|

Chicago Growth Partners

Chicago Growth Partners (formerly known as William Blair Capital Partners) is a private equity firm focused on leveraged buyout and growth capital investments in middle-market companies across a range of industries, including, education, business services, healthcare and industrial growth. The firm, which is based in Chicago, Illinois, was founded in 2004 although the group traces its roots back to the founding of William Blair Capital Partners in 1982. The Chicago Growth Partners and its predecessor have raised approximately $1.8 billion since inception across nine funds. The team had raised and deployed six funds as the core group behind William Blair Capital Partners.Chicago Growth Grows But Retains Smaller Focus . Reuters Buyouts, April 14, 2008 William Blair Capital Partne ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Chicago Growth Partners Logo

Chicago is the List of municipalities in Illinois, most populous city in the U.S. state of Illinois and in the Midwestern United States. With a population of 2,746,388, as of the 2020 United States census, 2020 census, it is the List of United States cities by population, third-most populous city in the United States after New York City and Los Angeles. As the county seat, seat of Cook County, Illinois, Cook County, the List of the most populous counties in the United States, second-most populous county in the U.S., Chicago is the center of the Chicago metropolitan area, often colloquially called "Chicagoland" and home to 9.6 million residents. Located on the shore of Lake Michigan, Chicago was incorporated as a city in 1837 near a Chicago Portage, portage between the Great Lakes and the Mississippi River, Mississippi River watershed. It grew rapidly in the mid-19th century. In 1871, the Great Chicago Fire destroyed several square miles and left more than 100,000 homeless, but ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

CCMP Capital

CCMP Capital Advisors, LP is an American private equity investment firm that focuses on leveraged buyout and growth capital transactions. Formerly known as JP Morgan Partners, the investment professionals of JP Morgan Partners separated from JPMorgan Chase on July 31, 2006. CCMP has invested approximately $12 billion in leveraged buyout and growth capital transactions since inception. In 2007, CCMP was ranked #17 among the world's largest private equity funds. CCMP has 37 employees with offices in New York, London, Hong Kong and Tokyo. In 2008, CCMP hired Greg Brenneman as chairman."Eddie Bauer Files for Bankruptcy" by Stephanie Rosenbloom and Michael J. de la Merced, ''The New York Times'', June 17, 2009 (6/18/09, p. B3, NY ed.). Retrieved 6/18/09. History CCMP has been known ...[...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Private Equity Firms Of The United States

Private or privates may refer to: Music * "In Private", by Dusty Springfield from the 1990 album ''Reputation'' * Private (band), a Denmark-based band * "Private" (Ryōko Hirosue song), from the 1999 album ''Private'', written and also recorded by Ringo Sheena * "Private" (Vera Blue song), from the 2017 album ''Perennial'' Literature * ''Private'' (novel), 2010 novel by James Patterson * ''Private'' (novel series), young-adult book series launched in 2006 Film and television * ''Private'' (film), 2004 Italian film * ''Private'' (web series), 2009 web series based on the novel series * ''Privates'' (TV series), 2013 BBC One TV series * Private, a penguin character in ''Madagascar'' Other uses * Private (rank), a military rank * ''Privates'' (video game), 2010 video game * Private (rocket), American multistage rocket * Private Media Group, Swedish adult entertainment production and distribution company * ''Private (magazine)'', flagship magazine of the Private Media Group ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Services Companies Established In 2004

Finance refers to monetary resources and to the study and discipline of money, currency, assets and liabilities. As a subject of study, is a field of Business Administration wich study the planning, organizing, leading, and controlling of an organization's resources to achieve its goals. Based on the scope of financial activities in financial systems, the discipline can be divided into personal, corporate, and public finance. In these financial systems, assets are bought, sold, or traded as financial instruments, such as currencies, loans, bonds, shares, stocks, options, futures, etc. Assets can also be banked, invested, and insured to maximize value and minimize loss. In practice, risks are always present in any financial action and entities. Due to its wide scope, a broad range of subfields exists within finance. Asset-, money-, risk- and investment management aim to maximize value and minimize volatility. Financial analysis assesses the viability, stability, and p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fortune (magazine)

''Fortune'' (stylized in all caps) is an American global business magazine headquartered in New York City. It is published by Fortune Media Group Holdings, a global business media company. The publication was founded by Henry Luce in 1929. The magazine competes with ''Forbes'' and '' Bloomberg Businessweek'' in the national business magazine category and distinguishes itself with long, in-depth feature articles. The magazine regularly publishes ranked lists including ranking companies by revenue such as in the ''Fortune'' 500 that it has published annually since 1955, and in the ''Fortune'' Global 500. The magazine is also known for its annual ''Fortune Investor's Guide''. History ''Fortune'' was founded by ''Time'' magazine co-founder Henry Luce in 1929, who declared it as "the Ideal Super-Class Magazine", a "distinguished and de luxe" publication "vividly portraying, interpreting and recording the Industrial Civilization". Briton Hadden, Luce's business partner, was no ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Diamond Castle Holdings

Diamond Castle Holdings is a private equity firm focused on leveraged buyout and growth capital investments in middle-market companies across a range of industries including the media, healthcare, financial services, power and industrial sectors. The firm, which is based in New York City, was founded in 2004. As of 2011, the firm had raised approximately $1.9 billion since its inception. History In 2004, DLJMB co-head Larry Schloss, along with four senior members of DLJ Merchant Banking Partners, led a spinout from Credit Suisse to form a new private equity firm which would come to be known as Diamond Castle Holdings. AltAssets, September 22, 2004 In December 2006, the firm announced it had completed fundraising for a $1.85 billion private equity fund, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Avista Capital Partners

Avista Capital Partners, LLP is an American private equity firm headquartered in New York City focused on growth capital and leveraged buyout investments in middle-market companies in the domestic healthcare sector. History The firm was founded in 2005 by Steven Webster, Thompson Dean and David Burgstahler, as a spinoff from Credit Suisse's private equity arm DLJ Merchant Banking Partners (Dean was head of DLJMBP). Avista's spinoff from Credit Suisse was at the same time as private equity groups from other leading investment banks were formed including JPMorgan Chase's CCMP Capital, Citigroup's Court Square Capital Partners, Deutsche Bank's MidOcean Partners, and Morgan Stanley's Metalmark Capital. In 2007, the firm closed its first fund at $2 billion. This included a commitment from predecessor Credit Suisse, whereas fellow spin-off Diamond Castle did not. Avista’s second fund closed with $1.8 billion of commitments, which was lower than its original target between $2.5 an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Suisse First Boston

Credit Suisse First Boston (also known as CSFB and CS First Boston) was the investment banking affiliate of Credit Suisse headquartered in New York. The company was created by the merger of First Boston Corporation and Credit Suisse Group in 1988 and was active in investment banking, capital markets and financial services. In 2006, Credit Suisse reorganized and merged CS First Boston into the parent company and retired use of the "First Boston" brand. In 2022, as part of a major restructuring, Credit Suisse began the process of spinning out the investment bank into an independent company and revived the brand. The process ultimately failed, and Credit Suisse was merged into rival Swiss bank UBS. History Credit Suisse / First Boston 50 / 50 Joint Venture (1978–1988) ''Main Article First Boston'' In 1978, Credit Suisse and First Boston Corporation formed a London-based 50-50 investment banking joint venture called ''Financière Crédit Suisse-First Boston''. This joint ve ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Metalmark Capital

Metalmark Capital, formerly Morgan Stanley, Morgan Stanley Capital Partners is a private equity firm focused on leveraged buyout investments in middle-market companies across a range of industries. Metalmark was acquired by Citigroup, Citigroup Alternative Investments in December 2007. The firm, which is based in New York City, traces its roots back to 1985. Metalmark was founded as an independent firm in 2004. The firm has raised approximately $8.5 billion since inception across four funds at Morgan Stanley and one fund raised since the firm's spinout. History From 1985 to 2004, Morgan Stanley Capital Partners invested over $7 billion through four funds. Morgan Stanley Leveraged Equity Fund I was raised in 1985 followed two years later by Morgan Stanley Leveraged Equity Fund II, which was raised in 1987 with $2.2 billion of investor commitments. In 1991, the group raised $1.87 billion of investor commitments for Morgan Stanley Capital Partners III. The most recent fund, Mor ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Morgan Stanley

Morgan Stanley is an American multinational investment bank and financial services company headquartered at 1585 Broadway in Midtown Manhattan, New York City. With offices in 42 countries and more than 80,000 employees, the firm's clients include corporations, governments, institutions, and individuals. Morgan Stanley ranked No. 61 in the 2023 Fortune 500 list of the largest United States corporations by total revenue and in the same year ranked #30 in Forbes Global 2000. The original Morgan Stanley, formed by J.P. Morgan & Co. partners Henry Sturgis Morgan (a grandson of J.P. Morgan), Harold Stanley, and others, came into existence on September 16, 1935, in response to the Glass–Steagall Act, which required the splitting of American commercial and investment banking businesses. In its first year, the company operated with a 24% market share (US$1.1 billion) in public offerings and private placements. The current Morgan Stanley is the result of the merger of the origi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

MidOcean Partners

MidOcean Partners is a New York City , New York based alternative asset management firm that specializes in mid-sized private equity and alternative leveraged investments. The firm, founded in February 2003, is based in Midtown Manhattan. MidOcean was originally formed by the managers of DB Capital Partners to acquire Deutsche Bank's late stage private equity investments in the United States and Europe in one of the largest private equity secondary market, private equity secondary transactions completed to date. History MidOcean Partners was formed through a private equity secondary market, management spinout transaction. A group of investors provided capital to the managers of DB Capital Partners, led by MidOcean Chief executive officer, CEO Ted Virtue, to acquire the portfolio of private equity investments they had managed at Deutsche Bank. In addition to the €1.5 billion DB portfolio, MidOcean took over a €1 billion portfolio from a subsidiary of DB. Among the investors i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

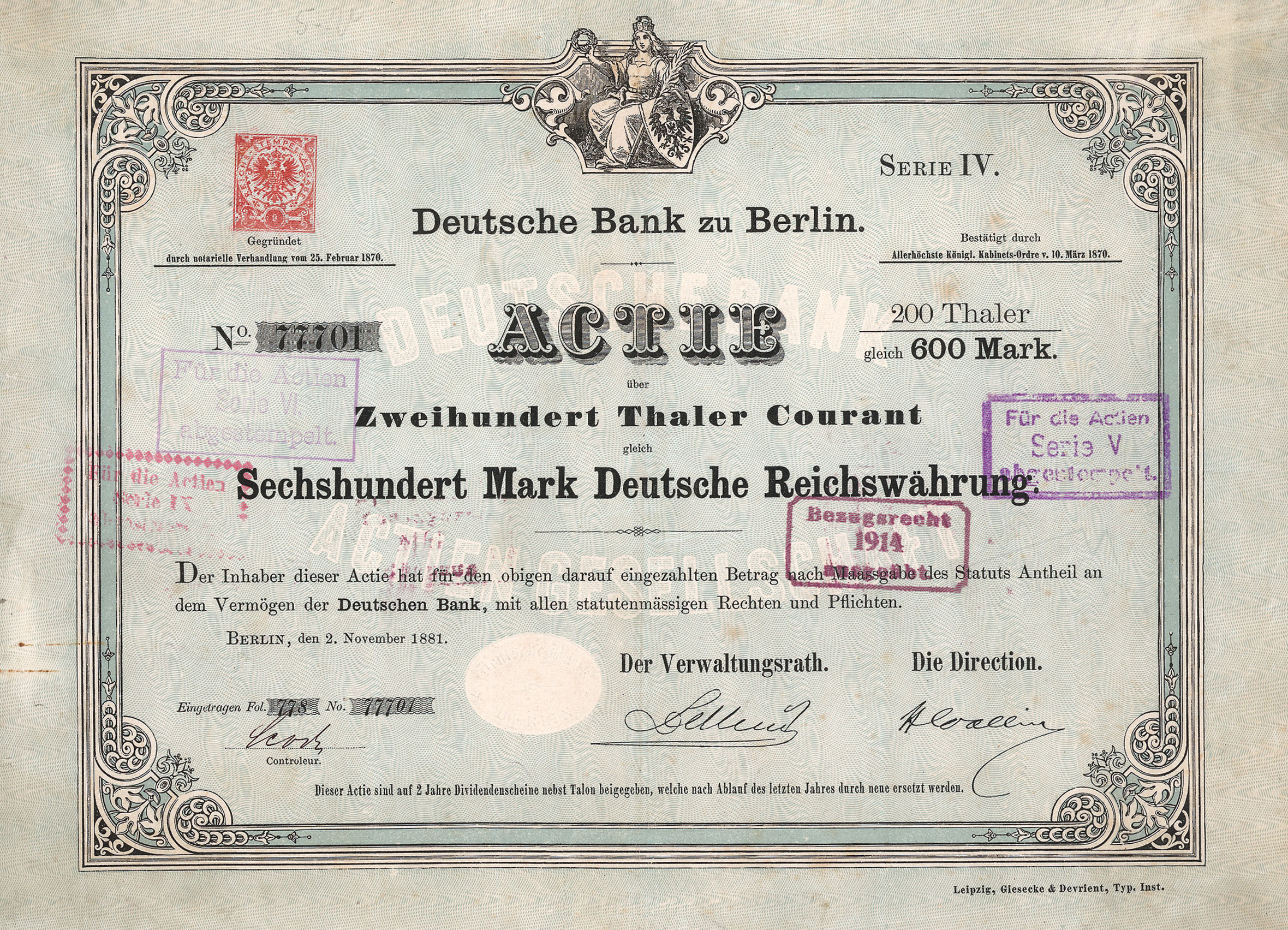

Deutsche Bank

Deutsche Bank AG (, ) is a Germany, German multinational Investment banking, investment bank and financial services company headquartered in Frankfurt, Germany, and dual-listed on the Frankfurt Stock Exchange and the New York Stock Exchange. Deutsche Bank was founded in 1870 in Berlin. From 1929 to 1937, following its merger with Disconto-Gesellschaft, it was known as ''Deutsche Bank und Disconto-Gesellschaft'' or DeDi-Bank. Other transformative acquisitions have included those of Mendelssohn & Co. in 1938, Morgan, Grenfell & Company, Morgan Grenfell in 1990, Bankers Trust in 1998, and Deutsche Postbank in 2010. As of 2018, the bank's network spanned 58 countries with a large presence in Europe, the Americas, and Asia. It is a component of the DAX stock market index and is often referred to as the List of banks in Germany, largest German banking institution, with Deutsche Bank holding the majority stake in DWS Group for combined assets of 2.2 trillion euros, rivaling even Spa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |