, and a number of non-sovereign entities are commonly considered countries. The definition and usage of the word "country" are flexible and have changed over time. ''The Economist'' wrote in 2010 that "any attempt to find a clear definition of a country soon runs into a thicket of exceptions and anomalies." Areas much smaller than a political entity may be referred to as a "country", such as the West Country in England, "big sky country" (used in various contexts of the American West), "coal ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Justice Network

The Tax Justice Network (TJN) is a British advocacy group consisting of a coalition of researchers and activists with a shared concern about tax avoidance, tax competition, and tax havens. Activity Research The TJN has reported on the OECD Base erosion and profit shifting (BEPS) projects and conducted their own research that the scale of corporate taxes being avoided by multinationals is an estimated $660 billion in 2012 (a quarter of US multinationals’ gross profits), which is equivalent to 0.9% of World GDP. In July 2012, following a study into wealthy individuals with offshore accounts, the Tax Justice Network published claims regarding deposits worth at least $21 trillion (£13 trillion), potentially even $32 trillion, in secretive tax havens. As a result, governments suffer a lack of income taxes of up to $280 billion. In November 2020, the TJN published "The State of Tax Justice 2020" report. It claims $427 billion is lost every year to tax abuse. Financial Secre ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Base Erosion And Profit Shifting (OECD Project)

The OECD G20 Base Erosion and Profit Shifting Project (or BEPS Project) is an OECD/ G20 project to set up an international framework to combat tax avoidance by multinational enterprises ("MNEs") using '' base erosion and profit shifting'' tools. The project, led by the OECD's Committee on Fiscal Affairs, began in 2013 with OECD and G20 countries, in a context of financial crisis and tax affairs (e.g. Offshore Leaks). Currently, after the BEPS report has been delivered in 2015, the project is now in its implementation phase, 116 countries are involved including a majority of developing countries. During two years, the package was developed by participating members on an equal footing, as well as widespread consultations with jurisdictions and stakeholders, including business, academics and civil society. And since 2016, the OECD/G20 Inclusive Framework on BEPS provides for its 140 members a platform to work on an equal footing to tackle BEPS, including through peer review of t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Avoidance

Tax avoidance is the legal usage of the tax regime in a single territory to one's own advantage to reduce the amount of tax that is payable. A tax shelter is one type of tax avoidance, and tax havens are jurisdictions that facilitate reduced taxes. Tax avoidance should not be confused with tax evasion, which is illegal. Forms of tax avoidance that use legal tax laws in ways not necessarily intended by the government are often criticized in the court of public opinion and by journalists. Many businesses pay little or no tax, and some experience a backlash (sociology), backlash when their tax avoidance becomes known to the public. Conversely, benefiting from tax laws in ways that were intended by governments is sometimes referred to as tax planning. The World Bank's World Development Report 2019 on the future of work supports increased government efforts to curb tax avoidance as part of a new social contract focused on human capital investments and expanded social protection. "T ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Rishi Sunak

Rishi Sunak (born 12 May 1980) is a British politician who served as Prime Minister of the United Kingdom and Leader of the Conservative Party (UK), Leader of the Conservative Party from 2022 to 2024. Following his defeat to Keir Starmer's Labour Party (United Kingdom), Labour Party in the 2024 United Kingdom general election, 2024 general election, he became Leader of the Opposition (United Kingdom), Leader of the Opposition, serving in this role from July to November 2024. He previously held two Cabinet of the United Kingdom, Cabinet positions under Boris Johnson, latterly as Chancellor of the Exchequer from 2020 to 2022. Sunak has been Member of Parliament (United Kingdom), Member of Parliament (MP) for Richmond and Northallerton, previously Richmond (Yorks), since 2015. Sunak was born in Southampton to parents of Indian descent who immigrated to Britain from East Africa in the 1960s. He was educated at Winchester College, studied philosophy, politics and economics at Linc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

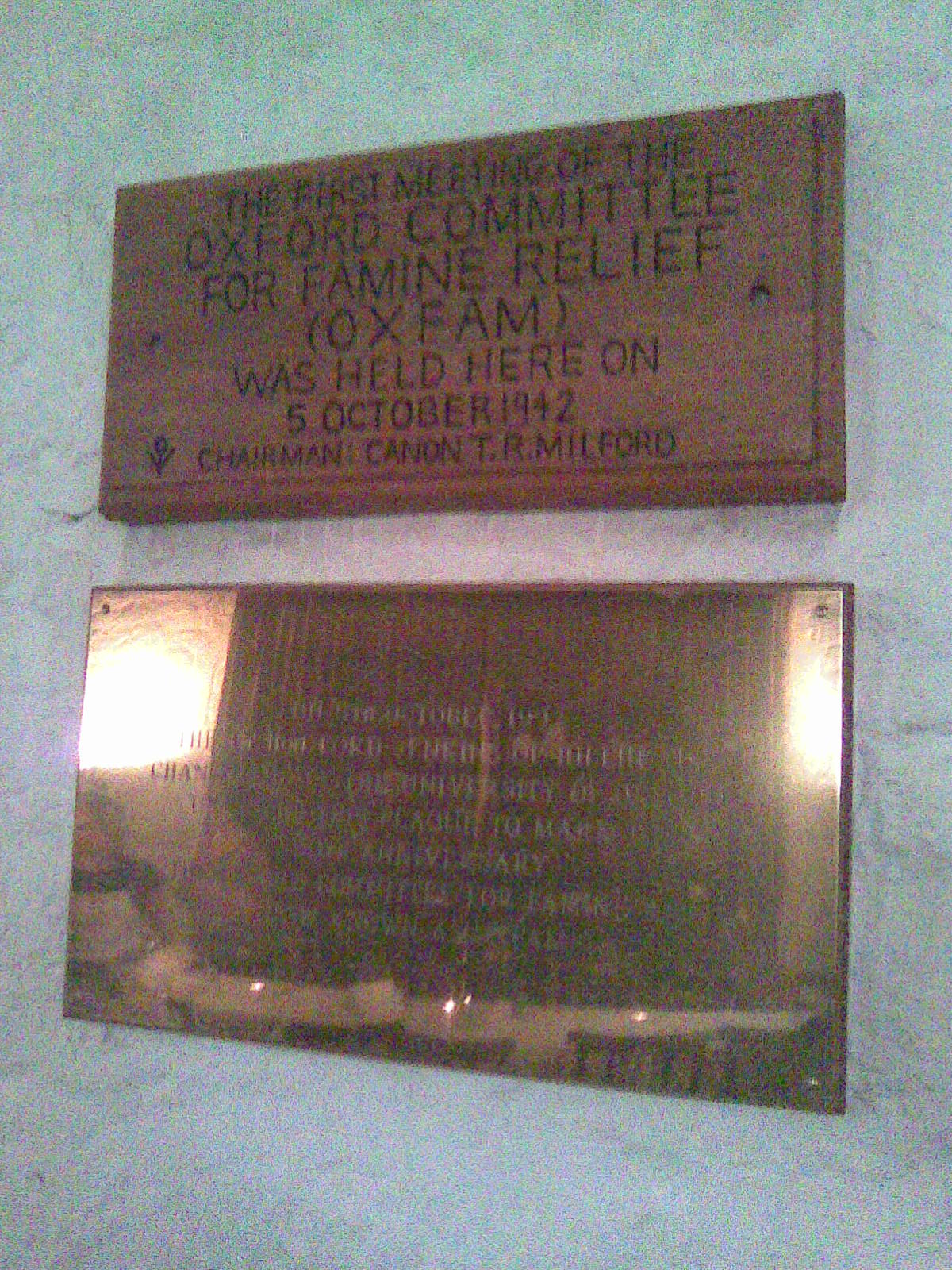

Oxfam

Oxfam is a British-founded confederation of 21 independent non-governmental organizations (NGOs), focusing on the alleviation of global poverty, founded in 1942 and led by Oxfam International. It began as the Oxford Committee for Famine Relief in Oxford, UK, in 1942, to alleviate World War Two related hunger and continued in the aftermath of the war. Oxfam has an international presence with operations in 79 countries and 21 members in the Oxfam Confederation in Australia, Asia, Europe, the Middle East, North and Latin America and the Caribbean. Since 2005, Oxfam International has been involved in a series of controversies as it expanded, especially concerning its operations in Haiti and Chad. There have been criticisms of its management of operations in the UK as well. History Founded at 17 Broad Street, Oxford, as the Oxford Committee for Famine Relief by a group of Quakers, social activists, and Oxford academics in 1942 and registered in accordance with UK law in 1943 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Double Irish Arrangement

The Double Irish arrangement was a base erosion and profit shifting (BEPS) corporate tax avoidance tool used mainly by United States multinationals since the late 1980s to avoid corporate taxation on non-U.S. profits. (The US was one of a small number of countries that did not use a "territorial" tax system, and taxed corporations on all profits, no matter whether the profit was made outside the US or not, in contrast to "territorial" tax systems which tax only profits made within that country.) It was the largest tax avoidance tool in history. By 2010, it was shielding US$100 billion annually in US multinational foreign profits from taxation, and was the main tool by which US multinationals built up untaxed offshore reserves of US$1 trillion from 2004 to 2018. Traditionally, it was also used with the Dutch Sandwich BEPS tool; however, 2010 changes to tax laws in Ireland dispensed with this requirement. Despite US knowledge of the Double Irish for a decade, it was the Eur ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ireland V Commission

Apple's EU tax dispute refers to an investigation by the European Commission into tax arrangements between Apple and Ireland, which allowed the company to pay close to zero corporate tax over 10 years. On 29 August 2016, after a two-year investigation, European Commission ordered Apple to pay €13 billion, plus interest, in unpaid Irish taxes from 2004–14 to the Irish state. It was the largest corporate tax fine (in fact a recovery order, technically not a fine) in history. Helena Malikova, an EU civil servant, was credited with uncovering the extent of the tax avoidance by Apple, namely that the company was paying only 0.005 per cent tax on profits booked through its Irish subsidiary. In November 2016, the Irish government formally appealed the ruling, claiming there was no violation of Irish tax law, and that the commission's action was "an intrusion into Irish sovereignty", as national tax policy is excluded from EU treaties. In November 2016, Apple CEO Tim Coo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |