|

Commodity Trading Advisor

A commodity trading advisor (CTA) is US financial regulatory term for an individual or organization who is retained by a fund or individual client to provide advice and services related to trading in futures contracts, commodity options and/or swaps. They are responsible for the trading within managed futures accounts. The definition of CTA may also apply to investment advisors for hedge funds and private funds including mutual funds and exchange-traded funds in certain cases. CTAs are generally regulated by the United States federal government through registration with the Commodity Futures Trading Commission (CFTC) and membership of the National Futures Association (NFA). Characteristics Trading activities A CTA generally acts as an asset manager, following a set of investment strategies utilizing futures contracts and options on futures contracts on a wide variety of physical goods such as agricultural products, forest products, metals, and energy, plus derivative contrac ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Regulation

Financial regulation is a broad set of policies that apply to the financial sector in most jurisdictions, justified by two main features of finance: systemic risk, which implies that the failure of financial firms involves public interest considerations; and information asymmetry, which justifies curbs on freedom of contract in selected areas of financial services, particularly those that involve retail clients and/or principal–agent problems. An integral part of financial regulation is the supervision of designated financial firms and markets by specialized authorities such as securities commissions and bank supervision, bank supervisors. In some jurisdictions, certain aspects of financial supervision are delegated to self-regulatory organizations. Financial regulation forms one of three legal categories which constitutes the content of financial law, the other two being market practices and case law. History In the early modern period, the Dutch were the pioneers in finan ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Technical Analysis

In finance, technical analysis is an analysis methodology for analysing and forecasting the direction of prices through the study of past market data, primarily price and volume. As a type of active management, it stands in contradiction to much of modern portfolio theory. The efficacy of technical analysis is disputed by the efficient-market hypothesis, which states that stock market prices are essentially unpredictable, and research on whether technical analysis offers any benefit has produced mixed results.Osler, Karen (July 2000). "Support for Resistance: Technical Analysis and Intraday Exchange Rates," FRBNY Economic Policy Reviewabstract and paper here. It is distinguished from fundamental analysis, which considers a company's financial statements, health, and the overall state of the market and economy. History The principles of technical analysis are derived from hundreds of years of financial market data. Some aspects of technical analysis began to appear in Amste ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Grain Futures Act

The Grain Futures Act (ch. 369, , ) is a United States federal law enacted September 21, 1922 involving the regulation of trading in certain commodity futures, and causing the establishment of the Grain Futures Administration, a predecessor organization to the Commodity Futures Trading Commission. The bill that became the Grain Futures Act was introduced in the United States Congress two weeks after the US Supreme Court declared the Futures Trading Act of 1921 unconstitutional in Hill v. Wallace 259 U.S. 44 (1922).Markham, Jerry The history of Commodity futures Trading and its Regulation, 13 The Grain Futures Act was held to be constitutional by the US Supreme Court in Board of Trade of City of Chicago v. Olsen 262 US 1 (1923). In 1936 it was revised into the Commodity Exchange Act (CEA). The act was further superseded in 1974 by establishing the Commodity Futures Trading Commission. In 1982 the Commodity Futures Trading Commission created the National Futures Associati ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Futures Trading

In finance, a futures contract (sometimes called futures) is a standardized legal contract to buy or sell something at a predetermined price for delivery at a specified time in the future, between parties not yet known to each other. The item transacted is usually a commodity or financial instrument. The predetermined price of the contract is known as the ''forward price'' or ''delivery price''. The specified time in the future when delivery and payment occur is known as the ''delivery date''. Because it derives its value from the value of the underlying asset, a futures contract is a derivative. Contracts are traded at futures exchanges, which act as a marketplace between buyers and sellers. The buyer of a contract is said to be the long position holder and the selling party is said to be the short position holder. As both parties risk their counter-party reneging if the price goes against them, the contract may involve both parties lodging as security a margin of the value of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Minimum Acceptable Rate Of Return

In corporate finance, business, and engineering economics - in both industrial engineering and civil engineering - the minimum acceptable rate of return (often abbreviated MARR) is the minimum rate of return on a project a manager or company is willing to accept. A synonym seen in many contexts is minimum attractive rate of return. The term hurdle rate (or cutoff rate) is also frequently used as a synonym, particularly in corporate finance, where the benchmark is often the cost of capital. See . MARR increases with increased risk, and given the opportunity cost of forgoing other projects. It is typically referenced in the preliminary analysis of proposed projects. Hurdle rate determination The hurdle rate is usually determined by evaluating existing opportunities in operations expansion, rate of return for investments, and other factors deemed relevant by management. As an example, suppose a manager knows that investing in a conservative project, such as a bond investment or a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Engineering

Engineering is the practice of using natural science, mathematics, and the engineering design process to Problem solving#Engineering, solve problems within technology, increase efficiency and productivity, and improve Systems engineering, systems. Modern engineering comprises many subfields which include designing and improving infrastructure, machinery, vehicles, electronics, Materials engineering, materials, and energy systems. The Academic discipline, discipline of engineering encompasses a broad range of more Academic specialization, specialized fields of engineering, each with a more specific emphasis for applications of applied mathematics, mathematics and applied science, science. See glossary of engineering. The word '':wikt:engineering, engineering'' is derived from the Latin . Definition The American Engineers' Council for Professional Development (the predecessor of the Accreditation Board for Engineering and Technology aka ABET) has defined "engineering" as: ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Statistics

Statistics (from German language, German: ', "description of a State (polity), state, a country") is the discipline that concerns the collection, organization, analysis, interpretation, and presentation of data. In applying statistics to a scientific, industrial, or social problem, it is conventional to begin with a statistical population or a statistical model to be studied. Populations can be diverse groups of people or objects such as "all people living in a country" or "every atom composing a crystal". Statistics deals with every aspect of data, including the planning of data collection in terms of the design of statistical survey, surveys and experimental design, experiments. When census data (comprising every member of the target population) cannot be collected, statisticians collect data by developing specific experiment designs and survey sample (statistics), samples. Representative sampling assures that inferences and conclusions can reasonably extend from the sample ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mathematics

Mathematics is a field of study that discovers and organizes methods, Mathematical theory, theories and theorems that are developed and Mathematical proof, proved for the needs of empirical sciences and mathematics itself. There are many areas of mathematics, which include number theory (the study of numbers), algebra (the study of formulas and related structures), geometry (the study of shapes and spaces that contain them), Mathematical analysis, analysis (the study of continuous changes), and set theory (presently used as a foundation for all mathematics). Mathematics involves the description and manipulation of mathematical object, abstract objects that consist of either abstraction (mathematics), abstractions from nature orin modern mathematicspurely abstract entities that are stipulated to have certain properties, called axioms. Mathematics uses pure reason to proof (mathematics), prove properties of objects, a ''proof'' consisting of a succession of applications of in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Science

Science is a systematic discipline that builds and organises knowledge in the form of testable hypotheses and predictions about the universe. Modern science is typically divided into twoor threemajor branches: the natural sciences, which study the physical world, and the social sciences, which study individuals and societies. While referred to as the formal sciences, the study of logic, mathematics, and theoretical computer science are typically regarded as separate because they rely on deductive reasoning instead of the scientific method as their main methodology. Meanwhile, applied sciences are disciplines that use scientific knowledge for practical purposes, such as engineering and medicine. The history of science spans the majority of the historical record, with the earliest identifiable predecessors to modern science dating to the Bronze Age in Ancient Egypt, Egypt and Mesopotamia (). Their contributions to mathematics, astronomy, and medicine entered and shaped the Gree ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Quantitative Analysis (finance)

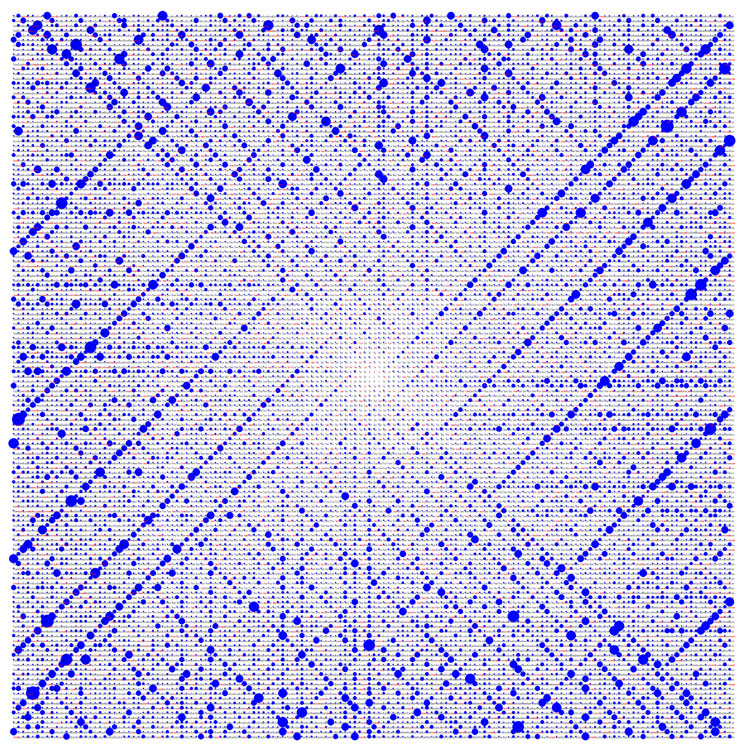

Quantitative analysis is the use of mathematical and statistical methods in finance and investment management. Those working in the field are quantitative analysts (quants). Quants tend to specialize in specific areas which may include derivative structuring or pricing, risk management, investment management and other related finance occupations. The occupation is similar to those in industrial mathematics in other industries. The process usually consists of searching vast databases for patterns, such as correlations among liquid assets or price-movement patterns ( trend following or reversion). Although the original quantitative analysts were "sell side quants" from market maker firms, concerned with derivatives pricing and risk management, the meaning of the term has expanded over time to include those individuals involved in almost any application of mathematical finance, including the buy side. Applied quantitative analysis is commonly associated with quantitative investment ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Options Spread

Option strategies are the simultaneous, and often mixed, buying or selling of one or more options that differ in one or more of the options' variables. Call options, simply known as Calls, give the buyer a right to buy a particular stock at that option's strike price. Opposite to that are Put options, simply known as Puts, which give the buyer the right to sell a particular stock at the option's strike price. This is often done to gain exposure to a specific type of opportunity or risk while eliminating other risks as part of a trading strategy. A very straightforward strategy might simply be the buying or selling of a single option; however, option strategies often refer to a combination of simultaneous buying and or selling of options. Options strategies allow traders to profit from movements in the underlying assets based on market sentiment (i.e., bullish, bearish or neutral). In the case of neutral strategies, they can be further classified into those that are bullish on vo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Short-term Trading

Short-term trading refers to those trading strategies in stock market or futures market in which the time duration between entry and exit is within a range of few days to few weeks. There are two main schools of thought: swing trading and trend following. Day trading is an extremely short-term style of trading in which all positions entered during a trading day are exited the same day. Short term trading can be risky and unpredictable due to the volatile nature of the stock market at times. Within the time frame of a day and a week many factors can have a major effect on a stock's price. Company news, reports, and consumer’s attitudes can all have a positive or negative effect on the stock going up or down. According to Zweig (2006), "In an article in a women's magazine many years ago we advised the readers to buy their stocks as they bought their groceries, not as they bought their perfume" (p. 8). This means doing the research to spot the best opportunities and leaving t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |