|

China Foreign Exchange Trade System

The China Foreign Exchange Trade System (CFETS, zh, 中國外匯交易中心), also known as National Interbank Funding Center (NIFC, zh, 全国银行间同业拆借中心), is a financial market infrastructure and electronic trading platform in China, established in 1994 under the People's Bank of China (PBoC) and established in Shanghai. It provides a major trading platform and pricing center for renminbi and foreign exchange-related products. CFETS is the trading platform of the China Interbank Bond Market (though not for the Chinese repo market, which is traded on the Shanghai Stock Exchange) and participates in China's policy of internationalization of the renminbi. It is supervised by the PBoC. Overview CFETS was created by the PBoC on , initially as the Forex Trading System ( zh, 外汇交易系统), intended to facilitate liquidity for transactions pairing the renminbi with Japanese yen, British pound, New Zealand dollar, Swiss franc, Malaysian ringgit, South A ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United Arab Emirates Dirham

The dirham (; ar, درهم إماراتي, abbreviation: د.إ in Arabic, Dh (singular) and Dhs (plural) or DH in Latin; ISO code: AED) is the official currency of the United Arab Emirates. The dirham is subdivided into 100 . History The name '' dirham'' is a loan from greek δραχμή (drakhmé). Due to centuries of trade and usage of the currency, ''dirham'' survived through the Ottoman Empire. Before 1966, all the emirates that now form the UAE used the Gulf rupee, which was pegged at parity to the Indian rupee. On 6 June 1966, India decided to devalue the Gulf rupee against the Indian rupee. Not accepting the devaluation, several of the states still using the Gulf rupee adopted their own or other currencies. All the Trucial States except Abu Dhabi adopted the Qatar and Dubai riyal, which was equal to the Gulf rupee prior to the devaluation. These emirates briefly adopted the Saudi riyal during the transition from the Gulf rupee to the Qatar and Dubai riyal. Ab ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Shenzhen

Shenzhen (; ; ; ), also historically known as Sham Chun, is a major Sub-provincial division, sub-provincial city and one of the Special economic zones of China, special economic zones of China. The city is located on the east bank of the Pearl River (China), Pearl River estuary on the central coast of southern province of Guangdong, bordering Hong Kong to the south, Dongguan to the north, and Huizhou to the northeast. With a population of 17.56 million as of 2020, Shenzhen is the third most populous city by urban population in China after Shanghai and Beijing. Shenzhen is a global center in List of technology centers, technology, List of cities by scientific output, research, Economy of China#Industry and manufacturing, manufacturing, Shenzhen#Economy, business and economics, Global Financial Centres Index, finance, Shenzhen#Tourism, tourism and Transport in China, transportation, and the Port of Shenzhen is the List of busiest container ports, world's fourth busiest container ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

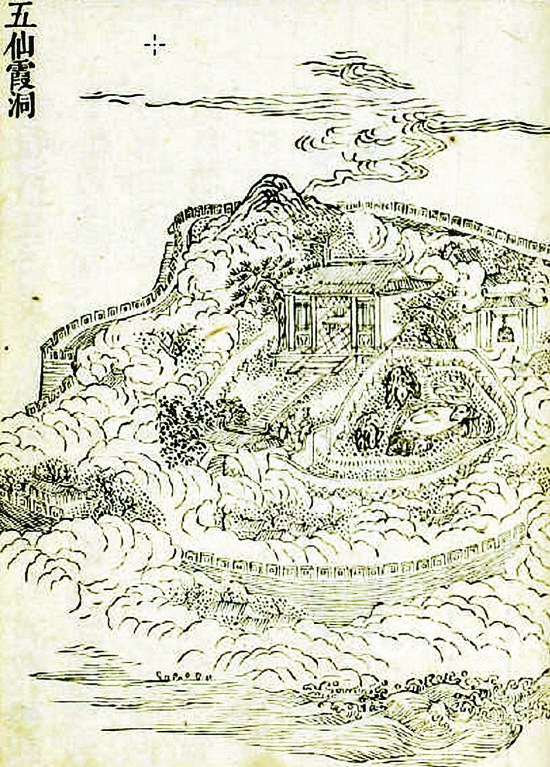

Guangzhou

Guangzhou (, ; ; or ; ), also known as Canton () and alternatively romanized as Kwongchow or Kwangchow, is the capital and largest city of Guangdong province in southern China. Located on the Pearl River about north-northwest of Hong Kong and north of Macau, Guangzhou has a history of over 2,200 years and was a major terminus of the maritime Silk Road; it continues to serve as a major port and transportation hub as well as being one of China's three largest cities. For a long time, the only Chinese port accessible to most foreign traders, Guangzhou was captured by the British during the First Opium War. No longer enjoying a monopoly after the war, it lost trade to other ports such as Hong Kong and Shanghai, but continued to serve as a major transshipment port. Due to a high urban population and large volumes of port traffic, Guangzhou is classified as a Large-Port Megacity, the largest type of port-city in the world. Due to worldwide travel restrictions at the beg ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Beijing

} Beijing ( ; ; ), alternatively romanized as Peking ( ), is the capital of the People's Republic of China. It is the center of power and development of the country. Beijing is the world's most populous national capital city, with over 21 million residents. It has an administrative area of , the third in the country after Guangzhou and Shanghai. It is located in Northern China, and is governed as a municipality under the direct administration of the State Council with 16 urban, suburban, and rural districts.Figures based on 2006 statistics published in 2007 National Statistical Yearbook of China and available online at archive. Retrieved 21 April 2009. Beijing is mostly surrounded by Hebei Province with the exception of neighboring Tianjin to the southeast; together, the three divisions form the Jingjinji megalopolis and the national capital region of China. Beijing is a global city and one of the world's leading centres for culture, diplomacy, politics, financ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Bund

The Bund or Waitan (, Shanghainese romanization: ''Nga3thae1'', , ) is a waterfront area and a protected historical district in central Shanghai. The area centers on a section of Zhongshan Road (East Zhongshan Road No.1) within the former Shanghai International Settlement, which runs along the western bank of the Huangpu River in the eastern part of Huangpu District. The area along the river faces the modern skyscrapers of Lujiazui in the Pudong District. The Bund usually refers to the buildings and wharves on this section of the road, as well as some adjacent areas. From the 1860s to the 1930s, it was the rich and powerful center of the foreign establishment in Shanghai, operating as a legally protected treaty port. Name The term "bund" was borrowed into English from Hindustani and originally referred to a dyke or embankment. Within the Chinese treaty ports, it was applied specifically to an embanked quay which ran along the shore. The Chinese name for the Bund is unrelate ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Zhangjiang Town

Zhangjiang Town () is a town located in the Pudong District of Shanghai, China. The town hosts an industrial park for high technology companies. See also *Zhangjiang Hi-Tech Park The Zhangjiang Hi-Tech Park is a technology park in the Pudong district of Shanghai, China. It is operated by Zhangjiang Hi-Tech Park Development Co., Ltd. The park specializes in research in life sciences, software, semiconductors, and inform ... External linksPudong local government website Towns in Shanghai Pudong {{Shanghai-geo-stub ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Shanghai Clearing House

The Shanghai Clearing House (SHCH, zh, link=no, 上海清算所), formally the Inter-bank Market Clearing House Co., Ltd. ( zh, link=no, 銀行間市場清算所股份有限公司簡稱上海清算所), is a significant central counterparty and central securities depository in China, established in 2009 in Shanghai. Overview The Shanghai Clearing House was established on and was recognized as a Qualified Central Counterparty by the People's Bank of China. Its founding shareholders were China Foreign Exchange Trade System (46.7 percent), China Central Depository & Clearing (33.3 percent), China Banknote Printing and Minting Corporation (10 percent), and China Gold Coin Inc. (10 percent). It provides services in central counterparty clearing, registration and custody, risk management and valuation, statistical information, and financial knowledge dissemination. In 2018, the total clearing volume on the Shanghai Clearing House reached 4.6 million, 31 percent up on the previ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Central Counterparty

A central clearing counterparty (CCP), also referred to as a central counterparty, is a financial institution that takes on counterparty credit risk between parties to a transaction and provides clearing and settlement services for trades in foreign exchange, securities, options, and derivative contracts. CCPs are highly regulated institutions that specialize in managing counterparty credit risk. CCPs "mutualize" (share among their members) counterparty credit risk in the markets in which they operate. A CCP reduces the settlement risks by netting offsetting transactions between multiple counterparties, by requiring collateral deposits (also called "margin deposits"), by providing independent valuation of trades and collateral, by monitoring the creditworthiness of the member firms, and in many cases, by providing a guarantee fund that can be used to cover losses that exceed a defaulting member's collateral on deposit. CCPs require a pre-set amount of collateral — referred to as ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Foreign Exchange Derivative

A foreign exchange derivative is a financial derivative whose payoff depends on the foreign exchange rates of two (or more) currencies. These instruments are commonly used for currency speculation and arbitrage or for hedging foreign exchange risk. History Foreign exchange transactions can be traced back to the fourteenth Century in the UK, but the coming into being and development of foreign exchange derivatives market was in the 1970s with the historical background and economic environment. Firstly, after the collapse of the Bretton Woods system, in 1976, IMF held a meeting in Jamaica and reached the Jamaica agreement. When the floating exchange-rate system replaced a fixed exchange-rate system, many countries relaxed control of interest rates and the risk of financial market increased. In order to reduce and avoid risks and achieve the purpose of hedging, modern financial derivatives came into being. Secondly, economic globalization promoted the globalization of fi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Interest Rate Derivative

In finance, an interest rate derivative (IRD) is a derivative whose payments are determined through calculation techniques where the underlying benchmark product is an interest rate, or set of different interest rates. There are a multitude of different interest rate indices that can be used in this definition. IRDs are popular with all financial market participants given the need for almost any area of finance to either hedge or speculate on the movement of interest rates. Modeling of interest rate derivatives is usually done on a time-dependent multi-dimensional Lattice ("tree") or using specialized simulation models. Both are calibrated to the underlying risk drivers, usually domestic or foreign short rates and foreign exchange market rates, and incorporate delivery- and day count conventions. The Heath–Jarrow–Morton framework is often used instead of short rates. Types The most basic subclassification of interest rate derivatives (IRDs) is to define linear and non- ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mexican Peso

The Mexican peso (Currency symbol, symbol: $; ISO 4217, code: MXN) is the currency of Mexico. Modern peso and dollar currencies have a common origin in the 16th–19th century Spanish dollar, most continuing to use dollar sign, its sign, "$". The current ISO 4217 code for the peso is ''MXN''; prior to the #Nuevo peso, 1993 revaluation, the code ''MXP'' was used. The peso is subdivided into 100 , represented by "cent sign, ¢". The Mexican peso is the 15th most traded currency in the world, the third most traded currency from the Americas (after the United States dollar and Canadian dollar), and the most traded currency from Latin America. , the peso's exchange rate was $20.50 per euro, $19.80 per U.S. dollar, and $15.50 per Canadian dollar. History Etymology The name was first used in reference to ('gold weights') or ('silver weights'). The Spanish word means 'weight'. Compare the British pound sterling. Other countries that use are Argentine peso, Argentina, Chilean pes ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |