|

Banques Départementales

The ''banques départementales'' were joint-stock Bank of issue, banks of issue that were created in major secondary trade hubs of France in the early 19th century, echoing the role that the Bank of France played in and around Paris. They were key components of the French financial system during the Bourbon Restoration in France, Bourbon Restoration and July Monarchy. There were two waves of creation of ''banques départementales'', with three established in the late 1810s immediately after the restoration, and six more in the late 1830s during the heyday of the July Monarchy. All nine ''banques départementales'' were wiped out in the financial crisis of early 1848, paving the way for the Bank of France to be granted a national monopoly on note issuance later that year. Overview At its creation in 1800, the Bank of France's geographical scope of activity was limited to Paris and its immediate surroundings. It relied on a network of around 150 correspondents in the rest of the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

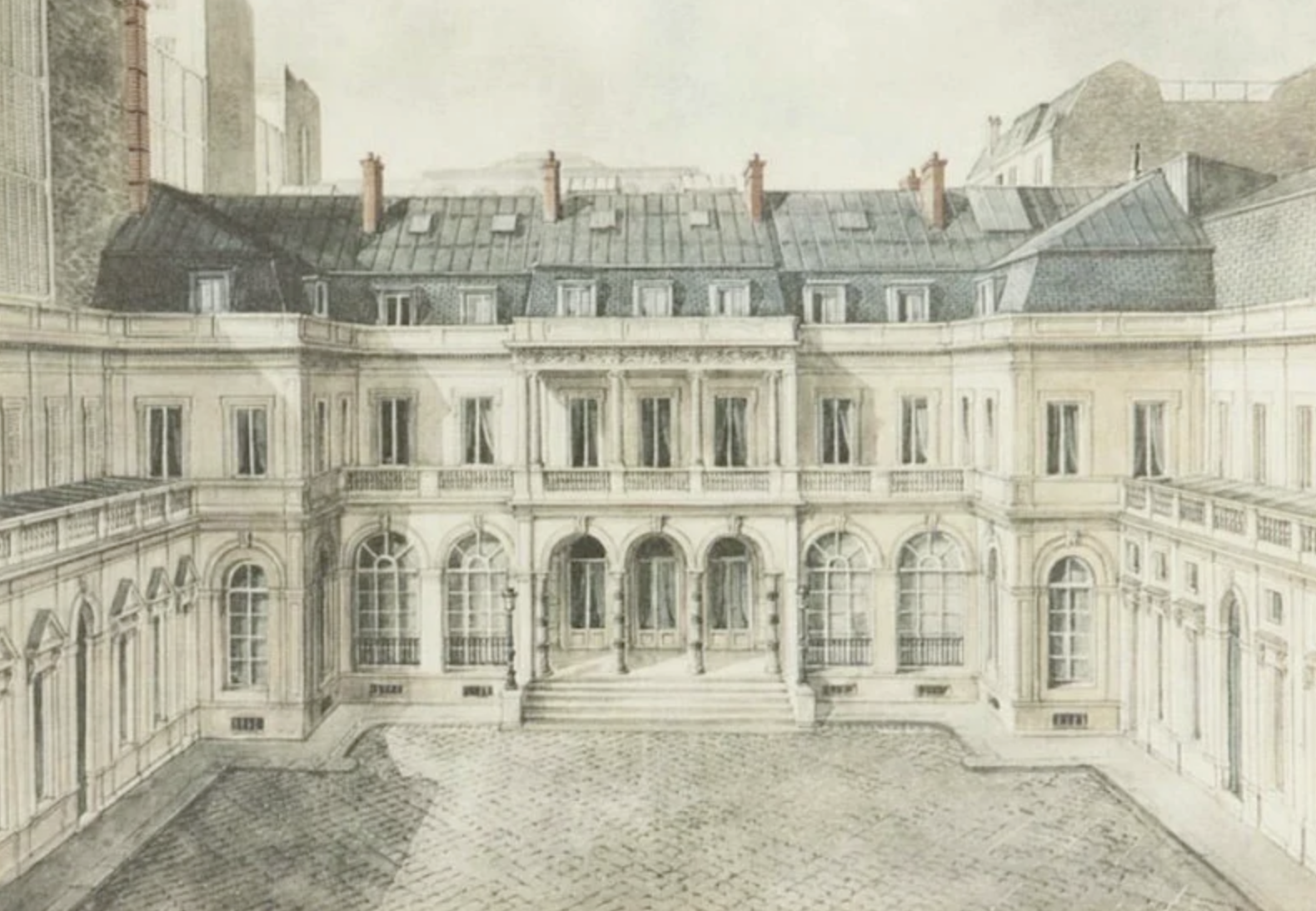

Façade Hôtel De Bourgtheroulde

A façade or facade (; ) is generally the front part or exterior of a building. It is a loanword from the French language, French (), which means "frontage" or "face". In architecture, the façade of a building is often the most important aspect from a design standpoint, as it sets the tone for the rest of the building. From the engineering perspective, the façade is also of great importance due to its impact on Efficient energy use, energy efficiency. For historical façades, many local zoning regulations or other laws greatly restrict or even forbid their alteration. Etymology The word is a loanword from the French , which in turn comes from the Italian language, Italian , from meaning 'face', ultimately from post-classical Latin . The earliest usage recorded by the ''Oxford English Dictionary'' is 1656. Façades added to earlier buildings It was quite common in the Georgian architecture, Georgian period for existing houses in English towns to be given a fashionable new f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Le Havre

Le Havre is a major port city in the Seine-Maritime department in the Normandy (administrative region), Normandy region of northern France. It is situated on the right bank of the estuary of the Seine, river Seine on the English Channel, Channel southwest of the Pays de Caux, very close to the Prime Meridian (Greenwich), Prime Meridian. Le Havre is the most populous commune of Upper Normandy, although the total population of the greater Le Havre conurbation is smaller than that of Rouen. It is also the second largest subprefecture in France, after only Reims. The name ''Le Havre'' means "the harbour" or "the port". Its inhabitants are known as ''Havrais'' or ''Havraises''. The city and Port of Le Havre, port were founded by Francis I of France, King Francis I in 1517. Economic development in the early modern period was hampered by European wars of religion, religious wars, conflicts with the English, epidemics, and storms. It was from the end of the 18th century that Le Havre st ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banking In France

The banking industry in France has, as of 11 October 2008, an average leverage ratio (assets/net worth) of 28 to 1, and its short-term liabilities are equal to 60% of the French GDP or 128% of its national debt. France operates a deposits guarantee fund, known as the Fonds de Garantie des Depôts. During 2018 the banking sector of the French economy employed 362,800 people. Largest banks The largest banks by total assets in Euros (as of year end 2020) in France are the following: 1. BNP Paribas: $2,488.5 bn 2. Crédit Agricole: $1,961.1 bn 3. Société Générale: $1,462.0 bn 4. BPCE: $863.3 bn 5. Crédit Mutuel - CIC: $624.0 Bn History of banking At about the time of the commencement of the year 1800, and of the first period of revolutionary change in banking within the continent of Europe, the high banking houses of France included the Banque Hottinguer, Hottinguer, :fr:Banque Mallet, Mallet (fr), :fr:Famille Poupart d ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

National Banks In Meiji Japan

The National Banks in Meiji Japan were a system of organization of the Japanese banking system created in the 1870s, inspired by the U.S. National Bank Act of the previous decade. Under the system, national banks were individually chartered by the government as Bank of issue, banks of issue whose banknotes were all accepted as legal tender. Starting with Dai-Ichi Bank, Dai-Ichi National Bank in 1873, around 150 national banks were thus created, most of which morphed into still-extant Japanese banks via multiple mergers and restructurings. The national banking system itself, however, was short-lived. It was superseded by the newly created Bank of Japan, inspired by European models and established in the early 1880s, and fully phased out in the late 1890s. Background Immediately after the Meiji Restoration in 1869, Japanese merchants in major trading centers introduced prototypes of modern commercial banks, known as , which were authorized to issue banknotes. These were establi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Comptoir D'Escompte

The ''Comptoirs d'Escompte'' or ''Comptoirs Nationaux d'Escompte'', literally " ationaldiscount counters", were 65 local banks created in a hurry in March 1848 by the government of the Second French Republic to maintain financial stability in the turmoil following the February Revolution. Most of them disappeared when the government withdrew its support in May 1852, except the following: * Comptoir d'escompte d'Alès (1848-?) * Comptoir d'escompte d'Angoulême (1848-1897?) * Comptoir d'escompte de Caen (1848-1874) * Comptoir d'escompte de Colmar (1848-1884) * Comptoir d'escompte de Dôle (1848-1892?) * Comptoir d'escompte de Lille (1848-1866), a predecessor entity of the Crédit du Nord * Comptoir d'escompte de Mulhouse (1848-1930), a predecessor entity of BNP Paribas * Comptoir National d'Escompte de Paris (1848-1966), another predecessor entity of BNP Paribas * (1848-1935), absorbed in 1935 by the Crédit Industriel et Commercial * Comptoir d'escompte de Sainte-Marie-aux-Mines ( ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banque Rothschild

The Banque Rothschild, formally known as ''de Rothschild Frères'' () until 1967, was the family-controlled bank of the Rothschild banking family of France. It was established in 1817, expropriated by Vichy France in 1940, returned to the Rothschilds after the liberation of France in 1944, and nationalized in 1982 after which it operated under the name of its subsidiary () and was eventually sold in 1991 to Barclays. It played a major role in French financial development in the 19th century, and remained significant for much of the 20th century. History Jacob Mayer Rothschild, the youngest son of Mayer Amschel Rothschild, settled in Paris in 1812 where his name Jacob was translated to James. In 1817, he formally created the bank , whose partners were himself and his brothers Amschel of Frankfurt, Carl of Naples, Nathan of London and Salomon of Vienna. In 1822 the five brothers were awarded the hereditary title of Baron by Emperor Francis I of Austria, after which James ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

French Second Republic

The French Second Republic ( or ), officially the French Republic (), was the second republican government of France. It existed from 1848 until its dissolution in 1852. Following the final defeat of Napoleon, Napoleon Bonaparte at the Battle of Waterloo, in June 1815, France had been reconstituted into a monarchy known as the Bourbon Restoration in France, Bourbon Restoration. After a brief period of July Revolution, revolutionary turmoil in 1830, royal power was again secured in the "July Monarchy", governed under principles of moderate conservatism and improved relations with the United Kingdom of Great Britain and Ireland, United Kingdom. In 1848, Europe erupted into a Revolutions of 1848, mass revolutionary wave in which many citizens challenged their royal leaders. Much of it was led by France in the French Revolution of 1848, February Revolution, overthrowing Louis Philippe I, King Louis-Philippe. Radical and liberal factions of the population convened the French Second ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

French Revolution Of 1848

The French Revolution of 1848 (), also known as the February Revolution (), was a period of civil unrest in France, in February 1848, that led to the collapse of the July Monarchy and the foundation of the French Second Republic. It sparked the wave of revolutions of 1848. The revolution took place in Paris, and was preceded by the French government's crackdown on the campagne des banquets. Starting on 22 February as a large-scale protest against the government of François Guizot, it later developed into a violent uprising against the monarchy. After intense urban fighting, large crowds managed to take control of the capital, leading to the abdication of King Louis Philippe on 24 February and the subsequent proclamation of the Second Republic. Background Under the Charter of 1814, Louis XVIII ruled France as the head of a constitutional monarchy. Upon Louis XVIII's death, his brother, the Count of Artois, ascended to the throne in 1824, as Charles X. Supported by the u ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banknote

A banknote or bank notealso called a bill (North American English) or simply a noteis a type of paper money that is made and distributed ("issued") by a bank of issue, payable to the bearer on demand. Banknotes were originally issued by commercial banks, which were legally required to Redemption value, redeem the notes for legal tender (usually gold or silver coin) when presented to the chief cashier of the originating bank. These commercial banknotes only traded at face value in the market served by the issuing bank. Commercial banknotes have primarily been replaced by national banknotes issued by central banks or monetary authority, monetary authorities. By extension, the word "banknote" is sometimes used (including by collectors) to refer more generally to paper money, but in a strict sense notes that have not been issued by banks, e.g. government notes, are not banknotes. National banknotes are often, but not always, legal tender, meaning that courts of law are required to ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Commercial Paper

Commercial paper, in the global financial market, is an Unsecured debt, unsecured promissory note with a fixed Maturity (finance), maturity of usually less than 270 days. In layperson terms, it is like an "IOU" but can be bought and sold because its buyers and sellers have some degree of confidence that it can be successfully redeemed later for cash, based on their assessment of the credit risk, creditworthiness of the issuing company. Commercial paper is a Money market, money-market security (finance), security issued by large corporations to obtain funds to meet short-term debt obligations (for example, payroll) and is backed only by an issuing bank or company promise to pay the face amount on the maturity date specified on the note. Since it is not backed by Collateral (finance), collateral, only firms with excellent credit ratings from a recognized credit rating agency will be able to sell their commercial paper at a reasonable price. Commercial paper is usually sold at a di ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Strasbourg

Strasbourg ( , ; ; ) is the Prefectures in France, prefecture and largest city of the Grand Est Regions of France, region of Geography of France, eastern France, in the historic region of Alsace. It is the prefecture of the Bas-Rhin Departments of France, department and the Seat of the European Parliament in Strasbourg, official seat of the European Parliament. The city has about three hundred thousand inhabitants, and together Eurométropole de Strasbourg, Greater Strasbourg and the arrondissement of Strasbourg have over five hundred thousand. Strasbourg's functional area (France), metropolitan area had a population of 860,744 in 2020, making it the eighth-largest metro area in France and home to 14% of the Grand Est region's inhabitants. The transnational Eurodistrict Strasbourg-Ortenau Eurodistrict, Strasbourg-Ortenau had a population of roughly 1,000,000 in 2022. Strasbourg is one of the ''de facto'' four main capitals of the European Union (alongside Brussels, Luxembourg ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dijon

Dijon (, ; ; in Burgundian language (Oïl), Burgundian: ''Digion'') is a city in and the Prefectures in France, prefecture of the Côte-d'Or Departments of France, department and of the Bourgogne-Franche-Comté Regions of France, region in eastern France. the Communes of France, commune had a population of 156,920. The earliest archaeological finds within the city limits of Dijon date to the Neolithic Period (geology), period. Dijon later became a Roman Empire, Roman settlement named ''Divio'', located on the road between Lyon and Paris. The province was home to the Duke of Burgundy, Dukes of Burgundy from the early 11th until the late 15th centuries, and Dijon became a place of tremendous wealth and power, one of the great European centres of art, learning, and science. The city has retained varied architectural styles from many of the main periods of the past millennium, including Capetian, Gothic architecture, Gothic, and Renaissance architecture, Renaissance. Many still-i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |