|

Bankers

A bank is a financial institution that accepts Deposit account, deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets. As banks play an important role in financial stability and the economy of a country, most jurisdictions exercise a high degree of Bank regulation, regulation over banks. Most countries have institutionalized a system known as fractional-reserve banking, under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure accounting liquidity, liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, the Basel Accords. Banking in its modern sense evolved in the fourteenth century in the prosperous cities of Renaissance Italy but, in many ways, functioned as a continuation of ideas and concepts o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Merchant Bank

A merchant bank is historically a bank dealing in commercial loans and investment. In modern British usage, it is the same as an investment bank. Merchant banks were the first modern banks and evolved from medieval merchants who traded in commodities, particularly cloth merchants. Historically, merchant banks' purpose was to facilitate or finance the production and trade of commodities, hence the name ''merchant''. Few banks today restrict their activities to such a narrow scope. In modern usage in the United States, the term additionally has taken on a more narrow meaning, and refers to a financial institution providing capital to companies in form of share ownership instead of loans. A merchant bank also provides advice on corporate matters to the firms in which they invest. History Merchant banks were the first modern banks. They emerged in the Middle Ages from the Italian grain and cloth merchants community and started to develop in the 11th century during the large E ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Of England

The Bank of England is the central bank of the United Kingdom and the model on which most modern central banks have been based. Established in 1694 to act as the Kingdom of England, English Government's banker and debt manager, and still one of the bankers for the government of the United Kingdom, it is the world's second oldest central bank. The bank was privately owned by stockholders from its foundation in 1694 until it was nationalised in 1946 by the Attlee ministry. In 1998 it became an independent public organisation, wholly owned by the Treasury Solicitor on behalf of the government, with a mandate to support the economic policies of the government of the day, but independence in maintaining price stability. In the 21st century the bank took on increased responsibility for maintaining and monitoring financial stability in the UK, and it increasingly functions as a statutory Financial regulation, regulator. The bank's headquarters have been in London's main financial di ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Principles Of Banking

The Principles of Banking is a 2012 non-fiction book written by Bangladesh-born English banking practitioner and educator Moorad Choudhry and published by John Wiley & Sons John Wiley & Sons, Inc., commonly known as Wiley (), is an American Multinational corporation, multinational Publishing, publishing company that focuses on academic publishing and instructional materials. The company was founded in 1807 and pr .... Overview The book explains the original, principles of banking, including lending policy and liquidity management, and why these need to be restored in order to avoid another bank crisis at the time of the next economic recession. It covers asset-liability management, liquidity risk, internal transfer pricing, capital management, and stress testing. The book considers business cycles as patterns of stable and stressful market behavior, and provides examples illustrating the key principles of bank asset-liability management. It illustrates how unsound banking ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Lending

In finance, a loan is the tender of money by one party to another with an agreement to pay it back. The recipient, or borrower, incurs a debt and is usually required to pay interest for the use of the money. The document evidencing the debt (e.g., a promissory note) will normally specify, among other things, the principal amount of money borrowed, the interest rate the lender is charging, and the date of repayment. A loan entails the reallocation of the subject asset(s) for a period of time, between the lender and the borrower. The interest provides an incentive for the lender to engage in the loan. In a legal loan, each of these obligations and restrictions is enforced by contract, which can also place the borrower under additional restrictions known as loan covenants. Although this article focuses on monetary loans, in practice, any material object might be lent. Acting as a provider of loans is one of the main activities of financial institutions such as banks and cred ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Knights Templar

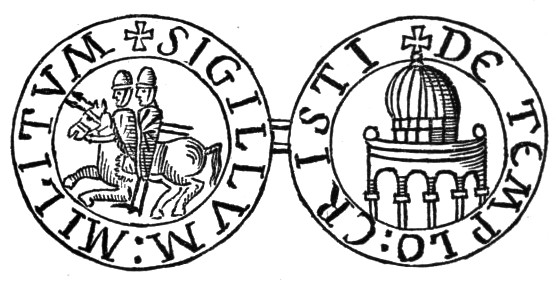

The Poor Fellow-Soldiers of Christ and of the Temple of Solomon, mainly known as the Knights Templar, was a Military order (religious society), military order of the Catholic Church, Catholic faith, and one of the most important military orders in Western Christianity. They were founded in 1118 to defend pilgrims on their way to Jerusalem, with their headquarters located there on the Temple Mount, and existed for nearly two centuries during the Middle Ages. Officially endorsed by the Catholic Church by such decrees as the papal bull ''Omne datum optimum'' of Pope Innocent II, the Templars became a favoured charity throughout Christendom and grew rapidly in membership and power. The Templar knights, in their distinctive white mantle (monastic vesture), mantles with a red Christian cross, cross, were among the most skilled fighting units of the Crusades. They were prominent in Christian finance; non-combatant members of the order, who made up as much as 90% of their members, ma ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banca Monte Dei Paschi Di Siena

Banca Monte dei Paschi di Siena S.p.A. (), known as BMPS or just MPS, is an Italian bank. Tracing its history to a mount of piety founded in 1472 () and established in its present form in 1624 (), it is the world's List of oldest banks, oldest bank, and the fifth largest Italian commercial and retail bank. In 1995, the bank (then known as Monte dei Paschi di Siena) was transformed from a statutory corporation to a limited company called Banca Monte dei Paschi di Siena (Banca MPS). The Fondazione Monte dei Paschi di Siena was created to continue the charitable functions of the bank and to be, until the bailout in 2013, its largest single shareholder. According to research by Mediobanca and a press release issued by Banco BPM, Banco BPM overtook BMPS as the third largest commercial banking group in Italy (in terms of total assets) on 31 December 2016, after Banco BPM's formal formation on 1 January 2017. In 2016–17, BMPS was struggling to avoid a collapse, and it was bailed out ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Berenberg Family

The Berenberg family (Dutch language, Dutch for "bear mountain") was a Flanders, Flemish-origined Hanseaten (class), Hanseatic family of merchants, bankers and senators in Hamburg, with branches in London, Livorno and other European cities. The family was descended from the brothers Hans and Paul Berenberg from Antwerp (province), Antwerp, who came as Protestant refugees to the Free imperial city, city-republic of Hamburg following the Fall of Antwerp in 1585 and who established what is now Berenberg Bank in Hamburg in 1590. The Berenbergs were originally cloth merchants and became involved in merchant banking in the 17th century. Having existed continuously since 1590, Berenberg Bank is the world's oldest surviving merchant bank. The Berenberg banking family became extinct in the male line with Elisabeth Berenberg (1749–1822); she was married to Johann Hinrich Gossler, who became a co-owner of the bank in 1769. From the late 18th century, the Gossler family, as owners of Bere ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fugger

The House of Fugger () is a German family that was historically a prominent group of European bankers, members of the fifteenth- and sixteenth-century mercantile patriciate of Augsburg, international mercantile bankers, and venture capitalists. Alongside the Welser family, the Fugger family controlled much of the European economy in the sixteenth century and accumulated enormous wealth. The Fuggers held a near monopoly on the European copper market. This banking family replaced the Medici family who influenced all of Europe during the Renaissance. The Fuggers took over many of the Medicis' assets and their political power and influence. They were closely affiliated with the House of Habsburg whose rise to world power they financed. Unlike the citizenry of their hometown and most other trading patricians of German free imperial cities, such as the Tuchers, they never converted to Lutheranism, as presented in the Augsburg Confession, but rather remained with the Roman Catholi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

History Of Banking

The history of banking began with the first prototype banks, that is, the merchants of the world, who gave grain loans to farmers and traders who carried goods between cities. This was around 2000 BCE in Assyria, India and Sumer. Later, in ancient Greece and during the Roman Empire, lenders based in temples gave loans, while accepting Deposit account, deposits and performing the Bureau de change, change of money. Archaeology from this period in History of China#Ancient China, ancient China and history of India, India also show evidences of Loan, money lending. Many scholars trace the historical roots of the modern banking system to medieval and Renaissance Italy#Early Modern, Italy, particularly the affluent cities of Florence, Venice and Genoa. The Bardi family, Bardi and Peruzzi families dominated banking in 14th century Florence, establishing branches in many other parts of Europe.Noble Foster Hoggson, Hoggson, N. F. (1926) ''Banking Through the Ages'', New York, Dodd, Mea ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

List Of Banking Families

Banking families are families that have been involved in banking for multiple generations, generally in the modern era as owners or co-owners of banks, which are often named after their families. Banking families have been important in the history of banking, especially before the 20th century. Banking families have existed and continue to exist in numerous countries. Antiquity *House of Egibi of Mesopotamia *Murashu family of Mesopotamia Modern See also * Private bank * Private banking References {{DEFAULTSORT:Banking families Banking families Lists of families, Banking Banking-related lists, Families ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fractional-reserve Banking

Fractional-reserve banking is the system of banking in all countries worldwide, under which banks that take deposits from the public keep only part of their deposit liabilities in liquid assets as a reserve, typically lending the remainder to borrowers. Bank reserves are held as cash in the bank or as balances in the bank's account at the central bank. Fractional-reserve banking differs from the hypothetical alternative model, full-reserve banking, in which banks would keep all depositor funds on hand as reserves. The country's central bank may determine a minimum amount that banks must hold in reserves, called the "reserve requirement" or "reserve ratio". Most commercial banks hold more than this minimum amount as excess reserves. Some countries, e.g. the core Anglosphere countries of the United States, the United Kingdom, Canada, Australia, and New Zealand, and the three Scandinavian countries, do not impose reserve requirements at all. Bank deposits are usually of a rel ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Loan

In finance, a loan is the tender of money by one party to another with an agreement to pay it back. The recipient, or borrower, incurs a debt and is usually required to pay interest for the use of the money. The document evidencing the debt (e.g., a promissory note) will normally specify, among other things, the principal amount of money borrowed, the interest rate the lender is charging, and the date of repayment. A loan entails the reallocation of the subject asset(s) for a period of time, between the lender and the borrower. The interest provides an incentive for the lender to engage in the loan. In a legal loan, each of these obligations and restrictions is enforced by contract, which can also place the borrower under additional restrictions known as loan covenants. Although this article focuses on monetary loans, in practice, any material object might be lent. Acting as a provider of loans is one of the main activities of financial institutions such as banks ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |