|

Britain’s Industrial Future

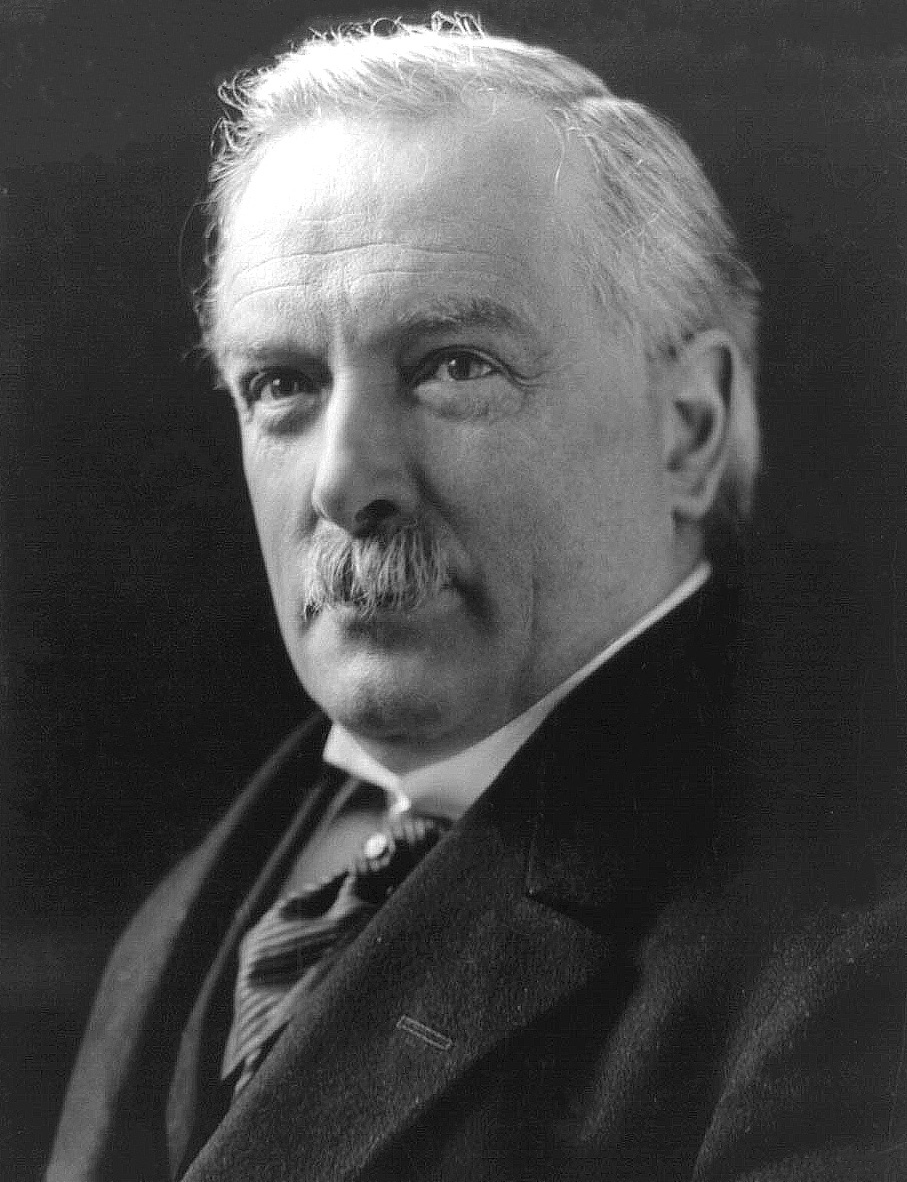

''Britain's Industrial Future'', commonly known as the Yellow Book, was the report of the British Liberal Party's Industrial Inquiry of 1928. Background The British economy had been in a depressed state since the end of the boom that had occurred immediately after the Great War. The War had disrupted her old trading patterns and had caused other countries to develop their own industries.C. L. Mowat, ''Britain Between the Wars, 1918–1940'' (London: Methuen, 1955), p. 259. Britain's staple industries (coal, iron, steel, shipbuilding, textiles) had provided most of her exports before the War and these were the hardest hit by the post-war depression. C. L. Mowat claimed that throughout the 1920s "Britain's industrial machine was throttled down; the world's workshop worked on short time".Mowat, p. 260. Unemployment was concentrated in the staple industries and the number of those out of work never went below one million. While imports were above the pre-war figure, exports never exce ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United Kingdom

The United Kingdom of Great Britain and Northern Ireland, commonly known as the United Kingdom (UK) or Britain, is a country in Northwestern Europe, off the coast of European mainland, the continental mainland. It comprises England, Scotland, Wales and Northern Ireland. The UK includes the island of Great Britain, the north-eastern part of the island of Ireland, and most of List of islands of the United Kingdom, the smaller islands within the British Isles, covering . Northern Ireland shares Republic of Ireland–United Kingdom border, a land border with the Republic of Ireland; otherwise, the UK is surrounded by the Atlantic Ocean, the North Sea, the English Channel, the Celtic Sea and the Irish Sea. It maintains sovereignty over the British Overseas Territories, which are located across various oceans and seas globally. The UK had an estimated population of over 68.2 million people in 2023. The capital and largest city of both England and the UK is London. The cities o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

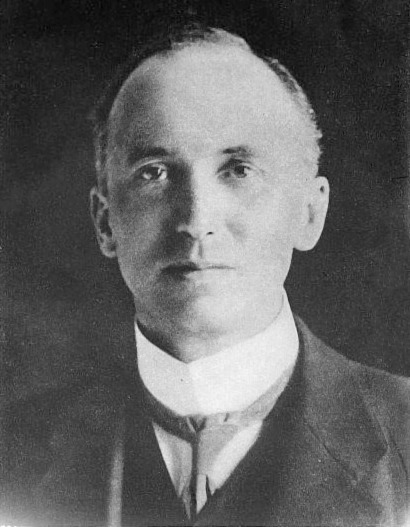

John Simon, 1st Viscount Simon

John Allsebrook Simon, 1st Viscount Simon, (28 February 1873 – 11 January 1954) was a British politician who held senior Cabinet posts from the beginning of the First World War to the end of the Second World War. He is one of three people to have served as Home Secretary, Foreign Secretary and Chancellor of the Exchequer, the others being Rab Butler and James Callaghan. He also served as Lord Chancellor, the most senior position in the British legal system. Beginning his career as a Liberal (identified initially with the left wing but later with the right wing of the party), he joined the National Government in 1931, creating the Liberal National Party in the process. At the end of his career, he was essentially a Conservative. Background and education Simon was born in a terraced house on Moss Side, Manchester, the eldest child and only son of Edwin Simon (1843–1920) and wife Fanny Allsebrook (1846–1936). His father was a Congregationalist minister, like three of hi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Of England

The Bank of England is the central bank of the United Kingdom and the model on which most modern central banks have been based. Established in 1694 to act as the Kingdom of England, English Government's banker and debt manager, and still one of the bankers for the government of the United Kingdom, it is the world's second oldest central bank. The bank was privately owned by stockholders from its foundation in 1694 until it was nationalised in 1946 by the Attlee ministry. In 1998 it became an independent public organisation, wholly owned by the Treasury Solicitor on behalf of the government, with a mandate to support the economic policies of the government of the day, but independence in maintaining price stability. In the 21st century the bank took on increased responsibility for maintaining and monitoring financial stability in the UK, and it increasingly functions as a statutory Financial regulation, regulator. The bank's headquarters have been in London's main financial di ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Site-value Taxation

A land value tax (LVT) is a levy on the value of land (economics), land without regard to buildings, personal property and other land improvement, improvements upon it. Some economists favor LVT, arguing it does not cause economic efficiency, economic inefficiency, and helps reduce economic inequality. A land value tax is a progressive tax, in that the tax burden falls on land owners, because land ownership is correlated with wealth and income. The land value tax has been referred to as "the perfect tax" and the economic efficiency of a land value tax has been accepted since the eighteenth century. Economists since Adam Smith and David Ricardo have advocated this tax because it does not hurt economic activity, and encourages development without subsidies. LVT is associated with Henry George, whose ideology became known as Georgism. George argued that taxing the land value is the most logical source of public revenue because the supply of land is fixed and because public infrastru ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Afforestation

Afforestation is the establishment of a forest or stand of trees in an area where there was no recent tree cover. There are three types of afforestation: natural Regeneration (biology), regeneration, agroforestry and Tree plantation, tree plantations. Afforestation has many benefits. In the context of climate change, afforestation can be helpful for climate change mitigation through the route of carbon sequestration. Afforestation can also improve the local climate through increased rainfall and by being a barrier against high winds. The additional trees can also prevent or reduce topsoil erosion (from water and wind), floods and landslides. Finally, additional trees can be a habitat for wildlife, and provide employment and wood products. In comparison, reforestation means re-establishing forest that have either been cut down or lost due to natural causes, such as fire, storm, etc. Nowadays, the boundaries between afforestation and reforestation projects can be blurred as it ma ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Electrification

Electrification is the process of powering by electricity and, in many contexts, the introduction of such power by changing over from an earlier power source. In the context of history of technology and economic development, electrification refers to the build-out of the electricity generation and electric power distribution systems. In the context of sustainable energy, electrification refers to the build-out of super grids and smart grids with distributed energy resources (such as energy storage) to accommodate the energy transition to renewable energy and the switch of end-uses to electricity. The electrification of particular sectors of the economy, particularly out of context, is called by modified terms such as Mass production#Factory electrification, ''factory electrification'', ''household electrification'', ''rural electrification'' and ''railway electrification''. In the context of sustainable energy, terms such as ''transport electrification'' (referring to electric v ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Slum Clearance In The United Kingdom

Slum clearance in the United Kingdom has been used as an urban renewal strategy to transform low-income settlements with poor reputation into another type of development or housing. Early mass clearances took place in the country's northern cities. Starting from 1930, councils were expected to prepare plans to Slum clearance, clear slum dwellings, although progress stalled upon the onset of World War II. Clearance of slum areas resumed and increased after the war, while the 1960s saw the largest number of house renewal schemes pursued by local authorities, particularly in Manchester where it was reported around 27% 'may' have been unfit for human habitation, although the majority were well built solid structures that could have been renovated or repurposed. Housing, churches, schools and pubs that formed close-knit communities were devastated, with families dispersed across other areas. Towards the end of the decade, a housing act in 1969 provided financial encouragement for autho ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Public Works

Public works are a broad category of infrastructure projects, financed and procured by a government body for recreational, employment, and health and safety uses in the greater community. They include public buildings ( municipal buildings, schools, and hospitals), transport infrastructure ( roads, railroads, bridges, pipelines, canals, ports, and airports), public spaces (public squares, parks, and beaches), public services ( water supply and treatment, sewage treatment, electrical grid, and dams), environmental protection ( drinking water protection, soil erosion reduction, wildlife habitat preservation, preservation and restoration of forests and wetlands) and other, usually long-term, physical assets and facilities. Though often interchangeable with public infrastructure and public capital, public works does not necessarily carry an economic component, thereby being a broader term. Construction may be undertaken either by directly employed labour or by a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Progressive Tax

A progressive tax is a tax in which the tax rate increases as the taxable amount increases. The term ''progressive'' refers to the way the tax rate progresses from low to high, with the result that a taxpayer's average tax rate is less than the person's marginal tax rate. The term can be applied to individual taxes or to a tax system as a whole. Progressive taxes are imposed in an attempt to reduce the tax incidence of people with a lower wikt:ability to pay, ability to pay, as such taxes shift the incidence increasingly to those with a higher ability-to-pay. The opposite of a progressive tax is a regressive tax, such as a sales tax, where the poor pay a larger proportion of their income compared to the rich (for example, spending on groceries and food staples varies little against income, so poor pay similar to rich even while latter has much higher income). The term is frequently applied in reference to personal income taxes, in which people with lower income pay a lower percen ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Profit Sharing

Profit sharing refers to various incentive plans introduced by businesses which provide direct or indirect payments to employees, often depending on the company's profitability, employees' regular salaries, and bonuses. In publicly traded companies, these plans typically amount to allocation of shares to employees. The profit sharing plans are based on predetermined economic sharing rules that define the split of gains between the company as a principal and the employee as an agent.Moffatt, Mike. (2008) About.com Sharing Rule'' Economics Glossary; Terms Beginning with S. Accessed June 19, 2008. For example, suppose the profits are x, which might be a random variable. Before knowing the profits, the principal and agent might agree on a sharing rule s(x). Here, the agent will receive s(x) and the principal will receive the residual gain x-s(x). Profit-sharing tends to lead to less conflict and more cooperation between labor and their employers. History American politician A ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Nationalisation

Nationalization (nationalisation in British English) is the process of transforming privately owned assets into public assets by bringing them under the public ownership of a national government or state. Nationalization contrasts with privatization and with demutualization. When previously nationalized assets are privatized and subsequently returned to public ownership at a later stage, they are said to have undergone renationalization (or deprivatization). Industries often subject to nationalization include telecommunications, electric power, fossil fuels, railways, airlines, iron ore, media, postal services, banks, and water (sometimes called the commanding heights of the economy), and in many jurisdictions such entities have no history of private ownership. Nationalization may occur with or without financial compensation to the former owners. Nationalization is distinguished from property redistribution in that the government retains control of nationalized property. S ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Minimum Wage

A minimum wage is the lowest remuneration that employers can legally pay their employees—the price floor below which employees may not sell their labor. List of countries by minimum wage, Most countries had introduced minimum wage legislation by the end of the 20th century. Because minimum wages increase the cost of labor, companies often try to avoid minimum wage laws by using gig workers, by moving labor to locations with lower or nonexistent minimum wages, or by Automation, automating job functions. Minimum wage policies can vary significantly between countries or even within a country, with different regions, sectors, or age groups having their own minimum wage rates. These variations are often influenced by factors such as the cost of living, regional economic conditions, and industry-specific factors. The movement for minimum wages was first motivated as a way to stop the exploitation of workers in sweatshops, by employers who were thought to have unfair bargaining power o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |