|

Buffett Rule

The Buffett Rule is part of a tax plan which would require millionaires and billionaires to pay the same tax rate as middle-class families and working people. It was proposed by President Barack Obama in 2011.Carrie Budoff Brown"Obama's 'Buffett Rule' to call for higher tax rate for millionaires".''Politico'', September 17, 2011. The tax plan proposed would apply a minimum tax rate of 30 percent on individuals making more than one million dollars a year. According to a White House official, the new tax rate would directly affect 0.3 percent of taxpayers. History The Buffett Rule is named after American investor Warren Buffett, who publicly stated in early 2011 that he believed it was wrong that rich people, like himself, could pay less in federal taxes, as a portion of income, than the middle class, and voiced support for increased income taxes on the wealthy. The rule would implement a higher minimum tax rate for taxpayers in the highest income bracket, to ensure that they ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Average Tax Rates For Selected Income Groups Under A Fixed Income Distribution, 1960-2010

In ordinary language, an average is a single number or value that best represents a set of data. The type of average taken as most typically representative of a list of numbers is the arithmetic mean the sum of the numbers divided by how many numbers are in the list. For example, the mean or average of the numbers 2, 3, 4, 7, and 9 (summing to 25) is 5. Depending on the context, the most representative statistic to be taken as the average might be another measure of central tendency, such as the mid-range, median, mode or geometric mean. For example, the average personal income is often given as the median the number below which are 50% of personal incomes and above which are 50% of personal incomes because the mean would be higher by including personal incomes from a few billionaires. General properties If all numbers in a list are the same number, then their average is also equal to this number. This property is shared by each of the many types of average. Another universal pr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Foundation

The Tax Foundation is an international research think tank based in Washington, D.C. that collects data and publishes research studies on Taxation in the United States, U.S. tax policies at both the federal and state levels. Its stated mission is to "improve lives through tax policy research and education that leads to greater economic growth and opportunity". The Tax Foundation is organized as a 501(c)(3) Tax exemption, tax-exempt Non-profit organization, non-profit educational and research organization, with three primary areas of research: the Center for Federal Tax Policy, the Center for State Tax Policy, and the Center for Global Tax Policy. The group is known for its annual reports such as the ''State Tax Competitiveness Index'', ''International Tax Competitiveness Index'', and ''Facts & Figures: How Does Your State Compare'', which was first produced in 1941. History The Tax Foundation was organized on December 5, 1937, in New York City by Alfred P. Sloan Jr., Chai ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Gallup Organization

Gallup, Inc. is an American multinational analytics and consulting firm, advisory company based in Washington, D.C. Founded by George Gallup in 1935, the company became known for its opinion poll, public opinion polls conducted worldwide. Gallup provides analytics and management consulting to organizations globally. In addition the company offers educational consulting, the StrengthsFinder, CliftonStrengths assessment and associated products, and business and management books published by its Gallup Press unit. Organization Gallup is a private employee-owned company based in Washington, D.C., founded by George Gallup in 1939. Headquartered in The Gallup Building, it maintains between 30 and 40 offices globally, in locations including in New York City, London, Berlin, Sydney, Singapore, and Abu Dhabi, and has approximately 1,500 employees. In 2022, Jon Clifton became Gallup's CEO, replacing his father, Jim Clifton, who had been the CEO since 1998. Gallup, Inc. has no affiliatio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

CBS News

CBS News is the news division of the American television and radio broadcaster CBS. It is headquartered in New York City. CBS News television programs include ''CBS Evening News'', ''CBS Mornings'', news magazine programs ''CBS News Sunday Morning'', ''60 Minutes'', and ''48 Hours (TV program), 48 Hours'', and Sunday morning talk show, Sunday morning political affairs program ''Face the Nation''. CBS News Radio produces hourly newscasts for hundreds of radio stations, and also oversees CBS News podcasts like ''Major Garrett, The Takeout Podcast''. CBS News also operates CBS News 24/7, a 24-hour digital news network. Up until April 2021, the president and senior executive producer of CBS News was Susan Zirinsky, who assumed the role on March 1, 2019. Zirinsky, the first female president of the network's news division, was announced as the choice to replace David Rhodes (CBS News President), David Rhodes on January 6, 2019. The announcement came amid news that Rhodes would step do ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Nobel Memorial Prize In Economic Sciences

The Nobel Memorial Prize in Economic Sciences, officially the Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel (), commonly referred to as the Nobel Prize in Economics(), is an award in the field of economic sciences administered by the Nobel Foundation, established in 1968 by Sveriges Riksbank (Sweden's central bank) to celebrate its 300th anniversary and in memory of Alfred Nobel. Although the Prize in Economic Sciences was not one of the original five Nobel Prizes established by Alfred Nobel's will, it is considered a member of the Nobel Prize system, and is administered and referred to along with the Nobel Prizes by the Nobel Foundation. Winners of the Prize in Economic Sciences are chosen in a similar manner to and announced alongside the Nobel Prize recipients, and receive the Prize in Economic Sciences at the Nobel Prize Award Ceremony. The laureates of the Prize in Economic Sciences are selected by the Royal Swedish Academy of Sciences, which ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Paul Krugman

Paul Robin Krugman ( ; born February 28, 1953) is an American New Keynesian economics, New Keynesian economist who is the Distinguished Professor of Economics at the CUNY Graduate Center, Graduate Center of the City University of New York. He was a columnist for ''The New York Times'' from 2000 to 2024. In 2008, Krugman was the sole winner of the Nobel Memorial Prize in Economic Sciences for his contributions to New Trade Theory, new trade theory and New Economic Geography, new economic geography. The Prize Committee cited Krugman's work explaining the patterns of international trade and the geographic distribution of economic activity, by examining the effects of Economy of scale, economies of scale and of consumer preferences for diverse goods and services. Krugman was previously a professor of economics at MIT, and, later, at Princeton University which he retired from in June 2015, holding the title of Emeritus, professor emeritus there ever since. He also holds the title o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Congressional Research Service

The Congressional Research Service (CRS) is a public policy research institute of the United States Congress. Operating within the Library of Congress, it works primarily and directly for members of Congress and their committees and staff on a confidential, nonpartisan basis. CRS is sometimes known as Congress' think tank due to its broad mandate of providing research and analysis on all matters relevant to national policymaking. CRS has roughly 600 employees, who have a wide variety of expertise and disciplines, including lawyers, economists, historians, political scientists, reference librarians, and scientists. In the 2023 fiscal year, it was appropriated a budget of roughly $133.6 million by Congress. Modeled after the Wisconsin Legislative Reference Bureau, CRS was founded during the height of the Progressive Era as part of a broader effort to professionalize the government by providing independent research and information to public officials. Its work was initially ma ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

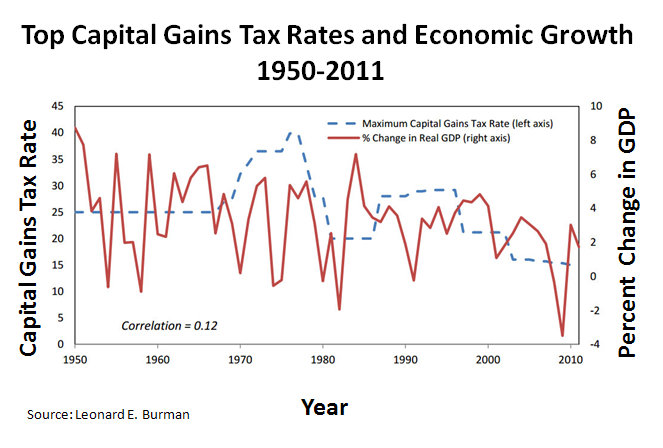

Capital Gains Tax In The United States

In the United States, individuals and corporations pay a tax on the net total of all their capital gains. The tax rate depends on both the investor's tax bracket and the amount of time the investment was held. Short-term capital gains are taxed at the investor's ordinary income tax rate and are defined as investments held for a year or less before being sold. Long-term capital gains, on dispositions of assets held for more than one year, are taxed at a lower rate. Current law The United States taxes short-term capital gains at the same rate as it taxes ordinary income. Long-term capital gains are taxed at lower rates shown in the table below. ( Qualified dividends receive the same preference.) However, taxpayers pay no tax on income covered by deductions: the standard deduction (for 2022: $12,950 for an individual return, $19,400 for heads of households, and $25,900 for a joint return), or more if the taxpayer has over that amount in itemized deductions. Amounts in excess of t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Wall Street Journal

''The Wall Street Journal'' (''WSJ''), also referred to simply as the ''Journal,'' is an American newspaper based in New York City. The newspaper provides extensive coverage of news, especially business and finance. It operates on a subscription model, requiring readers to pay for access to most of its articles and content. The ''Journal'' is published six days a week by Dow Jones & Company, a division of News Corp. As of 2023, ''The'' ''Wall Street Journal'' is the List of newspapers in the United States, largest newspaper in the United States by print circulation, with 609,650 print subscribers. It has 3.17 million digital subscribers, the second-most in the nation after ''The New York Times''. The newspaper is one of the United States' Newspaper of record, newspapers of record. The first issue of the newspaper was published on July 8, 1889. The Editorial board at The Wall Street Journal, editorial page of the ''Journal'' is typically center-right in its positio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Congress Joint Committee On Taxation

The Joint Committee on Taxation (JCT) is a Committee of the U.S. Congress established under the Internal Revenue Code at . Structure The Joint Committee is composed of ten Members: five from the Senate Finance Committee and five from the House Ways and Means Committee. The Committee is chaired on a rotating basis by the Chair of the Senate Finance Committee and the Chair of the House Ways and Means Committee. During the first Session of each Congress the House has the joint committee chair and the Senate has the vice-chair; during the second session the roles are reversed. The Members of the Joint Committee choose the Chief of Staff of the Joint Committee, who is responsible for selecting the remainder of the staff on a nonpartisan basis. Since May 15, 2009, the Chief of Staff of the Joint Committee has been Thomas A. Barthold. Duties The duties of the Joint Committee are: # Investigate the operation, effects, and administration of internal revenue taxes # Investigate measu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Modern Liberalism In The United States

Modern liberalism, often referred to simply as liberalism, is the dominant version of liberalism in the United States. It combines ideas of civil liberty and Social equality, equality with support for social justice and a mixed economy. Modern liberalism is one of two major political ideologies in the United States, with the other being Conservatism in the United States, conservatism. According to American philosopher Ian Adams, all major American parties are "Liberalism, liberal and always have been. Essentially they espouse classical liberalism, that is a form of democratized Whig constitutionalism plus the free market. The point of difference comes with the influence of social liberalism." Economically, modern liberalism supports government regulation on private industry, opposes corporate monopolies, and supports labor rights. Its fiscal policy supports sufficient funding for a social safety net, while simultaneously promoting income-proportional tax reform policies to reduce ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |