|

Bank Fee

A bank fee or a bank charge includes charges and fees made by a bank to their customers exclusive of interest payments. In common parlance, the term often relates to charges in respect of personal current accounts or checking account. These charges may take many forms such as monthly charges for the provision of an account, specific transaction charges such as withdrawal and transfer fees, ATM usage fees, debit card fees for doing a card transactions above a preset limit per month, credit card fees, loan establishment fees, early termination fees, and minimum account balance fees. They also include overdraft fees or non-sufficient funds (NSF) fees for exceeding authorized overdraft limits, or making payments (or attempting to make payments) where no authorized overdraft exists. History A banks main source of income is interest charges on lending but bank fees have been a minor but important part of a banks income since the early days of banking. Bank fees were initially desi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fees

A fee is the price one pays as remuneration for rights or services. Fees usually allow for overhead (business), overhead, wages, costs, and Profit (accounting), markup. Traditionally, professionals in the United Kingdom (and previously the Republic of Ireland) receive a fee in contradistinction to a payment, salary, or wage, and often use British coin Guinea, guineas rather than Pound Sterling, pounds as unit of account, units of account. Under the feudal system, a Knight's fee was what was given to a knight for his service, usually the usage of land. A contingent fee is an attorney's fee which is reduced or not charged at all if the court case is lost by the attorney. A service fee, service charge, or surcharge is a fee added to a customer's bill. The purpose of a service charge often depends on the nature of the product and corresponding service provided. Examples of why this fee is charged are: travel time expenses, truck rental fees, liability and workers' compensation insura ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

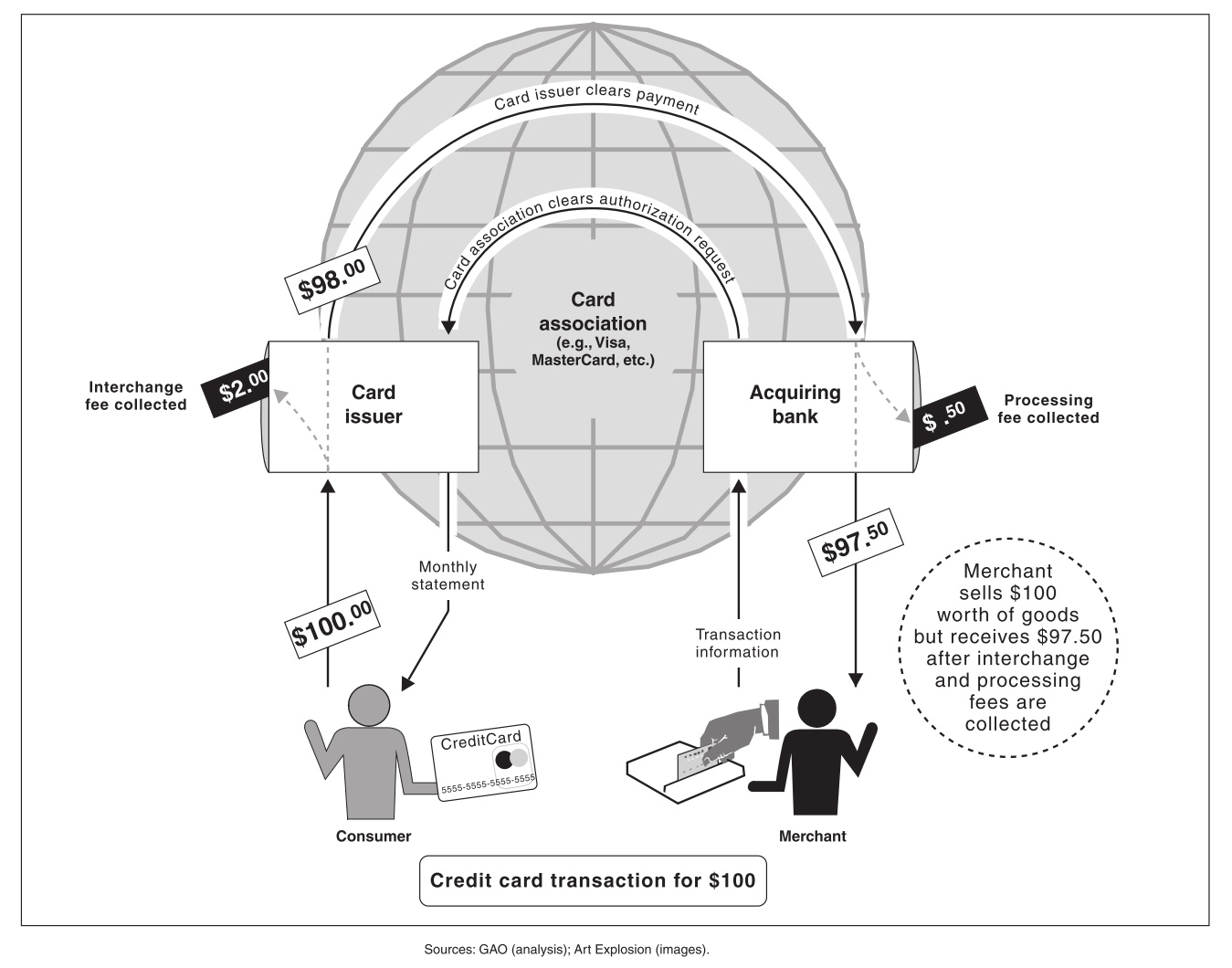

Interchange Fee

An interchange fee is a fee paid between banks for the acceptance of card-based transactions. Usually for sales/services transactions it is a fee that a merchant's bank (the "acquiring bank") pays a customer's bank (the " issuing bank"). In a credit card or debit card transaction, the card-issuing bank in a payment transaction deducts the interchange fee from the amount it pays the acquiring bank that handles a credit or debit card transaction for a merchant. The acquiring bank then pays the merchant the amount of the transaction minus both the interchange fee and an additional, usually smaller, fee for the acquiring bank or independent sales organization (ISO), which is often referred to as a discount rate, an add-on rate, or passthru. For cash withdrawal transactions at ATMs, however, the fees are paid by the card-issuing bank to the acquiring bank (for the maintenance of the machine). Overview These fees are set by the credit card networks, [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banking In The United Kingdom

Banking in the United Kingdom can be considered to have started in the Kingdom of England in the 17th century. The first activity in what later came to be known as banking was by goldsmiths who, after the dissolution of English monasteries by Henry VIII, began to accumulate significant stocks of gold. 17th century Many goldsmiths were associated with the Crown but, following seizure of gold held at the Royal Mint in the Tower of London by Charles I, they extended their services to gentry and aristocracy as the Royal Mint was no longer considered a safe place to keep gold. Goldsmiths came to be known as 'keepers of running cash' and they accepted gold in exchange for a receipt as well as accepting written instructions to pay back, even to third parties. This instruction was the forerunner to the modern banknote or cheque. Around 1650, a cloth merchant, Thomas Smith opened the first provincial bank in Nottingham. During 1694 the Bank of England was founded. The Governor and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Unavailable Funds Fee

An unavailable funds fee is a penal fee applied by a bank to a client's transaction account when a transaction is posted to the said account that has a ''negative available balance'', regardless of if the account factually contains a ''positive physical balance''. The fee is distinct from a non-sufficient funds fee, as there is a positive physical balance but some or all the funds are on hold (meaning that the balance is not yet available). Bank fees such as the unavailable funds fee are contentious and have been the subject of some debate. Consumer advocacy groups have criticised them as opaque and unfair and that they particularly penalise the poor and fees do not reflect the banks' costs. The banks argue that it is a penalty, not a transaction fee. These fees have become a major source of income for banks, replacing the traditional account and transaction fees which in many countries have disappeared. Governance United States Not all overspending fees are officially defined ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

OFT V Abbey

is a judicial decision of the United Kingdom Supreme Court relating to bank charges in the United Kingdom, with reference to the situation where a bank account holder goes into unplanned overdraft. When a bank customer uses an unplanned overdraft and then makes a payment request (whether by standing order, direct debit or using an ATM or debit card), banks generally make the payment as requested, and then charge fees (which may include "paid item" charges and unauthorised overdraft fees) which accrue on a daily basis whilst the unauthorised overdraft continues. The Office of Fair Trading (OFT), acting on behalf of consumers, challenged these fees under the Unfair Terms in Consumer Contracts Regulations 1999 (UTCCR), which implements European Union Unfair Contract Terms Directive. OFT claimed the sizeable fees charged were not a fair reflection of the banks' costs but were instead a penalty upon the consumer or bank account holder, hence unlawful. If these fees were confirmed t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Overdraft Fee

An overdraft occurs when something is withdrawn in excess of what is in a current account. For financial systems, this can be funds in a bank account. In these situations the account is said to be "overdrawn". In the economic system, if there is a prior agreement with the account provider for an overdraft, and the amount overdrawn is within the authorized overdraft limit, then interest is normally charged at the agreed rate. If the negative balance exceeds the agreed terms, then additional fees may be charged and higher interest rates may apply. By analogy, overdrafting of an aquifer refers to extraction of water faster than it will be replenished. History in finance The first overdraft facility was set up in 1728 by the Royal Bank of Scotland. The merchant William Hogg was having problems in balancing his books and was able to come to an agreement with the newly established bank that allowed him to withdraw money from his empty account to pay his debts before he received his ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Origination Fee

An origination fee or establishment fee is a payment charged for establishing a loan account with a bank, broker, or other financial service provider. While origination fees can be a set amount, a tiered amount, or a percentage. Percentages typically range from 1.0% to 5.0% of the loan amount, varying based on whether the loan is in the prime or subprime market. For example, an origination fee of 5% on a $10,000 loan is $500. In the United States, Discount points are used to buy down the interest rate An interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed (called the principal sum). The total interest on an amount lent or borrowed depends on the principal sum, the interest rate, ...s, temporarily or permanently. Origination fees and discount points are both items listed under lender-charges on the HUD-1 Settlement Statement. Regulation Z was enacted to protect borrowers from abusive lending practices. Under this ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Interchange Fee

An interchange fee is a fee paid between banks for the acceptance of card-based transactions. Usually for sales/services transactions it is a fee that a merchant's bank (the "acquiring bank") pays a customer's bank (the " issuing bank"). In a credit card or debit card transaction, the card-issuing bank in a payment transaction deducts the interchange fee from the amount it pays the acquiring bank that handles a credit or debit card transaction for a merchant. The acquiring bank then pays the merchant the amount of the transaction minus both the interchange fee and an additional, usually smaller, fee for the acquiring bank or independent sales organization (ISO), which is often referred to as a discount rate, an add-on rate, or passthru. For cash withdrawal transactions at ATMs, however, the fees are paid by the card-issuing bank to the acquiring bank (for the maintenance of the machine). Overview These fees are set by the credit card networks, [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Reserve Bank Of Australia

The Reserve Bank of Australia (RBA) is Australia's central bank and banknote issuing authority. It has had this role since 14 January 1960, when the ''Reserve Bank Act 1959'' removed the central banking functions from the Commonwealth Bank. The bank's main policy role is to control inflation levels within a target range of 2–3%, by controlling the unemployment rate according to the 'non-accelerating inflation rate of unemployment' (NAIRU) by controlling the official cash rate. The NAIRU was implemented in most western nations after 1975, and has been maintained at a target of 5–6% unemployment. The average unemployment rate in Australia between the end of the Second World War and the implementation of the NAIRU was consistently between 1 and 2%. Since the implementation of the NAIRU, the average unemployment rate in Australia has been close to 6%. The RBA also provides services to the Government of Australia and services to other central banks and official institutions. The ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank

A bank is a financial institution that accepts Deposit account, deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets. As banks play an important role in financial stability and the economy of a country, most jurisdictions exercise a high degree of Bank regulation, regulation over banks. Most countries have institutionalized a system known as fractional-reserve banking, under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure accounting liquidity, liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, the Basel Accords. Banking in its modern sense evolved in the fourteenth century in the prosperous cities of Renaissance Italy but, in many ways, functioned as a continuation of ideas and concepts o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |