|

Bereavement Benefit

In the United Kingdom, Bereavement Support Payments (also known as bereavement benefits) are paid to the husband/wife or partner of a person who has died in the previous 21 months. It replaced Bereavement Payment and Bereavement Allowance in April 2017, which had previously replaced Widow's benefit in April 2001. It is a social security benefit that is designed to support people who have recently lost their spouse, and need some financial support to help them get back on their feet. A similar benefit is provided in Malta in accordance to the ''Widows and Orphans Pension Act'' of 1927. The qualifying conditions are as follows: * the deceased partner must have paid National Insurance contributions for at least 25 weeks in one tax year since 6 April 1975. Bereavement Support Payment consists of 2 parts, firstly: *a bereavement payment of £3,500 which is a one off tax free lump sum, provided the claimant was receiving Child Benefit; otherwise the payment is £2,500 ::::(formerly ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Widow’s Pension

A widow's pension is a payment from the government of a country to a person whose spouse has died. Generally, such payments are made to a widow whose late spouse has fulfilled the country's requirements, including contribution, cohabitation, and length of marriage. United States During the Progressive Era, there was a proliferation of laws introducing widows' pensions (generally called "mothers' pensions) at the state level. At the federal level, the widow's pension was introduced in the Senate in 1930. It was not especially uncommon for young women in Arkansas to marry Confederate pensioners; in 1937 the state passed a law stating that women who married Civil War veterans would not be eligible for a widow's pension. The law was later changed in 1939 to state that widows born after 1870 were not eligible for pensions. In 1899, Congress approved a payment of $11,750 of widow's pension owed to Harriet Tubman. United Kingdom In the United Kingdom, the Widow’s Pension was di ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Social Security

Welfare spending is a type of government support intended to ensure that members of a society can meet basic human needs such as food and shelter. Social security may either be synonymous with welfare, or refer specifically to social insurance programs which provide support only to those who have previously contributed (e.g. pensions), as opposed to ''social assistance'' programs which provide support on the basis of need alone (e.g. most disability benefits). The International Labour Organization defines social security as covering support for those in old age, support for the maintenance of children, medical treatment, parental and sick leave, unemployment and disability benefits, and support for sufferers of occupational injury. More broadly, welfare may also encompass efforts to provide a basic level of well-being through subsidized ''social services'' such as healthcare, education, infrastructure, vocational training, and public housing.''The New Fontana Diction ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

National Insurance

National Insurance (NI) is a fundamental component of the welfare state in the United Kingdom. It acts as a form of social security, since payment of NI contributions establishes entitlement to certain state benefits for workers and their families. Introduced by the National Insurance Act 1911 and expanded by the Attlee ministry in 1948, the system has been subjected to numerous amendments in succeeding years. Initially, it was a contributory form of insurance against illness and unemployment, and eventually provided retirement pensions and other benefits. Currently, workers pay contributions from the age of sixteen years, until the age they become eligible for the State Pension. Contributions are due from employed people earning at or above a threshold called the Lower Earnings Limit, the value of which is reviewed each year. Self-employed people contribute through a percentage of net profits above a threshold, which is reviewed periodically. Individuals may also make volunt ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Year

A fiscal year (also known as a financial year, or sometimes budget year) is used in government accounting, which varies between countries, and for budget purposes. It is also used for financial reporting by businesses and other organizations. Laws in many jurisdictions require company financial reports to be prepared and published on an annual basis but generally with the reporting period not aligning with the calendar year (1 January to 31 December). Taxation laws generally require accounting records to be maintained and taxes calculated on an annual basis, which usually corresponds to the fiscal year used for government purposes. The calculation of tax on an annual basis is especially relevant for direct taxes, such as income tax. Many annual government fees—such as council tax and license fees are also levied on a fiscal year basis, but others are charged on an anniversary basis. Some companies, such as Cisco Systems, end their fiscal year on the same day of the week each ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

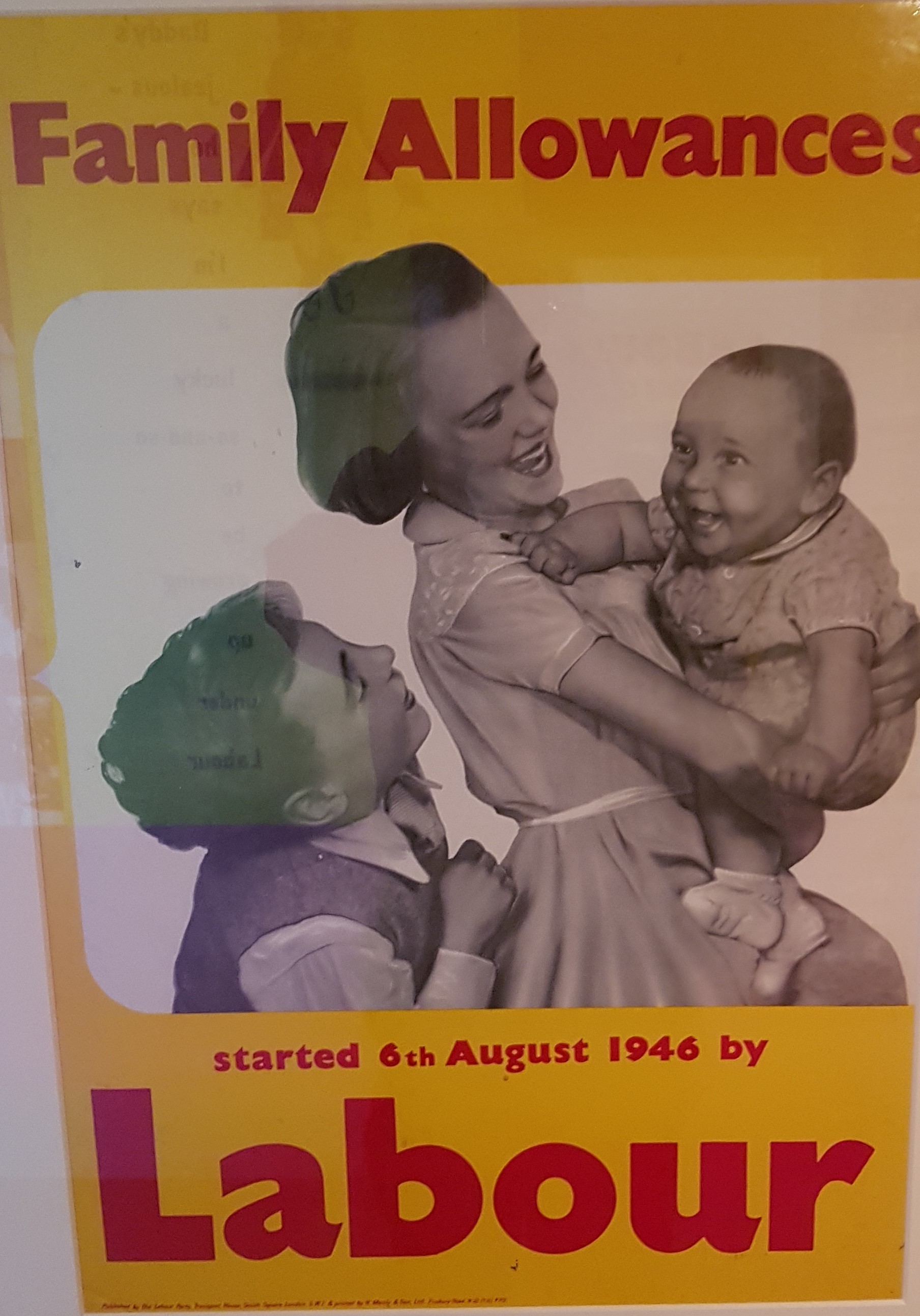

Child Benefit

Child benefit or children's allowance is a social security payment which is distributed to the parents or guardians of children, teenagers and in some cases, young adult (psychology), young adults. Countries operate different versions of the benefit. In most child benefit is means-testing, means-tested and the amount paid is usually dependent on the number of children. Conditions for payment A number of conditional cash transfer programs in Latin America and Africa link payment to the receivers' actions, such as enrolling children into schools, and health check-ups and vaccinations. In the UK, in 2011 CentreForum proposed an additional child benefit dependent on parenting activities. Australia In Australia, the system of child benefit payments, once termed child endowment and currently called Social Security (Australia)#Family Tax benefit, Family Tax Benefit, is income tested and linked to the Income tax in Australia#Family Tax Benefit, Australian Income tax system. It can be clai ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

UK State Pension

The State Pension is an existing benefit that forms part of the United Kingdom Government's pension arrangements. Benefits vary depending on the age of the individual and their contribution record. Currently anyone can make a claim, provided they have a minimum number of qualifying years of contributions. Background Old State Pension The Old State Pension, consisting of the Basic State Pension (alongside the Graduated Retirement Benefit, the State Earnings-Related Pension Scheme, and the State Second Pension; collectively known as Additional State Pension), is a benefit payable to men born before 6 April 1951, and to women born before 6 April 1953. The maximum amount payable for the Basic State Pension component is £169.50 a week (April 2024 – April 2025). New State Pension The New State Pension is a benefit payable to men born on or after 6 April 1951, and to women born on or after 6 April 1953. The maximum amount payable is £221.20 a week (April 2024 – April 20 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Child Benefit

Child benefit or children's allowance is a social security payment which is distributed to the parents or guardians of children, teenagers and in some cases, young adult (psychology), young adults. Countries operate different versions of the benefit. In most child benefit is means-testing, means-tested and the amount paid is usually dependent on the number of children. Conditions for payment A number of conditional cash transfer programs in Latin America and Africa link payment to the receivers' actions, such as enrolling children into schools, and health check-ups and vaccinations. In the UK, in 2011 CentreForum proposed an additional child benefit dependent on parenting activities. Australia In Australia, the system of child benefit payments, once termed child endowment and currently called Social Security (Australia)#Family Tax benefit, Family Tax Benefit, is income tested and linked to the Income tax in Australia#Family Tax Benefit, Australian Income tax system. It can be clai ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Means-tested

A means test is a determination of whether an individual or family is eligible for government benefits, assistance or welfare, based upon whether the individual or family possesses the means to do with less or none of that help. Means testing is in opposition to universal coverage, which extends benefits to everyone. Canada In Canada, means tests are used for student finance (for post-secondary education), legal aid, and "welfare" (direct transfer payments to individuals to combat poverty). They are not generally used for primary and secondary education which are tax-funded. Means tests for public health insurance were once common but are now illegal, as the Canada Health Act of 1984 requires that all the provinces provide universal healthcare coverage to be eligible for subsidies from the federal government. Means tests are also not used for pensions and seniors' benefits, but there is a clawback of Old Age Security payments for people making over $69,562 (in 2012). The La ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Funeral Payment

Funeral payments are a social security payment in the United Kingdom that are part of the Social Fund. They are to help with the costs of a funeral. To be eligible for a funeral payment, a claimant or their partner must be in receipt of one of the following income related benefits: *Income Support *Income-related Employment and Support Allowance *Income-based Jobseeker’s Allowance *Pension Credit (guarantee or savings credit) *Housing Benefit *Working Tax Credit (disability or severe disability element) * Child Tax Credit (at a rate higher than £545 per year) *Universal Credit Universal Credit is a United Kingdom based Welfare state in the United Kingdom, social security payment. It is Means test, means-tested and is replacing and combining six benefits, for working-age households with a low income: income-related Emp ... England and Wales In England and Wales, further entitlement conditions must also be met. A claimant can get a Funeral Expenses Payment if: * they live ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |