|

Co-operative Banking Group

Co-operative Banking Group Limited (originally Co-operative Financial Services) was a UK-based banking and insurance company and a wholly owned subsidiary of The Co-operative Group. Established in 2002, its head office was located at the CIS Tower, Miller Street, Manchester. It was mainly known through its two main subsidiaries: The Co-operative Bank (incorporating Smile, the first full internet bank in the UK) and The Co-operative Insurance. Co-operative Financial Services was formed as a holding company to bring these financial subsidiaries together under one umbrella society and to enable synergies between the businesses to be exploited. Following the Co-operative Bank's financial crisis in 2013, the group sold a majority of shares in the business, retaining a 20% stake. As a result, the group was reorganised, and the banking group structure was discontinued. History In 2007, the Group agreed to outsource its information systems to Xansa (now Sopra Steria). In 2008, Co-o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Consumer Co-operative

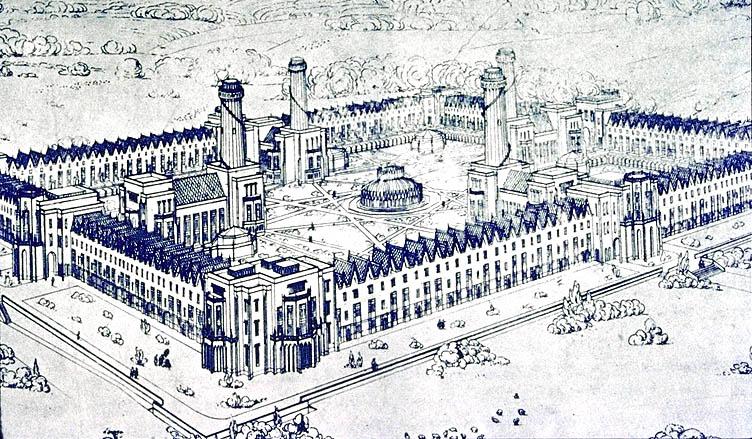

A consumer cooperative is an business, enterprise owned by consumers and managed democracy, democratically and that aims at fulfilling the needs and aspirations of its members. Such cooperatives operate within the market economy independently of the state, as a form of mutual aid oriented toward service rather than pecuniary profit. Many cooperatives, however, do have a degree of profit orientation. Just like other corporations, some cooperatives issue dividends to owners based on a share of total net profit or earnings (all owners typically receive the same amount); or based on a percentage of the total amount of purchases made by the owner. Regardless of whether they issue a dividend or not, most consumers’ cooperatives will offer owners discounts and preferential access to goods and services. Consumer cooperatives often take the form of retail outlets owned and operated by their consumers, such as food cooperatives. However, there are many types of consumers' cooperatives, ope ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sopra Steria

Sopra Steria is a European-based consulting, digital services, and software development company with 50,000 consultants. The company is headquartered in Paris and has operations in several countries in Western Europe. Sopra Steria has a new consulting wing under the "Next" brand. It employs 3,400 consultants across Europe, including 1,900 in the group's native France. After adding the shares held directly in registered form by current and former Group employees, these proportions amount to nearly 10% of the share capital and 13% of voting rights, thereby making employees the Group's second-largest shareholder. History Sopra was created in 1968, followed closely by the 1969 founding of Steria. SODERI (Information Research and Development Company) holds 51%, the BNP Group holds 29.5% and the Indochina Group holds 19.5%. By 1971, Sopra signed its first large global banking managed services agreement, which led to the first banking platform the following year. Steria computerized ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Of England

The Bank of England is the central bank of the United Kingdom and the model on which most modern central banks have been based. Established in 1694 to act as the Kingdom of England, English Government's banker and debt manager, and still one of the bankers for the government of the United Kingdom, it is the world's second oldest central bank. The bank was privately owned by stockholders from its foundation in 1694 until it was nationalised in 1946 by the Attlee ministry. In 1998 it became an independent public organisation, wholly owned by the Treasury Solicitor on behalf of the government, with a mandate to support the economic policies of the government of the day, but independence in maintaining price stability. In the 21st century the bank took on increased responsibility for maintaining and monitoring financial stability in the UK, and it increasingly functions as a statutory Financial regulation, regulator. The bank's headquarters have been in London's main financial di ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pound Sterling

Sterling (symbol: £; currency code: GBP) is the currency of the United Kingdom and nine of its associated territories. The pound is the main unit of sterling, and the word '' pound'' is also used to refer to the British currency generally, often qualified in international contexts as the British pound or the pound sterling. Sterling is the world's oldest currency in continuous use since its inception. In 2022, it was the fourth-most-traded currency in the foreign exchange market, after the United States dollar, the euro, and the Japanese yen. Together with those three currencies and the renminbi, it forms the basket of currencies that calculate the value of IMF special drawing rights. As of late 2022, sterling is also the fourth most-held reserve currency in global reserves. The Bank of England is the central bank for sterling, issuing its own banknotes and regulating issuance of banknotes by private banks in Scotland and Northern Ireland. Sterling banknotes issu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Royal London Group

The Royal London Mutual Insurance Society Limited, along with its subsidiaries, is the largest mutual insurer and investment company in the United Kingdom, and in the top 30 mutuals globally, with Group funds under management of £169 billion, as of March 2024. Group businesses provide 8.5 million policies and employ over 4,400 people, as of June 2024. Group Royal London is the largest mutual life, pensions and investment company in the UK, while also providing protection products in Ireland. Offices Royal London is registered in England with its head office in the City of London. It has other large offices in Alderley Park and Edinburgh, with smaller offices in Glasgow, Dublin, Lichfield & Liverpool. History Founded in 1861 by Joseph Degge and Henry Ridge in a London coffee shop, Royal London was initially set up as a friendly society dedicated to serving the interest of its members and securing their financial security. Royal London became a mutual life assurance societ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Rating

A credit rating is an evaluation of the credit risk of a prospective debtor (an individual, a business, company or a government). It is the practice of predicting or forecasting the ability of a supposed debtor to pay back the debt or default. The credit rating represents an evaluation from a credit rating agency of the qualitative and quantitative information for the prospective debtor, including information provided by the prospective debtor and other non-public information obtained by the credit rating agency's analysts. Credit reporting (or credit score) is a subset of credit rating. It is a numeric evaluation of an ''individual's'' credit worthiness, which is done by a credit bureau or consumer credit reporting agency. Sovereign credit ratings A sovereign credit rating is the credit rating of a sovereign entity, such as a national government. The sovereign credit rating indicates the risk level of the investing environment of a country and is used by investors when looki ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Moody's

Moody's Ratings, previously and still legally known as Moody's Investors Service and often referred to as Moody's, is the bond credit rating business of Moody's Corporation, representing the company's traditional line of business and its historical name. Moody's Ratings provides international financial research on bonds issued by commercial and government entities. Moody's, along with Standard & Poor's and Fitch Group, is considered one of the Big Three credit rating agencies. It is also included in the ''Fortune'' 500 list of 2021. The company ranks the creditworthiness of borrowers using a standardized ratings scale which measures expected investor loss in the event of default. Moody's Ratings rates debt securities in several bond market segments. These include government, municipal and corporate bonds; managed investments such as money market funds and fixed-income funds; financial institutions including banks and non-bank finance companies; and asset classes in struct ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

European Commission

The European Commission (EC) is the primary Executive (government), executive arm of the European Union (EU). It operates as a cabinet government, with a number of European Commissioner, members of the Commission (directorial system, informally known as "commissioners") corresponding to two thirds of the number of Member state of the European Union, member states, unless the European Council, acting unanimously, decides to alter this number. The current number of commissioners is 27, including the president. It includes an administrative body of about 32,000 European civil servants. The commission is divided into departments known as Directorate-General, Directorates-General (DGs) that can be likened to departments or Ministry (government department), ministries each headed by a director-general who is responsible to a commissioner. Currently, there is one member per European Union member state, member state, but members are bound by their oath of office to represent the genera ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Lloyds Banking Group

Lloyds Banking Group plc is a British financial institution formed through the acquisition of HBOS by Lloyds TSB in 2009. It is one of the UK's largest financial services organisations, with 30 million customers and 65,000 employees. Lloyds Bank was founded in 1765 but the wider Group's heritage extends over 320 years, dating back to the founding of the Bank of Scotland by the Parliament of Scotland in 1695. The Group's headquarters are located at 25 Gresham Street in the City of London, while its registered office is on The Mound in Edinburgh. It also operates office sites in Birmingham, Bristol, West Yorkshire and Glasgow. The Group also has overseas operations in the US and Europe. Its headquarters for business in the European Union is in Berlin, Germany. The business operates under a number of distinct brands, including Lloyds Bank, Halifax, Bank of Scotland and Scottish Widows. Former Chief Executive António Horta-Osório told ''The Banker'', "We will keep the d ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Suisse

Credit Suisse Group AG (, ) was a global Investment banking, investment bank and financial services firm founded and based in Switzerland. According to UBS, eventually Credit Suisse was to be fully integrated into UBS. While the integration was yet to be completed, both banks are operating separately. However, on May 31, 2024, it was announced that Credit Suisse ceased to exist. Headquartered in Zürich, as a standalone firm, it maintained offices in all major financial centres around the world and provided services in investment banking, private banking, asset management, and shared services. It was known for strict Bank secrecy, bank–client confidentiality and Banking in Switzerland, banking secrecy. The Financial Stability Board considered it to be a Systemically important financial institution, global systemically important bank. Credit Suisse was also a primary dealer and Forex counterparty of the Federal Reserve in the United States. Credit Suisse was founded in 185 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Building Societies (Funding) And Mutual Societies (Transfers) Act 2007

The Building Societies (Funding) and Mutual Societies (Transfers) Act 2007 (c. 26) (sometimes referred to as the Butterfill Act) is an act of Parliament of the Parliament of the United Kingdom. The act gives building societies greater powers to merge with other companies. Passage through Parliament The bill was introduced as a private member's bill by Conservative Member of Parliament Sir John Butterfill, originally titled the Financial Mutuals Arrangements Bill. It was also known as the Butterfill Bill. Mergers under the act There have been several high-profile mergers under the auspices of the act. In August 2009, Britannia Building Society merged with Co-operative Financial Services (part of The Co-operative Group). Britannia initially continued as a brand, although owned by the Co-op. In February 2011, Kent Reliance Building Society pooled its assets with American private equity Private equity (PE) is stock in a private company that does not offer stock to the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Britannia Building Society

The Britannia Building Society was founded as the Leek & Moorlands Building Society in Leek in 1856. It expanded steadily as a regional society until the late 1950s when it began a major expansion drive, partly through branch openings but also some 55 acquisitions. The most substantial of these were the NALGO Building Society in 1960; the Westbourne Park in 1965 (becoming the Leek and Westbourne); and the Eastern Counties Building Society in 1974. The Society’s name was changed to the Britannia Building Society the following year. Following the acquisition of the Bristol & West in 2005, the Britannia became the second-largest building society in the UK (based on total assets of £36.8 billion) at 31 December 2007. It merged with The Co-operative Banking Group in 2009, and was legally dissolved as a separate organisation on 1 August that year; it has remained as a trading name of The Co-operative Bank ever since. In January 2013, the Co-operative announced that the brand wou ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |