|

Convergence Trade

Convergence trade is a trading strategy consisting of two positions: buying one asset forward—i.e., for delivery in future (going ''long'' the asset)—and selling a similar asset forward (going '' short'' the asset) for a higher price, in the expectation that by the time the assets must be delivered, the prices will have become closer to equal (will have converged), and thus one profits by the amount of convergence. Convergence trades are often referred to as arbitrage, though in careful use arbitrage only refers to trading in ''the same'' or ''identical'' assets or cash flows, rather than in ''similar'' assets. Examples On the run/off the run On-the-run bonds (the most recently issued) generally trade at a premium over otherwise similar bonds, because they are more liquid—there is a liquidity premium. Once a newer bond is issued, this liquidity premium will generally decrease or disappear. For example, the 30-year US treasury bond generally trades at a premium relati ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Forward Contract

In finance, a forward contract, or simply a forward, is a non-standardized contract between two parties to buy or sell an asset at a specified future time at a price agreed on in the contract, making it a type of derivative instrument.John C Hull'', Options, Futures and Other Derivatives (6th edition)'', Prentice Hall: New Jersey, USA, 2006, 3 The party agreeing to buy the underlying asset in the future assumes a long position, and the party agreeing to sell the asset in the future assumes a short position. The price agreed upon is called the ''delivery price'', which is equal to the forward price at the time the contract is entered into. The price of the underlying instrument, in whatever form, is paid before control of the instrument changes. This is one of the many forms of buy/sell orders where the time and date of trade is not the same as the value date where the securities themselves are exchanged. Forwards, like other derivative securities, can be used to hedge ris ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Margin (finance)

In finance, margin is the collateral that a holder of a financial instrument has to deposit with a counterparty (most often their broker or an exchange) to cover some or all of the credit risk the holder poses for the counterparty. This risk can arise if the holder has done any of the following: * Borrowed cash from the counterparty to buy financial instruments, * Borrowed financial instruments to sell them short, * Entered into a derivative contract. The collateral for a margin account can be the cash deposited in the account or securities provided, and represents the funds available to the account holder for further share trading. On United States futures exchanges, margins were formerly called performance bonds. Most of the exchanges today use SPAN ("Standard Portfolio Analysis of Risk") methodology, which was developed by the Chicago Mercantile Exchange in 1988, for calculating margins for options and futures. Margin account A margin account is a loan account w ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

LTCM

Long-Term Capital Management L.P. (LTCM) was a highly leveraged hedge fund. In 1998, it received a $3.6 billion bailout from a group of 14 banks, in a deal brokered and put together by the Federal Reserve Bank of New York. LTCM was founded in 1994 by John Meriwether, the former vice-chairman and head of bond trading at Salomon Brothers. Members of LTCM's board of directors included Myron Scholes and Robert C. Merton, who three years later in 1997 shared the Nobel Prize in Economics for having developed the Black–Scholes model of financial dynamics.''A financial History of the United States Volume II: 1970–2001'', Jerry W. Markham, Chapter 5: "Bank Consolidation", M. E. Sharpe, Inc., 2002 LTCM was initially successful, with annualized returns (after fees) of around 21% in its first year, 43% in its second year and 41% in its third year. However, in 1998 it lost $4.6 billion in less than four months due to a combination of high leverage and exposure to the 1997 Asian fin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Concave Payoff

Concave or concavity may refer to: Science and technology * Concave lens * Concave mirror Mathematics * Concave function, the negative of a convex function * Concave polygon A simple polygon that is not convex is called concave, non-convex or reentrant. A concave polygon will always have at least one reflex interior angle—that is, an angle with a measure that is between 180° degrees and 360° degrees exclusive. ..., a polygon which is not convex * Concave set * The concavity of a function, determined by its second derivative See also * {{disambiguation, math ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Negative Skew

In probability theory and statistics, skewness is a measure of the asymmetry of the probability distribution of a real-valued random variable about its mean. The skewness value can be positive, zero, negative, or undefined. For a unimodal distribution (a distribution with a single peak), negative skew commonly indicates that the ''tail'' is on the left side of the distribution, and positive skew indicates that the tail is on the right. In cases where one tail is long but the other tail is fat, skewness does not obey a simple rule. For example, a zero value in skewness means that the tails on both sides of the mean balance out overall; this is the case for a symmetric distribution but can also be true for an asymmetric distribution where one tail is long and thin, and the other is short but fat. Thus, the judgement on the symmetry of a given distribution by using only its skewness is risky; the distribution shape must be taken into account. Introduction Consider the two d ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Short Squeeze

In the stock market, a short squeeze is a rapid increase in the price of a stock owing primarily to an excess of short selling of a stock rather than underlying fundamentals. A short squeeze occurs when demand has increased relative to supply because short sellers have to buy stock to cover their short positions. Overview Short selling is a finance practice in which an investor, known as the short-seller, borrows shares of stock and immediately sells them, hoping to buy them back later ("covering") at a lower price. As the shares were borrowed, the short-seller must eventually return that number of shares to the lender (plus interest and dividends, if any), and therefore makes a profit if they spend less buying back the shares than they received at the earlier date when selling them. However, an unexpected piece of favorable news can cause a jump in the stock's share price, resulting in a loss rather than a profit. Short-sellers might then be triggered to buy the shares they had b ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Flight To Quality

A flight-to-quality, or flight-to-safety, is a financial market phenomenon occurring when investors sell what they perceive to be higher-risk investments and purchase safer investments, such as gold and government bonds. This is considered a sign of fear in the marketplace, as investors seek less risk in exchange for lower profits. Flight-to-quality is usually accompanied by an increase in demand for assets that are government-backed and a decline in demand for assets backed by private agents. Definition More broadly, flight-to-quality refers to a sudden shift in investment behaviors in a period of financial turmoil whereby investors seek to sell assets perceived as risky and instead purchase safe assets. A defining feature of flight-to-quality is insufficient risk-taking by investors. While excessive risk-taking can be a source of financial turmoil, insufficient risk-taking can severely disrupt credit and other financial markets during a financial turmoil. Such a portfolio shift ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

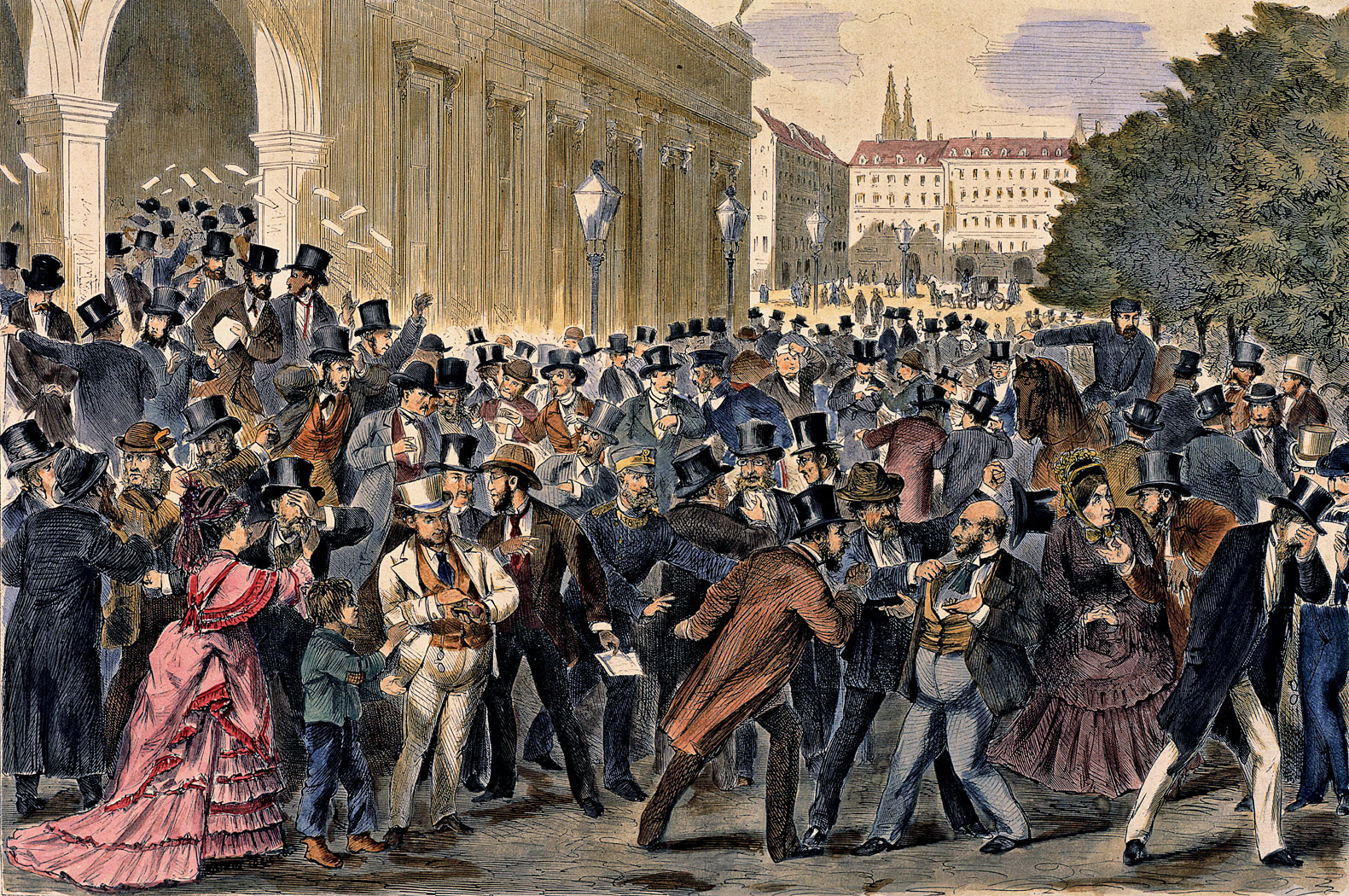

Financial Crisis

A financial crisis is any of a broad variety of situations in which some financial assets suddenly lose a large part of their nominal value. In the 19th and early 20th centuries, many financial crises were associated with Bank run#Systemic banking crises, banking panics, and many recessions coincided with these panics. Other situations that are often called financial crises include stock market crashes and the bursting of other financial Economic bubble, bubbles, currency crisis, currency crises, and sovereign defaults. Financial crises directly result in a loss of paper wealth but do not necessarily result in significant changes in the real economy (for example, the crisis resulting from the famous tulip mania bubble in the 17th century). Many economists have offered theories about how financial crises develop and how they could be prevented. There is little consensus and financial crises continue to occur from time to time. It is apparent however that a consistent feature of bo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Put Option

In finance, a put or put option is a derivative instrument in financial markets that gives the holder (i.e. the purchaser of the put option) the right to sell an asset (the ''underlying''), at a specified price (the ''strike''), by (or on) a specified date (the '' expiry'' or ''maturity'') to the ''writer'' (i.e. seller) of the put. The purchase of a put option is interpreted as a negative sentiment about the future value of the underlying stock. page 15 , 4.2.3 Positive and negative sentiment The term "put" comes from the fact that the owner has the right to "put up for sale" the stock or index. Puts may also be combined with other derivatives as part of more complex investment strategies, and in particular, may be useful for hedging. Holding a European put option is equivalent to holding the corresponding call option and selling an appropriate forward contract. This equivalence is called " put-call parity". Put options are most commonly used in the stock market to prot ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Margin Call

''Margin Call'' is a 2011 American drama film written and directed by J. C. Chandor in his feature directorial debut. The principal story takes place over a 24-hour period at a large Wall Street investment bank during the initial stages of the 2008 financial crisis. It focuses on the actions taken by a group of employees during the subsequent financial collapse. The title comes from the finance term for when an investor must increase the securities or other assets used as collateral for a loan when their value falls below a certain threshold. The film stars an ensemble cast consisting of Kevin Spacey, Paul Bettany, Jeremy Irons, Zachary Quinto, Penn Badgley, Simon Baker, Mary McDonnell, Demi Moore, and Stanley Tucci. The film was produced by Myriad Pictures, Benaroya Pictures and Before the Door Pictures (which was the first to sign on and is owned by Zachary Quinto). It was produced in association with Washington Square Films. Theatrically, it was distributed by Lio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

John Maynard Keynes

John Maynard Keynes, 1st Baron Keynes ( ; 5 June 1883 – 21 April 1946), was an English economist and philosopher whose ideas fundamentally changed the theory and practice of macroeconomics and the economic policies of governments. Originally trained in mathematics, he built on and greatly refined earlier work on the causes of business cycles. One of the most influential economists of the 20th century, he produced writings that are the basis for the schools of economic thought, school of thought known as Keynesian economics, and its various offshoots. His ideas, reformulated as New Keynesianism, are fundamental to mainstream economics, mainstream macroeconomics. He is known as the "father of macroeconomics". During the Great Depression of the 1930s, Keynes spearheaded Keynesian Revolution, a revolution in economic thinking, challenging the ideas of neoclassical economics that held that free markets would, in the short to medium term, automatically provide full employment, as ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Short (finance)

In finance, being short in an asset means investing in such a way that the investor will profit if the market value of the asset falls. This is the opposite of the more common Long (finance), long Position (finance), position, where the investor will profit if the market value of the asset rises. An investor that sells an asset short is, as to that asset, a short seller. There are a number of ways of achieving a short position. The most basic is physical selling short or short-selling, by which the short seller Securities lending, borrows an asset (often a security (finance), security such as a share (finance), share of stock or a bond (finance), bond) and sells it. The short seller must later buy the same amount of the asset to return it to the lender. If the market price of the asset has fallen in the meantime, the short seller will have made a profit equal to the difference in price. Conversely, if the price has risen then the short seller will bear a loss. The short seller ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |